Here are some tips for finding a provider where you live:

- If you already have a provider you like and want to keep working with, call their office and ask if they accept your coverage.

- Call your insurance company or state Medicaid and CHIP program. Look at their website or check your member handbook to find providers in your network who take your health coverage.

- Ask your friends or family if they have providers they like and use these tools to compare health care providers in your area.

What is the best Medicare coverage plan?

- Best Medicare Advantage Plan Providers

- Compare Medicare Advantage Plans

- What is a Medicare Advantage Plan

- Medicare Law and Medicare Advantage Plans

- Best Medicare Insurance Providers 1. ...

- Pros + Cons of Medicare Advantage Plans Advantages of Medicare Part C Disadvantages of Medicare Part C

- How to Compare Medicare Advantage Plans

What is the best Medicare plan for You?

Ranking the best medicare supplement plans of 2021

- Humana. Humana is one of the largest providers of healthcare and healthcare insurance in the country. ...

- Mutual of Omaha Medicare Supplement. Mutual of Omaha offers eight Medicare supplement plans that cover most out of pocket expenses most people will incur.

- United Medicare Advisors. ...

- Aetna Medicare Supplement. ...

- Cigna. ...

How do I know what Medicare plan I have?

- Review your Medicare plan coverage options. It’s a good idea to review your Medicare coverage every year to make sure the benefits of your Medicare plan remain aligned with your ...

- Make changes to your Medicare plan coverage during the right time of year. ...

- Find out what Medicare plan may fit your needs. ...

How to choose the right Medicare plan for You?

Original Medicare

- Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance).

- You can join a separate Medicare drug plan to get Medicare drug coverage (Part D).

- You can use any doctor or hospital that takes Medicare, anywhere in the U.S.

How do I choose the right Medicare plan?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

Who is the best provider for Medicare?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCoverage areaBlue Cross Blue Shield5.0Offers plans in 48 statesCigna4.5Offers plans in 26 states and Washington, D.C.United Healthcare4.0Offers plans in all 50 statesAetna3.5Offers plans in 44 states1 more row•Jun 8, 2022

What do most people choose for Medicare?

Kaiser found that 71 percent of people enrolling in Medicare for the first time chose traditional Medicare, as compared with 29 percent who chose Medicare Advantage.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.

What percent of seniors choose Medicare Advantage?

A team of economists who analyzed Medicare Advantage plan selections found that only about 10 percent of seniors chose the optimal Medicare Advantage plan. People were overspending by more than $1,000 per year on average, and more than 10 percent of people were overspending by more than $2,000 per year!

What will Medicare not pay for?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is Medicare Plan G and F?

Plans F and G are known as Medicare (or Medigap) Supplement plans. They cover the excess charges that Original Medicare does not, such as out-of-pocket costs for hospital and doctor's office care. It's important to note that as of December 31, 2019, Plan F is no longer available for new Medicare enrollees.

What's the difference between Medicare Part A and Part B?

If you're wondering what Medicare Part A covers and what Part B covers: Medicare Part A generally helps pay your costs as a hospital inpatient. Medicare Part B may help pay for doctor visits, preventive services, lab tests, medical equipment and supplies, and more.

Your other coverage

Do you have, or are you eligible for, other types of health or prescription drug coverage (like from a former or current employer or union)? If so, read the materials from your insurer or plan, or call them to find out how the coverage works with, or is affected by, Medicare.

Cost

How much are your premiums, deductibles, and other costs? How much do you pay for services like hospital stays or doctor visits? What’s the yearly limit on what you pay out-of-pocket? Your costs vary and may be different if you don’t follow the coverage rules.

Doctor and hospital choice

Do your doctors and other health care providers accept the coverage? Are the doctors you want to see accepting new patients? Do you have to choose your hospital and health care providers from a network? Do you need to get referrals?

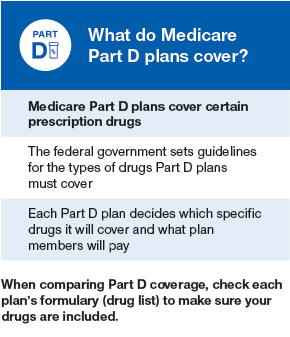

Prescription drugs

Do you need to join a Medicare drug plan? Do you already have creditable prescription drug coverag e? Will you pay a penalty if you join a drug plan later? What will your prescription drugs cost under each plan? Are your drugs covered under the plan’s formulary? Are there any coverage rules that apply to your prescriptions?

Quality of care

Are you satisfied with your medical care? The quality of care and services given by plans and other health care providers can vary. Get help comparing plans and providers

Convenience

Where are the doctors’ offices? What are their hours? Which pharmacies can you use? Can you get your prescriptions by mail? Do the doctors use electronic health records prescribe electronically?

How to become a Medicare provider?

Become a Medicare Provider or Supplier 1 You’re a DMEPOS supplier. DMEPOS suppliers should follow the instructions on the Enroll as a DMEPOS Supplier page. 2 You’re an institutional provider. If you’re enrolling a hospital, critical care facility, skilled nursing facility, home health agency, hospice, or other similar institution, you should use the Medicare Enrollment Guide for Institutional Providers.

How to get an NPI?

If you already have an NPI, skip this step and proceed to Step 2. NPIs are issued through the National Plan & Provider Enumeration System (NPPES). You can apply for an NPI on the NPPES website.

How long does it take to change your Medicare billing?

To avoid having your Medicare billing privileges revoked, be sure to report the following changes within 30 days: a change in ownership. an adverse legal action. a change in practice location. You must report all other changes within 90 days. If you applied online, you can keep your information up to date in PECOS.

Do you need to be accredited to participate in CMS surveys?

ii If your institution has obtained accreditation from a CMS-approved accreditation organization, you will not need to participate in State Survey Agency surveys. You must inform the State Survey Agency that your institution is accredited. Accreditation is voluntary; CMS doesn’t require it for Medicare enrollment.

Can you bill Medicare for your services?

You’re a health care provider who wants to bill Medicare for your services and also have the ability to order and certify. You don’t want to bill Medicare for your services, but you do want enroll in Medicare solely to order and certify.

What is the most important decision you make about health care?

Choosing the right provider is one of the most important decisions you’ll make about your health care. We can help you find the right one. Remember, you’re looking for a provider you can trust and work with to improve your health and well-being, so take time to think about what you need. Depending on how complicated your health care needs are, ...

What is a pediatrician called?

Your child or teenager’s provider may be called a pediatrician. Specialists: You’ll see a specialist for certain services or to treat specific conditions. Specialists include cardiologists, oncologists, psychologists, allergists, podiatrists, and orthopedists.

Do I need to see more than one provider?

Depending on how complicated your health care needs are, you may need to see more than one type of provider. Primary Care Providers: You’ll see a primary care provider first for most health issues. They’ll work with you to get your recommended screenings, help you manage chronic conditions, and refer you to other types of providers if you need them.

What is Medicare Advantage?

Medicare covers medical services and supplies in hospitals, doctors’ offices, and other health care settings. Services are either covered under Part A or Part B. Coverage in Medicare Advantage. Plans must cover all of the services that Original Medicare covers.

Does Medicare Advantage have a yearly limit?

If you join a Medicare Advantage Plan, once you reach a certain limit, you’ll pay nothing for covered services for the rest of the year. This option may be more cost effective for you. note:

Is coinsurance a part of Medicare Advantage?

Supplemental coverage in Medicare Advantage. It may be more cost effective for you to join a Medicare Advantage Plan because your cost sharing is lower (or included). And, many Medicare Advantage plans offer vision, hearing, and dental.

Can you use a Medigap policy?

You can’t use (and can’t be sold) a Medigap policy if you’re in a Medicare Advantage Plan. note: If you're in a Medicare plan, review the "Evidence of Coverage" (EOC)and "Annual Notice of Change" (ANOC) . Prescription drugs.

Does Medicare cover hearing?

Some plans offer benefits that Original Medicare doesn’t cover like vision, hearing, or dental. note: If you're in a Medicare plan, review the "Evidence of Coverage" (EOC)and "Annual Notice of Change" (ANOC) . Your other coverage.

Does Medicare Advantage include prescription drugs?

Most Medicare Advantage Plans include drug coverage. If yours doesn't, you may be able to join a separate Part D plan. note: If you're in a Medicare plan, review the "Evidence of Coverage" (EOC)and "Annual Notice of Change" (ANOC) . Doctor and hospital choice.

What Is Medicare Advantage?

Medicare Advantage is an all-in-one plan choice alternative for receiving Medicare benefits. You may also hear it referred to as Medicare Part C. This plan is bundled with Medicare Part A and Part B and usually includes Part D, which provides prescription drug coverage.

The Average Cost of a Medicare Advantage Plan

Some Medicare Advantage plans may have lower out-of-pocket costs than Original Medicare, and some have a $0 monthly premium. Here are a few questions to consider before purchasing a plan.

Types of Medicare Advantage Plans

There are four common types of Medicare Advantage plans to compare when making your selection.

Medicare Advantage vs. Original Medicare

Consider the following details when deciding whether a Medicare Advantage plan or Original Medicare is best for you.

Methodology

To determine the best Medicare Advantage providers of 2021, the Forbes Health editorial team evaluated all insurance companies that offer plans nationwide in terms of: