To begin, calculate your net earnings for the year. For self-employed individuals, this amount is usually found by subtracting total expenses from gross income or sales. Net Earnings = Gross Business Income - Total Business Expenses Understand the Self Employment Tax Rate

How to pay Medicare tax self employed?

- First, the net income from your business for that year is entered.

- Second, the amount of self-employment tax owed is calculated.

- Third, any income from employment and the amount of FICA tax is considered.

What deductions can I take when self employed?

Self-employed workers can qualify for tax deductions by making contributions to SIMPLE IRAs and SEP-IRAs. They can also take advantage of other tax-deferred plans like individual 401(k) accounts. 6. Deduction for Education Expenses. Other business expenses may be tax-deductible, including the money you spend to gain new skills or improve your ...

What taxes do self employed have to pay?

- You carry on a trade or business as a sole proprietorship or as an independent contractor.

- Youre a member of a partnership that carries on a trade or business.

- Youre otherwise in business including a part-time business for yourself.

Do self employed pay less tax?

To conserve money in this economics you may need all the self-employment tax reductions you may get. Generally, yes self employed people do have the opportunity to pay less tax. However, it depends on your sales and expenses and usually, it grows slowly.

How does self-employed pay for Medicare?

If you're self-employed, you pay the combined employee and employer amount. This amount is a 12.4% Social Security tax on up to $147,000 of your net earnings and a 2.9% Medicare tax on your entire net earnings.

Can I deduct my Medicare premiums if I am self-employed?

If you're self-employed and receive Medicare, you may be able to deduct all your Medicare insurance premiums. The IRS has recently ruled that Medicare recipients who have self-employment income may deduct the premiums they pay for Medicare coverage, the same as the premiums for any other type of health insurance.

How do I calculate Medicare tax deductions?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay. 2

How are self-employment deductions calculated?

The self-employment tax rate for 2021-2022 As noted, the self-employment tax rate is 15.3% of net earnings. That rate is the sum of a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings.

What income is used to determine Medicare premiums?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

How do you deduct Medicare as a business expense?

If the policy is in the name of the taxpayer and the taxpayer pays the premiums, then the partnership must reimburse the taxpayer. The premiums must be reported as guaranteed payments on the Schedule K-1 and the taxpayer must report it on Form 1040. The partnership can deduct those guaranteed payments.

How do you calculate Medicare tax 2020?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.

How do I calculate Medicare withholding 2021?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

How do I calculate Medicare wages?

These wages are taxed at 1.45% and there is no limit on the taxable amount of wages. The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction.

How does self-employed health insurance deduction work?

Self-employed people who qualify are allowed to deduct 100% of their health insurance premiums (including dental and long-term care coverage) for themselves, their spouses, their dependents, and any nondependent children aged 26 or younger at the end of the year.

What is the standard deduction for self-employed 2021?

$12,400 for single taxpayers or married couples filing separate tax returns. $18,650 for individuals filing as head of household. $24,800 for married couples filing jointly (or surviving spouses)

Is Medicare a tax deduction?

Medicare expenses, including Medicare premiums, can be tax deductible. You can deduct all medical expenses that are more than 7.5 percent of your adjusted gross income.

Who Does Social Security Consider Self-Employed?

You operate a trade, business or profession either by yourself or as an independent contractor.

When do you have to pay taxes on self employment?

Pay the proper amount of self-employment tax (based on your net earnings) Note: As long as you’re working, you must submit your tax returns along with your self-employment tax to the IRS each year by April 15, even if you already get Social Security benefits.

What are the two parts of Medicare?

When enroll in Medicare, one of the first things you’ll notice is that there are two parts: Part A (hospital insurance) and Part B (medical insurance). Everyone pays a monthly premium for Medicare Part B, but many Medicare enrollees are eligible for premium-free Part A (though some people may need to pay a premium for Part A benefits).

How many credits do you need to get Medicare?

You (or your spouse) have to 10 years of work credits (or 40 quarterly credits) to be eligible for premium-free Part A benefits. You earn work credits (up to the maximum of four credits) each year that you earn wages and pay Medicare taxes.

When do you have to know about Medicare?

If are or have been self-employed, there are some things you need to know about Medicare before you reach age 65. Find out how working for yourself can affect your Medicare eligibility and whether you can deduct your health insurance premiums from your taxes.

Can you deduct medical expenses on Medicare?

You can even deduct the cost of medical services not covered by Medicare — including dental, hearing and vision care, prescription eyeglasses and nursing home care. Transportation to and from medical treatment may count as an eligible medical expense.

Can I deduct my self employed health insurance?

In addition to claiming the self-employed health insurance deduction, you may also deduct the cost of your Medicare deductibles, coinsurance and copayments under Medicare if those costs contribute to an out-of-pocket total that is over 10% of your AGI.

What is Medicare tax deduction?

Medicare Tax Deduction #1: Your Income is Reduced by Half the Self-employment Tax – Before the Tax is Calculated. The 15.3% paid for the self employment tax, actually represents both halves of the FICA tax: the Federal Insurance Contributions Act, which helps to fund Social Security and Medicare.

Why is 15.3% tax a deduction?

That’s where the 15.3% comes from. Because you pay the self employment tax in addition to regular federal income taxes, the IRS does provide fairly generous deductions for that tax. Those deductions mostly help to reduce your federal income tax liability, by lowering the amount of income that is subject to both taxes.

How much is Social Security tax for 2016?

For 2016, the Social Security tax is required to be paid on the first $118,500 of net income from your business. The Medicare tax is required to be paid on all of your net income from your business, even beyond $118,500.

Can you deduct Medicare tax?

The IRS allows you to deduct half of the self employment tax, which includes Medicare tax, before actually calculating the tax. The IRS recognizes the extra burden of the self-employed in paying the employer half of the tax.

Can self employed use Medicare?

The self-employed can use Medicare premiums paid to reduce their taxable income for federal income tax purposes. The self-employed are permitted to deduct health insurance premiums as an “above the line” deduction. This not only means that Medicare premiums can be used to reduce taxable income, but the deduction can be taken ...

Is It Better To Withhold Taxes

Remember, one of the big reasons you file a tax return is to calculate the income tax on all of your taxable income for the year and see how much of that tax youve already paid via withholding tax. If it turns out youve overpaid, youll probably get a tax refund. If it turns out youve underpaid, youll have a tax bill to pay.

Other Payroll Tax Items You May Hear About

FUTA tax: This stands for Federal Unemployment Tax Act. The tax funds a federal program that provides unemployment benefits to people who lose their jobs. Employees do not pay this tax or have it withheld from their pay. Employers pay it.

Monitoring Ss And Medicare Status

The Research Foundation is solely responsible for processing the correct withholding or exemption of SS and Medicare taxes. Error where the RF has not withheld the taxes can result in significant risk of fines and penalties from the government. SS and Medicare status for all Research Foundation employees should be monitored periodically.

What Is The Fica Tax

The FICA tax is a U.S. federal payroll tax paid by employees and their employers. It consists of:

Before You Calculate Fica Tax Withholding

To calculate FICA taxes from an employee’s paycheck, you will need to know:

Pay Attention To Your Paycheck

Its important that you regularly track your paystub with your employer, particularly because of the temporary end-of-year changes. Calculate the dollar amount that you expect to see withheld every paycheck and make sure that the numbers are accurate. Mistakes happen, so its important to track things closely.

What Is The Medicare Tax Rate For 2021

The Medicare tax rate is 1.45%. But the Federal Insurance Contributions Act tax combines two rates. FICA taxes include both the Social Security Administration tax rate of 6.2% and the Medicare tax rate.

How much can you deduct for self employed health insurance?

The amount that you can deduct using the self-employed health insurance deduction is up to the full amount that you spent on health insurance premiums during the year. But only if that amount is less than or equal to the net profit that you made during the year.

What is self employed?

The most common definition that people think of when they hear the term self-employed is the typical self-employed workers such as sole proprietors and single-member LLC owners. Well, people might not think of it in those exact terms, but this is the person that works for themselves such as an independent contractor, a freelancer, or people who have their own single-person business.

What is the most studied topic when it comes to self employment?

Health insurance and taxes are two of the most studied topics when it comes to self-employment. For that reason, you can rest assured knowing that everything you read here comes from countless hours of research, IRS guidelines, and years’ worth of hands-on experience dealing with this stuff ourselves.

What is the second part of the equation?

The second part of the equation is how much earned income that you had during the year. Earned income can be described in a few different ways depending on the context that it’s being used. But for self-employed people, just think of it as the total net profit or loss.

Can you deduct health insurance if you have a net loss of $0?

And the last case, what if you had a really bad year and you had a net profit of $0 or you ended up losing money that year? If you have a profit of $0 or you took a net loss one year, you cannot deduct any of that $12,000 you paid in health insurance. If there’s no net profit to deduct the taxable income from, then you can’t use the deduction at all.

Can you deduct dental insurance premiums?

First and foremost, the amount that you can potentially deduct is the total amount that you spent on health insurance premiums during the year. This includes standard health insurance, dental insurance, and even long-term care in some cases. Keep in mind that this deduction can be used for your own insurance, your spouse’s, as well as any dependents that are 26 years old or younger.

Can you deduct self employment income if you lost money?

But the deduction cannot exceed the total net profit of how much you brought in as income during the year through your self-employment. And if you lost money during the year, you are unable to deduct anything at all. If that seems a little confusing, let’s run through a detailed example to make it crystal clear.

How do you get health insurance when you’re self-employed?

Self-employed individuals, who run businesses without employees, can buy health insurance through the individual Health Insurance Marketplace. When you fill out an application, you’ll learn if you qualify for premium tax credits and other savings.

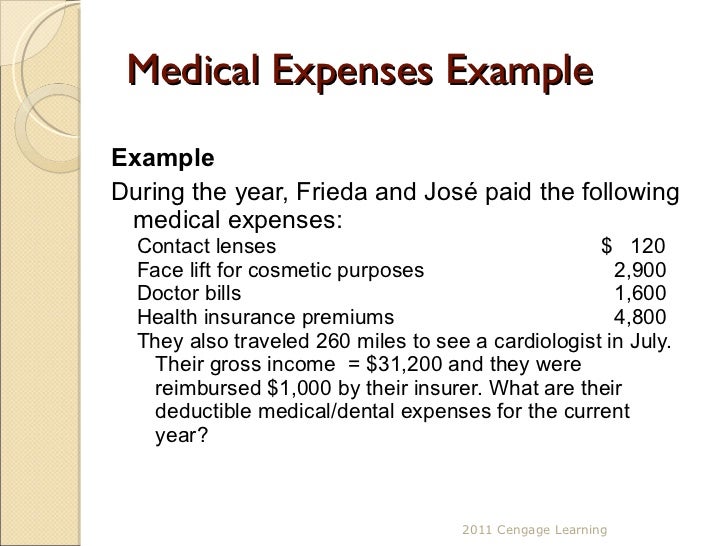

What About Medical Expenses?

Medical expenses can be deducted if you itemize your deductions on Schedule A (Form 1040). You can deduct medical expenses that add up to more than 7.5% of your adjusted gross income. The expenses can include money you spent to diagnose, cure, mitigate, treat, or prevent disease, as well as payments to treat any function or structure of the body. You can also include payments made for insurance premiums that exceed the amount of net income you earned in a year. 4

Are Self-Employed Health Insurance Premiums Deductible?

Under certain circumstances, self-employed individuals can deduct the amount they’ve spent on health insurance coverage for themselves and their families during a tax year —even though this is a personal expense, not a company cost. Eligibility requirements apply to this deduction.

What is the tax for self employed?

must pay taxes to fund Social Security and Medicare. For self-employed individuals, this is called Self-Employment Tax, sometimes called SECA Tax. It's similar to FICA taxes (Social Security and Medicare taxes paid by employees and employers). 1 .

What is My Income for Self-Employment Tax?

Business owners pay income taxes on their business income in different ways. The business income for self-employment tax purposes depends on the type of business:

How Is SECA Tax Calculated for Income Tax Purposes?

The amount of SECA tax is calculated and included in the owner's personal tax return in several steps:

How Does SECA Tax Work If I Also Have Employment Earnings?

You may get a paycheck from an employer as well as having a side business that is profitable and gets you Social Security benefits. In general, your FICA earnings are considered first for Social Security benefits, but it's a little more complicated than that.

How is SECA tax calculated?

The amount of SECA tax is calculated and included in the owner's personal tax return in several steps: Step 1: The business owner's taxable income is calculated, depending on the type of business owned, as described above. Step 2: This income is used to calculate self-employment tax by using Schedule SE.

What is Schedule SE?

Schedule SE is used to calculate your self-employment tax liability for your tax return. This calculation includes a deduction of half the amount of tax from your adjusted gross income. This deduction reduces your self-employment tax liability, but it doesn't change the amount for benefit calculations. Social Security Tax.

Where is half of self employment tax deducted?

Step 3: Half of the calculated amount of the self-employment tax is deducted from the individual's taxable income on page 1 of the 1040 form.

Can I efile my taxes?

Yes, you may e-file. I personally have to do this on my own return. There's not a software program that I'm aware of that can handle these calculations in the purest form, you kind of have to go back and forth until the numbers harmonize. And, I agree, some of the unintended consequences of the ACA are not that easy to calculate on the forms.

Is health insurance premium tax credit equal to self employed?

Health Insurance Premiums minus Premium Tax Credit is equal to or greater than the Self-Employed Health Insurance deduction, and the deduction must be equal to or less than your eligible Self-Employment income.

Can you deduct self employment income?

That is the delicate balance of the deduction. Your deduction is first limited to the amount of self-employment income. Clearly, that's not at issue here because you have more self-employment income than you do healthcare premiums. But the Premium Tax Credit can also interfere with the calculation, and there's no real "worksheet formula" that can work it out, because the solution is a true "chicken-and-egg" problem.

Can self employment deduction be greater than the difference of the actual premium amount?

Here's what the IRS says: your self-employment deduction cannot be greater than the difference of the actual premium amount minus any credit you receive. Problem is: when you put the full deduction, you create more credit, so the numbers don't line up. So the IRS says you can use any method to get the correct balance, and that's literally what I've had to do, because when you lower the deduction, the credit goes down also.

How is retirement plan contribution calculated?

Retirement plan contributions are often calculated based on participant compensation. For example, you might decide to contribute 10% of each participant's compensation to your SEP plan. This formula works to determine employees' allocations, but your own contributions are more complicated. You can't simply multiply your net profit on Schedule C by 10%.

How much is Section 164 F deduction?

the IRC Section 164 (f) deduction, which in this case is ½ of his SE tax ($14,130 x ½); and

How to amend a 1040?

You should amend your Form 1040 tax return and Schedule C if you: 1 deducted your own plan contribution on Schedule C instead of on Form 1040, Schedule 1, or 2 made and deducted more than the allowable plan contribution for yourself.

What is a 1040 Schedule 1 contribution?

the amount of your own (not your employees’) retirement plan contribution from your Form 1040 return, Schedule 1, on the line for self-employed SEP, SIMPLE, and qualified plans.

What is the maximum amount of retirement contributions?

A limit applies to the amount of annual compensation you can take into account for determining retirement plan contributions. This limit is $290,000 in 2021, $285,000 in 2020 and $280,000 in 2019 and is adjusted annually . Plan contributions for a self-employed individual are deducted on Form 1040, Schedule 1 (on the line for self-employed SEP, ...

What to do if you contributed more for yourself than your plan terms allowed?

If you contributed more for yourself than your plan terms allowed, you should also correct this plan qualification failure by using the IRS correction programs.

Can you multiply your net profit on Schedule C?

You can't simply multiply your net profit on Schedule C by 10%. You calculate self-employment (SE) tax using the amount of your net earnings from self-employment and following the instructions on Schedule SE, Self-Employment Tax. However, you must make adjustments to your net earnings from self-employment to arrive at the amount ...

How Do I Calculate Net Earnings for Self-Employment Taxes?

Net earnings are calculated generally by starting with gross income from the business and subtracting:

How Do I Pay Estimated Self-Employment Taxes?

So, you must pay these taxes at tax time, through your personal tax return.

What Are Self-Employment Taxes?

Self-employment taxes are taxes that every self-employed person must pay for Social Security and Medicare. This tax is similar to FICA taxes, the Social Security and Medicare taxes that employees pay through payroll withholding.

How Do Self-Employment Taxes Affect My Personal 1040 Tax Bill?

Your self-employment taxes are added to your income taxes on your personal income tax return.

What Does It Mean to Be Self-Employed?

According to the Internal Revenue Service (IRS), you're self-employed if either of the following applies to you:

What If I Am Self-Employed and Also an Employee?

If you are self-employed and also an employee of someone else, both incomes are included to determine the total amount of Social Security and Medicare tax you must pay.

What is the result of business taxes?

You must figure your business taxes for the year, including income, expenses, tax credits, and other adjustments. The result is your net earnings (the same thing as profit or loss).