What drugs are covered in Part D?

Mar 06, 2021 · Medicare Part D is prescription drug coverage offered by private insurance companies. You can get Medicare Part D coverage through a stand-alone plan that works together with Original Medicare (Part A and Part B) or through a Medicare Advantage prescription drug plan. Find affordable Medicare plans in your area.

What are the best Medicare Part D plans?

Nov 01, 2021 · This checklist will help you look at Part D plans' formularies, networks, convenience, and more to aid your decision-making. If you're shopping around for Medicare prescription drug coverage, it can be a mistake to simply look at just costs. Instead, you should weigh several factors in choosing a Part D plan:

How to find the best Medicare Part D drug plan?

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you. What Medicare Part D drug plans cover. Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

What drugs are excluded from Part D plans?

Nov 05, 2021 · How to Find the Best Medicare Part D Drug Plan. Enter All Your Meds. Start by adding all the medications you take into the Medicare.gov tool, including the dosages, quantity, and frequency. Your ... Do a Thorough Pharmacy Search. Consider the Doughnut Hole. Find Cash Discounts. Get Free Help.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What are the two types of Medicare Part D plan?

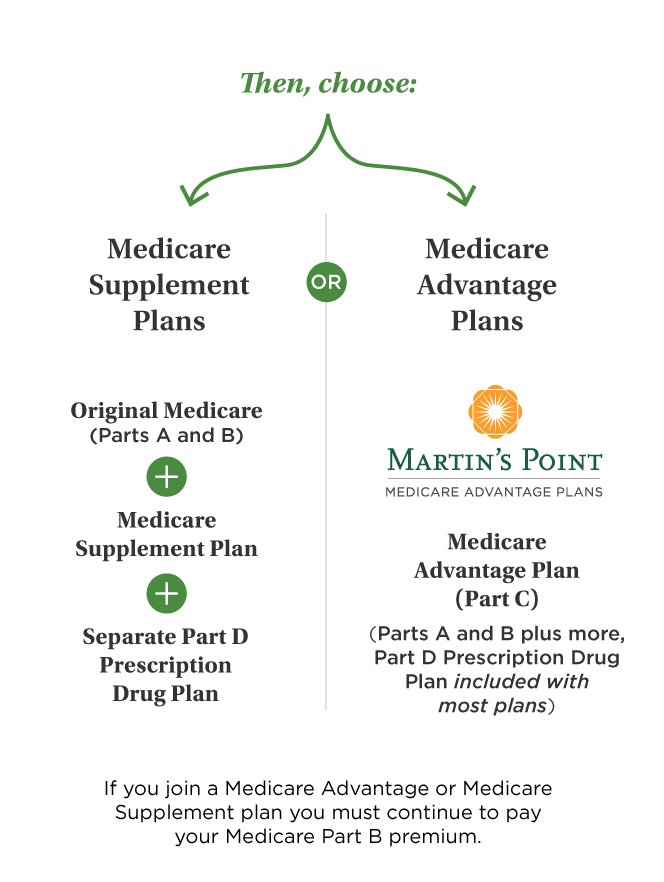

As you may know, there are two main ways to get this coverage: Stand-alone Medicare Part D Prescription Drug Plan. Medicare Advantage Prescription Drug plan.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Can you use GoodRx If you have Medicare Part D?

So let's get right to it. While you can't use GoodRx in conjunction with any federal or state-funded programs like Medicare or Medicaid, you can use GoodRx as an alternative to your insurance, especially in situations when our prices are better than what Medicare may charge.Aug 31, 2021

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

What is the max out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

Does Medicare Part D have a maximum out-of-pocket?

Medicare Part D plans do not have an out-of-pocket maximum in the same way that Medicare Advantage plans do. However, Medicare Part D plans have what's called a “catastrophic coverage” phase, which works similar to an out-of-pocket maximum.Nov 24, 2021

What is the Part D deductible for 2022?

$480What is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

Does Costco have a Medicare Part D plan?

Costco has partnered with eHealth to make signing up or changing your Medicare Prescription Drug coverage easier.

What is the Best Medicare plan D for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

Is Medicare Part D deducted from Social Security?

You can have your Part C or Part D plan premiums deducted from Social Security. You'll need to contact the company that sells your plan to set it up. It might take several months to set up and for automatic payments to begin.Dec 1, 2021

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , or with additional coverage in the. coverage gap.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is a low monthly premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for drug coverage. If you need prescription drugs in the future, all plans still must cover most drugs used by people with Medicare.

What is a formulary drug?

formulary. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list. (a list of prescription drugs covered by a drug plan). Then, compare costs.

Does a lower tier drug cost less?

Generally, a drug in a lower tier will cost you less than a drug in a higher tier. ” that charge you nothing or low copayments for generic prescriptions. I don't have many drug costs now, but I want coverage for peace of mind and to avoid future penalties. Look at Medicare drug plans with a low monthly. premium.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage Plans offer prescription drug coverage. with prescription drug coverage. Now that you have some information for how to choose a Medicare drug plan, you may want to learn more about Medigap and Medicare drug coverage.

Formulary

A plan’s formulary is just a list of the medications the plan covers. If one or more of the medications you take is not on a plan’s formulary, you may want to look elsewhere.

Network

Most plans have a network of pharmacies they want you to use in order to get the best prices. If you go to a pharmacy that’s not in your plan’s network, you may have to pay more for your prescriptions. Make sure your preferred pharmacy is in your plan’s network.

Mail Order

Many prescription drug plans can give you a lower price if you have your medicine sent to you by mail. The plan may also require that you get a 3-month supply at a time. In most cases, this isn't a problem, but you may want to check with your doctor to make sure mail order is right for your medicines.

Service & Convenience

If you have a Medicare Advantage plan with prescription drug coverage, there’s generally just one company to contact if there’s ever an issue with your coverage. If your prescription drug plan is with a different carrier than your other Medicare coverage, it may be more difficult to coordinate benefits between plans.

Review Your Prescriptions

Gather all prescriptions you take before comparing plans and formularies. In addition to checking whether the formulary covers a certain drug, look at any restrictions placed by the insurer. Some require your healthcare provider to obtain authorization from the insurer before covering the prescription.

Out-of-Pocket Costs

The temptation to choose the plan with the lowest premium can be strong. However, your out-of-pocket costs do not begin and end with the premium. Potential out-of-pocket costs include the premium, co-pays co-insurance, and deductibles. This is why a plan with a higher premium may actually cost less.

Check the Plan Ratings

Every October, Medicare releases ratings on Part D plans, called the Medicare Star Rating System. Plans receive an overall rating (up to five stars), as well as ratings on four subcategories. These are:

Key Takeaways

If you're shopping around for Medicare Part D drug plan, you should consider several things other than costs.

Expert Help to Understand Medicare Plan Options

Did you know that Medicare isn’t free, which means you need to consider plan coverage and prices before you enroll? Or that if you don’t enroll on time during your initial enrollment period, you could face a penalty? Navigating your Medicare selection needs and priorities may feel overwhelming.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

Enter All Your Meds

Start by adding all the medications you take into the Medicare.gov tool, including the dosages, quantity, and frequency. Your goal is to find a plan that covers all or as many of your meds as possible, says Dianne Savastano, founder of Healthassist, a healthcare consulting firm for consumers.

Consider the Doughnut Hole

In Medicare Part D, that is what you fall into when your annual drug costs (not including premiums) reach $4,430. It’s a gap in coverage that requires you to start shelling out 25 percent of the cost for brand-name or generic drugs.

Get Free Help

A great first source to go to could be your local pharmacist, if you have a favorite, because they can tell you the plans for which they are preferred providers. In addition:

How does Medicare Part D work?

Part D plans can help you control prescription expenses. Even with Medicare Part D prescription drug coverage, you may have some expenses associated your plan. Consider copays, a coverage gap, and annual deductibles when figuring how much the plans you compare will cost to use. Naturally, your own costs will also depend upon the plan’s formulary and the medications you need. Many Medicare Part D plans also use networks of pharmacies, and you’ll want to make certain that you can access convenient local or mail order pharmacies with your prescription drug coverage.

How many medications are included in Medicare Part D?

Each Medicare Part D plan has to include at least two medications from each of the most common prescription drug categories and classes. With that said, all plans won’t always include the same medications.

What is Medicare Part A?

Medicare Part A: Part A typically covers medication you receive in an inpatient setting, such as a hospital. You generally need Medicare Part D prescription coverage for helping with the types of medications that you might normally get from a pharmacy.

Does Medicare cover prescription drugs?

Prescription drugs are generally not covered by basic Medicare (Part A and Part B) but you may be able to get Medicare Part D prescription drug coverage through a private insurance company that has a contract with Medicare. Depending on your area, you may have multiple options for your Medicare Part D prescription drug coverage.

Does Medicare Advantage cover hospital care?

Medicare Advantage plans cover your hospital and medical benefits at least to the extent that the government covers them. Many Medicare Advantage plans come with Medicare Part D prescription drug coverage already bundled in for a convenient all-one plan. If you decided to stick with Original Medicare ...

Does a Part D plan cover generics?

Specialty medications: A Part D plan might cover some rarer and more expensive prescriptions because there isn’t a good replacement.

Is generic medicine cheaper than brand name?

Since generics are almost always cheaper than their brand-name versions, Part D plans will encourage you to use these with lower out-of-pocket costs.

What is Medicare Part D pricing?

Medicare Part D plans with a drug pricing tool let you search for drugs and prices online before filling prescriptions at the pharmacy. Pricing is based on your specific plan benefits and includes costs for home delivery, if offered, and pharmacy pickup. Some tools will also show you other drug options that may cost less as well as additional information that may be helpful before purchasing.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is home delivery pharmacy?

Medication home delivery (sometimes called mail order pharmacy) is a plan benefit that may end those trips, or at least cut down on them. This service ships your drug refills right to your door, and you can usually get a 90-day supply at a time. You could even pay less than you would pay at a retail pharmacy. 3.

Which tier of a drug plan is higher?

Plan formularies may have higher tiers, too. Brand-name drugs typically cost more than generics and may be placed in tier 3, tier 4, tier 5 or higher. Drugs in higher tiers generally require higher copays, but it’s still a good idea to compare copays across plans to find the best option. 2.

Does Medicare Part D have a copay?

Some Medicare Part D plans offer $0 copays for certain drugs on their formularies (drug list). These drugs are usually in the lower tiers of a tiered formulary. For example, you may pay nothing out of pocket when filling prescriptions for generic drugs that are commonly in tier 1 or tier 2 of a tiered formulary.

Does Medicare Part D have automatic refills?

Medicare Part D plans with automatic refill programs let you sign up to have refills sent to you on an ongoing basis. This could be a great option for medications you take regularly. You won’t have to worry about ordering a refill, and you may never run out of your medication again!

Can Medicare Part D help you forget to refill?

No matter how well you manage your prescriptions, it’s easy to lose track of time and forget to refill a drug you take regularly. Some Medicare Part D plans offer refill reminders that could help you avoid this.

How to decide if you need Medicare Part D?

How To Decide If You Need Part D. Medicare Part D is insurance. If you need prescription drug coverage, selecting a Part D plan when you’re eligible to enroll is probably a good idea—especially if you don’t currently have what Medicare considers “creditable prescription drug coverage.”. If you don’t elect Part D coverage during your initial ...

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

What is Medicare Part D 2021?

Luke Brown. Updated July 15, 2021. Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequences—good or bad. Learn how Medicare Part D works, when and under what circumstances you can enroll, ...

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

What is Tier 3 drug?

Tier 3: Non-preferred brand name drugs with higher copayments. Specialty: Drugs that cost more than $670 per month, the highest copayments 4. A formulary generally includes at least two drugs per category; one or both may be brand-name or one may be a brand name and the other generic.

Formulary

- A plan’s formulary is just a list of the medications the plan covers. If one or more of the medications you take is not on a plan’s formulary, you may want to look elsewhere.

Network

- Most plans have a network of pharmacies they want you to use in order to get the best prices. If you go to a pharmacy that’s not in your plan’s network, you may have to pay more for your prescriptions. Make sure your preferred pharmacy is in your plan’s network.

Mail Order

- Many prescription drug plans can give you a lower price if you have your medicine sent to you by mail. The plan may also require that you get a 3-month supply at a time. In most cases, this isn't a problem, but you may want to check with your doctor to make sure mail order is right for your medicines.

Service & Convenience

- If you have a Medicare Advantage plan with prescription drug coverage, there’s generally just one company to contact if there’s ever an issue with your coverage. If your prescription drug plan is with a different carrier than your other Medicare coverage, it may be more difficult to coordinate benefits between plans.

Review Your Prescriptions

- Gather all prescriptions you take before comparing plans and formularies. In addition to checking whether the formulary covers a certain drug, look at any restrictions placed by the insurer. Some require your healthcare provider to obtain authorization from the insurer before covering the prescription. You may also find a “step” requirement, meaning that the plan requires you to try a …

Out-Of-Pocket Costs

- The temptation to choose the plan with the lowest premium can be strong. However, your out-of-pocket costs do not begin and end with the premium. Potential out-of-pocket costs include the premium, co-pays co-insurance, and deductibles. This is why a plan with a higher premium may actually cost less. Look at your total spend from the previous year to help determine the real pla…

Check The Plan Ratings

- Every October, Medicare releases ratings on Part D plans, called the Medicare Star Rating System. Plans receive an overall rating (up to five stars), as well as ratings on four subcategories. These are: 1. Customer service 2. Member experience 3. Member satisfaction, including complaints, issues experienced receiving service, and how many members choose to leave the plan 4. Pricin…