Calculate the Medicare Withholding. Multiply the current Medicare tax rate by the amount of gross wages subject to Medicare. Check to see if the employee has reached the additional Medicare tax level and increase deductions from the employee's pay.

Full Answer

What is the Medicare tax rate for 2011?

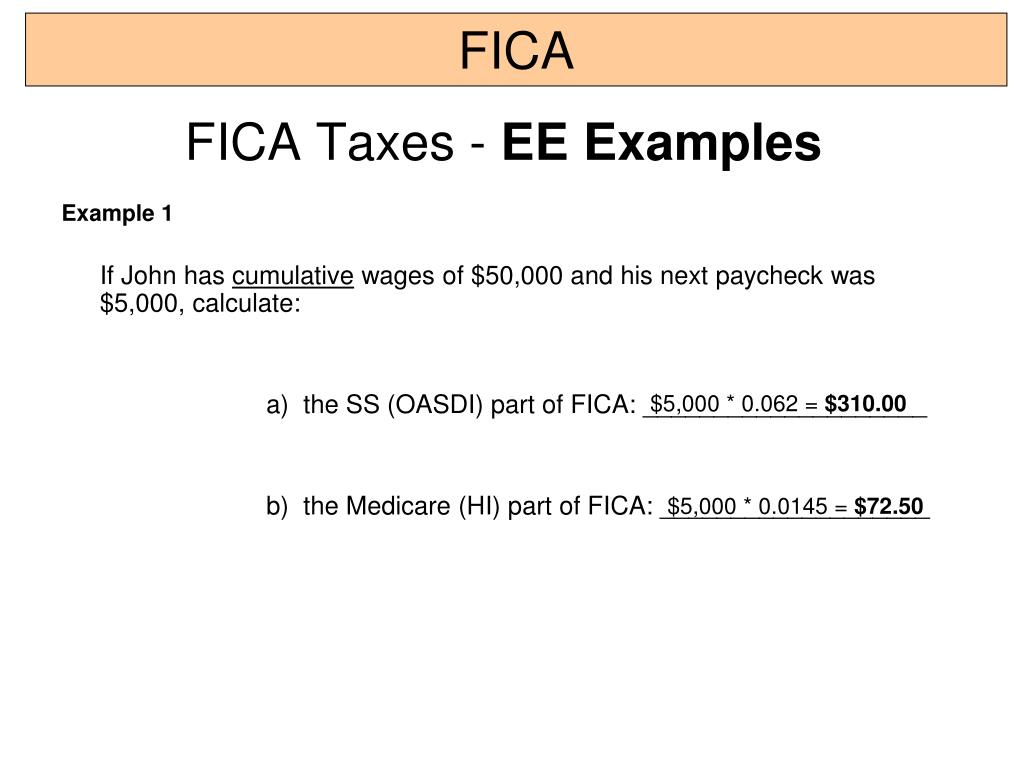

The Social Security tax rate remains at 6.2 percent, resulting in a maximum Social Security tax of $6,621.60. There is still no limit on the amount of earnings subject to Medicare (hospital insurance). The Medicare tax rate applies to all taxable wages, and remains at 1.45 percent. The Federal Insurance Contributions Act (FICA) tax rate, which is the combined Social Security rate …

What is the current tax rate for Social Security and Medicare?

Mar 15, 2022 · Different rates apply for these taxes. Social Security and Medicare Withholding Rates The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

How do you calculate Medicare withholding from gross pay?

How Contributions are Calculated. The FICA (for Federal Insurance Contributions Act) tax (also known as Payroll Tax or Self-Employment Tax, depending on your employment status) is your contribution to Social Security and Medicare as a percentage of your salary: If you're an employee, then you pay one half of this total (probably as a withholding on your paycheck); your employer …

What is the FICA tax rate for 2011?

Cancer Hospitals and Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA) Hospitals. Claims are final action and total payments include the Medicare Claim payment amount, the ... (CY 2011) [ZIP, 38MB] Medicare Data to Calculate Your Primary Service Areas (CY 2010) [ZIP, 50MB] 2

How do I calculate my Medicare tax?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.Jan 12, 2022

How is Medicare payroll calculated?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

How do you calculate additional Medicare tax 2021?

It is paid in addition to the standard Medicare tax. An employee will pay 1.45% standard Medicare tax, plus the 0.9% additional Medicare tax, for a total of 2.35% of their income....What is the additional Medicare tax?StatusTax thresholdmarried tax filers, filing separately$125,0003 more rows•Sep 24, 2020

What are Medicare wages?

Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

How much is Medicare tax?

The Medicare Tax is an additional 0.9% in tax an individual or couple must pay on income thresholds above $200,000 for singles and $250,000 for couples. People who owe this tax should file Form 8959, with their tax return.

How to be more flexible with your income?

One of the best ways to be more flexible with your income is to start and operate a business. You have more flexibility in terms of receiving payment, purchasing business equipment, and investing in your companies future to adjust your income accordingly.

What is net investment tax?

In addition to the Medicare Tax, there is also the Net Investment Income Tax an individual or couple must pay if their respective incomes are over $200,000 and $250,000. Net Investment Income Tax includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, and non-qualified annuities.

Is investment income subject to income tax?

To the extent the gain is excluded from gross income for regular income tax purposes, it is not subject to the Net Investment Income Tax. If an individual owes the net investment income tax, the individual must file Form 8960. Form 8960 Instructions provide details on how to figure the amount of investment income subject to the tax.

What is the Medicare tax rate for 2013?

Starting in 2013, people with high salaries will pay a new additional Medicare tax of 0.9%. Unlike the rest of Medicare, this new tax depends on your filing status:

How much did the employee contribute to Social Security in 2011?

For 2011 and 2012 only, the employee's "half" didn't equal the employer's "half" for Social Security: they contributed 4.2% and 6.2% respectively. For 2013, both contribute 6.2%. For 2017, there is a very large increase in the Social Security income limit, from $118,500 to $127,200.

What is FICA tax?

The FICA (for Federal Insurance Contributions Act) tax (also known as Payroll Tax or Self-Employment Tax, depending on your employment status) is your contribution to Social Security and Medicare as a percentage of your salary: If you're an employee, then you pay one half of this total (probably as a withholding on your paycheck);

Why does the IRS agree with Flo's figure?

Why does the IRS agree with Flo’s figure? Because her $200,000 threshold exceeds her $180,000 earnings. The 3.8 percent tax is another story. The IRS requires her to pay $760—3.8 percent of $20,000.

Is MAGI the same as adjusted gross income?

For most persons, MAGI and adjusted gross income are the same. “Modified” applies only to individuals who live outside the United States and avail themselves of the foreign earned income exclusion. Expatriates have to add back excluded amounts.

What is Medicare Care Tax?

What is Additional Medicare Care tax? Medicare tax rate is 1.45% for salaried individuals. An equal amount is contributed by the employer. So aggregate deposit on behalf of an employee is 2.9 % of gross wages. In the case of a self-employed person, the Medicare tax rate is 2.9 % of net income.

When is Medicare tax due for 2019?

February 12, 2019. The additional Medicare Tax calculator is for knowing medicare surcharge you are liable to pay or your employer will withhold.As you know the Medicare is the federal health insurance program as per FICA (Federal Insurance Contributions Act) for people who are 65 or older.

How to determine Medicare tax amount?

To determine the amount of Medicare tax an employee should pay, you must first figure the wages. Determine whether the employee has voluntary pretax deductions. These are deductions the employer offers and the employee accepts.

How much Medicare tax is paid if there is no pretax deduction?

If the employee has no pretax deductions, her entire gross pay is also her Medicare wages. Calculate Medicare tax at 1.45 percent of the employee’s Medicare wages to arrive at the amount of tax to withhold. Notably, the employer pays an equal portion of Medicare tax.

What is pretax deduction?

Pretax deductions are those that meet the requirements of IRS Section 125 code, such as a traditional 401k plan, a Section 125 medical or dental plan or a flexible spending account. Subtract applicable pretax deductions from the employee’s gross pay – earnings before deductions – to arrive at Medicare wages.

Is Medicare based on wages?

Unlike federal income tax, which depends on varying factors such as the employee’s filing status and allowances, Medicare tax is based on a flat percentage of wages. Furthermore, unlike Social Security tax, which has an annual wage limit, Medicare has none.

Can an employer withhold Medicare from employee wages?

An employer is legally required to withhold Medicare tax from employee wages. The employee is exempt from withholding only if an exception applies, such as if she works for a university at which she is also a student.