Changing from Medicare Advantage to Original Medicare is a very simple process once you’re ready and eligible to switch. There are three ways you can make the change: Visit your local Social Security Office and ask to be disenrolled from Medicare Advantage; Call 1-800-MEDICARE (1-800-633-4227) and process your disenrollment over the phone; or

- To switch to a new Medicare Advantage Plan, simply join the plan you choose during one of the enrollment periods. ...

- To switch to Original Medicare, contact your current plan, or call us at 1-800-MEDICARE.

When to choose Original Medicare vs. Medicare Advantage?

You may want to choose between Original Medicare and Medicare Advantage for financial reasons, but you may also want to consider access to certain healthcare services. The important thing is to understand the differences between each type of Medicare before you commit yourself to a plan for the coming year.

Can I switch between Medicare Advantage and Original Medicare?

You can move from Medicare Advantage to Original Medicare for up to two months after you’re discharged. Once you become eligible for Medicaid benefits, then you can drop your Medicare Advantage plan and switch to Original Medicare.

Why is Medicare Advantage cheaper than Medicare?

There are lower premiums but more cost sharing with a Medicare Advantage plan. Medicare Advantage (also known as “MA”) plans monthly premiums are typically much lower than a traditional Medicare Supplement plan. The reasoning behind this is “cost sharing.”

Does Medicare Advantage cost less than traditional Medicare?

UnitedHealth Group, for example, discovered that Medicare Advantage costs beneficiaries 40 percent less than traditional Medicare does.

Can I switch from Medicare Advantage back to Original Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Can you switch from a Medicare Advantage to a Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

Can I disenroll from Medicare Advantage at any time?

No, you can't switch Medicare Advantage plans whenever you want. But you do have options if you're unhappy with your plan. You can jump to another plan or drop your Medicare Advantage plan and change to original Medicare during certain times each year.

Does getting a Medicare Advantage plan make you lose original Medicare?

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Is Medicare Advantage more expensive than Medicare?

Slightly more than half of all Medicare Advantage enrollees would incur higher costs than beneficiaries in traditional Medicare with no supplemental coverage for a 6-day hospital stay, though cost are generally lower in Medicare Advantage for shorter stays.

How do I switch back to regular Medicare?

If you're already in a Medicare Advantage plan and you want to switch to traditional Medicare, you should contact your current plan to cancel your enrollment and call 1-800-MEDICARE (1-800-633-4227). Note there are specific enrollment periods each year to do this.

Can I cancel Medicare Advantage?

A person may decide that they no longer want their Medicare Advantage plan and they can disenroll in the same way as with a prescription drug plan, by: contacting the plan provider by phone and asking for a disenrollment notice, which will be mailed for a person to complete and return.

Can I switch from Medicare Advantage to Medigap without underwriting?

For example, when you get a Medicare Advantage plan as soon as you're eligible for Medicare, and you're still within the first 12 months of having it, you can switch to Medigap without underwriting.

What is the benefit of choosing Medicare Advantage rather than the original Medicare plan?

Under Medicare Advantage, you will get all the services you are eligible for under original Medicare. In addition, some MA plans offer care not covered by the original option. These include some dental, vision and hearing care. Some MA plans also provide coverage for gym memberships.

Does Medicare Advantage replace Medicare Part B?

Medicare Advantage doesn't replace Original Medicare Part A and Part B coverage; it simply delivers these benefits through an alternative channel: private insurance companies. Medicare Advantage plans are offered by private insurance companies that contract with Medicare.

Who is the largest Medicare Advantage provider?

/UnitedHealthcareAARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

Why switch to Medicare Advantage?

Medicare Advantage provides all the benefits offered by Medicare Part A and Part B, and most Medicare Advantage plans also include prescription drug (Part D) coverage. If you’re relatively healthy or you don’t frequently use healthcare, switching to Medicare Advantage could end up saving you money.

When does the Medicare enrollment period end?

Annual Enrollment Period (AEP) The Annual Enrollment Period starts October 15 and lasts until December 7. During AEP, you can change your coverage in several ways, and that includes switching to Medicare Advantage.

What are supplemental benefits?

Supplemental benefits are items and services that Original Medicare doesn’t provide. They can include the typical vision, dental, and hearing benefits, or even a membership to SilverSneakers or Silver&Fit. Recently, however, plans are going beyond typical supplemental benefits and including extras such as an allowance for over-the-counter medications, transportation services, and meal delivery. Many plans offer these benefits as a free perk, while other plans require an additional premium for extras such as dental and vision.

Does Medicare Advantage work nationwide?

Medicare Advantage usually restricts your coverage to a local/regional network. If you travel a lot or you’re a snowbird/sunbird, keep in mind that Medicare Advantage typically limits your coverage to a local network —unless you can find a Medicare Cost Plan, a type of Medicare Advantage plan that works nationwide.

Does Medicare Advantage cover original Medicare?

The right Medicare Advantage plan could end up saving you money. And Medicare Advantage plans often include benefits that Original Medicare doesn’t cover. If you’re on the fence about switching to Medicare Advantage, that’s okay.

Can you switch from Medicare to Medicare Advantage?

And, in some ways, it is: If you switch, you might be limited to a network. You might need authorization for certain treatments. Your company might change your coverage each year.

Does Medicare Advantage have a free perk?

Many plans offer these benefits as a free perk, while other plans require an additional premium for extras such as dental and vision. Here is a list of supplemental benefits available through Medicare Advantage and the percentage of Medicare Advantage enrollees who have that benefit as part of their plan:

When can I join a health or drug plan?

Find out when you can sign up for or change your Medicare coverage. This includes your Medicare Advantage Plan (Part C) or Medicare drug coverage (Part D).

Types of Medicare health plans

Medicare Advantage, Medicare Savings Accounts, Cost Plans, demonstration/pilot programs, and Programs of All-inclusive Care for the Elderly (PACE).

Your other coverage

Do you have, or are you eligible for, other types of health or prescription drug coverage (like from a former or current employer or union)? If so, read the materials from your insurer or plan, or call them to find out how the coverage works with, or is affected by, Medicare.

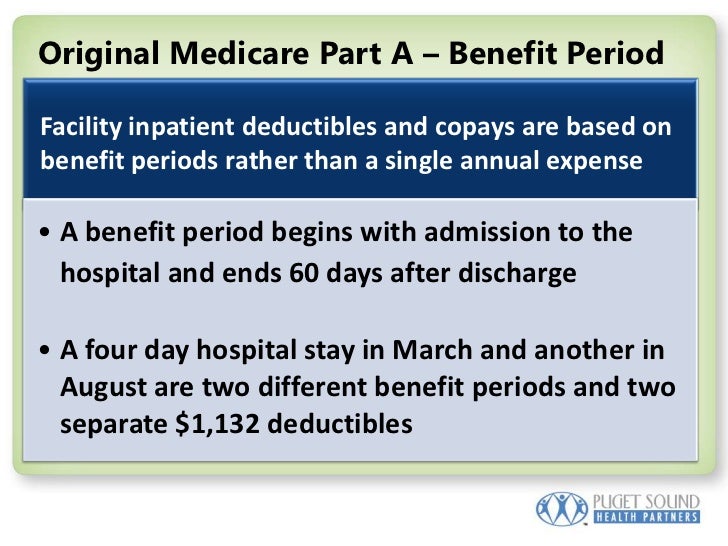

Cost

How much are your premiums, deductibles, and other costs? How much do you pay for services like hospital stays or doctor visits? What’s the yearly limit on what you pay out-of-pocket? Your costs vary and may be different if you don’t follow the coverage rules.

Doctor and hospital choice

Do your doctors and other health care providers accept the coverage? Are the doctors you want to see accepting new patients? Do you have to choose your hospital and health care providers from a network? Do you need to get referrals?

Prescription drugs

Do you need to join a Medicare drug plan? Do you already have creditable prescription drug coverag e? Will you pay a penalty if you join a drug plan later? What will your prescription drugs cost under each plan? Are your drugs covered under the plan’s formulary? Are there any coverage rules that apply to your prescriptions?

Quality of care

Are you satisfied with your medical care? The quality of care and services given by plans and other health care providers can vary. Get help comparing plans and providers

Convenience

Where are the doctors’ offices? What are their hours? Which pharmacies can you use? Can you get your prescriptions by mail? Do the doctors use electronic health records prescribe electronically?