How do I calculate Medicare and Social Security tax deductions?

How do independent contractors pay Social Security taxes?

Do you pay Social Security and Medicare tax on investment income?

How do you calculate how much to take out of salary for Medicare and Social?

- The Social Security (OASDI) withholding rate is gross pay times 6.2% up to the maximum pay level for that year. ...

- The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. ...

- For a total of 7.65% withheld, based on the employee's gross pay.

How much can you make on a side job without paying taxes?

How is Social Security tax calculated?

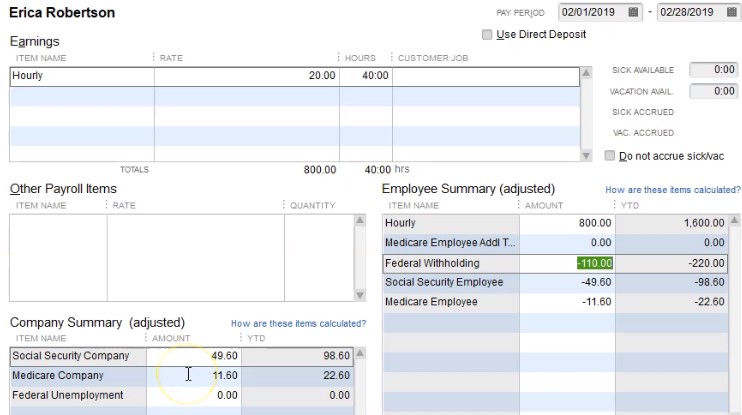

To calculate FICA tax contribution for an employee, multiply their gross pay by the Social Security and Medicare tax rates. For example, if an employee's taxable wages are $700 for the week, their social security contribution would be: $700.00 x 6.2% = $43.40.Feb 24, 2020

How is net investment income tax calculated?

Who pays 3.8 net investment tax?

How much investment income is taxable?

How do you calculate FICA and Medicare tax 2021?

Is Social Security tax calculated on gross or net income?

How do you calculate federal income tax withheld?

- Multiplying taxable gross wages by the number of pay periods per year to compute your annual wage.

- Subtracting the value of allowances allowed (for 2017, this is $4,050 multiplied by withholding allowances claimed).

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

How much tax do you pay on Medicare?

There are no tax limits for Medicare. You will pay taxes at a rate of 1.45% on all of your taxable wages. In addition, employers are required to withhold Additional Medicare tax of 0.9% once taxable wages are over $200,000 for the year.

Why do Medicare and Social Security go hand in hand?

Social Security and Medicare taxes go hand in hand. One reason for this is because the taxable wages for these two taxes are generally the same. The taxable wages for Social Security and Medicare taxes are defined below:

What is the Social Security tax limit for 2017?

Social Security tax limit for 2017 is $7,886.40. One of the differences between Social Security and Medicare is that Social Security is taxed only on the first $127,200 of taxable wages, or $7,886.40 in taxes. Once you hit that limit, you will no longer be taxed for Social Security in 2017.

What are the big amounts that come out of our paychecks?

Some big amounts that come out of our paychecks are for Social Security and Medicare taxes. How are they calculated? Read on for a complete guide.

How much is Bob's semi monthly salary?

Example: Bob is paid semi-monthly. On this paycheck, he earned $8,000 in salary. Bob gets a semi-monthly auto allowance of $1,000. He has a medical deduction of $1,500, and he contributes 10% of his income to his 401k.

Is 401(k) income taxable?

For Social Security and Medicare, deferred income (401k, 403b, Simple IRA’s, etc.) is considered taxable and not subtracted from gross pay. Using Bob again as our example:

Is there a cap on Medicare taxes?

There is no Medicare cap, and employers are required to withhold an additional Medicare Tax of 0.9% for wages over $200,000. Now that we’ve covered Social Security and Medicare taxes, we’ll tackle state taxes in our next segment. Bookmark ( 0) Please login to bookmark. Username or Email Address.

How is Social Security tax calculated?

The Old-Age, Survivors and Disability Insurance program (OASDI) tax—more commonly called the Social Security tax —is calculated by taking a set percentage of your income from each paycheck. Social Security tax rates are determined by law each year and apply to both employees and employers. 1 2 .

How much is Medicare taxed in 2021?

Though Medicare tax is due on the entire salary, only the first $142,800 is subject to the Social Security tax for 2021.

How much is the FICA tax withheld?

For the first 20 pay periods, therefore, the total FICA tax withholding is equal to ($6,885 x 6.2%) + ($6,885 x 1.45%), or $526.70. Only the Medicare HI tax is applicable to the remaining four pay periods, so the withholding is reduced to $6,885 x 1.45%, or $99.83. In total, the employee pays $8,537.40 to Social Security and $2,395.98 to Medicare each year. Though it does not affect the employee's take-home pay, the employer must contribute the same amount to both programs. 18

What is the maximum amount of income subject to OASDI tax in 2021?

For 2021, the maximum amount of income subject to the OASDI tax is $142,800, capping the maximum annual employee contribution at $8,853.60. For 2022, the maximum amount of income subject is $147,000, capping the maximum annual employee contribution at $9114. 3 The amount is set by Congress and can change from year to year. 1

How is Social Security funded?

Because Social Security is a government program aimed at providing a safety net for working citizens, it is funded through a simple withholding tax that deducts a set percentage of pretax income from each paycheck. Workers who contribute for a minimum of 10 years are eligible to collect benefits based on their earnings history once they retire or suffer a disability. 7

What is the Social Security tax rate for 2021?

For 2021, the Social Security tax rate for both employees and employers is 6.2% of employee compensation , for a total of 12.4%. Those who are self-employed are liable for the full 12.4%. 3 . The combined taxes withheld for Social Security and Medicare are referred to as the Federal Insurance Contributions Act (FICA).

What happens if you overpay Social Security?

When an overpayment occurs, that amount is applied to the individual’s federal tax bill or is refunded.

How to get a replacement SSA-1099?

To get your replacement Form SSA-1099 or SSA-1042S, select the "Replacement Documents" tab to get the form.

How much of your unemployment benefits are taxable?

more than $34,000, up to 85 percent of your benefits may be taxable. between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits. more than $44,000, up to 85 percent of your benefits may be taxable.

Do you pay taxes on your benefits if you are married?

are married and file a separate tax return, you probably will pay taxes on your benefits.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

Is there a wage base limit for Medicare?

There's no wage base limit for Medicare tax. All covered wages are subject to Medicare tax.

Is FSA contribution subject to federal income tax?

1) "Amounts contributed to an FSA are not subject to federal income tax, Social Security tax or Medicare tax, allowing your medical or dependent care expenses to be paid with pre-tax..."

Can Social Security be deducted from wages?

They are not deducted at any point. Social security and medicare taxes cannot be subtracted form wages to determine taxable income.

Social Security taxable benefit calculator

Enter the total of any exclusion for U.S. savings bond interest, foreign-earned income, or housing.

The amount of Social Security benefits subject to federal income tax

For advisor use only. This calculator should not be used to provide tax or legal advice. For specific advice, please contact an experienced attorney or CPA.

What is the Medicare tax rate if you make more than the threshold?

The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional Medicare tax of 0.9%.

What is the Medicare tax rate for 2019?

In 2019, the tax rate for employees was 1.45% for Medicare and 6.2% for Social Security. High-income employees are charged an additional 0.9% Medicare surtax. Employers have the responsibility of withholding FICA taxes from their employees’ wages.

What is FICA tax?

FICA Tax. FICA is an acronym for Federal Insurance Contributions Act. This act was introduced in 1930 to cover Social Security. Both you and your employer will pay into this tax. Now, the tax is divided into Medicare and Social Security tax which is why you will probably see these two items on your paystub rather than just FICA.

What is the most important tax to stay on top of and get correct?

FICA taxes are the most important tax to stay on top of and get correct. Not withhold or paying the correct amount of FICA taxes will result in serious consequences for the employer. All businesses must report FICA taxes quarterly to the IRS using Form 941.

What happens if you don't pay Social Security taxes?

If an employee makes more than the set $132,900, Social Security tax should not be withheld from their pay for any earning made above this amount. If you do not follow Social Security, Medicare, or FICA instruction carefully, you may end up either not deducting enough or too much.

Do self employed people pay Medicare taxes?

If you are self-employed, you will pay self-employment tax, which is the equivalent of both employee and employer portions of the Medicare Tax. In 2019, the rate of Medicare tax was 1.45% of an employee’s gross earnings. The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional ...

Do self employed pay Social Security taxes?

Both employers and employees must pay Social Security Tax. As with Medicare tax, self-employed individuals will have to pay both the employee and employer portion of Social Security Tax. The rate for Social Security tax in 2019 was 6.2% of an employee’s gross wages below $132,900. The employer must match the amount paid by the employee.