- Check plan availability. Medicare supplement insurance plans are standardized by law and are named with letters. ...

- Compare Medigap plan costs. Deductible, coinsurance and copayment coverages are standardized between companies. ...

- Consider customer service. Because coverage is mainly the same regardless of which provider you select, a company’s customer service is an important factor to consider when you’re choosing a ...

- Verify the provider’s reputation. A company’s reputation may help you choose between insurers with similarly priced plans. ...

- Consider extra features. Some companies offer additional features and benefits for policyholders. ...

Full Answer

What is the best and cheapest Medicare supplement insurance?

Apr 12, 2022 · You can even compare plans – side by side. Shop Plans Looking for the differences between Medicare Advantage and Medicare Supplement plans instead? Comparing Medicare Advantage plans vs. Medicare Supplement plans Find a Plan Call Us Call UnitedHealthcare at 1-866-408-5545 , TTY 711 (toll-free) Hours: 7 a.m. to 11 p.m. ET, Monday – …

What is the best way to compare Medicare plans?

Jun 08, 2021 · Here’s a Medicare Supplement Plan comparison chart to help you see the differences between plans [3]. Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits ...

How do I Choose Medicare supplemental insurance?

Jan 19, 2021 · How to compare Medicare Supplement plans 1. Check plan availability Medicare supplement insurance plans are standardized by law and are named with letters. The standardization means that every...

Are supplemental Medicare insurance plans a good idea?

Call to speak with a licensed insurance agent now. 1- TTY 711. Enter your ZIP Code to compare plans ZIP Code Get Started eHealth's Medicare website is operated by eHealthInsurance Services, Inc., a licensed health insurance agency doing business as eHealth. The purpose of this site is the solicitation of insurance.

What is the difference between the different Medicare Supplement plans?

A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What are the 3 ways Medicare Supplement plans are rated?

Medigap Plan Costs Policy prices for Medigap are set by the individual insurance companies selling them. Companies set their premium pricing in one of three ways: Community-rated: Premiums are the same regardless of age. Issue or entry age-rated: Premiums are cheaper if the policy is purchased at a younger age.Feb 9, 2022

What is the best way to compare Medicare Advantage plans?

Answer: The Plan Finder tool at Medicare.gov is the best way to compare all of the Medicare Advantage plans in your area. These plans provide medical and drug coverage from a private insurer, and are an alternative to signing up for traditional Medicare along with a medigap and a Part D prescription-drug policy.

What is the difference between Plan G and select Plan G?

Plan G Select offers the same benefits as Plan G with the exception of national coverage. Plan G Select members use a local network of hospitals for inpatient services in exchange for lower premiums.Mar 6, 2017

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

What is the most expensive Medicare Supplement plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the deductible for Medicare supplement plan g?

$233Plan G has nearly the same level of coverage as Plan F. With Plan G, you are responsible for the Part B deductible of $233. Otherwise, coverage is exactly the same as Plan F.

Which Is The Best Medicare Plan?

Plan F and Plan G are the two most popular Medigap plans. As you can see in the Medigap comparison chart, Plan F covers all the gaps in Medicare. P...

How to Compare Medigap Plans – Benefits

Medicare publishes a booklet each year that includes this Medicare Supplements Plans comparison chart. The Medigap comparison chart allows you to s...

Medigap Plans Comparison Chart

The Medigap Plans comparison chart above compares all of the plans side by side. This allows you to see which ones have the most benefits, and whic...

Shop Rates With Our Free Medigap Plans Comparison Report

Once you determine which Medigap plan feels right for you, you can then shop rates. Boomer Benefits makes this easy our free Medigap rate compariso...

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

How much coinsurance is required for skilled nursing?

There is no coinsurance requirement for the first 20 days of inpatient skilled nursing facility care. However, a $185.50 per day coinsurance requirement begins on day 21 of your stay, and you are then responsible for all costs after day 101 of inpatient skilled nursing facility care (in 2021).

What are the different types of Medicare Supplement Plans?

Depending on where you live, there may be three types of Medicare Supplement plans. This can include community-rated, issue-age-rated or attained-age-rated. In some states, attained-age-rated often ends up being the most cost-effective.

What is a Medigap Plan C?

Medigap Plan C is one of the most comprehensive supplements. It covers everything except Medicare excess charges. This means it pays both of your deductibles and the 20% that you would normally owe toward all outpatient expenses. Medigap plans C & F are very popular.

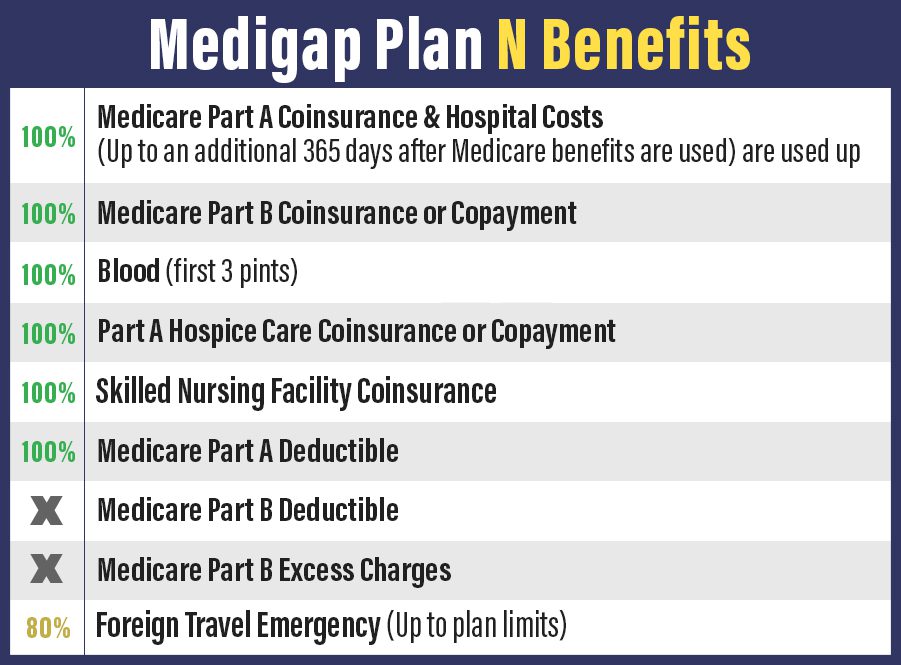

Does Plan N cover excess charges?

Plan N offers lower premiums if you are willing to do a bit of cost-sharing. Unlike Plan F or G though, Plan N does not cover excess charges. You’ll want to read up on this and understand what that means before enrolling. For a list of Medicare supplement insurance companies, visit this page.

Does Medicare cover Plan A?

Medigap Plan A offers the most basic of all the Medigap plans. Even still, it will cover the 20% that Medicare doesn’t pay for on outpatient treatments. That’s arguably the most important piece of all Medigap plans. All Medicare insurance carriers must offer Plan A. However, some states do not require companies to offer it to people under age 65 on Medicare disability.

Is Plan G better than Plan F?

It covers everything that Plan F does except for the Part B deductible. Premiums for Plan G are often very competitive, which can often make it a better value than Plan F . When we compare Medicare Supplements between Plan F and G in most states, we often find that Plan G is a better value annually.

Is Medicare Supplement the same as Medigap?

This makes comparing Medicare Supplement plans pretty easy. ( Medicare Supplements and Medigap plans are the same thing) The Centers for Medicare and Medicaid Services updates the Medigap plans comparison chart every year, although most plans do not have benefit changes from year to year. Some Medigap plans will have higher premiums ...

Which Medicare plan offers the most supplemental coverage?

Plans C, F and G offer the most supplemental coverage, paying many of your out-of-pocket costs for Medicare-approved services. Consider one of these plans if you are willing to pay a monthly premium that is typically higher in exchange for more covered benefits and lower out-of-pocket costs.

What is the difference between Medicare Supplement Plan A and Plan B?

Plans A and B: Lower Benefits, Higher Out-of-Pocket. Medicare Supplement Plan A offers just the Basic Benefits while Plan B covers Basic Benefits plus a benefit for the Medicare Part A deductible. The Medicare Part A deductible could be one of your largest out-of-pocket expenses if you need to spend time in a hospital.

What is Medicare Supplement?

Medicare Supplement insurance plans, also called Medigap plans, provide help with some of the out-of-pocket expenses not paid for by Original Medicare. When you go to the doctor under Original Medicare, you still have expenses to pay. Medicare Supplement insurance plans work with your Medicare Part A (hospital stays) and Medicare Part B ...

Does Plan N cover Medicare Part B?

Plan N covers the Medicare Part B coinsurance, but you pay copayments for covered doctor office and emergency room visits in exchange for a monthly premium that tends to be more mid-range.

Is AARP an insurer?

These fees are used for the general purposes of AARP. AARP and its affiliates are not in surers. AARP does not employ or endorse agents, brokers or producers. You must be an AARP member to enroll in an AARP Medicare Supplement Plan.

What is a K and L plan?

The premiums are typically lower because, for some services, they pay a percentage of the coinsurance instead of the full coinsurance amount. Once the out-of-pocket limit is reached, these plans pay 100% of covered services for the rest of the calendar year.

How much does Plan N pay for Part B?

1 Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don't result in an inpatient admission. 2 Care needed immediately because of an injury or an illness of sudden and unexpected onset.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, is insurance that pays for some costs that aren’t covered in Original Medicare. A Medicare Supplement Plan might (for instance) cover copayments, coinsurance or deductibles you owe under Original Medicare. Medicare Supplement Plans operate as ...

How does Medicare Supplement Plan work?

Understanding how Medicare Supplement Plans work can take some time. Here are the basics [2]: Medigap plans cover one person. If your spouse or partner also wants a Medicare Supplement Plan, they must buy a policy of their own. Medigap plans can’t cancel you for health issues.

How long does Medicare Supplement last?

This starts the month you turn 65 and enroll in Medicare Part B, and it lasts six months. It also never repeats, so don’t miss it.

What is issue age rated?

Issue-age-rated: Premiums are based on the age you are when you purchase them. Generally, younger people pay lower premiums than older people. This may also be called “entry age-rated.”. Attained-age-rated: Premiums are based on your current age, meaning costs will go up as you get older.

Does Medicare cover vision?

They don’t cover everything. Generally, Medicare Supplement Insurance doesn’t cover dental care, vision care, hearing aids, long-term care, eyeglasses or private-duty nursing. Some plans are no longer available. You can no longer purchase Plans E, H, I and J, but if you purchased one of those plans before June 1, 2010, you can continue with it.

What is Medicare Supplement Insurance?

Medicare supplement insurance is also known as “Medigap” because it covers gaps in Original Medicare coverage. This supplemental insurance, offered by private companies, covers costs including deductibles, copayments and coinsurance. You pay a monthly premium for this added coverage.

What is Medicare Select?

Medicare SELECT is a type of Medigap policy that requires policyholders to use hospitals and doctors within its network to get coverage. The premiums are typically lower than those offered by other Medigap providers, which don’t enforce network restrictions. Medicare SELECT can provide the same Plan A through N coverage as other Medigap policies, just with added network and geographical restrictions.

How long does it take to enroll in Medigap?

Medigap open enrollment starts on the first day of the month you are 65 or older and enrolled in Medicare Part B and lasts six months. Because you can enroll in Medicare Part B starting three months before you turn 65, you may have enrolled in Part B but may not yet be able to purchase a Medigap plan.

What is Plan K for Medicare?

Plan K covers additional days in the hospital after Medicare benefits are exceeded and 50% of the following (up to a yearly out-of-pocket limit): Part B coinsurance, up to three pints of blood, hospice care coinsurance or copayments, coinsurance for skilled nursing facilities and the deductible for Part A.

Is Plan C still available for new Medicare recipients?

As of Jan. 1, 2020, Plan C is no longer available for new Medicare recipients.

What is Plan M?

Plan M covers additional days in the hospital after Medicare benefits are exceeded, Part B copayments and coinsurance, hospice care coinsurance and copayments, skilled nursing facility care coinsurance and up to three pints of blood. It also covers 50% of the Part A deductible and 80% of charges for care abroad.

Does Medicare cover Plan F?

Plan F covers everything covered by Plan C and also covers any excess charge by a doctor or hospital that Medicare does not cover. Due to the changes regarding the Part B deductible, newly eligible consumers can no longer enroll in Plan F.

What is Medicare Supplement?

Medicare Supplement (also known as Medigap or MedSupp) insurance plans help cover certain out-of-pocket costs that Original Medicare, Part A and Part B, doesn’t cover. There are 10 plan types available in most states, and each plan is labeled with a different letter that corresponds with a certain level of basic benefits. ...

Does Medigap have the same benefits?

In most states, Medigap insurance plans have the same standardized benefits for each letter category. This means that the basic benefits for a Plan A, for example, is the same across every insurance company that sells Plan A, regardless of location.

How to choose a Medigap plan?

Medigap policies are standardized, and in most states are named by letters, Plans A-N. Compare the benefits each plan helps pay for and choose a plan that covers what you need. See benefits of each plan. Step 2.

What is Medigap insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs.

What is Medicare Supplement Plan A?

Plan A is the basic benefits supplement plan; it’s required by every Medicare insurance carrier to offer this coverage. However, each additional plan must have more coverage than Plan A.

How many Medigap plans are there?

There are 12 Medigap plans, lettered A-N. Each lettered plan covers the core policy benefits. Depending on the letter plan you enroll in, you will have coverage for out-of-pocket medical costs such as deductible, copays, and coinsurance.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare. You can also find her over on our Medicare Channel on YouTube as well as contributing to our Medicare Community on Facebook.

Is Medicare Part A or B?

Don’t confuse Medigap Plans A and B with Medicare Parts A and B. Original Medicare includes Part A, which is inpatient hospital coverage, and Part B, which covers outpatient physician visits. Medigap Plans A and B are supplemental insurance to cover what Medicare doesn’t.