How to Choose the Best Medicare Supplement Insurance Plan

- Health Care Costs and Original Medicare. Original Medicare provides health insurance coverage for hospital stays,...

- Choosing the Best Medicare Supplement Plan for You. Medigap plans supplement your Original Medicare coverage with...

- Getting the Most From Medicare Supplement Insurance. If you buy a plan during...

Full Answer

How to pick the best Medicare supplement plan?

Aug 17, 2021 · How do I shop for a Medigap policy? Enter your ZIP code on the Medicare search tool to see which plans are offered in your state. Contact your State Health Insurance Assistance Program (SHIP) to find out which insurance companies sell Medigap policies in your state. Ask for a ... Call your state ...

What are the top 5 Medicare supplement plans?

If you want to travel outside of the United States, the best Medicare Supplement Insurance plans to look at are C, D, F, G, M, or N. Bear in mind that you may no longer be able to buy plans C and F if you become eligible for Medicare on or after January 1, 2020. Plan F is the most comprehensive plan you can get and includes one additional ...

What is the best and cheapest Medicare supplement insurance?

Original Medicare. Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). You can join a separate Medicare drug plan to get Medicare drug coverage (Part D). You can use any doctor or hospital that takes Medicare, anywhere in …

What is the best medical supplement for Medicare?

Feb 03, 2022 · How to Choose the Best Medicare Supplement Insurance Plan Health Care Costs and Original Medicare. Original Medicare provides health insurance coverage for hospital stays,... Choosing the Best Medicare Supplement Plan for You. Medigap plans supplement your Original Medicare coverage with... Getting ...

How do I know which Medicare plan is best for me?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

What are the pros and cons of Medicare Supplement plans?

Medigap Pros and ConsMedigap ProsMedigap ConsPlans are easy to compareDifficult to switch once enrolledGuaranteed 6 month enrollment period when 1st eligibleMay not be able to enroll after initial enrollment periodAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductible3 more rows•Sep 26, 2021

Is Plan G as good as Plan F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.Feb 18, 2021

What is the most basic Medicare Supplement plan?

There are 10 different Medicare Supplement plans approved by Medicare, each with a different level of provided benefits. Three plans — Plan F, Plan G, and Plan N — are the most popular (accounting for over 80 percent of all plans sold).Sep 25, 2021

Why is Medigap so expensive?

Medigap plans are administered by private insurance companies that Medicare later reimburses. This causes policy prices to vary widely. Two insurers may charge very different premiums for the exact same coverage. The more comprehensive the medical coverage is, the higher the premium may be.

What's the difference between Medigap and advantage?

Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Does Plan G have a deductible?

Plan G has nearly the same level of coverage as Plan F. With Plan G, you are responsible for the Part B deductible of $233. Otherwise, coverage is exactly the same as Plan F. Plan N is the least expensive of these three plans but you'll have more out-of-pocket costs with it.

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.Mar 1, 2022

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Does Medicare Part G cover prescriptions?

Are prescription drugs covered under Medicare Supplement Plan G? Medicare Plan G does not cover outpatient retail prescriptions that are typically covered by Medicare Part D. It does, however, cover the coinsurance on all Part B medications.May 27, 2020

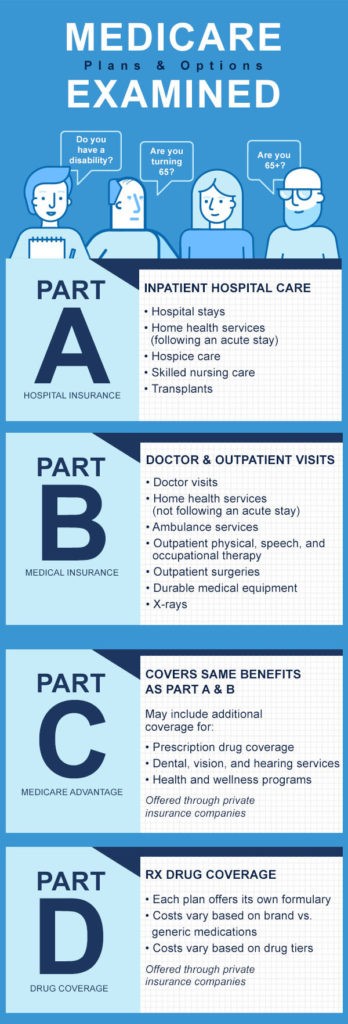

What Are the Different Types of Medicare?

Let’s start with Original Medicare. Original Medicare is made up of Medicare Parts A and B. Part A provides coverage for hospitalizations, hospice care, some skilled nursing facility care, and home health care. Part B provides physician and outpatient services, as well as preventive care. Government cost-sharing is in place for both parts A and B.

What Is Medigap?

Medigap, also known as Medicare Supplement, is a private insurance policy that can be bought to help pay for things that Original Medicare doesn’t cover. These secondary coverage plans are only available with Original Medicare.

Who Is Eligible for Medigap?

You’re eligible for Medigap if you are already enrolled in Original Medicare Parts A and B and don’t have a Medicare Advantage plan. You must also meet one of the following conditions:

Medigap Comparison

In order to compare Medicare supplement plans, you need to know that there are ten standardized Medigap plans, denoted by the letters A through N and that plans with the same letter must have the same basic benefits regardless of insurer.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

Health Care Costs and Original Medicare

Original Medicare provides health insurance coverage for hospital stays, doctor's office visits, lab testing, medical supplies and some other services. For Medicare beneficiaries, other out-of-pocket costs can add up quickly.

Choosing the Best Medicare Supplement Plan for You

Medigap plans supplement your Original Medicare coverage with benefits that help fill in some key cost gaps. The basic benefits of each type of Medicare Supplement Insurance plan are standardized by Medicare, though the policies themselves are sold by private companies.

Getting the Most From Medicare Supplement Insurance

If you buy a plan during your Medigap open enrollment period, insurers cannot deny you a policy or charge more for your Medigap plan based on your health or pre-existing conditions. If you don't purchase a Medicare Supplement Insurance plan during your open enrollment period, you could potentially be denied coverage or pay higher monthly premiums.

Medicare Advantage Plans Replace Original Medicare Benefits

Another health plan option is Medicare Advantage plans. It is important to note that Medicare Advantage and Medicare Supplement Insurance are different. Medicare Advantage plans are an alternative to Original Medicare, while Medigap plans work alongside your Original Medicare benefits to help cover out-of-pocket costs.

Get Help Buying the Right Medigap Plan for You

The right Medicare Supplement Insurance plan is the one that best matches your health care cost requirements and your budget. A licensed agent can answer your questions and help you determine which plan is right for you.

Compare Medigap plans in your area

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareSupplement.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

What are the factors to consider when choosing a Medicare supplement?

When deciding a Medicare supplement, there are 3 important factors to consider. These are rating of the company, how long they’ve been selling Medicare supplements, and average rate increase history. Premium of the plan is actually one of the least important factors as premiums can ...

How long have Medicare supplements been around?

Many people confuse the year in which a company was established with how long they’ve been selling Medicare supplements in a particular area. These are 2 completely different things. Many companies have been established in the early-mid 1900s, yet may have only been selling supplements in a particular area for 2 years ...

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

How to Choose the Right Medicare Supplement Plan for You

What are my health care needs now and possibly in the future? Consider your current health status as well as your family history.

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best.

How to Sign Up for Medigap Plans

Signing up for a Medigap plan is easy. “Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time.

What is the best Medicare Supplement Insurance Plan?

If you’re looking for minimal coverage, the best Medicare Supplement Insurance plan to consider might be Plan A, which offers the most basic level of coverage. If you prefer more coverage, Plans F* and G cover nearly all of the available benefits. Plans K and L may be the best Medicare Supplement Insurance plans for those want a yearly ...

When do you sign up for Medicare Supplement?

This is the six-month period that starts the first month you’re 65 or over , and enrolled in Medicare Part B.

Is Medicare Supplement insurance one size fits all?

The truth is that when it comes to Medicare Supplement insurance there is not a one-size-fits-all solution. The best Medicare Supplement Insurance plan for you depends on your needs and budget. Here are five steps to help you find the best Medicare Supplement Insurance plan for your situation.

Is a plan available in all areas?

All plans are not available in all areas and are subject to plan limitations and applicable laws, rules, and regulations. The general information in this article is not intended to fully explain any specific plan. Please see the official plan documents for more complete information about any specific plan.

Does Medicare Supplement Insurance come with a monthly premium?

Medicare Supplement Insurance plans typically come with a monthly premium. However, insurance companies that sell Medicare Supplement Insurance coverage may price their plans differently. As you’re deciding on the best Medicare Supplement Insurance plan for your financial situation, keep in mind that insurance companies may use three types ...

What is the most comprehensive Medicare Supplement?

Plan F along with Plan G are the most comprehensive Medicare Supplements you can buy. Along with the coverages included in Plan C, excess charges in Part B are covered.

What is the extra 15% charge for Medicare?

But under traditional Medicare, doctors are allowed to charge an extra 15% to the patient beyond the portion that Medicare reimburses. Plan F picks up any of that extra 15% charge. Some plans also restrict doctor choice, Plan F allows you to choose any doctor you want.

What is a Medigap policy?

This is a shorthand expression that refers to the supplement policies and the gap in Medicare they fill. In the 1980s, the federal government allowed private insurance companies to begin selling policies to cover those gaps.

What is Plan A?

Plan A. Plan A is the most basic plan you can purchase. All other plans build off Plan A. Plan A covers Part A Medicare coinsurance including an extra 365 days of hospital costs, Part B coinsurance, three pints of blood, and Part A hospice care. The Part B coinsurance can be confusing.

Is Medicare good at 65?

You just turned 65 and have entered the world of Medicare. Or maybe, you been familiar with Medicare for some time and are frustrated by the gaps in coverage and the amount you still need to pay out of pocket. If you were in a traditional employer health plan, you discover quickly that while Medicare is great, there are limitations.

Can insurance companies sell standardized Medicare?

According to Medicare.gov: “Insurance companies can only sell you a ‘standardized’ Medigap policy. Medigap policies must follow Federal and state laws. These laws protect you.

Can I buy Medicare Supplement Plan at 65?

The first thing to remember is to keep your eye on your 65th birthday. Something magical happens around this time. During this period, the government has guaranteed you the right to purchase any Medicare Supplement plan available in your state. Your health and pre-existing conditions do not matter.

What is a medicare supplement?

A Medicare Supplement plan (also called a Medigap plan) supplements Original Medicare to fill in the 20% gap. If you’re new to Medicare, you can enroll in a Medicare Supplement plan no questions asked. However, after that “guaranteed issue” period, you will likely have to go through medical underwriting — you can be denied or charged more based on ...

What is the most popular Medicare plan?

For years, Medicare Supplement Plan F was the most popular plan. More than 50% of plans purchased were Plan F. However, Medicare beneficiaries who become eligible after January 1, 2020, will no longer be able to purchase Plan F. Plan F was popular because it covered all out-of-pocket expenses.

Is Medicare Supplement Plan K similar to Plan N?

Although they’re not traditionally very popular, Medicare Supplement Plan K and Plan L offer unique features that should be considered. Plan K and Plan L are similar to Plan N, but they only cover some of your out-of-pocket expenses.

When Can I Enroll In Medicare?

Remember, you are automatically eligible to receive Medicare the day you turn 65. If you are already receiving Social Security benefits and enrolled in Medicare before you hit 65, you will automatically be enrolled in Part A of Medicare.

Can I Add, Drop, And Change Coverage?

You can’t add, drop, and change coverage as you please. There are certain times and dates when you can do this. There can also be some confusion as to whether or not there will be fees or penalties for adding certain coverage or dropping it from your plan.