- File your appeal within 120 days of receiving the Medicare Summary Notice (MSN) that lists the denied claim.

- Circle the item on your MSN that you are appealing and clearly explain why you think Medicare’s decision is wrong. ...

- Include additional information that supports your appeal. You may want to ask your doctor, health care provider or health equipment supplier for help in providing information that could assist in ...

- Carefully read the specific instructions that appear on your MSN about how to file your appeal. (Don’t forget to sign your name and include your telephone number.)

How do I appeal a denial from my Medicare health plan?

If you have a Medicare health plan, start the appeal process through your plan. Follow the directions in the plan's initial denial notice and plan materials. You, your representative, or your doctor must ask for an appeal from your plan within 60 days from the date of the coverage determination.

How do I stop Medicare Easy Pay?

If you want to stop Medicare Easy Pay, you can simply call 1-800-MEDICARE (1-800-633-4227). How much does Medicare cost by state? Does Medicare cost change by income level?

Can I sign up for Medicare easy pay if I'm Behind?

If you pay out-of-pocket monthly premiums for Medicare Part A or Part B, you can sign up for Medicare Easy Pay. However, if you’re behind in your payments, you may need to catch up first before you can sign up.

How long does it take to change Medicare Easy Pay?

Also, starting, stopping, or changing Medicare Easy Pay can take up to eight weeks. In addition, you cannot use Medicare Easy Pay to pay monthly premiums for Medicare products offered by private insurance companies, nor can you use it to pay for Medicare Part D premiums, so you still need to keep track of these deadlines and payments separately.

How do I fight Medicare?

Fill out a "Redetermination Request Form [PDF, 100 KB]" and send it to the company that handles claims for Medicare. Their address is listed in the "Appeals Information" section of the MSN. Or, send a written request to company that handles claims for Medicare to the address on the MSN.

How do I win a Medicare appeal?

Appeals with the best chances of winning are those where something was miscoded by a doctor or hospital, or where there is clear evidence that a doctor advised something and the patient followed that advice and then Medicare didn't agree with the doctor's recommendation.

How do I challenge Medicare Irmaa?

To get an appeal form, you can go into a nearby Social Security office, call 800-772-1213, or check the Social Security website. Even if you haven't experienced a life-changing event, you can still appeal an IRMAA. Request an appeal in writing by completing a request for reconsideration form.

What are the five levels for appealing a Medicare claim?

The Social Security Act (the Act) establishes five levels to the Medicare appeals process: redetermination, reconsideration, Administrative Law Judge hearing, Medicare Appeals Council review, and judicial review in U.S. District Court. At the first level of the appeal process, the MAC processes the redetermination.

What are the chances of winning a Medicare appeal?

People have a strong chance of winning their Medicare appeal. According to Center, 80 percent of Medicare Part A appeals and 92 percent of Part B appeals turn out in favor of the person appealing.

How do I write a Medicare reconsideration letter?

The Medicare appeal letter format should include the beneficiary's name, their Medicare health insurance number, the claim number and specific item or service that is associated with the appeal, dates of service, name and location of the facility where the service was performed and the patient's signature.

How can I lower my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

Does Medicare reevaluate your income every year?

Yes. If we determine you must pay more for your Medicare Part B or Medicare prescription drug coverage because of your income, and you disagree, you have the right to request an appeal, also known as a reconsideration. You'll need to request an appeal in writing by completing a Request for Reconsideration (SSA-561-U2).

Does Social Security count towards Irmaa?

Some examples of what counts as income towards IRMAA are: Wages, Social Security benefits, Pension/Rental income, Interest, Dividends, distributions from any tax-deferred investment like a Traditional 401(k) or IRA and, again, Capital Gains.

Who pays if Medicare denies a claim?

The denial says they will not pay. If you think they should pay, you can challenge their decision not to pay. This is called “appealing a denial.” If you appeal a denial, Medicare may decide to pay some or all of the charge after all.

What is the difference between reconsideration and redetermination?

Any party to the redetermination that is dissatisfied with the decision may request a reconsideration. A reconsideration is an independent review of the administrative record, including the initial determination and redetermination, by a Qualified Independent Contractor (QIC).

Can providers appeal denied Medicare claims?

If you disagree with a Medicare coverage or payment decision, you can appeal the decision. Your MSN contains information about your appeal rights. If you decide to appeal, ask your doctor, other health care provider, or supplier for any information that may help your case.

How to appeal Medicare summary notice?

If you have Original Medicare, start by looking at your " Medicare Summary Notice" (MSN). You must file your appeal by the date in the MSN. If you missed the deadline for appealing, you may still file an appeal and get a decision if you can show good cause for missing the deadline.

How long does it take for a Medicare plan to make a decision?

The plan must give you its decision within 72 hours if it determines, or your doctor tells your plan, that waiting for a standard decision may seriously jeopardize your life, health, or ability to regain maximum function. Learn more about appeals in a Medicare health plan.

What is an appeal in Medicare?

An appeal is the action you can take if you disagree with a coverage or payment decision by Medicare or your Medicare plan. For example, you can appeal if Medicare or your plan denies: • A request for a health care service, supply, item, or drug you think Medicare should cover. • A request for payment of a health care service, supply, item, ...

How long does Medicare take to respond to a request?

How long your plan has to respond to your request depends on the type of request: Expedited (fast) request—72 hours. Standard service request—30 calendar days. Payment request—60 calendar days. Learn more about appeals in a Medicare health plan.

What is a Pace plan?

A special type of health plan that provides all the care and services covered by Medicare and Medicaid as well as additional medically necessary care and services based on your needs as determined by an interdisciplinary team. PACE serves frail older adults who need nursing home services but are capable of living in the community. PACE combines medical, social, and long-term care services and prescription drug coverage.

How long does it take to appeal a Medicare denial?

You, your representative, or your doctor must ask for an appeal from your plan within 60 days from the date of the coverage determination. If you miss the deadline, you must provide ...

How long does it take to get a decision from Medicare?

Any other information that may help your case. You’ll generally get a decision from the Medicare Administrative Contractor within 60 days after they get your request. If Medicare will cover the item (s) or service (s), it will be listed on your next MSN. Learn more about appeals in Original Medicare.

What to do if Medicare decision is not in your favor?

If that decision is not in your favor, you can proceed up the appeals levels to an administrative law judge, the Medicare Appeals Council and federal court.

What happens if you disagree with a Medicare decision?

If you disagree with a decision about one of your Medicare claims, you have the right to challenge that decision and file an appeal. Situations in which you can appeal include: Denials for health care services, supplies or prescriptions that you have already received. For example: During a medical visit your doctor conducts a test.

How to report Medicare not paying?

If you still have questions about a claim you think Medicare should not have paid, report your concerns to the Medicare at 1-800-MEDICARE. Make copies for your records of everything you are submitting. Send the MSN and any additional information to the address listed at the bottom on the last page of your MSN.

How long does it take to appeal a denied Medicare claim?

File your appeal within 120 days of receiving the Medicare Summary Notice (MSN) that lists the denied claim.

How long does it take to appeal Medicare?

The final level of appeal is to the federal courts. You generally have 60 days to file appeals before an ALJ, the Medicare Appeals Council and to federal court.

What is the second level of Medicare appeal?

If your concerns aren’t resolved to your satisfaction at this level, you can file an appeal form with Medicare to advance your request to the second “reconsideration” level in which an independent review organization, referred to as the “qualified independent contractor,” assesses your appeal.

Why does Medicare reject my doctor's recommendation?

For example: Your Medicare Part D drug plan rejects your doctor’s recommendation that you receive a discount on an expensive medication because the available lower-cost drugs are not effective for your condition.

How to make sure your health bill is reasonably priced?

To make sure the charges on your bill are reasonably priced, use the Healthcare Blue Book. This is a free resource that lets you look up the going rate of health care costs in your area. If you find errors or have questions about charges, contact your provider’s billing office and your insurer.

What to do if you find errors in medical bills?

If you find errors or have questions about charges, contact your provider's billing office and your insurer. If they don't help you and the discrepancies are significant, you should consider getting help from a trained professional who specializes in analyzing medical bills and negotiates with health care providers, insurers and even collection agencies.

How many hospital bills have errors?

According to the Medical Billing Advocates of America, nine out of 10 hospital bills have errors on them, most of which are in the hospital’s favor. Bills from doctor’s offices and labs have mistakes too, but they tend to be fewer and further apart. To help you get a handle on your medical bills and check for costly errors, ...

How to look up medical billing codes?

You can also look up most medical billing codes online by going to any online search engine and typing in “CPT” followed by the code number. Once you receive and decode the statement, review it carefully and keep your eyes peeled for these mistakes:

Is double checking medical bills smart?

Dear Trying: Errors and overcharging have become so commonplace on medical bills today that double-checking them is a very smart move that may save you some money. Here are some tips and tools that can help.

What else do I need to know about Medicare Easy Pay?

Also, if you decide to change the bank account from which you withdraw payments, all you need to do is complete a new payment authorization agreement form.

How do I set up Medicare Easy Pay?

As the name implies, Medicare Easy Pay is easy to set up. Here’s how it works:

What can I expect after I send in the Medicare SF-5510 form?

Medicare will process your form within six to eight weeks. Once processed, you’ll receive something that looks like a bill (Note: It’s called a CMS-500 form or ‘Medicare Premium Bill’); however, it will clearly state the following in the upper right corner: ‘THIS IS NOT A BILL.’

Why might I want to consider Medicare Easy Pay?

There are several reasons some beneficiaries may consider using Medicare Easy Pay, such as the following:

Are there any drawbacks to Medicare Easy Pay?

Not really. However, as with any automatic bill pay, you need to make sure you have enough money to cover each withdrawal to avoid potential overdraft fees. Also, starting, stopping, or changing Medicare Easy Pay can take up to eight weeks.

What is the Medicare account number?

Your ‘agency account number’ is your 11-character Medicare number from your red, white, and blue Medicare insurance card. The ‘type of payment’ is ‘Medicare premiums.’

What is the agency name for Medicare?

First, know that the ‘agency name’ is ‘Centers for Medicare & Medicaid Services.’

What chapter is Medicare for Dummies?

Now that you know what Medicare is and when the right time to apply is, we can move onto chapter 3 of Medicare for Dummies.

What is Medicare Advantage?

Medicare Advantage Plans – Rather than these plans paying after Medicare, they pay instead of Medicare. This is private insurance that contains its own network of providers. You will be responsible to pay a copay for physician visits, facility stays, etc.

What is the SEP period for Medicare?

If this criterion is met, you may delay enrollment for Medicare until after turning age 65. GEP – General Enrollment Period: If you fail to apply for Medicare ...

What is part A of Medicare?

Part A: This is hospital coverage. It covers your stay in the hospital, a nursing facility, or any inpatient care.

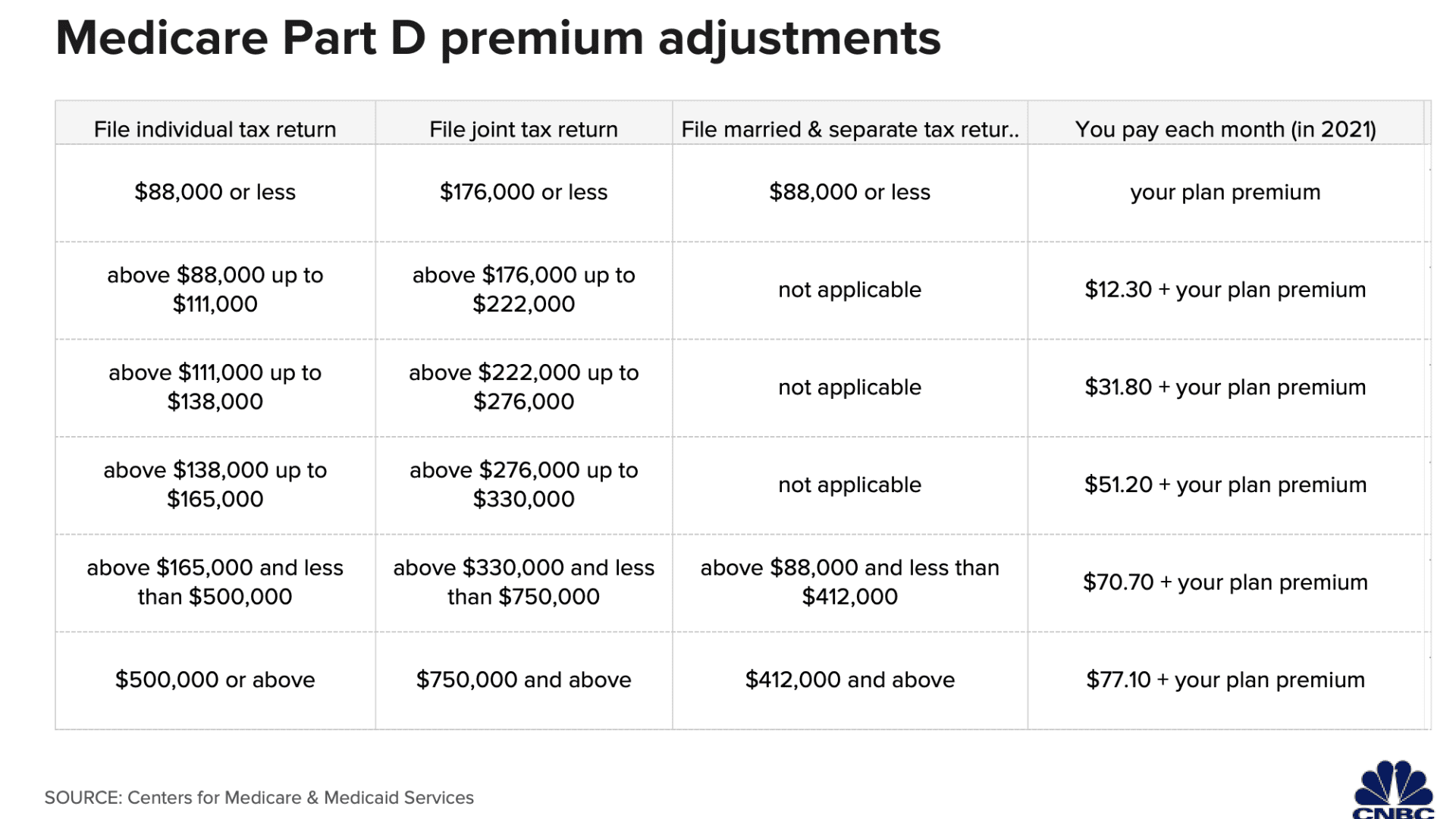

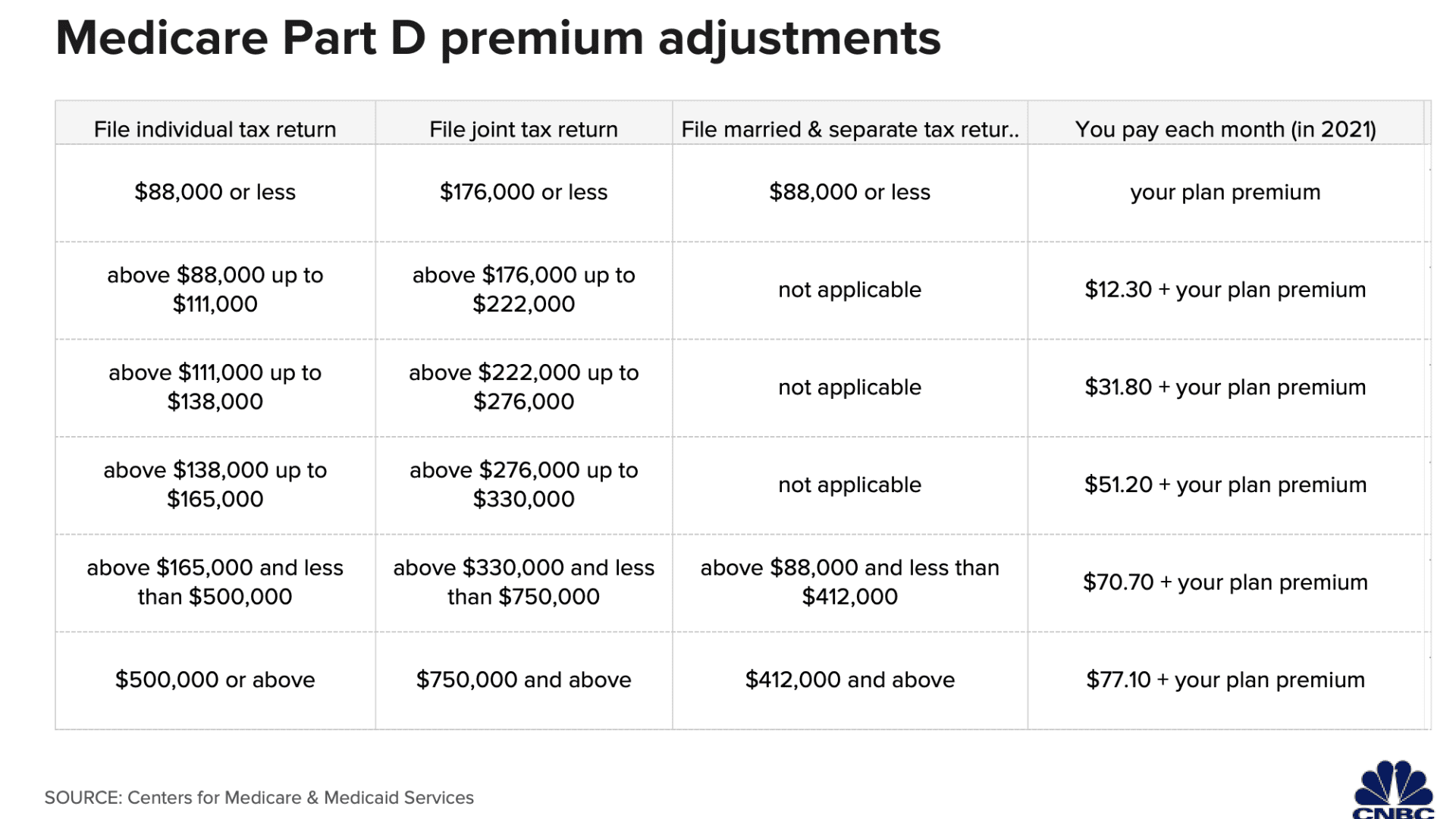

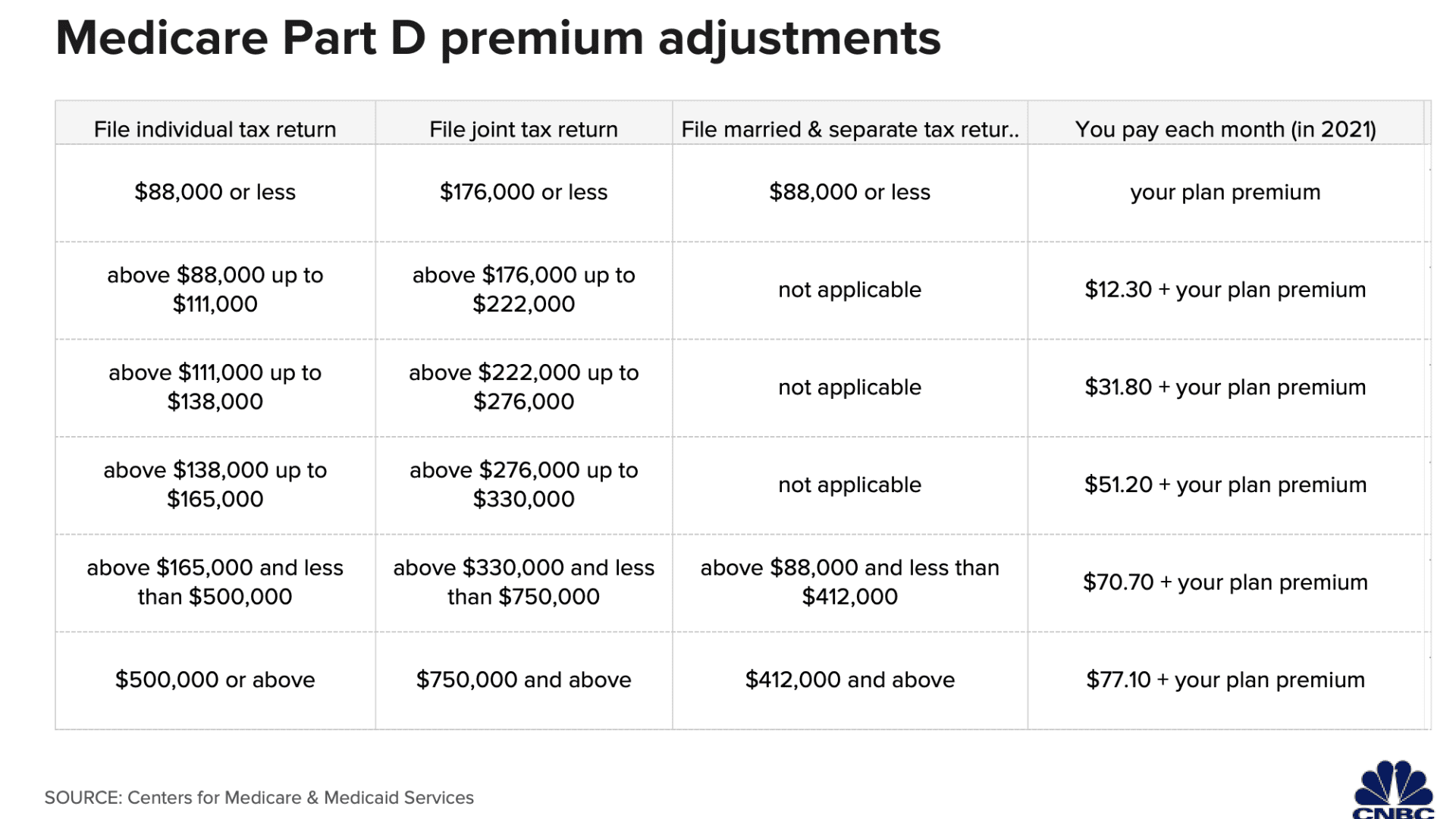

How long does it take for Social Security to review your income?

When determining one’s income adjustment, Social Security will review previous tax returns, up to two years. If you find that your income has decreased from the previous years, you may be able to file a reconsideration request. Social Security will require proof of income and will then reconsider your premium costs.

How much of Medicare will gobble up in 2040?

By 2040, Part B will gobble up 25 percent.

How much is Medicare unfunded?

According to the Office of the Actuary at the Center for Medicare and Medicaid Services, Medicare’s unfunded obligations will reach $37.7 trillion during that same 75-year timeframe.

How much will Medicare spend in the next decade?

The CBO projects overall Medicare spending will double over the next decade, from $707 billion to over $1.5 trillion annually. Even the hottest economy cannot “outgrow” the deficits and debt worsened by financially troubled Medicare and other federal entitlements.

How long does Medicare have to draw from general funds?

For the second consecutive year, the trustees project that Medicare will have to draw 45 percent of its money from general funds within seven years.

What was the income for Obamacare in 2010?

For the first few years, Obamacare’s s Medicare tax hike would strike only the “rich” — statutorily defined as persons with annual incomes of $200,000 (or $250,000 for couples).

What is the normal age for Medicare?

The Heritage Foundation suggests that Congress gradually raise the normal age of Medicare eligibility to 67 and reduce the taxpayer subsidies.

Will seniors' access to care decline?

Moreover, seniors’ access to care could decline, thanks to Obamacare. Over the next 10 years, Obamacare is scheduled to squeeze out more than $800 billion in Medicare payment changes and reductions. If that happens, the trustees estimate that by 2040, “approximately half of hospitals, roughly two thirds of skilled nursing facilities, and over 80 percent home health agencies would have negative total facility margins.” In plain English: These provider will be hemorrhaging red ink and limiting Medicare patient access to their services.

How does the 28 day challenge help you?

We’re here to help you break those habits and live your best life! In this 28 day health challenge, you can turn your life around and start a new healthy lifestyle. Making healthy choices should not be one-time decisions.

What is the 21st day of the Healthy Living Challenge?

Day Twenty-one: Splurge on a spa day or a Massage. You may have learned from day 13 that posture is incredibly important, and you might not even realize that you hurt your posture. Use day 21 of this Healthy Living Challenge as an excuse to treat yourself to a nice massage or a day at the spa.

How to start a healthy lifestyle?

Remember that to start a new healthy lifestyle is to do more than eat your vegetables and exercise – you also have to keep a rounded diet, exercise safely, engage in social activities, reduce stress, drink plenty of water, and more.

How to get your metabolism up?

Getting your daily exercise does not necessarily have to mean an intense cardio workout. Especially as you’re getting older, you have to be careful about over-exerting yourself and getting hurt. Today, go for a walk around your neighborhood or at a local park. Even a one-mile leisurely walk can lift your spirits and boost your metabolism. Consider taking your grandkids to the park for even more fun!

Does Medicare cover wellness visits?

Have you been attending your annual wellness visits with your doctor? Medicare covers an annual wellness visit for all beneficiaries. This visit is your chance to ask your doctor about any possible health concerns you have, and to request tests and screenings for various illnesses that you’re worried about. Remember, it’s always best to get ahead of your health and start healing before your symptoms worsen.

Does Medicare cover chiropractic care?

Medicare covers spinal manipulation when necessary, and some Medicare Advantage plans may cover other chiropractic services.

Adding Fuel to the Fire?

The Bush administration’s new estimated cost for Medicare Part D caused quite a stir because it was substantially higher than the previously released estimated cost of Part D spending for the period two estimates is easily explained.

No Easy Answers for Medicare

Diagnosing the problem for Medicare is much easier than finding viable solutions. As is well known, 78 million baby boomers will start to turn 65 in 2011. They will continue reaching retirement age over the next 20 years, doubling the population covered by Medicare. Moreover, these boomers will live longer than their predecessors.