How to calculate additional Medicare tax properly?

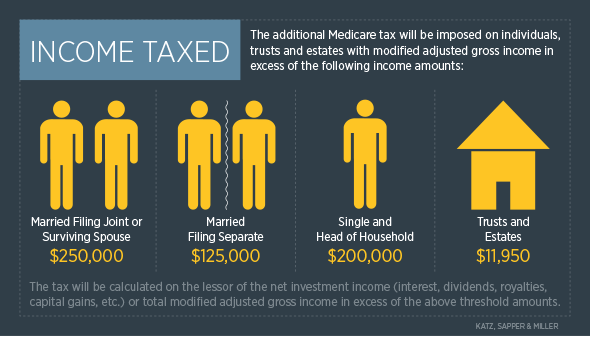

Jan 15, 2022 · The Medicare Tax is an additional 0.9% in tax an individual or couple must pay on income thresholds above $200,000 for singles and $250,000 for couples. People who owe this tax should file Form 8959, with their tax return. Lets look …

What percentage of your paycheck is Medicare?

Nov 05, 2021 · So any part of your income that exceeds a certain amount gets taxed for Medicare at a total rate of 2.35% . That income ceiling for 2020 is $200,000 for single filers, qualifying widows and anyone with the head of household filing status $250,000 for married couples filing joint tax returns and $125,000 for couples filing separate tax returns.

How do you calculate Medicare withholding?

How are Medicare wages calculated? The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction. Dental – subtract the YTD employee dental insurance deduction. What is the cap for Medicare tax?

How to calculate Medicare surtaxes?

Dec 28, 2021 · How do I calculate taxable wages? Total all the wages, including salary, overtime, and tips. Subtract any non-taxable wages from the gross wage. Subtract pre-tax deductions, such as retirement contributions and flexible spending accounts.

How do you calculate Medicare tax 2020?

The FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2020 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

How do you calculate Medicare tax 2021?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.Mar 23, 2021

How do you calculate FICA and Medicare tax 2022?

For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021). For 2022, an employee will pay: 6.2% Social Security tax on the first $147,000 of wages (6.2% of $147,000 makes the maximum tax $9,114), plus.Jan 12, 2022

How are Medicare wages calculated?

The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction. Dental – subtract the YTD employee dental insurance deduction.

What percentage is Medicare tax?

1.45%The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Is Medicare tax based on gross income?

The tax is based on "Medicare taxable wages," a calculation that uses your gross pay and subtracts pretax health care deductions such as medical insurance, dental, vision or health savings accounts.Mar 28, 2022

How is Medicare tax withheld calculated on w2?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay.Nov 7, 2019

How is Futa calculated?

How to calculate FUTA Tax?FUTA Tax per employee = (Taxable Wage Base Limit) x (FUTA Tax Rate).With the Taxable Wage Base Limit at $7,000,FUTA Tax per employee = $7,000 x 6% (0.06) = $420.Feb 15, 2022

How is my Social Security tax calculated?

Calculate Social Security and Medicare Matches Multiply the employee's gross wage by 7.65 percent. This is the amount of your company's Social Security (6.2 percent) and Medicare tax (1.45 percent) matching contribution.

What is Medicare wages on w2?

Box 5 "Medicare wages and tips": This is total wages and tips subject to the Medicare component of social security taxes. Box 6 "Medicare tax withheld": This is Medicare tax withheld from your pay for the Medicare component of social security taxes.

Are Medicare wages the same as gross wages?

Medicare Taxable Wages Definition Medicare taxable wage refers to the employee wages on which Medicare tax is paid. It is calculated as the employee's gross earnings less the non-taxable items, without any maximum on gross wages.

Some More Good Calculators That You May Find Useful

US Salary examples are useful for those who want to understand how income tax is calculated in the US or to get a quick idea of how payroll deductions are calculated in the United States. If you have time and prefer to produce a more detailed and accurate calculation, we suggest you use one of the following tools:

Making Your Tax Payments

Because youre self-employed, youll be expected to pay estimated taxes each quarter, as well as filing your annual return. Your quarterly estimated tax payments should include amounts to cover both your Social Security and Medicare tax obligations, as well as your estimated income tax bill.

How Fica Tax And Tax Withholding Work In 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here’s how we make money.

What Is The Social Security Tax Rate

The Social Security tax rate is a percentage of your payroll that goes towards funding the program. In 2021, this rate is 6.20%. Anyone self-employed will need to pay double. Although, with proper deductions, you may pay half of that.

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal.

How Fica Tax Or Withholding Tax Are Calculated

The amount of tax your employer withholds from your check largely depends on what you put on your Form W-4, which you probably filled out when you started your job. Here are some things to know:

The Tax Is Also Subject To An Income Cap

The Old-Age, Survivors and Disability Insurance program taxmore commonly called the Social Security tax is calculated by taking a set percentage of your income from each paycheck. Social Security tax rates are determined by law each year and apply to both employees and employers.

How do you calculate Medicare tax 2021?

For 2021, the FICA tax rate is 15.30% which is split equally between the employer and employee. So Employer deducts the FICA tax of 7.65%. (6.2% for Social Security and 1.45% for Medicare) from wages of an employee and deposits, the combined contribution (its own 7.65%) totaling 15.3%.

How much do you pay in Medicare tax?

Medicare tax: 1.45%. Sometimes referred to as the “hospital insurance tax,” this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000.

How is Medicare calculated?

Medicare premiums are based on your modified adjusted gross income, or MAGI .If your MAGI for 2019 was less than or equal to the “higher-income” threshold — $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly — you pay the “standard” Medicare Part B rate for 2021, which is $148.50 a month.

How are Medicare wages calculated?

The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction. Dental – subtract the YTD employee dental insurance deduction.

What is the percentage of Medicare tax withheld for 2020?

1.45 percent The FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2020 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

Do I have Medicare if I pay Medicare tax?

For those who are self-employed, the full 2.9% must be paid by the individual, rather than splitting the tax with an employer. This tax toward Medicare is included in the self-employment tax that is paid quarterly through estimated tax payments.

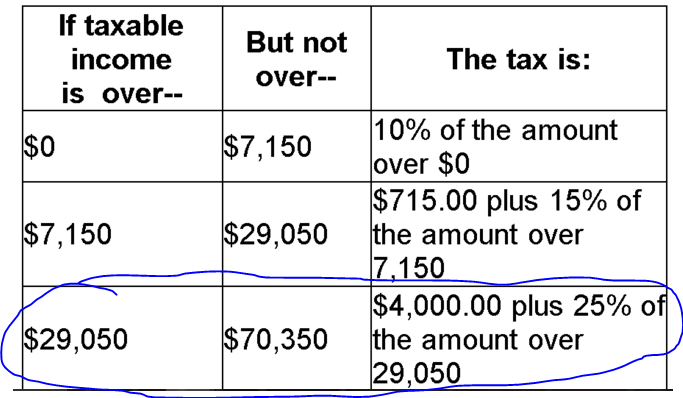

What percentage of federal tax is withheld?

For the 2021 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your filing status and taxable income (such as your wages) will determine what bracket you’re in.

What is net investment tax?

In addition to the Medicare Tax, there is also the Net Investment Income Tax an individual or couple must pay if their respective incomes are over $200,000 and $250,000. Net Investment Income Tax includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, and non-qualified annuities.

How much is Medicare tax?

The Medicare Tax is an additional 0.9% in tax an individual or couple must pay on income thresholds above $200,000 for singles and $250,000 for couples. People who owe this tax should file Form 8959, with their tax return.

What happens if you don't pay quarterly estimated taxes?

If an individual has too little withholding or fails to pay enough quarterly estimated taxes to also cover the Net Investment Income Tax, the individual may be subject to an estimated tax penalty. The Net Investment Income Tax is separate from the Additional Medicare Tax, which also went into effect on January 1, 2013.

How to be more flexible with your income?

One of the best ways to be more flexible with your income is to start and operate a business. You have more flexibility in terms of receiving payment, purchasing business equipment, and investing in your companies future to adjust your income accordingly.

How long did Sam work in finance?

About the Author: Sam worked in finance for 13 years. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income.

Is investment income subject to income tax?

To the extent the gain is excluded from gross income for regular income tax purposes, it is not subject to the Net Investment Income Tax. If an individual owes the net investment income tax, the individual must file Form 8960. Form 8960 Instructions provide details on how to figure the amount of investment income subject to the tax.

When did Sam start Financial Samurai?

He spends time playing tennis, taking care of his family, and writing online to help others achieve financial freedom too. Sam started Financial Samurai in 2009 and has grown it to be one of the largest independently owned personal finance sites in the world.

What happens if you select a tax filing status of married filing jointly?

If you select a tax-filing status of married filing jointly, the inputs for both you and your spouse are used and Social Security tax and Medicare tax are calculated for both you and your spouse. If you select any other filing status, the "Your Spouse" inputs are not used.

Is self employment income subject to Social Security?

If the result is less than $400, the calculator assumes the self-employment income is not subject to tax. Social Security wages and self-employment income above an annually inflation-adjusted limit are not subject to Social Security tax (but are subject to Medicare tax).

Why do you check your withholding?

Checking your withholding can help protect against having too little tax withheld and facing an unexpected tax bill or penalty at tax time next year. At the same time, you may prefer to have less tax withheld up front, so you receive more in your paychecks and get a smaller refund at tax time.

What happens if you don't make adjustments to your withholding?

If you do not make adjustments to your withholding for these situations, you will likely owe additional tax when filing your tax return, and you may owe penalties.

Can you pay estimated tax on income from other sources?

For income from sources other than jobs, you can pay estimated tax instead of having extra withholding. You are eligible for deductions other than the basic standard deduction, such as itemized deductions, the deduction for IRA contributions, or the deduction for student loan interest (Step 4 (b)).

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio