If Medicare covers the service, the provider may bill Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

Full Answer

How to find out if someone has Medicaid?

Feb 11, 2022 · Via Medicare Advantage, program participants receive Medicare Part A, Part B, and often Part D (prescription drug coverage). To be dual eligible, persons must also be enrolled in either full coverage Medicaid or one of Medicaid’s Medicare Savings Programs (MSPs).

What's the income level requirement to qualify for Medicaid?

If you are dual eligible, you are can enroll in a dual eligible special needs plan (D-SNP) that covers both Medicare and Medicaid benefits. These plans may also pay for expenses that Medicare and Medicaid don’t over individually, including over-the-counter items, …

How do you check eligibility for Medicaid?

Jan 07, 2020 · Payment rates for Medicare and Medicaid, with the exception of managed care plans, are set by law rather than through a negotiation process, as with private insurers. These payment rates are currently set below the costs of providing care, resulting in underpayment. Payments made by managed care plans contracting with the Medicare and Medicaid programs …

Does Medicaid check your bank account?

State Medicaid programs must recover certain Medicaid benefits paid on behalf of a Medicaid enrollee. For individuals age 55 or older, states are required to seek recovery of payments from the individual's estate for nursing facility services, home and community-based services, and related hospital and prescription drug services. States have the option to recover payments for …

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

How do I get money back on my Medicare?

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan. These plans are sometimes called Medicare buy back plans.Jan 20, 2022

Does Medicare give you money?

Medicare pays for much of the cost of hospital stays and doctor's office visits for eligible beneficiaries. This government health insurance program has more recently added preventive care to its covered services. Here's how to make the most of your Medicare benefit. Hospital care is covered by Medicare Part A.

When the patient is covered by both Medicare and Medicaid what would be the order of reimbursement?

Medicare pays first, and Medicaid pays second . If the employer has 20 or more employees, then the group health plan pays first, and Medicare pays second .

Will Medicaid pay for my Medicare Part B premium?

Medicaid can provide premium assistance: In many cases, if you have Medicare and Medicaid, you will automatically be enrolled in a Medicare Savings Program (MSP). MSPs pay your Medicare Part B premium, and may offer additional assistance.

What is the income limit for extra help in 2021?

You should apply for Extra Help if: Your yearly income is $19,140 or less for an individual or $25,860 or less for a married couple living together. Even if your yearly income is higher, you still may qualify if you or your spouse meet one of these conditions: – You support other family members who live with you.

How much does Medicare take out of Social Security?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

Does Social Security count as income for extra help?

We do not count: You should contact Social Security at 1-800-772-1213 (TTY 1-800-325-0778) for other income exclusions.

Who is eligible for Medicare Part B reimbursement?

How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B. 2.

Can a Medicaid patient self pay?

A Medicaid patient can be billed as a self-pay patient, as long as their only insurance is Medicaid or a Medicaid Managed Care Plan. If a patient has primary insurance with a payer that the practice is in network with (Medicare, commercial insurance, etc.), the patient cannot be billed as a private pay patient.Nov 17, 2017

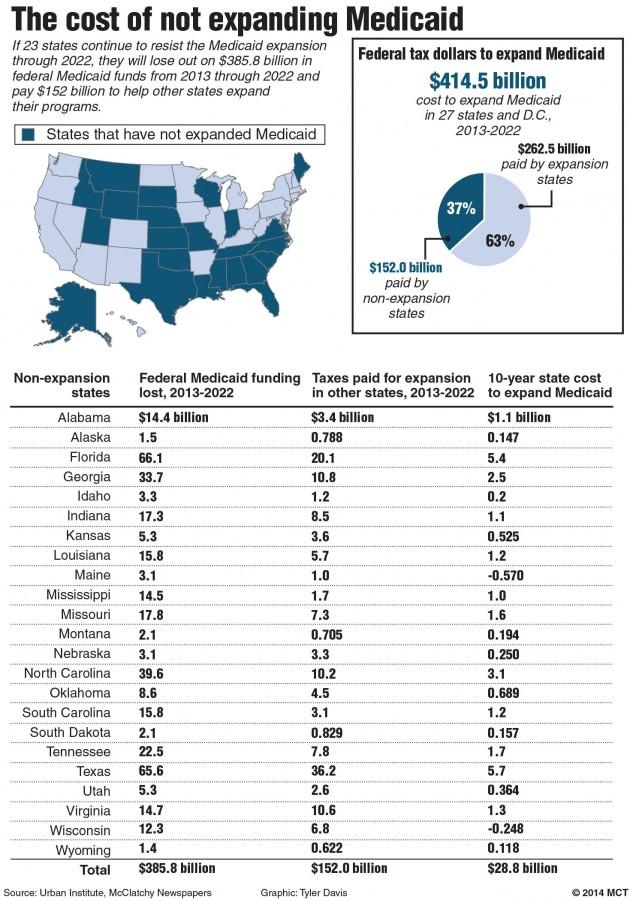

How does the funding of Medicaid differ from the funding for Medicare?

Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults. Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state.

What are the disadvantages of Medicaid?

Disadvantages of MedicaidLower reimbursements and reduced revenue. Every medical practice needs to make a profit to stay in business, but medical practices that have a large Medicaid patient base tend to be less profitable. ... Administrative overhead. ... Extensive patient base. ... Medicaid can help get new practices established.

How are my health care costs reimbursed if I have Medicare and Medicaid?

When dual eligible beneficiaries have healthcare expenses, Medicare pays first and Medicaid pays last. But this is not the case for things Medicare...

How do I know if I should be dual eligible?

Beneficiaries can find out if they’re eligible for Medicaid by contacting their Medicaid office. An Internet search for Medicaid offices in a benef...

What is the income range for beneficiaries who are dual eligibles?

Generally, beneficiaries earning less than 135 percent of the federal poverty level are eligible for the MSP if they also have limited savings (alt...

Can I select an insurance plan for my Medicare and Medicaid benefits?

If you are dual eligible, you are can enroll in a dual eligible special needs plan (D-SNP) that covers both Medicare and Medicaid benefits. These p...

Which pays first, Medicare or Medicaid?

Medicare pays first, and. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. pays second.

What is original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or a.

Does Medicare have demonstration plans?

Medicare is working with some states and health plans to offer demonstration plans for certain people who have both Medicare and Medicaid and make it easier for them to get the services they need. They’re called Medicare-Medicaid Plans. These plans include drug coverage and are only in certain states.

Does Medicare Advantage cover hospice?

Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Most Medicare Advantage Plans offer prescription drug coverage. . If you have Medicare and full Medicaid, you'll get your Part D prescription drugs through Medicare.

Can you get medicaid if you have too much income?

Even if you have too much income to qualify, some states let you "spend down" to become eligible for Medicaid. The "spend down" process lets you subtract your medical expenses from your income to become eligible for Medicaid. In this case, you're eligible for Medicaid because you're considered "medically needy."

Can you spend down on medicaid?

Medicaid spenddown. Even if you have too much income to qualify, some states let you "spend down" to become eligible for Medicaid . The "spend down" process lets you subtract your medical expenses from your income to become eligible for Medicaid.

Does Medicare cover prescription drugs?

. Medicaid may still cover some drugs and other care that Medicare doesn’t cover.

What is dual eligible Medicare?

Beneficiaries with Medicare and Medicaid are known as dual eligibles – and account for about 20 percent of Medicare beneficiaries (12.1 million people). Dual eligibles are categorized based on whether they receive partial or full Medicaid benefits. Full-benefit dual eligibles have comprehensive Medicaid coverage, ...

Does Medicare cover long term care?

But this is not the case for things Medicare doesn’t cover, like long-term care . If Medicaid is covering a beneficiary’s long-term care, Medicare will still be the primary payer for any Medicare-covered services – like skilled nursing care or physical therapy.

Do seniors qualify for medicaid?

Many seniors who live in nursing homes are dual eligible: they qualify for Medicare based on their age, and Medicaid because of their financial circumstances.

Is Medicare the same as Medicaid?

The federal government oversees Medicare eligi bility – meaning it is the same in each state. But states set their own eligibility rules for Medicaid and the MSPs (within federal guidelines) – and income limits for these programs vary widely.

How are Medicare and Medicaid payments reported?

Gross charges for these services are then translated into costs. This is done by multiplying each hospital’s gross charges by each hospital’s overall cost-to-charge ratio, which is the ratio of a hospital’s costs (total expenses exclusive of bad debt) to its charges (gross patient and other operating revenue).

How much is the Medicare shortfall?

This includes a shortfall of $56.8 billion for Medicare and $19.0 billion for Medicaid. For Medicare, hospitals received payment of only 87 cents for every dollar spent by hospitals caring for Medicare patients in 2019. For Medicaid, hospitals received payment of only 90 cents for every dollar spent by hospitals caring for Medicaid patients in 2019.

What is underpayment in healthcare?

Underpayment occurs when the payment received is less than the costs of providing care, i.e., the amount paid by hospitals for the personnel, technology and other goods and services required to provide hospital care is more than the amount paid to them by Medicare or Medicaid for providing that care.

Is Medicare voluntary for hospitals?

Hospital participation in Medicare and Medicaid is voluntary. However, as a condition for receiving federal tax exemption for providing health care to the community, not-for-profit hospitals are required to care for Medicare and Medicaid beneficiaries. Also, Medicare and Medicaid account for more than 60 percent of all care provided by hospitals.

Is Medicare underpayment voluntary?

Hospital participation in Medicare and Medicaid is voluntary. However, as a condition for receiving federal tax ...

Is Medicare and Medicaid bridging the gaps?

Bridging the gaps created by government underpayments from Medicare and Medicaid is only one of the benefits that hospitals provide to their communities. In a separate fact sheet, AHA has calculated the cost of uncompensated hospital care (financial assistance and bad debt), which also are benefits to the community.

Can you recover Medicaid from a deceased spouse?

States may not recover from the estate of a deceased Medicaid enrollee who is survived by a spouse, child under age 21, or blind or disabled child of any age. States are also required to establish procedures for waiving estate recovery when recovery would cause an undue hardship.

Can Medicaid liens be placed on a home?

States may also impose liens on real property during the lifetime of a Medicaid enrollee who is permanently institutionalized, except when one of the following individuals resides in the home: the spouse, child under age 21, blind or disabled child of any age, or sibling who has an equity interest in the home.

How to meet Medicaid's asset limit?

Ways in which one might spend down an inheritance to meet Medicaid’s asset limit include paying off debt, purchasing an irrevocable funeral trust to prepay for funeral / burial costs, buying new household furnishings or appliances, and / or making home modifications.

How long does it take to receive Medicaid inheritance?

As mentioned previously, a Medicaid beneficiary generally has 10 calendar days to report the receipt of an inheritance. However, based on the state in which one resides, the timeframe could be shorter or it could be longer. Also, as mentioned above, California allows Medicaid recipients to gift inheritance, which is considered “income”, the month in which it is received without violating Medicaid’s look back period. For state specific rules, one should contact their state Medicaid agency or a Medicaid professional that can research the individual’s specific situation.

How long does Medicaid look back?

Medicaid’s look back rule considers a long term care Medicaid applicant’s asset transfers for 60-months immediately preceding application to ensure assets were not given away or sold under fair market value. It also considers a Medicaid beneficiary giving away an inheritance as a violation of this rule, resulting in a penalty period.

How long does it take to report an inheritance to Medicaid?

Generally, this change in circumstance must be reported within 10 calendar days. Although this doesn’t give you a very large window to report it, it is vital that you do so. If you do not and the inheritance would have ...

Does Medicaid consider unearned income?

In the month in which the inheritance is received, Medicaid will view it as unearned income (income that one does not have to work for to receive). This means that it is very likely, unless the inheritance is very modest, that it will push one over the income limit, resulting in Medicaid ineligibility in the month it is received.

Can inheritance affect Medicaid?

State specific income and asset limits can be found here .) Therefore, the receipt of an inheritance could cause you to have greater financial means than Medicaid allows for eligibility purposes, and hence, result in Medicaid disqualification.

What is an annuity in New York?

Essentially, an annuity takes a lump sum of cash and converts it into an income stream. The income from the annuity allows one to pay for his / her long term care during the penalization period for gifting assets to a loved one. Please note that in New York, short term annuities are prohibited.

What type of insurance is ordered to pay for care before Medicaid?

Some of the coverage types that may be ordered to pay for care before Medicaid include: Group health plans. Self-insured plans. Managed care organizations. Pharmacy benefit managers. Medicare. Court-ordered health coverage. Settlements from a liability insurer. Workers’ compensation.

What is a dual eligible Medicare Advantage plan?

There are certain types of Medicare Advantage plans known as Dual-eligible Special Needs Plans (D-SNP) that are custom built to accommodate the specific needs of those on both Medicare and Medicaid.

Can you be on Medicare and Medicaid at the same time?

Some people are eligible for both Medicare and Medicaid and can be enrolled in both programs at the same time. These beneficiaries are described as being “dual eligible.”.

Is medicaid a primary or secondary insurance?

Medicaid can work as both a primary or secondary insurer. In this Medicaid review, we explore when and how the program works as secondary, or supplemental, insurance that can coordinate with other types of insurance.

Does Medicare pick up coinsurance?

Copayments and coinsurances that are left remaining after Medicare applies its coverage will be picked up by Medicaid. Dual-eligible beneficiaries can expect to pay little to nothing out of their own pocket after Medicaid has picked up its share of the cost.

Medicaid Income Limits by State

See the Medicaid income limit for every state and learn more about qualifying for Medicaid health insurance where you live. While Medicaid is a federal program, eligibility requirements can be different in each state.

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

Is medicaid a public service?

It is different in every case and state (Medicaid). This answer is provided as a public service for informational purposes only and is not intended as legal advice . Providing this information does not create an attorney-client relationship nor is any information shared considered privileged or confidential.

Is money paid for wrongful death a lien?

Generally speaking, money paid as a settlement for "wrongful death" is not subject to any liens on the deceased's estate because the damaged parties are the survivors, not the deceased. Money paid for damages to the deceased due to negligence or other actionable torts, will be subject to Medicaid and/or Medicare liens AT LEAST to the extent that Medicaid or Medicare paid for care that was...