When deciding a Medicare supplement, there are 3 important factors to consider. These are rating of the company, how long they’ve been selling Medicare supplements Medicare is a national health insurance program in the United States, begun in 1966 under the Social Security Administration and now administered by the Centers for Medicare and Medicaid Services. It provides health insurance for Americans aged 65 and older, younger people with some disability st…Medicare

Full Answer

What is the best Medicare supplement?

How Do I Choose the Medicare Supplement Plan That’s Best for Me? Medicare Supplement Options. Currently on the market are 10 supplemental plans. Though they are sold by private... Guaranteed Issue Right. In certain scenarios, insurance providers are required to furnish …

Which Medicare supplement plan should I Choose?

Mar 24, 2020 · Let’s review the basics. In general, Original Medicare (Parts A & B) covers 80% of your out-of-pocket medical costs. A Medicare Supplement plan (also called a Medigap plan) supplements Original Medicare to fill in the 20% gap. If you’re new to Medicare, you can enroll …

What is the best and cheapest Medicare supplement insurance?

The 3 Most Important Factors in Choosing a Medicare Supplement. When deciding a Medicare supplement, there are 3 important factors to consider. These are rating of the company, how …

How to figure out Medicare and choose the right plan?

Plan F and G provide almost all available benefits if you need extra coverage. Plans K and L may be the best options if you want to keep your early Medicare out-of-pocket costs under control. …

How do I know which Medicare plan is right for me?

What are the top 3 most popular Medicare supplement plans in 2021?

What is the highest rated supplemental insurance?

- Best Overall: Mutual of Omaha.

- Best User Experience: Humana.

- Best Set Pricing: AARP.

- Best Medigap Coverage Information: Aetna.

- Best Discounts for Multiple Policyholders: Cigna.

What is the highest rated Medicare Advantage plan?

| Category | Company | Rating |

|---|---|---|

| Best overall | Kaiser Permanente | 5.0 |

| Most popular | AARP/UnitedHealthcare | 4.2 |

| Largest network | Blue Cross Blue Shield | 4.1 |

| Hassle-free prescriptions | Humana | 4.0 |

What is the least expensive Medicare supplement plan?

What is the most expensive Medicare supplement plan?

What is the average cost of supplemental insurance for Medicare?

Are all Plan G Medicare supplements the same?

What is the difference between a Medicare Advantage plan and a Medicare supplement plan?

What are the disadvantages to a Medicare Advantage plan?

What are 4 types of Medicare Advantage plans?

- Health Maintenance Organization (HMO) Plans.

- Preferred Provider Organization (PPO) Plans.

- Private Fee-for-Service (PFFS) Plans.

- Special Needs Plans (SNPs)

Does Medicare cover dental?

What is a medicare supplement?

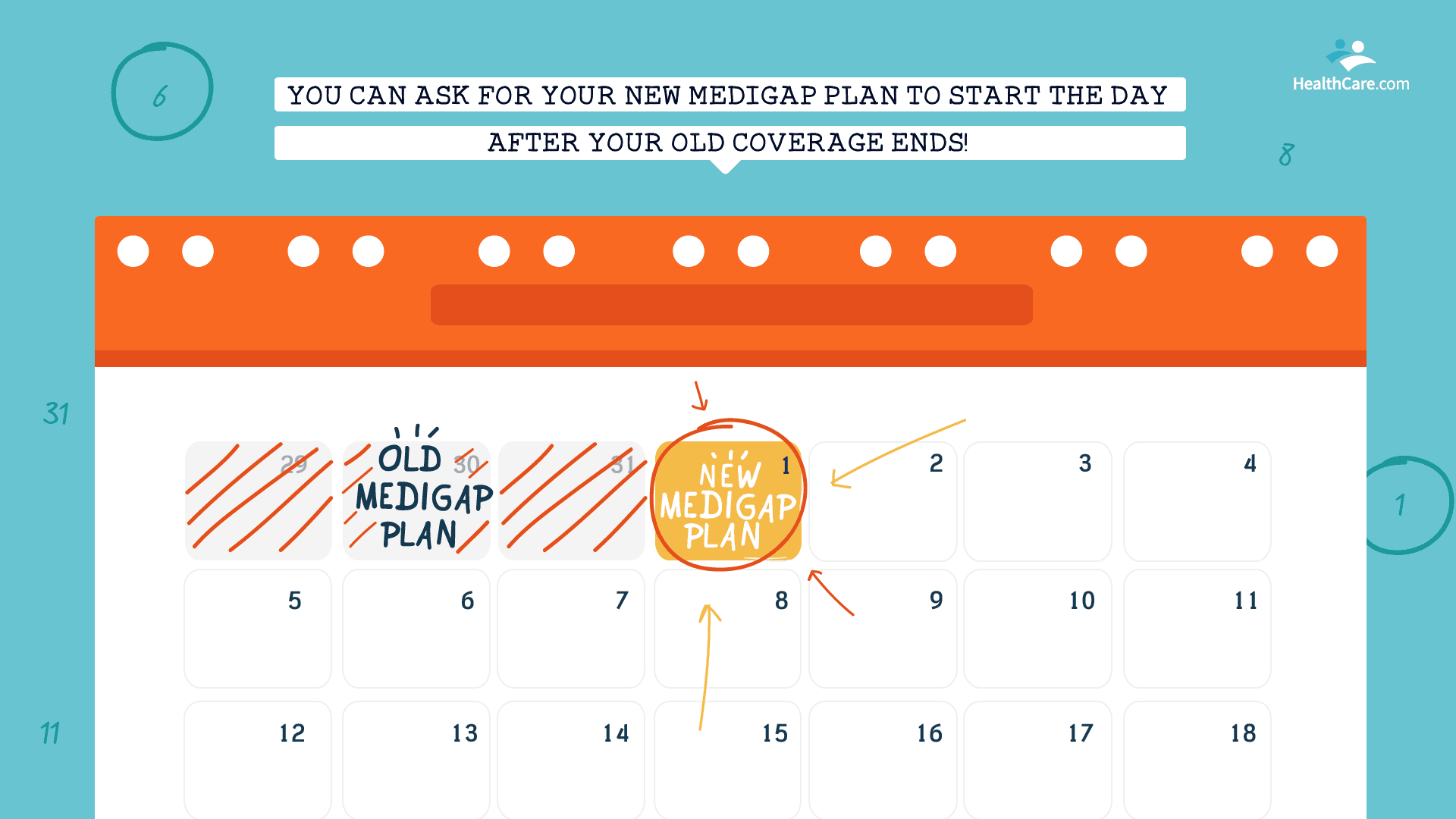

A Medicare Supplement plan (also called a Medigap plan) supplements Original Medicare to fill in the 20% gap. If you’re new to Medicare, you can enroll in a Medicare Supplement plan no questions asked. However, after that “guaranteed issue” period, you will likely have to go through medical underwriting — you can be denied or charged more based on ...

Does Medicare Supplement Insurance cover out of pocket expenses?

With a Medicare Supplement insurance plan, you still have your Original Medicare coverage. That means only your out-of-pocket cost sharing expenses after Original Medicare count against your Medicare Supplement deductible. This is a pretty confusing concept, so let’s look at an example.

What is the deductible for Medicare Supplement Plan G?

There is a Medicare Supplement Plan G High Deductible. It offers the same coverage as a standard Plan G, after you reach the $2,340 deductible.

Does Medicare Supplement Plan N cover Part B excess?

Medicare Supplement Plan N and Plan D offer nearly identical coverage to each other, and to Plan G. But Plan N and D do not cover Part B excess charges. Medicare Part B excess charges are the difference between how much a doctor charges for a treatment or procedure and how much Medicare has agreed to pay for it.

Rating of the Company

Medicare supplement companies are rated by 2 rating agencies which are A.M. Best and Standard & Poor’s (S&P) and are given letter grades A through F. These letters describe the company as a whole including, claims loss ratio, customer service, and overall stability.

How Long A Company Has Been Selling Medicare Supplements

Many people confuse the year in which a company was established with how long they’ve been selling Medicare supplements in a particular area. These are 2 completely different things.

Average Rate Increase History

Average rate increase history is perhaps the most important factor in your decision of which plan and company to go with and should hold a heavy weight. Again, we find newer companies in an area to have heavier rate increases than those that have been in the area 20+ years.

How Medicare Supplement Insurance Works

Medicare Supplement Insurance works alongside Original Medicare (Part A and Part B) to supplement your benefits and help pay out-of-pocket costs left by coverage gaps. If you choose to supplement your benefits with a Medicare Supplement Insurance plan, Medicare will pay its share of the costs first, and then your Medigap policy pays its share.

Medigap Plan Types

In most states, there are 10 standardized plan types to choose from — Plan A, B, C, D, F, G, K, L, M and N. Basic benefits offered by each type of Medigap plan of the same letter are the same, although one carrier's Plan F and another carrier's Plan F may come at different prices.

Basic Benefits and Medicare Supplement Insurance Plans

Depending on which Medicare Supplement Insurance plan type you choose, a certain combination of Medicare-related expenses may be covered:

Plan Pricing Can Vary Widely

Prices for the same plan type can differ from one insurance company to the next. The monthly premiums can vary widely, depending on where you live and the carrier you choose. Insurance companies also determine their own pricing structures, which affects what you pay in premiums when you first buy the policy and in the future.

Get A Medicare Supplement Insurance Quote Today

For help paying your out-of-pocket medical expenses, consider extending your health care coverage with a Medicare Supplement Insurance plan. To speak with a licensed agent, call 1-800-995-4219. To learn more about Medicare Supplement Insurance, read through our Medigap comparison guide.