To switch to Original Medicare, contact your current plan, or call us at 1-800-MEDICARE. Unless you have other drug coverage, you should carefully consider Medicare prescription drug coverage (Part D). You may also want to consider a Medicare Supplement Insurance (Medigap

Medigap

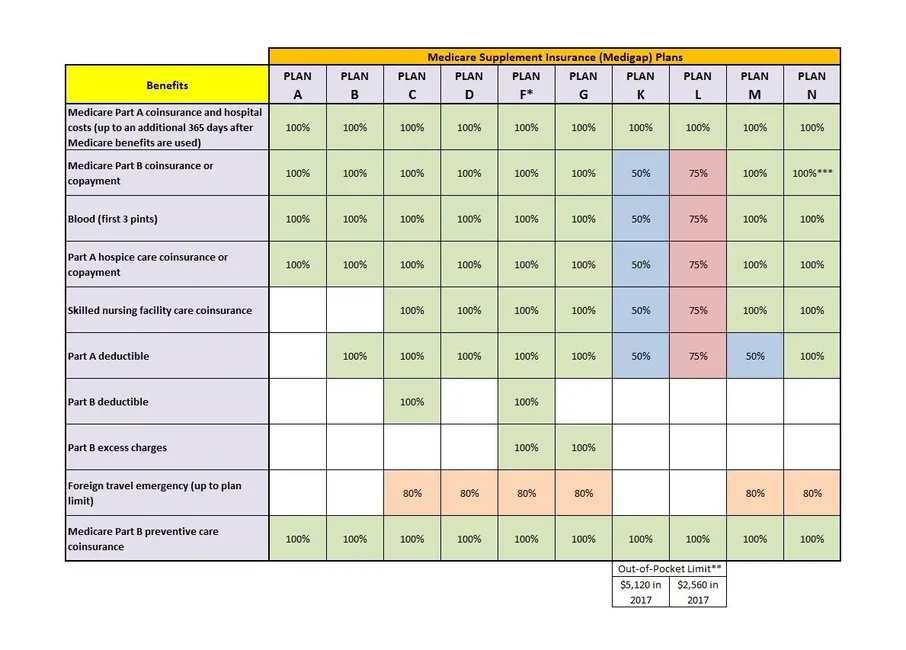

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

What do you need to know about Medicare open enrollment?

- Medicare Supplement Insurance, also known as Medigap

- Medicare Part C, also known as Medicare Advantage

- Medicare Part D, also known as Prescription Drug Plans (PDPs)

How we can help with Medicare open enrollment?

- Select a different Medicare Part C plan

- Opt-out of Medicare Part C coverage altogether

- Enroll in a different Medicare Part C Prescription Drug Plan

Does open enrollment only apply to Medicare?

The annual Medicare open enrollment period does not apply to Medigap plans, which are only guaranteed-issue in most states during a beneficiary’s initial enrollment period, and during limited special enrollment periods. If you didn’t enroll in Medicare when you were first eligible, you cannot use the fall open enrollment period to sign up.

When does open enrollment start for Medicare?

When’s the Medicare Open Enrollment Period? Every year, Medicare’s open enrollment period is October 15 - December 7. What’s the Medicare Open Enrollment Period? Medicare health and drug plans can make changes each year—things like cost, coverage, and what providers and pharmacies are in their networks. October 15 to December 7 is when all people with Medicare can change their Medicare ...

Can you go back to Original Medicare during open enrollment?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Can you switch from Medicare Advantage to Original Medicare at any time?

At any point during your first year in a Medicare Advantage plan, you can switch back to Original Medicare without penalty.

Are you automatically enrolled in Original Medicare?

through Original Medicare. You'll be automatically enrolled in a Medicare drug plan unless you decline coverage or join a plan yourself.

How does she enroll in Original Medicare?

Signing up for Medicare Visiting your local Social Security office. Calling Social Security at 800-772-1213. Mailing a signed and dated letter to Social Security that includes your name, Social Security number, and the date you would like to be enrolled in Medicare.

Can you switch back and forth between Medicare Advantage and Medigap?

Can I switch from Medicare Advantage to Medigap? A person can switch from Medicare Advantage to Medicare with a Medigap policy. However, the Centers for Medicare and Medicaid Services designate certain periods to do so. That said, some people can also switch at certain other times without incurring a penalty.

Does getting a Medicare Advantage plan make you lose original Medicare?

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is the difference between traditional Medicare and Original Medicare?

Original Medicare covers most medically necessary services and supplies in hospitals, doctors' offices, and other health care facilities. Original Medicare doesn't cover some benefits like eye exams, most dental care, and routine exams.

In which two parts of Medicare is enrollment generally automatic?

You'll be automatically enrolled in Medicare Part A and Part B: If you are already getting benefits from Social Security or the Railroad Retirement Board. If you are younger than 65 and have a disability.

Is Original Medicare Part A and B?

Original Medicare includes Part A and Part B. You can join a separate Medicare drug plan to get Medicare drug coverage (Part D).

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Why is my first Medicare bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

Are you automatically enrolled in Medicare Part A when you turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

When does Medicare open enrollment end?

Medicare’s Open Enrollment ends December 7. Even if you’re happy with your current Medicare coverage, it’s important to know your Medicare coverage options for 2021. Here are a few reasons why: Your needs may change.

How much does insulin cost on Medicare?

If you take insulin, this Open Enrollment you may be able to get a Medicare plan that offers broad access to many types of insulin for no more than $35 for a 30-day supply. You can get this savings on insulin if you join a Medicare drug plan or Medicare Advantage Plan with drug coverage that participates in the insulin savings model. You can choose among plans that offer insulin at a predictable and affordable cost. Select the “insulin savings” filter in Medicare Plan Finder to find plans that participate in this new model that can help you save on your insulin costs.

Can you change your Medicare plan for 2021?

If you like your current Medicare coverage and it’s still available for 2021, you don’t need to do anything. New plan options may be available to you.

Does Medicare cover the same benefits?

Benefits can vary. Not all Medicare coverage options offer the same benefits. Plan benefits can change from year-to-year.

How many open enrollment periods are there for Medicare Advantage?

Some even overlap with each other. In the case of Medicare Advantage, there are two MA-specific open enrollment periods.

When does Medicare open enrollment end?

If you’re still within the Initial Enrollment Period for Medicare, which starts 3 months before your 65th birthday and ends 3 months after the month of your 65th birthday , these open enrollment rules do not apply even if the timing of the initial and open enrollment periods overlap.

When is Part C open enrollment for Medicare?

It’s important to understand that if you are not an existing MA plan enrollee before January 1st, you will not be able to take advantage of the Part C Open Enrollment Period from January 1-March 31. This is an open enrollment period available only to those Medicare recipients who have existing MA plans and are interested in changing to a different MA plan or returning to Original Medicare.

When is open enrollment for Part D?

The second, which includes Part D prescription drug plan enrollment, is from October 15th through December 7th. Depending on which open enrollment period you’re in, different options may be available to you.

What is a special enrollment period?

Special enrollment periods can be triggered by different life events, such as losing private insurance coverage through a union, an employer or a spouse’s employer. You can also be eligible for a special enrollment period of your current MA plan provider leaves your coverage area or if you move out of their coverage area.

How to switch to a new Medicare Advantage plan?

To switch to a new Medicare Advantage Plan, simply join the plan you choose during one of the enrollment periods. You'll be disenrolled automatically from your old plan when your new plan's coverage begins .

What happens if you lose Medicare coverage?

In other cases, you may still be able to use your employer or union coverage along with the Medicare Advantage plan you join.

How to switch Medicare Advantage plan to Original Medicare?

Switching from a Medicare Advantage plan to original Medicare: You can make this switch during either the open enrollment period or the Medicare Advantage open enrollment period . You can do this by contacting the provider of your MA plan or by calling Medicare at 1-800-MEDICARE ( 1-800-633-4227 / TTY 1-877-486-2048 ).

When to switch Medicare plans?

Switching Medicare plans during the open enrollment period (October 15 through December 7) can be a smart move if your needs or costs have changed. For example, changes in your income or financial situation could have affected your monthly premium. Your Part D prescription drug plan or Medicare Advantage plan might have raised premiums, deductibles, or changed its cost-sharing percentages.

How to hedge your bets on Medicare?

You might want to hedge your bets by submitting your Medigap application for an issuance decision before actually disenrolling from your current Medicare Advantage plan. Consult your local SHIP advisor about this.

How to switch Medicare Part D plan?

Switch from one Medicare Part D plan to another: If you have original Medicare and are enrolled in a stand-alone Part D plan that you want to replace, you can do that during the fall open enrollment period. Call 1-800-MEDICARE to enroll in your new plan before you exit your old one.

What to do if your prescription isn't in your plan?

If your prescription drugs aren’t in your plan’s formulary, you’ll want to find a different plan that covers all or most of your current prescriptions. Also, drug costs often change from year to year, so it’s wise to check that your medications will still be affordable on your plan. Refer to the Annual Notice of Change letter that Part D plans and Medicare Advantage plans are required to send by October for how your plan’s costs and coverage may shift in the coming year.

How long do you have to cancel a new insurance policy?

If you do want to make a change, don’t cancel your current policy right away. You’re entitled to have a 30-day “free look” period once the new policy takes effect (though you’ll have to pay the premium for both policies during that month). If the new one doesn’t suit you, you can return to the old one.

Can you change your Medigap policy?

That’s prudent, because during this time you have guaranteed issue rights. That means the company behind your chosen Medigap policy must accept you without requiring medical underwriting — health tests that could bump up your premium or disqualify you altogether. If you decide to change from one Medigap policy to another later on, you’ll probably have to undergo a physical exam and could get charged more or even rejected because of pre-existing conditions.

What is open enrollment in Medicare?

What is Medicare Open Enrollment? Understanding Medicare’s enrollment periods for eligible recipients can help you plan for the future. Enrollment periods will allow you to sign up for Medicare coverage when you first qualify, and change plans at certain times during the year if you choose to do so.

When does Medicare open enrollment end?

The Medicare Advantage Open Enrollment Period begins January 1st and ends March 31st, but the first 3 months that a recipient is enrolled in Original Medicare can also activate an enrollment period for Medicare Advantage plans.

What is a special enrollment period?

Special Enrollment Periods allow recipients to choose Medicare coverage without accruing penalty delays and charges once their Initial Enrollment Period is over. If you had qualifying, creditable coverage through other insurance providers, such as plans provided by an employer, you can enroll in Medicare and Medicare-contracted plans if that coverage is ending. Special Enrollment Periods are also activated when Medicare-contracted plans, such as those offered through Medigap or Part C carriers, are no longer available in your area or you move outside of the coverage area.

What happens if you miss your Medicare enrollment period?

If you miss your Initial Enrollment Period, Medicare has other enrollment periods that you can use to acquire certain types of coverage. The General Enrollment Period, which runs from January 1st through March 31st of each year, allows recipients to join Original Medicare.

How long does Medicare enrollment last?

The Medicare Initial Enrollment Period starts 3 months before a recipient turns 65, then lasts through the month of their 65th birthday and for 3 months after that month. During this period, recipients can enroll in Original Medicare Parts A and B, a Part C Medicare Advantage Plan, or they can enroll in Parts A and B and choose a Medicare ...

How long does it take to enroll in Medigap?

Medigap has a separate Initial Enrollment Period that begins when you turn 65 and are enrolled in Part B. During this 6-month period, you can purchase any Medigap plan sold in your state without being subject to medical underwriting.

When are special enrollment periods activated?

Special Enrollment Periods are also activated when Medicare-contracted plans, such as those offered through Medigap or Part C carriers, are no longer available in your area or you move outside of the coverage area.

What is Medicare?

Medicare is a federal program that offers coverage for individuals who are age 65 years and older. It also provides coverage for those who are under the age of 65 but are receiving Social Security Disability benefits, or for those who are under 65 and have ESRD (end-stage renal disease).

Is Original Medicare more flexible than private insurance?

| Updated for Key Takeaways: Original Medicare has comprehensive benefits for diagnosing, treating, and preventing illness and disease. Original Medicare is more flexible than many private insurance plans, allowing you to see any provider that...

Are Special Enrollment Periods Available?

It is important to know about the Special Enrollment Periods (SEPs) for Medicare, as some circumstances can prevent you from changing your Medicare plans during the Open Enrollment Period.

Key Takeaways

You can enroll in Medicare health and drug plans from October 15 to December 7.

1. Check your mailbox

If you’ve been ignoring the marketing mail from plans looking to get you to change, make sure you don’t overlook anything that comes from Medicare or Social Security.

2. Check with your doctors and specialists

Medicare Advantage plans may limit members to using specific providers. If you want to continue seeing your doctor and any specialists, be sure to check that they are still in your Medicare plan’s network. Medicare Advantage plans are required by the Centers for Medicare & Medicaid Services (CMS) to keep their online provider directories updated.

3. Check the drug formulary

Each Medicare plan that covers prescription drugs has its own formulary, or list of covered medications. In addition, most formularies have tiers that affect how much you pay for your drugs at the pharmacy. Medicare Open Enrollment is the time to check:

4. Check with your pharmacy

Some plans have negotiated with specific pharmacies to offer discounts to plan members who fill their prescriptions there. If you have a preferred pharmacy, or like to receive your medications by mail, be sure to compare how much you’ll pay for those options when shopping for plans.

5. Check how much Medicare will cost you in 2022

While CMS has indicated that on average, Medicare health and drug plan premiums will increase slightly in 2022, you should look beyond premiums to determine actual out-of-pocket costs. Be sure to check for the deductible, copayments, and whether you may fall into the Part D coverage gap (or “donut hole”).

How to get started when choosing your Medicare plan during Open Enrollment

If you’re confused about Medicare and need a place to start learning about your coverage options, take our Medicare cost estimator to get a free, short report that helps you compare your choices.