What are the best Medicare Part D plans?

Mar 06, 2021 · Consider all costs before deciding what the best Medicare Part D plan is for you. For example, one plan might have a low premium and a $0 deductible, but high copayments/coinsurance. Another plan might have a higher premium and a $445 deductible, but lower copayments/coinsurance.

How to find the best Medicare Part D drug plan?

Oct 01, 2021 · The first choice: Medicare Advantage or a stand-alone Medicare Part D prescription drug plan. Medicare Advantage is offered by private insurance companies that have contracts with Medicare. Medicare Advantage plans cover your hospital and medical benefits at least to the extent that the government covers them. Many Medicare Advantage plans come …

What drugs are excluded from Part D plans?

7 rows · Mar 16, 2022 · updated Mar 16, 2022. For most people, the best Medicare Part D plan for prescription ...

What is the cheapest Medicare Part D plan?

6 rows · Jan 11, 2020 · As you are browsing Medicare Part D Plans, you may notice three basic cost features of every ...

What is the best Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

How do I choose a Part D plan?

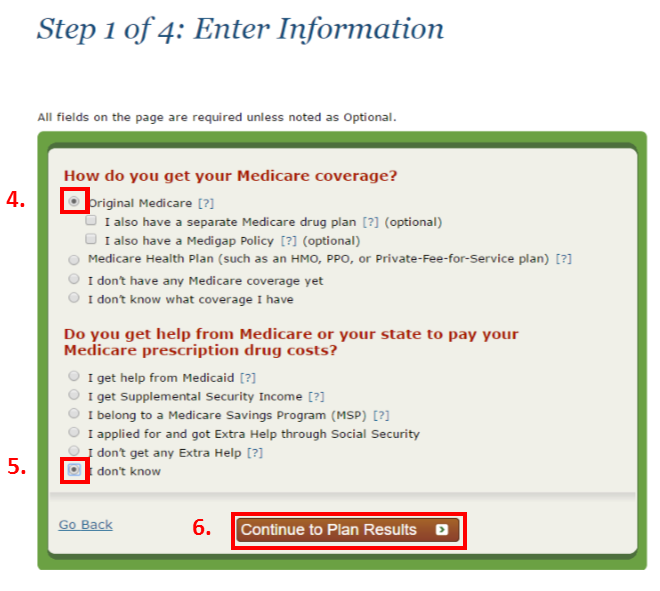

Take your list to the Medicare Plan Finder at Medicare.gov. It can show you which Part D drug plans are available in your area and which of those plans cover your drugs. (You can also use the Plan Finder each year to check your current Part D plan and see if better options are available.)Oct 14, 2021

What is the Best Medicare Plan D for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.Sep 27, 2021

Is Elixir a good Medicare Part D plan?

Elixir RxPlus is a 3.0 Star Rated Part D Plan for People on Medicare in Maryland. The Centers for Medicare & Medicaid Services (CMS) evaluated this Medicare Part D plan's previous year performance and rated it 3.0 out of 5 stars (Average) for quality.Oct 10, 2021

Is SilverScript choice a good plan?

Fortunately, the SilverScript SmartRx plan has very low copays on the most common prescriptions. It won't be the best fit for everyone, but it can be a good choice for those on only Tier I generics. The Choice or Plus plan can also be a good fit if you're taking more expensive medications.

Does Costco have a Medicare Part D plan?

Costco has partnered with eHealth to make signing up or changing your Medicare Prescription Drug coverage easier.

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

Is Medicare Part D deducted from Social Security?

You can have your Part C or Part D plan premiums deducted from Social Security. You'll need to contact the company that sells your plan to set it up. It might take several months to set up and for automatic payments to begin.Dec 1, 2021

What is catastrophic coverage in Medicare Part D?

Once you get out of the coverage gap (Medicare prescription drug coverage), you automatically get "catastrophic coverage." It assures you only pay a small. coinsurance. An amount you may be required to pay as your share of the cost for services after you pay any deductibles.

Does Medicare Part D cover chemotherapy drugs?

Part D covers most prescription medications and some chemotherapy treatments and drugs. If you have Original Medicare with a Medicare drug plan, and Part B doesn't cover a cancer drug, your drug plan may cover it.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , or with additional coverage in the. coverage gap.

What is a low monthly premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for drug coverage. If you need prescription drugs in the future, all plans still must cover most drugs used by people with Medicare.

What is a formulary drug?

formulary. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list. (a list of prescription drugs covered by a drug plan). Then, compare costs.

Does a lower tier drug cost less?

Generally, a drug in a lower tier will cost you less than a drug in a higher tier. ” that charge you nothing or low copayments for generic prescriptions. I don't have many drug costs now, but I want coverage for peace of mind and to avoid future penalties. Look at Medicare drug plans with a low monthly. premium.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage Plans offer prescription drug coverage. with prescription drug coverage. Now that you have some information for how to choose a Medicare drug plan, you may want to learn more about Medigap and Medicare drug coverage.

Enter All Your Meds

Start by adding all the medications you take into the Medicare.gov tool, including the dosages, quantity, and frequency. Your goal is to find a plan that covers all or as many of your meds as possible, says Dianne Savastano, founder of Healthassist, a healthcare consulting firm for consumers.

Consider the Doughnut Hole

In Medicare Part D, that is what you fall into when your annual drug costs (not including premiums) reach $4,430. It’s a gap in coverage that requires you to start shelling out 25 percent of the cost for brand-name or generic drugs.

Get Free Help

A great first source to go to could be your local pharmacist, if you have a favorite, because they can tell you the plans for which they are preferred providers. In addition:

How does Medicare Part D work?

Part D plans can help you control prescription expenses. Even with Medicare Part D prescription drug coverage, you may have some expenses associated your plan. Consider copays, a coverage gap, and annual deductibles when figuring how much the plans you compare will cost to use. Naturally, your own costs will also depend upon the plan’s formulary and the medications you need. Many Medicare Part D plans also use networks of pharmacies, and you’ll want to make certain that you can access convenient local or mail order pharmacies with your prescription drug coverage.

How many medications are included in Medicare Part D?

Each Medicare Part D plan has to include at least two medications from each of the most common prescription drug categories and classes. With that said, all plans won’t always include the same medications.

What is Medicare Part A?

Medicare Part A: Part A typically covers medication you receive in an inpatient setting, such as a hospital. You generally need Medicare Part D prescription coverage for helping with the types of medications that you might normally get from a pharmacy.

Does Medicare cover prescription drugs?

Prescription drugs are generally not covered by basic Medicare (Part A and Part B) but you may be able to get Medicare Part D prescription drug coverage through a private insurance company that has a contract with Medicare. Depending on your area, you may have multiple options for your Medicare Part D prescription drug coverage.

Does Medicare Advantage cover hospital care?

Medicare Advantage plans cover your hospital and medical benefits at least to the extent that the government covers them. Many Medicare Advantage plans come with Medicare Part D prescription drug coverage already bundled in for a convenient all-one plan. If you decided to stick with Original Medicare ...

Does a Part D plan cover generics?

Specialty medications: A Part D plan might cover some rarer and more expensive prescriptions because there isn’t a good replacement.

Is generic medicine cheaper than brand name?

Since generics are almost always cheaper than their brand-name versions, Part D plans will encourage you to use these with lower out-of-pocket costs.

What is Medicare Part D pricing?

Medicare Part D plans with a drug pricing tool let you search for drugs and prices online before filling prescriptions at the pharmacy. Pricing is based on your specific plan benefits and includes costs for home delivery, if offered, and pharmacy pickup. Some tools will also show you other drug options that may cost less as well as additional information that may be helpful before purchasing.

Which tier of a drug plan is higher?

Plan formularies may have higher tiers, too. Brand-name drugs typically cost more than generics and may be placed in tier 3, tier 4, tier 5 or higher. Drugs in higher tiers generally require higher copays, but it’s still a good idea to compare copays across plans to find the best option. 2.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is home delivery pharmacy?

Medication home delivery (sometimes called mail order pharmacy) is a plan benefit that may end those trips, or at least cut down on them. This service ships your drug refills right to your door, and you can usually get a 90-day supply at a time. You could even pay less than you would pay at a retail pharmacy. 3.

Does Medicare Part D have a copay?

Some Medicare Part D plans offer $0 copays for certain drugs on their formularies (drug list). These drugs are usually in the lower tiers of a tiered formulary. For example, you may pay nothing out of pocket when filling prescriptions for generic drugs that are commonly in tier 1 or tier 2 of a tiered formulary.

Does Medicare Part D have automatic refills?

Medicare Part D plans with automatic refill programs let you sign up to have refills sent to you on an ongoing basis. This could be a great option for medications you take regularly. You won’t have to worry about ordering a refill, and you may never run out of your medication again!

Can Medicare Part D help you forget to refill?

No matter how well you manage your prescriptions, it’s easy to lose track of time and forget to refill a drug you take regularly. Some Medicare Part D plans offer refill reminders that could help you avoid this.

Best-rated Medicare Part D providers

Prescription drug plans, called Medicare Part D, are stand-alone policies purchased from private insurance companies. The plans give you coverage for specific drugs that are not included in your Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) coverages.

Kaiser Permanente: Best value Part D

Top-rated and affordable prescription plans, but only available in select regions.

BlueCross BlueShield (Anthem): Largest network of pharmacies

Expensive plans are well-rated, have a large pharmacy network and offer strong coverage options.

Humana: Best overall

Well-rated and affordable prescription drug plans, but Humana customers complain about slow customer service.

Cigna (Express Scripts): Best low-cost generic drugs

Well-rated and moderately priced Part D plans are available nationwide.

Centene (WellCare): Lowest monthly rates

Affordable and popular prescription drug plans, but many have high deductibles.

How to choose the best Medicare Part D plan for you

Most people will have about 30 Medicare Part D plans to choose from, and it's not always clear which is the best plan for your prescription medication needs. To help you choose your plan, ask yourself these seven questions:

What is the deductible for Medicare Part D?

A Medicare Part D deductible is an amount you have to pay out of pocket before the plan begins to pay. The federal maximum for the deductible is $405 in 2018.

What is Medicare Part D plan Juliet?

Premiums can vary widely; as you see here, Medicare Part D plan Juliet has more than double the monthly premium that Medicare Part D plan Penelope has. A second cost that most Medicare Part D plans have is the deductible, although some plans have a $0 deductible.

What is the out of pocket limit for Medicare Part D?

Some plans may set lower deductibles, such as Medicare Part D Plan Juliet in our example. All Medicare Part D plans have an out of pocket limit, which is $5,000 in 2018.

What is cost sharing in Medicare?

Cost-sharing is what you pay every time you fill a prescription. Medicare Part D plans typically arrange medications into tiers, with lower-cost medications on the bottom of tiers and higher-cost medications on the higher tiers. Here’s what Medicare Part D Plan Penelope and Medicare Part D Plan Juliet charge for prescriptions you fill:

How much would you save on copayments?

Over the whole year you would save $252 on copayments (12 times $21). Once you’ve considered how much you spend a year on copayments, the price difference between the two plans is only $42 a year.

How many times do you have to pay for a prescription?

The prescription drug you take costs $100, so you must fill it three times and pay the full $100 before your plan begins to pay. For other plans, tier 1 and tier 2 prescription drugs don’t require you to reach the deductible.

Does Medicare have a stand alone plan?

Every Medicare beneficiary has access to at least one stand-alone Medicare Part D Prescription Drug Plan in 2018, according to the Centers for Medicare and Medicaid Services (CMS). This means that you, like most other Medicare beneficiaries, will have dozens of options to choose from when you’re looking for Medicare Part D Prescription Drug ...