How to Compare Medicare Supplement Plans You can use the 2022 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information.

Full Answer

What is the best and cheapest Medicare supplement insurance?

Jun 08, 2021 · Medicare Supplement Insurance, or Medigap, is insurance that pays for some costs that aren’t covered in Original Medicare. A Medicare Supplement Plan might (for instance) cover copayments,...

What are the top Medicare supplement plans?

Apr 12, 2022 · You can even compare plans – side by side. Shop Plans Looking for the differences between Medicare Advantage and Medicare Supplement plans instead? Comparing Medicare Advantage plans vs. Medicare Supplement plans Find a Plan Call Us Call UnitedHealthcare at 1-866-408-5545 , TTY 711 (toll-free) Hours: 7 a.m. to 11 p.m. ET, Monday – …

Which Medicare supplement plan should I Choose?

Sep 15, 2020 · How to Compare Medicare Supplement Plans. Medicare is not free. Many people qualify for premium-free Medicare Part A, but Medicare Part B requires a monthly premium. On top of that, there are deductibles, copays and other expenses that can add up to major out of pocket expenses. To keep these costs down, some people buy a Medicare Supplement …

Which Medicare supplement plan is the most popular?

Apr 21, 2021 · You can purchase Medicare supplement insurance, also known as Medigap plans, to help cover some of the costs of Medicare. You’ll pay a monthly premium for your Medigap plan, and the plan will pay for costs that would normally fall to you, such as copayments for doctor’s office visits. You can choose from among 10 Medigap plans.

What is the difference between the different Medicare Supplement plans?

A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What are the 3 ways Medicare Supplement plans are rated?

Medigap Plan Costs Policy prices for Medigap are set by the individual insurance companies selling them. Companies set their premium pricing in one of three ways: Community-rated: Premiums are the same regardless of age. Issue or entry age-rated: Premiums are cheaper if the policy is purchased at a younger age.Feb 9, 2022

What is the difference between Plan G and select Plan G?

Plan G Select offers the same benefits as Plan G with the exception of national coverage. Plan G Select members use a local network of hospitals for inpatient services in exchange for lower premiums.Mar 6, 2017

What is the best way to compare Medicare Advantage plans?

Answer: The Plan Finder tool at Medicare.gov is the best way to compare all of the Medicare Advantage plans in your area. These plans provide medical and drug coverage from a private insurer, and are an alternative to signing up for traditional Medicare along with a medigap and a Part D prescription-drug policy.

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

What is the most expensive Medicare Supplement plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Does Plan G have a deductible?

Plan G has nearly the same level of coverage as Plan F. With Plan G, you are responsible for the Part B deductible of $233. Otherwise, coverage is exactly the same as Plan F. Plan N is the least expensive of these three plans but you'll have more out-of-pocket costs with it.

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What is the most popular Medicare Advantage plan?

Best for size of network: UnitedHealthcare Standout feature: UnitedHealthcare offers the largest Medicare Advantage network of all companies, with more than 1 million network care providers. UnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

Which Is The Best Medicare Plan?

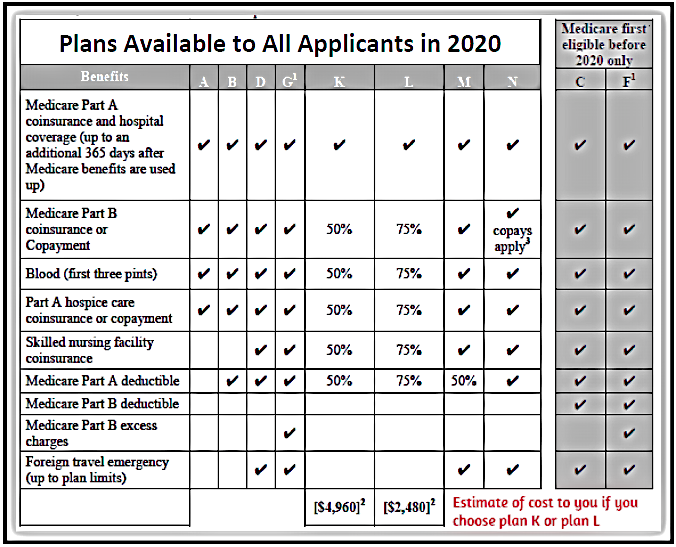

Plan F and Plan G are the two most popular Medigap plans. As you can see in the Medigap comparison chart, Plan F covers all the gaps in Medicare. P...

How to Compare Medigap Plans – Benefits

Medicare publishes a booklet each year that includes this Medicare Supplements Plans comparison chart. The Medigap comparison chart allows you to s...

Medigap Plans Comparison Chart

The Medigap Plans comparison chart above compares all of the plans side by side. This allows you to see which ones have the most benefits, and whic...

Shop Rates With Our Free Medigap Plans Comparison Report

Once you determine which Medigap plan feels right for you, you can then shop rates. Boomer Benefits makes this easy our free Medigap rate compariso...

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

How much coinsurance is required for skilled nursing?

There is no coinsurance requirement for the first 20 days of inpatient skilled nursing facility care. However, a $185.50 per day coinsurance requirement begins on day 21 of your stay, and you are then responsible for all costs after day 101 of inpatient skilled nursing facility care (in 2021).

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, is insurance that pays for some costs that aren’t covered in Original Medicare. A Medicare Supplement Plan might (for instance) cover copayments, coinsurance or deductibles you owe under Original Medicare. Medicare Supplement Plans operate as ...

How does Medicare Supplement Plan work?

Understanding how Medicare Supplement Plans work can take some time. Here are the basics [2]: Medigap plans cover one person. If your spouse or partner also wants a Medicare Supplement Plan, they must buy a policy of their own. Medigap plans can’t cancel you for health issues.

How long does Medicare Supplement last?

This starts the month you turn 65 and enroll in Medicare Part B, and it lasts six months. It also never repeats, so don’t miss it.

Does Medicare cover vision?

They don’t cover everything. Generally, Medicare Supplement Insurance doesn’t cover dental care, vision care, hearing aids, long-term care, eyeglasses or private-duty nursing. Some plans are no longer available. You can no longer purchase Plans E, H, I and J, but if you purchased one of those plans before June 1, 2010, you can continue with it.

Does Medicare Supplement Plan G cover Ohio?

Medicare Supplement Plans operate as additional — not primary — insurance coverage. You must have Medicare Part A and Part B to buy a Medigap plan. These policies are sold by private companies, and the plans are standardized, so Medicare Supplement Plan G in New York will offer the same coverage as Medicare Supplement Plan G in Ohio [1].

What are the different types of Medicare Supplement Plans?

Depending on where you live, there may be three types of Medicare Supplement plans. This can include community-rated, issue-age-rated or attained-age-rated. In some states, attained-age-rated often ends up being the most cost-effective.

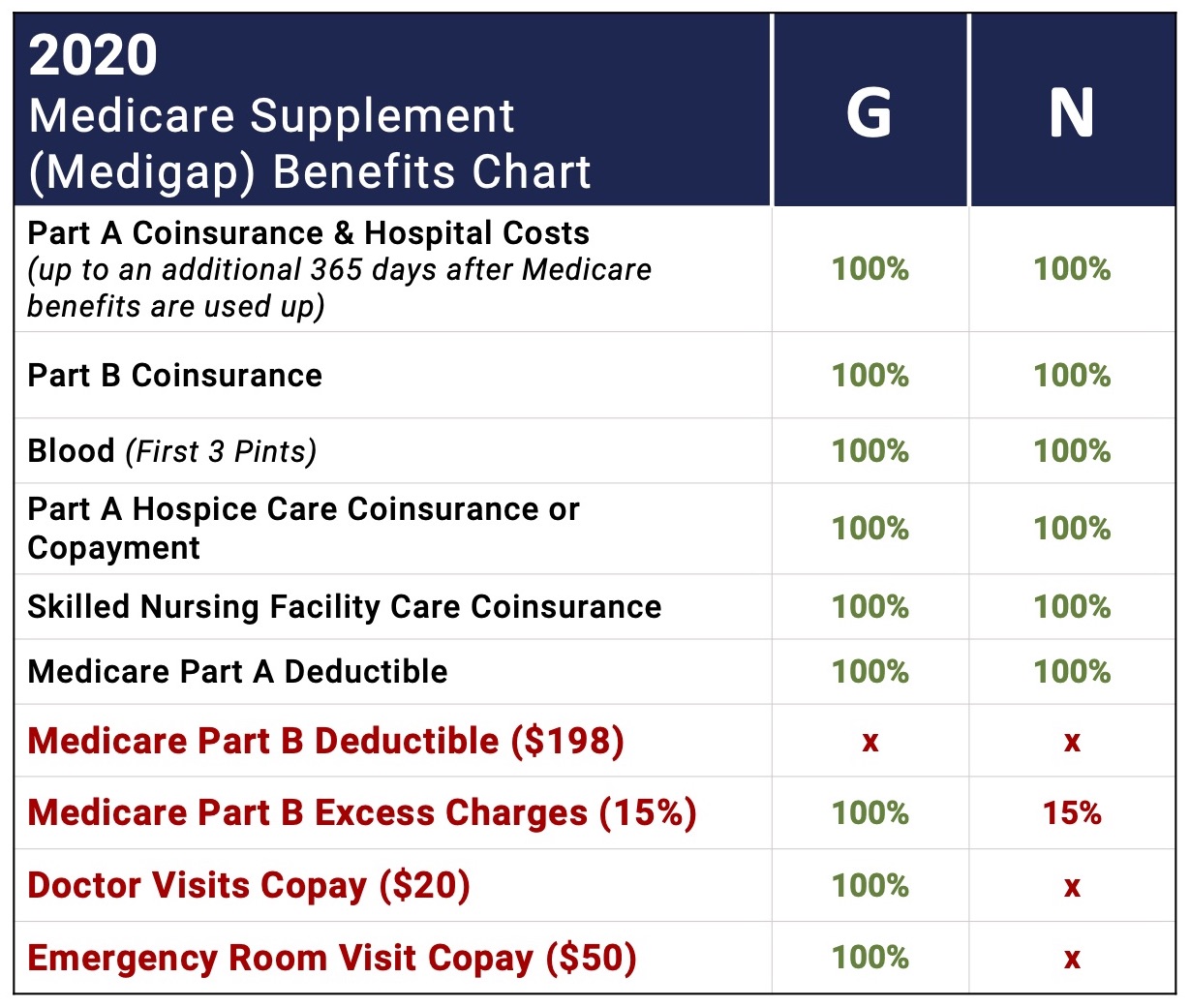

Which Medicare supplement plan requires copays?

When you are learning how to compare Medicare Supplement plans, just remember that Plan N is the one that requires copays from you for doctor and E.R. visits. That’s why the premiums are lower. People interested in the Medigap policies which offer the most affordable rates are usually interested in Plan N.

What is a Medigap Plan B?

Medigap Plan B. Medigap Plan B covers everything that Plan A covers but it also picks up the Medicare Part A hospital deductible. Plan B is a Medigap plan that pays after Medicare pays. Don’t confuse it with Part B, which is part of your Original Medicare benefits that pays for outpatient medical.

What is the difference between Plan F and Plan G?

Plan F and Plan G are the two most popular Medigap plans. As you can see in the Medigap comparison chart, Plan F covers all the gaps in Medicare. Plan G is only slightly different, so it is also a popular seller. When you compare Plans F and G side by side, you’ll immediately notice that Plan G has only one difference: the Part B deductible.

Does Medicare cover Plan A?

Medigap Plan A offers the most basic of all the Medigap plans. Even still, it will cover the 20% that Medicare doesn’t pay for on outpatient treatments. That’s arguably the most important piece of all Medigap plans. All Medicare insurance carriers must offer Plan A. However, some states do not require companies to offer it to people under age 65 on Medicare disability.

Is Medicare Supplement the same as Medigap?

This makes comparing Medicare Supplement plans pretty easy. ( Medicare Supplements and Medigap plans are the same thing) The Centers for Medicare and Medicaid Services updates the Medigap plans comparison chart every year, although most plans do not have benefit changes from year to year. Some Medigap plans will have higher premiums ...

Does Plan N cover excess charges?

Plan N offers lower premiums if you are willing to do a bit of cost-sharing. Unlike Plan F or G though, Plan N does not cover excess charges. You’ll want to read up on this and understand what that means before enrolling. For a list of Medicare supplement insurance companies, visit this page.

Which Medicare plan offers the most supplemental coverage?

Plans C, F and G offer the most supplemental coverage, paying many of your out-of-pocket costs for Medicare-approved services. Consider one of these plans if you are willing to pay a monthly premium that is typically higher in exchange for more covered benefits and lower out-of-pocket costs.

What is the difference between Medicare Supplement Plan A and Plan B?

Plans A and B: Lower Benefits, Higher Out-of-Pocket. Medicare Supplement Plan A offers just the Basic Benefits while Plan B covers Basic Benefits plus a benefit for the Medicare Part A deductible. The Medicare Part A deductible could be one of your largest out-of-pocket expenses if you need to spend time in a hospital.

Why are coinsurance premiums lower?

The premiums are typically lower because, for some services, they pay a percentage of the coinsurance instead of the full coinsurance amount. Once the out-of-pocket limit is reached, these plans pay 100% of covered services for the rest of the calendar year.

What is Medicare Supplement?

Medicare Supplement insurance plans, also called Medigap plans, provide help with some of the out-of-pocket expenses not paid for by Original Medicare. When you go to the doctor under Original Medicare, you still have expenses to pay. Medicare Supplement insurance plans work with your Medicare Part A (hospital stays) and Medicare Part B ...

How much does Plan N pay for Part B?

1 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don't result in an inpatient admission. 2 Care needed immediately because of an injury or an illness of sudden and unexpected onset.

Does Plan N cover Medicare Part B?

Plan N covers the Medicare Part B coinsurance, but you pay copayments for covered doctor office and emergency room visits in exchange for a monthly premium that tends to be more mid-range.

Does Medicare Supplement cover doctor visits?

Medicare Supplement insurance plans work with your Medicare Part A (hospital stays) and Medicare Part B (doctor visits) to help lower the out-of-pocket medical costs that Original Medicare doesn’t cover. The Medicare Supplement plans that are available to you depend on the state in which you live.

What is Medicare.org?

Medicare.org helps those eligible for Medicare, research, compare, buy, and enroll in a health insurance plan. Our quoting tool works to help Medicare beneficiaries like you compare hundreds of Medicare plans. We offer several ways to compare Medicare plans through helpful features integrated into the quoting tool.

What time does Medicare sales agent open?

If you need help choosing or enrolling in a plan, a licensed Medicare sales agent is available Monday – Friday 5:00 a.m. – 6:00 p.m. PT.