What wages are subject to Medicare tax?

Nov 16, 2021 · In 2021, the Medicare tax rate is 1.45%. This is the amount you'll see come out of your paycheck, and it's matched with an additional 1.45% contribution from

What percent of wages goes to Medicare?

Starting with an employee's gross wages – hours worked multiplied by hourly rate, or fixed salary amount for the payroll period – subtract any qualifying pre-tax deductions. The result is the taxable income. Convert the 6.2 percent Social Security withholding rate to a decimal by dividing 6.2 by 100 to get 0.062.

Are all wages subject to Medicare tax?

Sep 26, 2017 · Subtract applicable pretax deductions from the employee’s gross pay – earnings before deductions – to arrive at Medicare wages. This process gives the employee a tax break since it reduces the amount of wages subject to Medicare tax. If the employee has no pretax deductions, her entire gross pay is also her Medicare wages.

Why are Medicare wages higher than wages?

Dec 28, 2021 · The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction.

What makes up Medicare wages on w2?

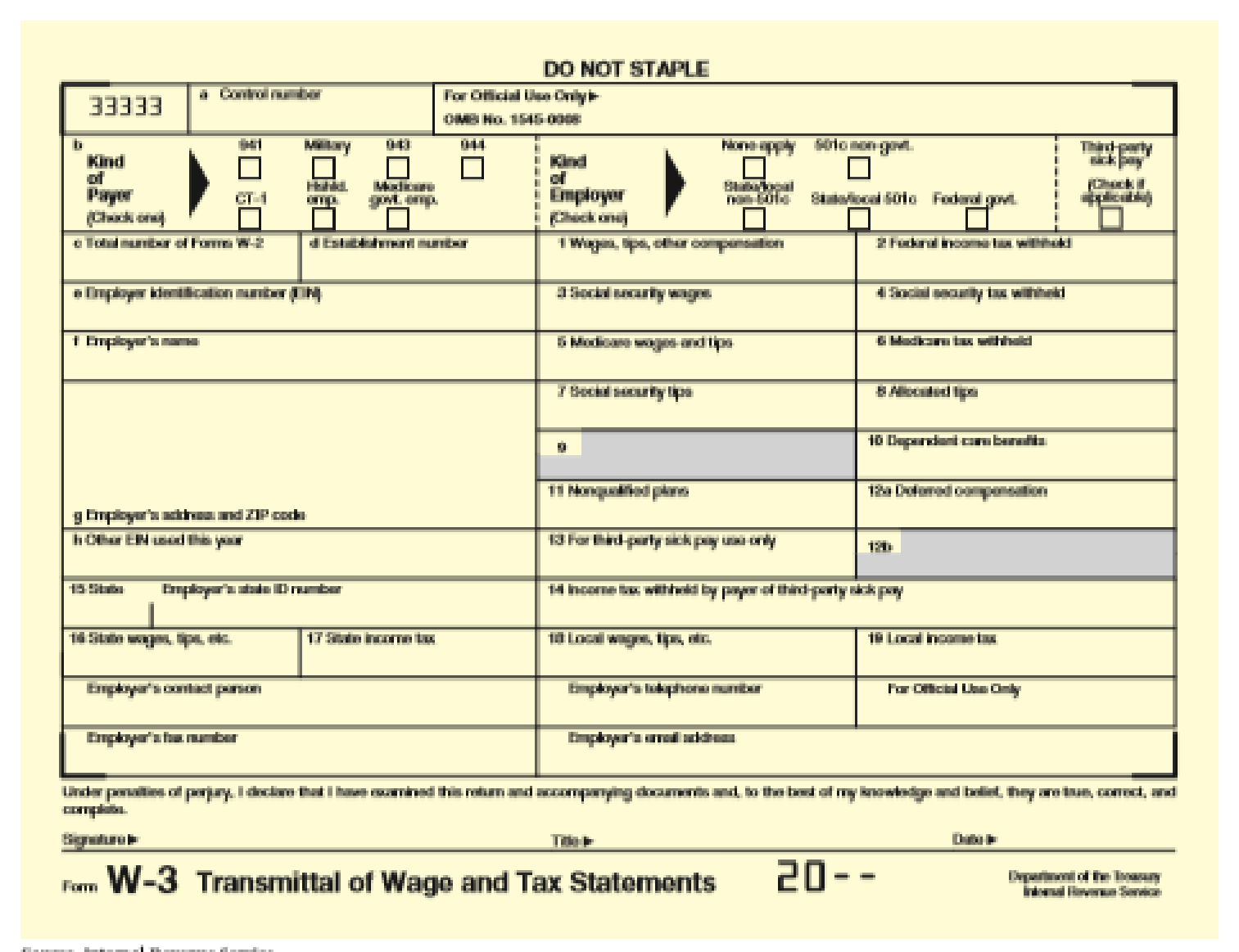

Box 5 "Medicare wages and tips": This is total wages and tips subject to the Medicare component of social security taxes. Box 6 "Medicare tax withheld": This is Medicare tax withheld from your pay for the Medicare component of social security taxes.

What wages are not included in Medicare wages?

The non-taxable wages are deductions appearing on the pay stub under 'Before-Tax Deductions. ' These include medical, vision, and dental insurance premiums, Flexible Spending Account Health Care, and Flexible Spending Account Dependent Care. Employers are required to withhold Medicare tax on employees' Medicare wages.Aug 29, 2012

Is Medicare calculated on gross income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What are Medicare wages?

Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax.

What the difference between wages and Medicare wages?

Box 1 (Wages, Tips and Other Compensation) represents the amount of compensation taxable for federal income tax purposes while box 3 (Social Security Wages) represents the portion taxable for social security purposes and box 5 (Medicare Wages) represents the portion taxable for Medicare tax purposes.

Why is Medicare wages higher than wages?

The most common questions relate to why W-2 Wages differ from your final pay stub for the year, and why Federal and State Wages per your W-2 differ from Social Security and Medicare Wages per the W-2. The short answer is that the differences relate to what wage amounts are taxable in each case.

Why are Medicare wages lower than wages?

Box 5: Medicare Wages and Tips. This represents income subject to Medicare tax. There is no maximum wage base for Medicare taxes. Medicare wages are reduced by pre-tax deductions such as health/dental/vision insurances, parking and flex spending but not reduced by your contributions to a retirement plan (403b or 457.)

Is Medicare taxed on gross or net income?

For Social Security and Medicare, deferred income (401k, 403b, Simple IRA's, etc.) is considered taxable and not subtracted from gross pay.Apr 20, 2017

What is Medicare wages?

What Are Medicare Wages? Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax. Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government's Medicare program, which provides subsidized healthcare and hospital insurance benefits to people ages 65 ...

How much is Medicare taxed?

Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. Employers also pay 1.45%. Employees whose wages exceed $200,000 are also subject to a 0.9% Additional Medicare Tax.

What are the benefits of the Cares Act?

On March 27, 2020, former President Trump signed a $2 trillion coronavirus emergency stimulus package, called the CARES (Coronavirus Aid, Relief, and Economic Security) Act, into law. 7 It expands Medicare's ability to cover treatment and services for those affected by COVID-19. The CARES Act also: 1 Increases flexibility for Medicare to cover telehealth services. 2 Authorizes Medicare certification for home health services by physician assistants, nurse practitioners, and certified nurse specialists. 3 Increases Medicare payments for COVID-19–related hospital stays and durable medical equipment.

What is the Medicare tax rate for self employed?

The Medicare tax for self-employed individuals is 2.9% to cover both the employee's and employer's portions. 2 . The 2020 CARES Act expanded Medicare's ability to cover the treatment and services of those affected by COVID-19. Employees should also consider having money deducted from their wages to fund their retirement through an ...

What is the Social Security tax rate for 2021?

For 2021, the rate for the Social Security tax is 6.2% for the employee and 6.2% for the employer, or 12.4% total—the same as 2020. The tax applies to the first $142,800 of income in 2021. The Social Security tax rate is assessed on all types of income that an employee earns, including salaries, wages, and bonuses. 4 .

What is the maximum Social Security tax for self employed in 2021?

5 The maximum Social Security tax for self-employed people in 2021 is $17,707.20. 6 . ...

What is a vesting plan?

Many employers offer certain types of retirement plans, depending on the length of time an employee has been with an organization (known as vesting) and the type of organization (company, nonprofit, or government agency). Many companies, for example, offer a 401 (k) plan.

What is Medicare tax?

Medicare taxes go toward the Medicare program—a federal health insurance program for Americans who are older than 65 or have certain disabilities and diseases. The funds taken from Medicare taxes cover three areas.

Who is responsible for Medicare taxes?

They must also deposit these wages into an authorized bank or financial institution. An employer is also required to match 1.45% of an employee’s withholding for Medicare wages and tips.

What is the Medicare tax rate for 2020?

If you are self-employed, the 2020 Medicare tax rate is 2.9% on the first $137,700 of your yearly earnings.

What is the percentage of Medicare and Social Security?

Social Security wages and Medicare both fall under FICA taxes. The percentage for Medicare is typically lower at around 1.3% – 1.5%. Just as with Social Security, this percentage is determined annually by the IRS and put out as a law. Both the employer and the employee participate in Medicare the same way as in Social Security.

How much of your Social Security income is taxed?

Other income can be taxed if you earn more than $600. However much you are taxed, your social security benefits will never pay taxes on more than 85% of your social security income. This can be a confusing web of retirement income, social security income, and income from other sources.

What percentage of Social Security tax is withheld?

The employer will withhold from the employee the same amount they have to pay. For example. If the total Social Security tax is 12%, the employer will pay 6% of their gross income and withhold 6% from the employee. These taxes go into a pool that the IRS uses to provide benefits to those who cannot work.

How long does it take to get Social Security?

Once the application is submitted the Social Security will look over the application to verify eligibility. This process usually takes about six weeks.

Is Social Security a part of FICA?

Social Security wages are part of the FICA (Federal Insurance Contribution Act) along with Medicare. These taxes are withheld by the employer so that they can pay these taxes to the IRS as required. Both Social Security and Medicare are withheld in this way.