Compare Medicare Advantage plans side by side

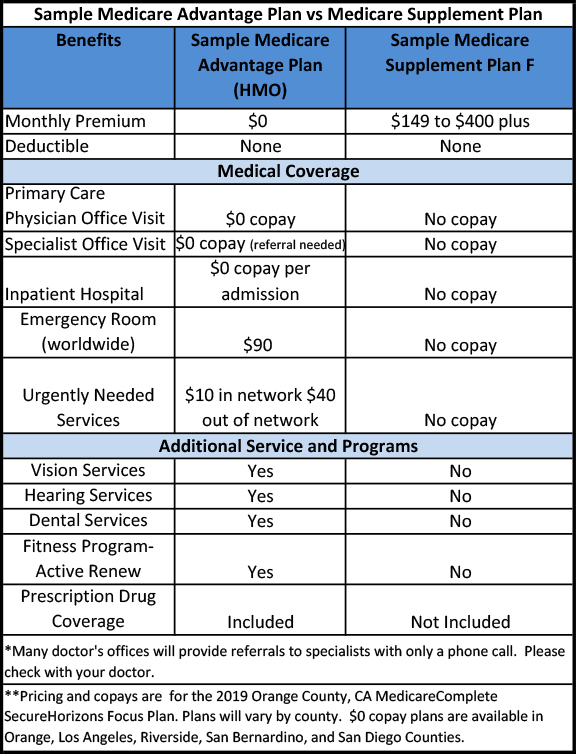

- Coverage. All other things being equal, Part C plans that offer more benefits may have higher premiums than plans with fewer benefits.

- Location. Medicare Advantage plan quotes may differ according to location. ...

- Medicare Advantage plan carrier. Medicare Advantage plans are all sold by private insurance companies. ...

- Medicare Advantage plan types. ...

Full Answer

How do I choose the best Medicare Advantage plan?

Apr 09, 2021 · How to compare Medicare Advantage plan types Common Medicare Advantage plan types include HMOs, PPOs, PFFS, and SNPs. The plan type indicates the rules about having a primary care doctor and seeing providers in network. A network is made up of medical professionals who have agreed to work with your plan. Health Maintenance Organization (HMO)

What are the best Medicare Advantage plans?

Original Medicare: Medicare Advantage: For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible .This is called your coinsurance .. Out-of-pocket costs vary – plans may have different out-of-pocket costs for certain services.. You pay a premium (monthly payment) for Part B .If you choose to join a Medicare drug plan, you’ll pay …

How much cheaper is Medicare Advantage compared to Medicare?

Feb 15, 2022 · Compare Medicare Advantage plans side by side Coverage. All other things being equal, Part C plans that offer more benefits may have higher premiums than plans with... Location. Medicare Advantage plan quotes may differ according to location. Learn more about Medicare Advantage in your... Medicare ...

How to select a Medicare Advantage plan?

Nov 03, 2020 · The best place to start shopping for Medicare Advantage plans (or a Part D or Medigap policy) is on the Medicare.gov comparison tool. After answering a few questions about your location and any...

What is the best way to compare Medicare Advantage plans?

Answer: The Plan Finder tool at Medicare.gov is the best way to compare all of the Medicare Advantage plans in your area. These plans provide medical and drug coverage from a private insurer, and are an alternative to signing up for traditional Medicare along with a medigap and a Part D prescription-drug policy.

Is there a website to compare Medicare Advantage plans?

The plan comparison tool on Medicare.gov and some private comparison sites allow you to enter your regular prescriptions to help determine plan coverage and cost.

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

Are all Medicare Advantage plans basically the same?

Not all Medicare Advantage Plans work the same way. Before you join, you can find and compare Medicare health plans in your area by visiting Medicare.gov/plan-compare. Once you understand the plan's rules and costs, use one of these ways to join: Visit Medicare.gov/plan-compare and search by ZIP code to find a plan.

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Can you switch back and forth between Medicare and Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

Why would you choose a Medicare Advantage plan?

Under Medicare Advantage, you will get all the services you are eligible for under original Medicare. In addition, some MA plans offer care not covered by the original option. These include some dental, vision and hearing care. Some MA plans also provide coverage for gym memberships.Oct 12, 2021

What is the biggest difference between Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.Oct 1, 2020

What are the different types of Medicare Advantage plans?

There are three main types of Medicare Advantage Special Needs Plans: 1 Dual Eligible SNP (D-SNP)#N#A D-SNP is designed to serve beneficiaries who have both Medicare and Medicaid. 2 Institutional SNP (I-SNP)#N#An I-SNP is designed to serve beneficiaries who live in an institution such as a nursing home, or beneficiaries who require in-home nursing care. 3 Chronic Condition SNP (C-SNP)#N#A C-SNP is designed to serve people who are diagnosed with a specific chronic disease or condition. Some plans might include access to providers who specialize in treating a certain condition.#N#A C-SNP would also include a clinical case management program that would be set up to specifically help support the beneficiary based on their condition.#N#The plan’s drug formulary would also typically be designed to cover drugs commonly used to treat the specific condition.#N#Some of the severe or disabling chronic conditions that may qualify someone for a C-SNP include:#N#Chronic dependence to alcohol or other chronic substance abuse#N#An autoimmune disorder#N#Cancer (excluding pre-cancer conditions)#N#A cardiovascular disorder#N#Chronic heart failure#N#Dementia#N#Diabetes mellitus#N#End-Stage Renal Disease (ESRD) that requires dialysis#N#End-stage liver disease#N#Severe hematologic disorders#N#HIV/AIDS#N#Chronic lung disorders#N#Chronic and disabling mental health conditions#N#Neurologic disorders#N#Stroke

How many Medicare Advantage plans are there in 2021?

There are over 3,550 Medicare Advantage plans available nationwide in 2021.1. Depending on where you live, there may be $0 premium Medicare Advantage (Part C) plans available in your area. In fact, 96 percent of Medicare beneficiaries have access to a Medicare Advantage Prescription Drug plan (MA-PD) with no monthly premium in 2021. 1.

What is Medicare Advantage Health Maintenance Organization?

A Medicare Advantage health maintenance organization (HMO) plan is a type of health plan that typically utilizes a local network of doctors, health care providers and hospitals. With an HMO plan, you are typically limited to a local network of providers for care that will be covered by your plan.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is Medicare Advantage PPO?

A Medicare Advantage preferred provider organization (PPO) plan is a type of health plan that may offer you the ability to receive approved health care outside of your plan network. Your plan costs will typically be lower, however, if you see providers within your PPO plan network.

How many stars does Medicare have?

These Medicare Star Ratings can change each year. 2. Each plan is rated from one to five stars on a variety of criteria, with one star being “poor” and five stars being “excellent”. Plans that are rated with 4 stars or higher are considered "top-rated" Medicare Advantage plans.

What is Medicare Advantage Special Needs Plan?

A Medicare Advantage Special Needs Plan (SNP) is a type of specialized Medicare Advantage plan that is designed to provide customized services and coverage to people with specific health conditions or financial needs.#N#All Medicare Advantage SNPs include prescription drug coverage.

What are the different types of Medicare Advantage plans?

There are five types of Medicare Advantage Plans: 1 Health maintenance organization, or HMO, plans: Require you to see an in-network provider unless it’s an emergency situation, and most require a referral to see a specialist. 2 Preferred provider organization, or PPO, plans: Allow you to see both in-network and out-of-network health care providers, although it’s usually more expensive to go out of network. 3 Private fee-for-service, or PFFS, plans: Allow you to see any Medicare-approved health care provider as long as they accept the plan’s payment terms and agree to see you. You may also have access to a network of providers. You can see doctors that don’t accept the plan’s payment terms, but you might pay more. 4 Special needs plans, or SNPs: Provide benefits to people with certain diseases, such as cancer, or health care needs, such as living in a nursing home. These plans also provide benefits to people with a limited income. 5 Medical savings account, or MSA, plans: Combine a high-deductible insurance plan with a medical savings account that can be used for health care costs.

What are the pros and cons of Medicare Advantage?

The pros of Medicare Advantage Plans include potentially lower premiums for coverage, limits on out-of-pocket costs, and additional benefits such as hearing, dental and vision care.

What is MA plan?

Also known as Medicare Part C or MA Plans, they’re offered by private insurers that have been approved by Medicare. Most plans offer additional benefits that aren’t covered under Original Medicare, which may include dental, hearing and vision coverage.

Which is better, a PPO or an HMO?

If you see specialists frequently and you don’t want to request a referral for every office visit, a PPO plan will be a better option than an HMO. If you’re a light health care user and see mostly your primary care physician, an HMO might be more affordable. Visit the plan’s website.

What is MSA insurance?

Medical savings account, or MSA, plans: Combine a high-deductible insurance plan with a medical savings account that can be used for health care costs.

Does Medicare Advantage cover prescriptions?

Do most Medicare Advantage Plans offer prescription drug coverage? Yes, in most cases, Medicare Advantage Plans offer prescription drug coverage. But you must sign up for a plan that offers prescription drug coverage.

What are the extra benefits Medicare Advantage plans may provide?

Although Medicare Advantage plans aren’t required to offer extra benefits, many plans do offer one or more extra benefits.

Are you looking for more information about Medicare Advantage plans that offer extra benefits?

Would you like help comparing benefits between MA plans available where you live? Please feel free to contact me by using the links below. If you wish to compare some of the Medicare plans where you live, use the Compare Plans button on this page.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

What is MSA plan?

Medicare Medical Savings Account (Msa) Plan. MSA Plans combine a high deductible Medicare Advantage Plan and a bank account. The plan deposits money from Medicare into the account. You can use the money in this account to pay for your health care costs, but only Medicare-covered expenses count toward your deductible.

What is a special needs plan?

Special Needs Plans (SNPs) Other less common types of Medicare Advantage Plans that may be available include. Hmo Point Of Service (Hmopos) Plans. An HMO Plan that may allow you to get some services out-of-network for a higher cost. and a. Medicare Medical Savings Account (Msa) Plan.

Does Medicare Advantage include drug coverage?

Most Medicare Advantage Plans include drug coverage (Part D). In many cases , you’ll need to use health care providers who participate in the plan’s network and service area for the lowest costs.