- You can apply to switch plans online.

- You can give us a call at 800-930-7956 and we can help you switch plans in minutes.

What is the best Medicare plan?

They are here to talk about their 5 star medicare plans available to switch your current plan or during the election periods throughout the year. As independent agents, Deb and Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers.

Is high deductible plan F the best?

This Plan is Perfect For Those Who:

- Need a lower monthly premium

- Are comfortable with paying a higher deductible before receiving full coverage

- See the doctor or visit the hospital semi-frequently

- Live in states that allow excess charges

- Like to travel outside the United States

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

What is Medicare Part F plan?

which means that it will cover all the gaps found in Medicare. Next is Plan G, which covers almost as much as Plan F, except for the Part B deductible. And Plan N is likely to be the third most popular because it functions just like Plan G, except that the ...

Can I switch from Medicare Plan F to Plan G?

Switching from Plan F to Plan G If you enrolled in Plan F before 2020, you can continue your plan or switch to another Medigap plan, such as Plan G, if you prefer. You may want to make the change to reduce the price of your health insurance.

Can you switch from Plan F to Plan G in 2021?

Can't I just move from a Medigap Plan F to a Plan G with the same insurance plan? Yes, you can.

Is Plan G as good as Plan F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

Can I switch to a different Medigap policy?

. If you want to switch to a different Medigap policy, you'll have to check with your current or new insurance company to see if they'll offer you a different policy. If you decide to switch, you may have to pay more for your new Medigap policy.

Can I switch from Plan F to Plan G without underwriting in Colorado?

Colorado has issued a Special Enrollment Period for Medigap Plan F members to switch to Medigap Plan G without medical underwriting. This means that for a limited time, you can switch Medigap plans without answering any health questions.

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

What is Medicare Plan F being replaced with?

No plan completely replaces Medicare Part F, but the closest available is Medicare Supplement Plan G. Like Plan F, Plan G covers 100% of many benefits, including: Part A coinsurance and hospital costs. Part B copays/coinsurance (not deductibles)

Has Plan F been discontinued?

Medicare Supplement Plan F is being phased out as a result of “The Medicare Access and CHIP Reauthorization Act of 2015”, also known as MACRA. As a result of MACRA, anybody who becomes eligible for Medicare in 2020 will not be able to purchase Plan F.

How much is the deductible for Plan G?

$233With a standard Supplement Plan G, you're covered immediately and are responsible only for the $233 Part B deductible, plus your monthly premium. With a high-deductible Plan G, your coverage begins once you pay your $2,490 deductible, which then covers all future out-of-pocket costs.

Can I switch my Medicare Supplement plan at any time?

As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period. An application may be “medically underwritten”.

Can I change my Medicare plan at any time?

If you enroll during your Initial Enrollment Period, you can also make changes anytime in the first 3 months of your Medicare coverage. “After that, you can switch plans during open enrollment in the Fall or during Medicare Advantage open enrollment, which is at the beginning of each year,” Dworetsky says.

Can I switch from plan N to plan G without underwriting?

You can change Medigap carriers, while keeping the same level of coverage, during the months surrounding your Medigap anniversary. For example, you can switch from a Plan G to a Plan G without underwriting, but not from a Plan G to a Plan N.

What does Medicare Part B cover?

Medicare Part B generally covers medically necessary doctors’ services and preventive tests. This includes but is not limited to:

What is the ultimate Medicare checklist?

The Ultimate Medicare Checklist for Ages 66+ helps you determine what needs to be done after you’re a seasoned Medicare enrollee. Learn how to handle rate increases, price shopping, coverage gaps, and more in this short e-guide.

Is Medicare Plan G or Medicare Plan F better?

Because of a new federal regulation, Medicare Supplement Plan F is getting phased out. This means that only those who would have qualified before the new regulation can access it.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, a separate plan from traditional Medicare that fills in the gaps in your coverage, commonly utilizes underwriting when offering approvals for different consumers. These questions include but are not limited to: Height, weight and BMI guidelines. Prescription reports. Interview regarding any health concerns.

Does Medicare have a deductible on Medigap Plan F?

Because Medigap Plan F has the added benefit of Medicare Plan B deductible coverage, this switch would depend on how likely you are to need that extra coverage.

Does Plan F cover deductible?

Depending on your location and carrier options, Plan F is a great pick. It covers the part B deductible that Plan G doesn’t, and as long as you can find it for a reasonably low payment, this may be a great plan option for you.

Do Medicare Allies miss deadlines?

Timing is everything, and Medicare Allies will ensure you don’t miss critical deadlines. Just be sure to contact us before you turn 65!

How to switch Medigap insurance?

How to switch Medigap policies. Call the new insurance company and arrange to apply for your new Medigap policy. If your application is accepted, call your current insurance company, and ask for your coverage to end. The insurance company can tell you how to submit a request to end your coverage.

How to end Medigap coverage?

Call the new insurance company and arrange to apply for your new Medigap policy. If your application is accepted, call your current insurance company, and ask for your coverage to end. The insurance company can tell you how to submit a request to end your coverage.

How long do you have to have a Medigap policy?

If you've had your Medicare SELECT policy for more than 6 months, you won't have to answer any medical questions.

How long is the free look period for Medigap?

Medigap free-look period. You have 30 days to decide if you want to keep the new Medigap policy. This is called your "free look period.". The 30- day free look period starts when you get your new Medigap policy. You'll need to pay both premiums for one month.

Can I keep my Medigap policy if I move out of state?

I'm moving out of state. You can keep your current Medigap policy no matter where you live as long as you still have Original Medicare. If you want to switch to a different Medigap policy, you'll have to check with your current or new insurance company to see if they'll offer you a different policy. If you decide to switch, you may have ...

Can you exclude pre-existing conditions from a new insurance policy?

The new insurance company can't exclude your Pre-existing condition. If you've had your Medigap policy less than 6 months: The number of months you've had your current Medigap policy must be subtracted from the time you must wait before your new Medigap policy covers your pre-existing condition.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F provides coverage for two areas that Plan N does not: Medicare Part B deductible. Part B excess charges. Doctors who do not accept Medicare assignment reserve the right to charge up to 15 percent more than the Medicare-approved amount for services and items they provide.

What percentage of Medicare beneficiaries are enrolled in a Medigap plan?

Close to 34 percent of all Medicare beneficiaries are enrolled in a Medicare supplement insurance (Medigap) plan. These optional plans, issued by private insurance companies, help pay for some of the out-of-pocket costs that Original Medicare (Part A and Part B) doesn’t cover. Plan F has long been the most popular Medigap plan.

How much does Plan N pay for Part B?

4 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to $50 copayment for emergency room visits that don’t result in an inpatient admission .

What is the deductible for Plan L in 2021?

3 Plan L has an out-of-pocket yearly limit of $3,110 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

How much is Plan K 2021?

2 Plan K has an out-of-pocket yearly limit of $6,220 in 2021. After you pay the out-of-pocket yearly limit and yearly Part B deductible, it pays 100% of covered services for the rest of the calendar year.

Which states have Medigap plans?

Residents in most states can purchase and use Plan G policies, though Massachusetts, Minnesota, and Wisconsin standardize their Medigap plans in different ways than most states.

Can you sell a Medicare plan for 2020?

As part of that act, from January 1, 2020, insurers couldn't sell a policy that covers the annual Medicare Part B deductible to new Medicare beneficiaries. This ruling effectively meant insurers couldn't offer Plan F or Medigap Plan C to people who become eligible for Medicare after January 1, 2020, because both plans cover the Part B deductible.

Q: Is it possible to switch from Plan F to Plan G?

Yes, you can switch from Plan F to Plan G, but only if you can pass underwriting. Underwriting reviews your medical history in order to check if you're eligible for the new plan. Some plans do not cover pre-existing serious medical concerns.

Q: What is the difference between Plan F and Plan G?

The only real difference in coverage between a Plan F and a Plan G is the Part B deductible, which is $233 in 2022. What’s nice about Plan F is the convenience factor of having the Part B deductible included in the plan benefits. But both offer nearly identical coverage.

Q: Is Plan F or Plan G better?

Both plans are great – they are very similar. The only major difference is the Part B deductible. What’s best for you is which plan design you prefer and which premium makes sense for your budget. A lot of folks enjoy the Part B deductible coverage that comes with an F, whereas a lot of folks prefer the premium savings of a G.

Q: Why have the premium rates raised for Plan F?

As we mentioned earlier in this article, Plan F is no longer available to newly eligible Medicare consumers. For those who’ve had a Plan F for a very long time, their Plan F rates have likely increased quite a bit.

Q: If I am already on Plan F, should I be looking at Plan G?

If you’ve been on a Plan F for many years, it’s definitely worth shopping around and making sure your plan is still the right plan for your needs. Your rates may be skyrocketing, and we could either switch you to a different Plan F or take a look at Plan G, which is very similar to your current plan.

Can you get approved?

Before you consider changing your supplement plan, you need to make sure your request will not be denied. Although you can make change to your Medicare plan at any time, but any changes that is made outside of your open enrollment period will require a medical underwriting process.

What are the pros of Medicare Supplement plan G?

Plan G premium is usually lower than plan F premium. I ran a quote based on the zip 32082 for a 67 year old female non-tobacco user earlier. The premium for plan F is around $190 and plan G is around $170. That is $240 per year of saving.

What are the pros of Medicare Supplement plan G?

Plan G premium is usually lower than plan F premium. I ran a quote based on the zip 32082 for a 67 year old female non-tobacco user earlier. The premium for plan F is around $190 and plan G is around $170. That is $240 per year of saving.

What are the cons of Medicare Supplement plan G?

Plan G does not cover Part B deductible. Part B annual deductible is $198 in 2020. It is more than likely going to increase every year.

How easy is it to switch to Medicare supplement Plan F from Plan G?

Quite often I get questions about whether or not it is advisable to switch to a different Medicare supplement plan.

Comparing Plan F to Plan G

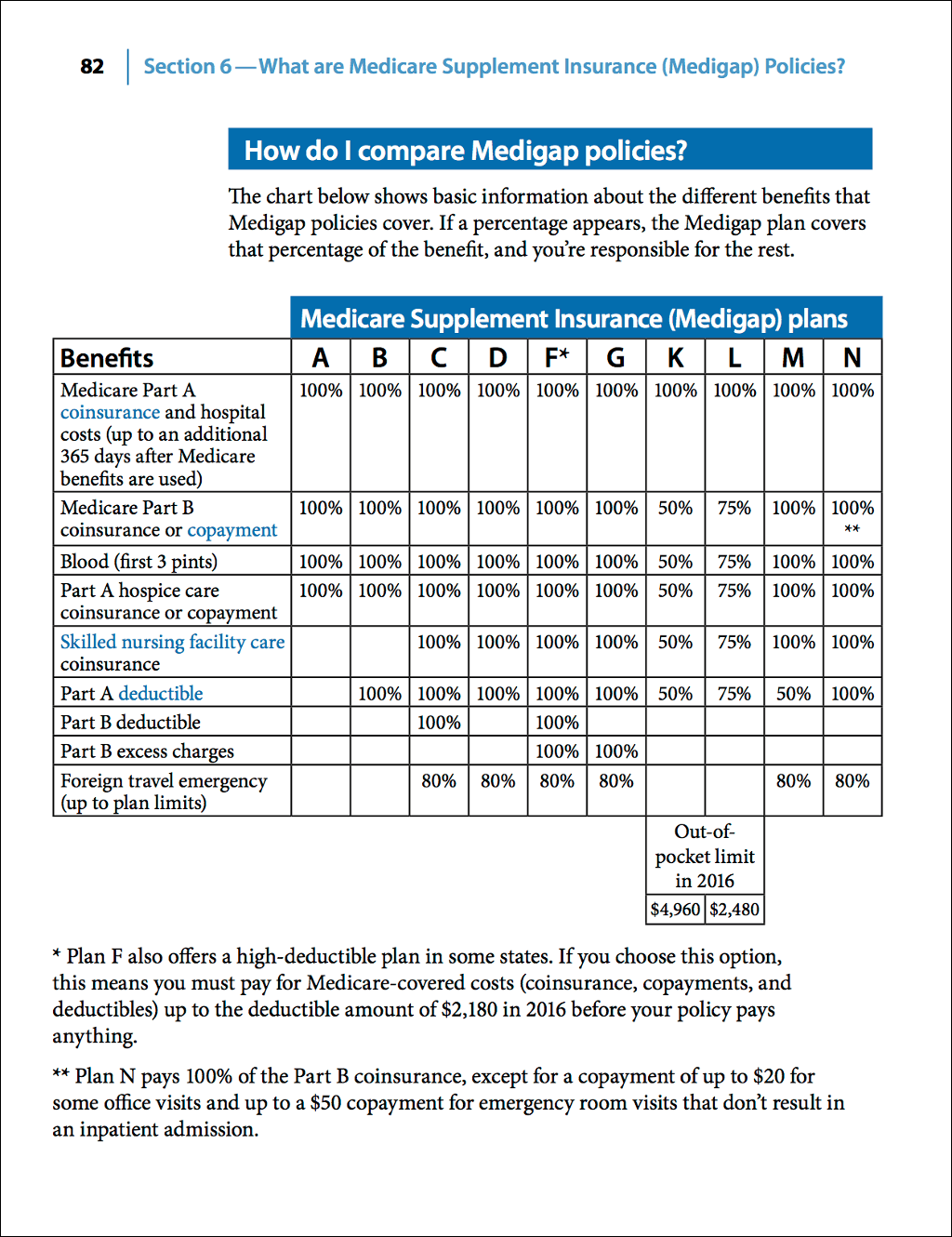

As you review the benefits chart for all Medicare supplements, you can see that the only difference between Plan F and Plan G is that with plan G you will be required to pay the Part B deductible.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G: Plan G has become increasingly popular for several reasons. First of all , it covers all of the gaps in Medicare that Plan F covers, with the sole exception of the annual Medicare Part B deductible ($198 in 2020). Medicare Supplement Plan N: Under Plan N, which tends to have lower monthly premiums than Plan G, ...

Why Is Plan F Not Taking New Enrollees?

Specifically, MACRA prevents insurance companies from offering plans that cover the Part B deductible to newly eligible beneficiaries after 2020.

How much does Plan N cost?

Plan N will bill a $20 copay for office visits and a $50 copay for emergency room visits that don’t lead to hospital admission. Like Plan G, it does not cover the annual Medicare Part B deductible ($198 in 2020). This is a good replacement for high-deductible Plan F.

Can you switch Medigap plans without medical underwriting?

Note, also, that some states will allow you to switch Medigap plans without medical underwriting.

When is the earliest you can switch your Medigap plan?

The earliest start date (AKA effective date) will be the first of the month after your birthday or anniversary month. Call one of our licensed independent insurance agents at 800-930-7956 to help you switch your plan. Learn More about Medigap Get a Medigap Quote Apply for Medigap.

How Can I Switch if I Don’t Have a Medigap Switching Right?

Nevertheless, sometimes none of them will apply to you and you will need to go through underwriting. Each insurance company asks different questions about your health history during this process. We can help you select an insurance provider that optimizes your chances of approval.

How long before your birthday can you switch insurance?

The rules can also vary by the insurance providers. Some insurance companies allow you to submit you application up to 30 days before your Birthday where others require that you must wait until after your birthday has passed. The earliest start date (AKA effective date) will be the first of the month after your birthday or anniversary month. Call one of our licensed independent insurance agents at 800-930-7956 to help you switch your plan.

When will Medigap be updated in 2021?

Last Updated: Jul 15, 2021 10:00 am. If you currently have a Medigap plan and want to switch to a different plan, you can do so at any time, but you might have to reapply and answer medical questions before being approved on your new plan. This is called medical underwriting.

What is the phone number for Medicare?

If you have an urgent matter or need enrollment assistance, call us at 800-930-7956. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans.

Can you switch Medigap plans every year?

If you live in a state that offers a Medigap Birthday Rule or Medigap Anniversary rule, you can switch plans every year without having to answer medical questions. There is a catch though: you must do it during designated switching times and your choices may be limited. By the way, the state of Colorado is offering a switching period for Plan F ...

Does Missouri have a Medigap anniversary?

Missouri has the Medigap Anniversary Rule. This allows you to switch during the anniversary date of when you first signed up. Learn more about MO’s MO Anniversary Rule here. Compare MO Medigap prices here.