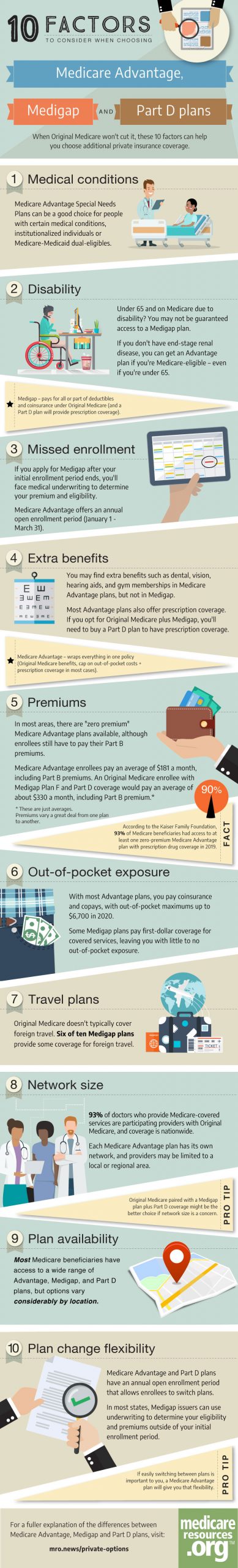

How to Decide Between Medigap and Medicare Advantage

- Doctor Network. Original Medicare and Medigap do not have doctor networks. ...

- Current and Future Health. It’s important to consider not only your current health, but also your future health. ...

- Your Budget. Your budget is another important factor to consider when choosing between Medigap and Medicare Advantage.

Full Answer

What is the difference between Medicare and advantage?

Sep 15, 2021 · Take stock of your healthcare, travel, and financial needs when comparing Medicare Advantage (MA) and Medigap. Try to compare total out-of-pocket costs and lifestyle needs rather than just premiums. For Medigap, use your open enrollment period to choose a plan and avoid possible denial, a waiting period, or higher premiums later on.

Is Medicare Advantage better than Medicare?

Feb 01, 2022 · Medicare Advantage plans typically have copays for most services, whereas Medigap policies cover coinsurance and copays in Original Medicare. Be assured, there is a maximum out-of-pocket amount in Medicare Advantage plans if your total payments for copays, coinsurance, and deductible reach the maximum out-of-pocket amount, the Medicare …

Why choose a Medicare Advantage plan?

Within Medicare Advantage and Medigap, there will be differences in coverage, cost and the provider networks. These will vary greatly and thus are important to recognize before you decide on a plan that will be right for your health situation. Below is an overview of the main differences between Advantage and Supplement coverage. Coverage

Why are Medicare Advantage plans bad?

Dec 20, 2021 · They may have no premium or a lower one compared to the significant premiums for Medigap and prescription drug insurance policies. Medicare Advantage plans cover hospitals and doctors and often ...

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

Is a Medigap plan better than an Advantage plan?

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include:Higher monthly premiums.Having to navigate the different types of plans.No prescription coverage (which you can purchase through Plan D)

Can you switch from Medicare Advantage to Medigap?

For example, when you get a Medicare Advantage plan as soon as you're eligible for Medicare, and you're still within the first 12 months of having it, you can switch to Medigap without underwriting. The opportunity to change is the "trial right."Jun 3, 2020

How do I choose a good Medigap plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.Feb 9, 2022

Why is Medigap so expensive?

Medigap plans are administered by private insurance companies that Medicare later reimburses. This causes policy prices to vary widely. Two insurers may charge very different premiums for the exact same coverage. The more comprehensive the medical coverage is, the higher the premium may be.

Why should I choose a Medigap plan?

A Medigap plan is a private insurance policy that can help you pay for some of the out-of-pocket costs associated with traditional Medicare and sometimes additional services. You must pay a premium for Medigap insurance in addition to your Medicare Part B premium and Medicare Part D prescription drug premium.

What are the pros and cons of a Medigap plan?

Medigap Pros and ConsMedigap ProsMedigap ConsPlans are easy to compareDifficult to switch once enrolledGuaranteed 6 month enrollment period when 1st eligibleMay not be able to enroll after initial enrollment periodAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductible3 more rows•Sep 26, 2021

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Can you go back and forth between Original Medicare and Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

Healthmarkets Helps With Medicare Advantage And Medigap Plans

HealthMarkets can quickly help you find the Medicare plan that best fits your needs. Need help deciding? Answer a few quick questions to see whether a Medicare Advantage or Medigap plan is a better choice for you.

How Does Original Medicare Work

Original Medicare is a government-funded medical insurance option for people age 65 and older. Many older Americans use Medicare as their primary insurance since it covers:

Choosing A Medicare Advantage Plan

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules.

Why Should I Choose Medicare Advantage

Medicare Advantage covers some of the gaps of Original Medicare and usually offers a $0 premium through a private company. It can be an affordable option for patients who are not currently sick or in need of intense medical care. If a patients situation worsens, it might be difficult or expensive to switch plans.

What Does Medicare Cover

The two main parts of Medicare are Part A and Part B. Part A is hospital coverage for inpatient services, and Part B is your doctors coverage for outpatient services. Part A is premium-free for most beneficiaries, and Part B comes with a standard monthly premium.

Enrolling In Medicare Advantage

Your initial coverage election period begins three months before your 65th birthday and ends either the last day of the month before your Part B becomes effective or the last day of your IEP.

What Is The Difference Between Plan G And Plan G With A High Deductible

The difference between a regular Plan G plan and a High Deductible Plan G plan is the deductible amount and coverage timing. With a standard Supplement Plan G, youre covered immediately and are responsible only for the $233 Part B deductible, plus your monthly premium.

What is Medicare Advantage?

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules. Most provide prescription drug coverage. Some require a referral to see a specialist while others do not. Some may pay a portion of out-of-network care, while others will cover only doctors and facilities that are in the HMO or PPO network. There are also other types of Medicare Advantage plans.

What is a Medigap policy?

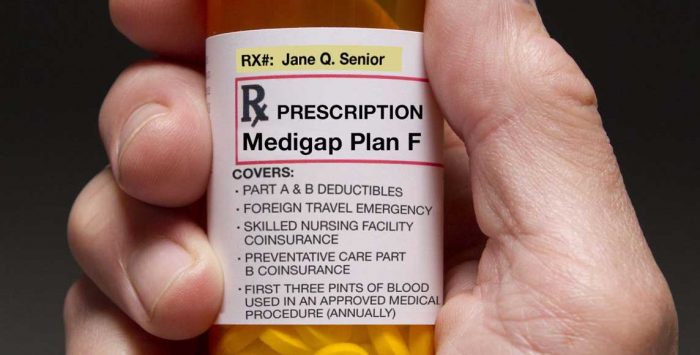

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov . They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states. 12 Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurer’s prices for each letter plan and simply choose the better deal.

How long can you stay on medicare?

You generally won't have to pay a penalty if you later decide to enroll in a Medicare prescription drug plan and you haven't gone for longer than 63 continuous days without creditable coverage. 98.

What happens if you don't enroll in Medicare?

Once you’ve enrolled in Medicare, a key decision point is choosing coverage for Part D prescription drug insurance . If you don’t enroll in Part D insurance when you start Medicare and want to buy drug coverage later on, you may be permanently penalized for signing up late. 8

How to get started with Medicare?

To get started, find the plans available in your zip code. Once you have created an account at Medicare.gov, you can enter the names of your drugs and use a convenient tool that allows you to compare plan premiums, deductibles, and Medicare star ratings. 10

Does Medigap cover Part B?

Consumers can confidently compare insurer’s prices for each letter plan and simply choose the better deal. As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren't allowed to cover the Part B deductible.

Does Medicare Advantage cover doctors?

Medicare Advantage plans cover hospitals and doctors and often include prescription drug coverage and some services not covered by Medicare, too.

How much is Medicare Advantage 2021?

In most areas, there are “ zero-premium ” Medicare Advantage plans available (although you still have to pay for Medicare Part B; in 2021, the premium for Part B is $148.50/month for most enrollees ). According to the Kaiser Family Foundation, 96% of Medicare beneficiaries have access to at least one zero-premium Medicare Advantage plan for 2021.

How much does a 65 year old pay for medicaid?

But according to data from eHealth, the average 65-year-old paid $134/month for Medigap coverage in 2020.

What is a SNP in Medicare?

Would you qualify for a Medicare Advantage Special Needs Plan (SNP)? SNPs are geared to the needs of very specific populations, and can be a good choice for people with certain medical conditions, as well as those who are institutionalized or who are Medicare-Medicaid dual eligible.

Does Medicare Advantage have an open enrollment period?

So while Medicare Advantage and Part D have an annual open enrollment period that lets enrollees switch plans, Medigap issuers can use your medical history to determine eligibility and premiums if you’re enrolling after your initial enrollment period.

Is Medicare Advantage guaranteed?

Although Medigap, Part D, and Medicare Advantage are all guaranteed issue for all enrollees during their initial enrollment period, Medigap plans aren’t guaranteed issue after that in most states. So while Medicare Advantage and Part D have an annual open enrollment period that lets enrollees switch plans, Medigap issuers can use your medical history to determine eligibility and premiums if you’re enrolling after your initial enrollment period.

Is Medicare Part D or Original?

Original Medicare paired with a Medigap plan and Part D coverage might be the better choice if network size is a concern, or if you expect to travel widely within the U.S. during your retirement. But if you have a specific provider in mind, do your homework before you pick a coverage option.

Does Medicare cover travel?

Original Medicare doesn’t cover foreign travel except for a few rare circumstances, but most Medigap plans provide some coverage for foreign travel (80% of the cost of emergency care received in the first two months of a trip, limited to a $50,000 lifetime cap, and with a $250 annual deductible). Medicare Advantage plans can cover foreign travel ...

Can You Switch From Medicare Advantage To Medigap

You can technically leave your Medicare Advantage plan at any time and enroll in Medigap. The issue, however, is whether the Medigap carrier will accept you. If youre outside your one-time Medigap OEP, you no longer have guaranteed issue rights and you will have to go through medical underwriting.

Which Is Better: Medigap Or Medicare Advantage

Neither type of policy is necessarily better than the other. But one option may prove to be better for a particular persons needs.

Costs Of Medicare Advantage

Medicare advantage premiums vary like any other insurance plan, based on the provider and the plan you select.

When Can I Buy A Medicare Supplement Plan

When it comes to Medicare eligibility, you can buy a Medicare Supplement policy beginning on the first day of the month you turn 65, and for the following six months. Depending on the plan and state, however, people who are under 65 may qualify if they are permanently disabled.

When Might Medicare Advantage Be Right For You

A Medicare Advantage plan might be ideal for beneficiaries who want dental, vision or hearing coverage but do not have it through other means.

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility.

Medicare Advantage Also Known As Medicare Part C

Medicare Advantage , also called Medicare Part C, is a type of private Medicare health plan sold by insurance companies. These plans replace your Medicare Part A and Part B coverage and offer all of the same benefits you would otherwise receive from Medicare Part A and Part B.

What are the different types of Medicare?

Medicare is available in a few different "parts" or coverage options. They are: 1 Medicare Part A and Part B combine to form the Basic Medicare coverage plan. 2 Part C, also known as Medicare Advantage, provides you with more comprehensive coverage than Basic Medicare and limits out-of-pocket costs. 3 Part D works with Parts A & B. It adds prescription drug coverage, and there is an additional premium for this. 4 Medicare Supplement Insurance, also known as Medigap, can lower your out-of-pocket costs even more than a Medicare Advantage plan can. It does not, however, add additional coverage to Medicare.

How long is the open enrollment period for Medigap?

The open enrollment period is limited to 6 months/180 days from the Part B effective date.

What are the options for Medicare 2021?

Beyond the basic coverage, two major options you'll have to consider are Medigap and Medicare Advantage.

How much does Medicare Part B cover?

Medicare Part B covers 80% of your health care costs, which then leaves 20% for you to cover out of pocket. 3 Medicare has no out of pocket maximum, so that 20% could add up to a lot of money if you have a lot of medical needs.

Can I use Medigap outside the US?

Since Medigap is supplemental Medicare, you can use your coverage at any U.S. provider that accepts Medicare. Some plans even offer coverage outside the U.S. 9 10. Medicare Advantage may have its own limits in terms of network, specialist restrictions, and more.

Does Medigap cover deductibles?

Medigap can help cover that 20% Medicare co-pay or part of the deductibles which you would otherwise pay out of pocket with Basic Medicare coverage. Some of the Medigap plans also include maximum out-of-pocket limits. The scope of coverage depends on the Medigap plan you choose. 5.

Is Medicare Advantage a private insurance?

No. Yes. Both Medicare Advantage and Medigap are health insurance options that are provided by private insurers; their coverage basics are regulated by the government, just like Medicare. Each one has its advantages, either providing you with more coverage or helping to lower your out-of-pocket costs .

What is the difference between Medicare Advantage and Medigap?

Medicare Advantage and Medigap plans are both sold through private insurers, but there are major differences. Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

What are the advantages of Medigap?

The biggest advantage of Medigap may be your choice of doctors. You have more doctors and hospitals to choose from since you can go to any provider that accepts Medicare. If your doctor is not in a Medicare Advantage plan you’re considering, and you don’t want to switch doctors, you may want to consider Medigap.

What is Medicare Advantage?

Medicare Advantage: Covers Medicare Parts A and B, but most provide extra benefits, including vision, dental, hearing and prescription drugs. Medigap: You still have Original Medicare Parts A and B, and the choice of eight different Medigap plans each providing different levels of coverage. Out-of-Pocket Limit.

How much is Medicare Advantage 2021?

Medicare Advantage: An average $21 a month premium (for 2021) on top of your Medicare Part B premium. Medigap: The average Medigap cost is $2,100 per year ($175 per month), and covers about $1,600 in out-of-pocket expenses per year, on average. Coverage.

What is the difference between Medicare Supplement and Medicare Advantage?

Licensed insurance advisor John Clark explains the main difference between Medicare Supplement plans and Medicare Advantage plans. You may have fewer choices in terms of doctors and health care providers in some cases with Medicare Advantage plans. With Medigap, you have access to any doctor or provider who accepts Medicare.

How much does Medicare cost out of pocket?

Medicare Advantage: Plans must cap annual out-of-pocket costs at $7,550 for in network services and $11,300 for in - and out-of-network services combined. Medigap: A Medigap policy can ease concerns about Medicare's lack of caps or limits. Each plan has specific benefits with specified out-of-pocket costs. Prescription Drug Coverage.

When can I switch to a different Medicare Advantage plan?

If you are in a Medicare Advantage plan, you can make a switch to a different Medicare Advantage plan during Medicare’s open enrollment period, which runs from October 15 through December 7 each year. You may also not be able to get a Medigap policy if you give up your Medicare Advantage plan.

Your Options

There are a number of Medicare insurance plans available in the marketplace. You can supplement your insurance plan either with Medigap, Medicare Advantage, or Part D coverage.

Ten Options for Making a Decision

There is no right or wrong answer—both Medicare Advantage plan and Original Medicare plus supplemental coverage are effective. However, there are several factors to consider when making your decision: