As of 2012, calculate Medicare tax at 1.45 percent of all taxable wages. Let’s say an employee’s taxable wages equal $412 for the weekly pay period. Multiply $412 by 0.0145 to get $5.97, which is her Medicare liability for that weekly pay period.

How do you calculate Medicare withholding from paycheck?

To calculate Medicare withholding, multiply your employee’s gross pay by the current Medicare tax rate (1.45%). Example Medicare withholding calculation: $5,000 (employee’s gross pay for the current pay period) x.0145 (current Medicare tax rate) = $72.50 (Medicare tax to be deducted from employee’s paycheck

What is the current tax rate for Social Security and Medicare?

Different rates apply for these taxes. Social Security and Medicare Withholding Rates. The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

How do I calculate Medicare tax on biweekly payroll?

When calculating Medicare tax on a biweekly payroll, consider the tax rate and the employee’s taxable wages. Biweekly gross pay is an employee’s entire pay before deductions for the two-week payroll period. For nonexempt employees, add regular and overtime hours for the pay period.

How much Medicare tax do I have to pay my employees?

$5,000 (employee’s gross pay for the current pay period) x .0145 (current Medicare tax rate) = $72.50 (Medicare tax to be deducted from employee’s paycheck As an employer, you are responsible for matching what your employees pay in FICA taxes. So in this case, you would also remit $310 for Social Security tax and $72.50 for Medicare tax.

How to calculate weekly take home pay?

What taxes do employers withhold from paychecks?

How much is FICA tax in 2021?

How does your paycheck work?

How does FICA work?

What are pre-tax contributions?

What is tax withholding?

See more

About this website

How is Medicare tax calculated on paycheck?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay.

How do you calculate Medicare tax 2020?

The tax is split between employers and employees. They both pay 7.65% (6.2% for Social Security and 1.45% for Medicare) of their income to FICA, the combined contribution totaling 15.3%. The maximum taxable earnings for employees as of 2020 is $137,700. There is no wage limit for Medicare.

How do you calculate FICA and Medicare tax 2021?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

How much tax is taken off my paycheck?

Overview of Federal TaxesGross Paycheck$3,146Federal Income15.22%$479State Income4.99%$157Local Income3.50%$110FICA and State Insurance Taxes7.80%$24623 more rows

Salary Calculator

A free calculator to convert a salary between its hourly, biweekly, monthly, and annual amounts. Adjustments are made for holiday and vacation days.

Free Payroll Tax Calculator: Free Paycheck Calculator

Paycheck Manager's Free Payroll Calculator offers online payroll tax deduction calculation, federal income tax withheld, pay stubs, and more.

Tax Withholding Estimator | Internal Revenue Service

Check your tax withholding with the IRS Tax Withholding Estimator, a tool that helps ensure you have the right amount of tax withheld from your paycheck.

Hourly Paycheck Calculator - Calculate Hourly Pay | ADP

Easily estimate hourly employee wages with ADP’s hourly paycheck calculator.

Calculate your paycheck with paycheck calculators and withholding ...

Use PaycheckCity’s free paycheck calculators, withholding calculators, and tax calculators for all your paycheck and payroll needs.

Income Tax Calculator

Income Tax Calculator. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. It is mainly intended for residents of the U.S. and is based on the tax brackets of 2021 and 2022.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

How to calculate weekly take home pay?

But calculating your weekly take-home pay isn’t a simple matter of multiplying your hourly wage by the number of hours you’ll work each week, or dividing your annual salary by 52. That’s because your employer withholds taxes from each paycheck, lowering your overall pay.

What taxes do employers withhold from paychecks?

Overview of Federal Taxes. When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, ...

How much is FICA tax in 2021?

However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2021 is $142,800 (up from $137,700 in 2020).

How does your paycheck work?

How Your Paycheck Works: Local Factors. If you live in a state or city with income taxes, those taxes will also affect your take-home pay. Just like with your federal income taxes, your employer will withhold part of each of your paychecks to cover state and local taxes.

How does FICA work?

How Your Paycheck Works: FICA Withholding. In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. FICA stands for the Federal Insurance Contributions Act.

What are pre-tax contributions?

These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 (k) or 403 (b).

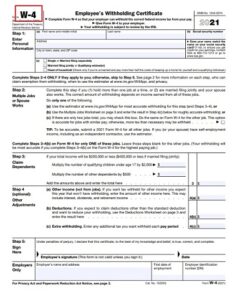

What is tax withholding?

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks.

US Tax Calculators

Current and historical tax calculators supported and maintained by iCalculator™

Tax Guides

We hope you found the United States Weekly Tax Calculator for 2022 useful, we have collated the following US Tax guides to support the US Tax Calculators and US Salary Calculators published on iCalculator. Each tax guide is designed to support you use of the US tax calculators and with calculating and completing your annual tax return.

How much is Medicare tax in 2012?

For 2012, calculate Medicare tax at 1.45 percent of the employee’s gross taxable wages for the biweekly pay period. For example, she earns $1,000 biweekly and pays $60 for Section 125 medical and dental benefits. Subtract $60 from $1,000 to arrive at $940, which is subject to Medicare tax of $13.63 biweekly. If she didn’t have the health benefit, the entire $1,000 would be subject to Medicare tax of $14.50 biweekly.

What is gross taxable wages?

Gross taxable wages are an employee’s earnings after pretax deductions, which are employer-sponsored benefits that meet the respective part of the Internal Revenue Code. Pretax deductions can include Section 125 plans, such as medical, dental and vision insurance; flexible spending accounts; and traditional, safe harbor and SIMPLE 401 (k) plan contributions. Section 125 plans are not subject to Medicare tax, but pretax 401 (k) contributions are.

How much is Medicare tax in 2012?

As of 2012, calculate Medicare tax at 1.45 percent of all taxable wages. Let’s say an employee’s taxable wages equal $412 for the weekly pay period. Multiply $412 by 0.0145 to get $5.97, which is her Medicare liability for that weekly pay period.

What is nontaxable wages?

Nontaxable wages include lodging, meal and mileage reimbursements. Pretax deductions include section 125 cafeteria plans and parking fees and transit fares. If necessary, contact the Internal Revenue Service for clarification on what constitutes nontaxable wages and pretax deductions for Medicare tax purposes.

Does Medicare withholding change if you work for a fixed salary?

If an employee receives a fixed salary, unless her compensation or deductions change, her Medicare withholding stays the same. All employees must pay Medicare tax, unless they work one of the few jobs that deem them exempt.

Do you have to pay Social Security tax on Medicare?

Therefore, both you and your employees must also pay Social Security tax at the required rate, unless an exemption applies. The same exemptions that apply to Medicare tax apply for Social Security tax. You submit the employees’ -- and your -- portion of Social Security tax to the IRS with your Medicare payments.

Do you pay Medicare taxes from paychecks?

Payment and Reporting Criteria. You pay all Medicare tax that you withhold from your employees’ paychecks, plus your portion of the tax, together, to the IRS. Consult the agency or its Circular E, The Employer Tax Guide for your deposit schedule, which may be semiweekly or monthly. Most employers must report their tax liabilities to ...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the FICA tax?

Federal Insurance Contributions Act (FICA) Also known as ‘paycheck tax’ or ‘payroll tax’, these taxes are taken from your paycheck directly and are used to fund social security and medicare. For example, in the fiscal year 2020 Social Security tax is 6.2% for employee and 1.45% for Medicare tax.

What is tax deduction?

You might be confused with deductions and exemptions, so the following is a quote from Zacks.com: Tax deductions are items you claim to reduce your tax liability while exemptions refer to the people you claim to reduce tax liability, such as dependents.

What happens if you pay more than your tax liability?

If your tax liability is more than your tax credits and withheld, then you need to pay IRS or your state the difference. If your tax credits and withheld is more than your tax liability, then IRS or your state owes you the difference. You need to do these steps separately for federal, state and local income taxes.

How many states don't have income tax?

The income tax rate varies from state to state. There are 8 states which don’t have income tax and 1 state (New Hampshire) that has no wage income tax. It is also worth noting that the recent Tax Cuts and Jobs Act (TCJA) of 2017 made several significant changes to the individual income tax across the board.

When is the next fiscal year?

A fiscal year is different for the federal and state. A federal fiscal year is the 12-months period beginning October 01 and ending September 30 the following year. The fiscal year 2021 will starts on Oct 01 2020 and ends on Sep 30 2021. The state fiscal year is also 12 months but it differs from state to state.

Does the IRS adjust tax brackets?

Income tax brackets. Every year, IRS adjusts some tax provisions for inflation. This means that your federal tax bracket varies from year to year and you need to check the latest data before you do your tax return. For the latest on federal income tax brackets, you can refer to Tax Foundation.

Can you take the standard deduction for post tax?

For post-tax deductions, you can choose to either take the standard deduction amount or itemize your deductions. If your itemized deductions are less than the standard deduction, just claim the standard amount

What is the most straightforward way to calculate payroll tax?

Most employers have two options, the wage bracket method and the percentage method. While not exactly simple, the wage bracket method is the more straightforward way to calculate payroll tax.

How to calculate Social Security withholding?

To calculate Social Security withholding, multiply your employee’s gross pay for the current pay period by the current Social Security tax rate (6.2%). This is the amount you will deduct from your employee’s paycheck and remit along with your payroll taxes.

What is the current FICA rate?

The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Combined, the FICA tax rate is 15.3% of the employees wages.

What is FICA in tax?

FICA stands for “Federal Insurance Contributions Act.” It’s a mandatory payroll tax deduction used to pay for programs like Social Security (disability insurance, old age, survivors) and Medicare (covering health insurance for folks over 65).

What taxes come out of your pocket?

Payroll taxes that come out of your pocket: FICA tax: covers social security and Medicare. This cost is shared by employer and employee. The employer portion is 6.2% for social security and 1.45% for Medicare, and you’ll collect and remit the same amount from your employees.

How much does an employee pay for FICA?

When it comes to funding FICA, your employee pays 50% from their paycheck while you, the employer, pay 50% out of your own revenue. As the employer, you are required to withhold and pay the amount your employee is responsible for from her paycheck, and remit those funds on their behalf.

What is the FUTA rate?

It’s an employer-paid payroll tax that pays for state unemployment agencies. The FUTA tax rate is 6% on the first $7,000 of wages paid to employees in a calendar year. However, the actual rate that employers pay is actually 0.6%, since each state receives a credit to cover the remaining 5.4% of FUTA payments.

What is the Medicare withholding rate?

The Medicare withholding rate is gross pay times 1.45 % , with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9%. For a total of 7.65% withheld, based on the employee's gross pay. 2 .

How much Medicare tax is required to be deducted?

The 0.9% additional Medicare tax must be deducted when the employee's wages reach $200,000 each year, and the additional amount is calculated on only the amount over $200,000.

What is Medicare additional tax?

The Additional Medicare Tax. The pay amount at which additional Medicare taxes must be withheld from higher-paid employees. The pay amount is different depending on the individual's tax status (married, single, etc.) At the specified level for the year, an additional 0.9% must be withheld from the employee's pay for the remainder of the year.

How to calculate FICA taxes?

First, multiply 40 hours x $12.50 = $500. Then multiply 4 overtime hours x $18.75 (1 1/2 times the hourly rate) = $75.00. Add $500 + $75 for a total of $575 in gross wages for the week. Determine the amount of employee wages/salaries that are subject to FICA taxes.

What to do if you deduct too much tax?

If you deducted too much tax from an employee's pay, either for Social Security or for Medicare tax, you may have several things to fix: Refund the employee. You will need to pay the employee back for the excess deduction amount. You can give this amount back to the employee in a paycheck or as a separate check.

How to calculate gross pay for hourly?

The gross pay for an hourly employee is the total calculated pay, multiplying hours times hourly rate and including hours for overtime and the overtime rate . First, multiply 40 hours x $12.50 = $500. Add $500 + $75 for a total of $575 in gross wages for the week.

Does FICA tax come from paycheck?

Updated November 07, 2019. Every person working in the U.S. as an employee must have FICA taxes withheld from every paycheck by law. FICA taxes include taxes for both Social Security and Medicare. The FICA tax is shared by employees and employers, so one half of the tax is deducted from employee paychecks each payday.

How to calculate weekly take home pay?

But calculating your weekly take-home pay isn’t a simple matter of multiplying your hourly wage by the number of hours you’ll work each week, or dividing your annual salary by 52. That’s because your employer withholds taxes from each paycheck, lowering your overall pay.

What taxes do employers withhold from paychecks?

Overview of Federal Taxes. When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, ...

How much is FICA tax in 2021?

However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2021 is $142,800 (up from $137,700 in 2020).

How does your paycheck work?

How Your Paycheck Works: Local Factors. If you live in a state or city with income taxes, those taxes will also affect your take-home pay. Just like with your federal income taxes, your employer will withhold part of each of your paychecks to cover state and local taxes.

How does FICA work?

How Your Paycheck Works: FICA Withholding. In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. FICA stands for the Federal Insurance Contributions Act.

What are pre-tax contributions?

These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 (k) or 403 (b).

What is tax withholding?

Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks.