How to Choose Between Medigap, Medicare Advantage, and Part D

- Medical Conditions. Do you think you’d be eligible for the Medicare Advantage Special Needs Plan (SNP)? SNPs are...

- Disability Factor. Are you under the age of 65 and on Medicare due to a disability? If this is the case, you might be...

- Missed Enrollment. Are you only enrolled in the Original Medicare...

Full Answer

What is the difference between Medicare and advantage?

Dec 20, 2021 · They may have no premium or a lower one compared to the significant premiums for Medigap and prescription drug insurance policies. Medicare Advantage plans cover hospitals and doctors and often ...

Is Medicare Advantage better than Medicare?

Mar 17, 2022 · Medigap does not cover the cost of prescription drugs. If you want to add that on to Medigap, you'll need Medicare Part D. Most Medicare Advantage plans include prescription drug coverage. 2 3 Coverage for Out-of-Pocket Costs

Why choose a Medicare Advantage plan?

Jan 17, 2022 · There are plenty of differences between Medigap and Medicare Advantage including doctor networks, coverage benefits, and the need for referrals. Of course, the cost is different, but we’ll get to that. If you want coverage that gives you the most flexibility, a Medigap plan could be your ideal policy. Medigap Doctor Network

Why are Medicare Advantage plans bad?

Feb 01, 2022 · Medicare Advantage plans typically have copays for most services, whereas Medigap policies cover coinsurance and copays in Original Medicare. Be assured, there is a maximum out-of-pocket amount in Medicare Advantage plans if your total payments for copays, coinsurance, and deductible reach the maximum out-of-pocket amount, the Medicare …

Is a Medigap plan better than an Advantage plan?

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include:Higher monthly premiums.Having to navigate the different types of plans.No prescription coverage (which you can purchase through Plan D)

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

Can I switch from a Medigap plan to a Medicare Advantage plan?

Can you switch from Medicare Supplement (Medigap) to Medicare Advantage? Yes. There can be good reasons to consider switching your Medigap plan. Maybe you're paying too much for benefits you don't need, or your health needs have changed and now you need more benefits.Jun 24, 2021

Why should I choose a Medigap plan?

A Medigap plan is a private insurance policy that can help you pay for some of the out-of-pocket costs associated with traditional Medicare and sometimes additional services. You must pay a premium for Medigap insurance in addition to your Medicare Part B premium and Medicare Part D prescription drug premium.

Why is Medigap so expensive?

Medigap plans are administered by private insurance companies that Medicare later reimburses. This causes policy prices to vary widely. Two insurers may charge very different premiums for the exact same coverage. The more comprehensive the medical coverage is, the higher the premium may be.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

Can I switch from a Medicare Advantage plan back to Original Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

Can you switch Medigap plans without underwriting?

During your Medigap Open Enrollment Period, you can sign up for or change Medigap plans without going through medical underwriting. This means that insurance companies cannot deny you coverage or charge you more for a policy based on your health or pre-existing conditions.Nov 22, 2021

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Does getting a Medicare Advantage plan make you lose original Medicare?

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is Medicare Advantage?

Medicare Advantage. Medicare Advantage plans work much like traditional health insurance plans. By law, these plans must provide at least the same minimal coverage as Original Medicare and may also offer additional benefits such as vision or dental coverage.

How much does Medicare Advantage cost?

Consumer Reports estimates these costs totaling $3,400 to $6,700 per year.

How much is Medigap monthly premium?

The monthly premium of a Medigap plan can offset some of the expenses that it covers such as the Part A deductible ($1,364 per benefit period in 2019) or skilled nursing facility coinsurance (up to $170.50 per day of each benefit period in 2019).

Does Medicare Advantage replace Original Medicare?

Unlike Medigap plans, which help supplement your Original Medicare benefits, Medicare Advantage plans replace Original Medicare altogether. A Medicare Advantage plan may be for you if you wish to have some extra coverage such as dental, vision or prescription drug benefits.

Does Medigap cover out of pocket costs?

Medigap (also known as Medicare Supplement Insurance) is sold by private insurers to cover some of the out-of-pocket costs of Original Medicare. With Medigap, you’ll continue to use your Original Medicare benefits, but when it comes time to make a copayment, satisfy a deductible or pay out of your own pocket in other ways, your Medigap plan might pick up some of the cost for you. There are currently 10 standardized plans in most states that work in conjunction with Original Medicare.

Is Medigap right for me?

A Medigap plan may be right for you if you are seeking increased cost predictability, fewer surprise out-of-pocket expenses and wish to have a health insurance plan that you can take with you wherever you go within the United States.

Can I leave Medigap at anytime?

Plus, providers can leave the plan’s network at anytime throughout the year. Continue learning about Medigap with this helpful guide. If you have questions and would prefer to talk to a licensed agent, call 1-800-995-4219 today. 1 https://www.mymedicarematters.org/costs/part-c/?SID=58ab5afcd9264.

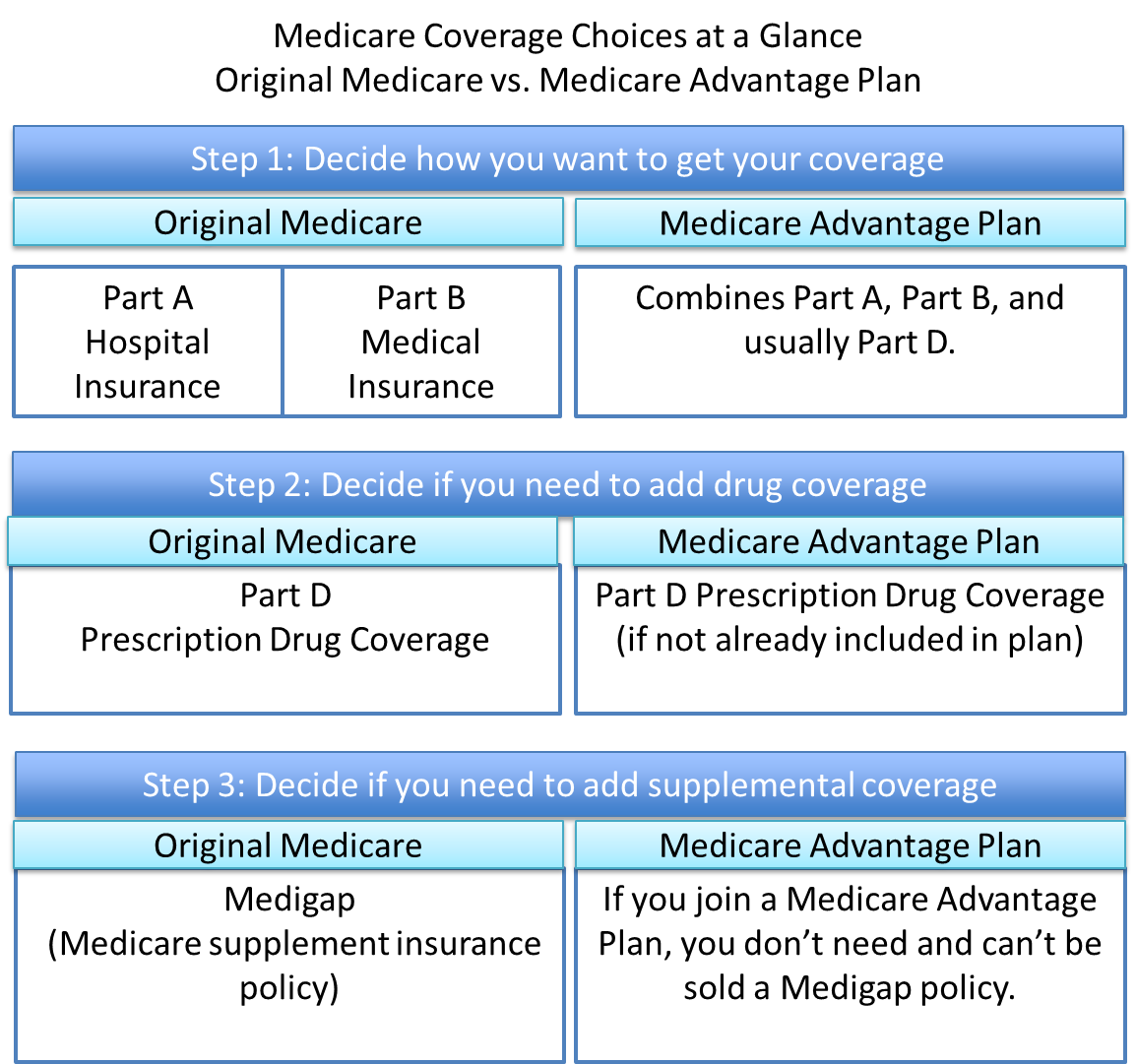

What are the different types of Medicare?

Medicare is available in a few different "parts" or coverage options. They are: 1 Medicare Part A and Part B combine to form the Basic Medicare coverage plan. 2 Part C, also known as Medicare Advantage, provides you with more comprehensive coverage than Basic Medicare and limits out-of-pocket costs. 3 Part D works with Parts A & B. It adds prescription drug coverage, and there is an additional premium for this. 4 Medicare Supplement Insurance, also known as Medigap, can lower your out-of-pocket costs even more than a Medicare Advantage plan can. It does not, however, add additional coverage to Medicare.

How long is the open enrollment period for Medigap?

The open enrollment period is limited to 6 months/180 days from the Part B effective date.

What are the options for Medicare 2021?

Beyond the basic coverage, two major options you'll have to consider are Medigap and Medicare Advantage.

How much does Medicare Part B cover?

Medicare Part B covers 80% of your health care costs, which then leaves 20% for you to cover out of pocket. 3 Medicare has no out of pocket maximum, so that 20% could add up to a lot of money if you have a lot of medical needs.

Can I use Medigap outside the US?

Since Medigap is supplemental Medicare, you can use your coverage at any U.S. provider that accepts Medicare. Some plans even offer coverage outside the U.S. 9 10. Medicare Advantage may have its own limits in terms of network, specialist restrictions, and more.

Does Medigap cover deductibles?

Medigap can help cover that 20% Medicare co-pay or part of the deductibles which you would otherwise pay out of pocket with Basic Medicare coverage. Some of the Medigap plans also include maximum out-of-pocket limits. The scope of coverage depends on the Medigap plan you choose. 5.

Is Medicare Advantage a private insurance?

No. Yes. Both Medicare Advantage and Medigap are health insurance options that are provided by private insurers; their coverage basics are regulated by the government, just like Medicare. Each one has its advantages, either providing you with more coverage or helping to lower your out-of-pocket costs .

Healthmarkets Helps With Medicare Advantage And Medigap Plans

HealthMarkets can quickly help you find the Medicare plan that best fits your needs. Need help deciding? Answer a few quick questions to see whether a Medicare Advantage or Medigap plan is a better choice for you.

How Does Original Medicare Work

Original Medicare is a government-funded medical insurance option for people age 65 and older. Many older Americans use Medicare as their primary insurance since it covers:

Choosing A Medicare Advantage Plan

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules.

Why Should I Choose Medicare Advantage

Medicare Advantage covers some of the gaps of Original Medicare and usually offers a $0 premium through a private company. It can be an affordable option for patients who are not currently sick or in need of intense medical care. If a patients situation worsens, it might be difficult or expensive to switch plans.

What Does Medicare Cover

The two main parts of Medicare are Part A and Part B. Part A is hospital coverage for inpatient services, and Part B is your doctors coverage for outpatient services. Part A is premium-free for most beneficiaries, and Part B comes with a standard monthly premium.

Enrolling In Medicare Advantage

Your initial coverage election period begins three months before your 65th birthday and ends either the last day of the month before your Part B becomes effective or the last day of your IEP.

What Is The Difference Between Plan G And Plan G With A High Deductible

The difference between a regular Plan G plan and a High Deductible Plan G plan is the deductible amount and coverage timing. With a standard Supplement Plan G, youre covered immediately and are responsible only for the $233 Part B deductible, plus your monthly premium.

Can You Switch From Medicare Advantage To Medigap

You can technically leave your Medicare Advantage plan at any time and enroll in Medigap. The issue, however, is whether the Medigap carrier will accept you. If youre outside your one-time Medigap OEP, you no longer have guaranteed issue rights and you will have to go through medical underwriting.

Which Is Better: Medigap Or Medicare Advantage

Neither type of policy is necessarily better than the other. But one option may prove to be better for a particular persons needs.

Costs Of Medicare Advantage

Medicare advantage premiums vary like any other insurance plan, based on the provider and the plan you select.

When Can I Buy A Medicare Supplement Plan

When it comes to Medicare eligibility, you can buy a Medicare Supplement policy beginning on the first day of the month you turn 65, and for the following six months. Depending on the plan and state, however, people who are under 65 may qualify if they are permanently disabled.

When Might Medicare Advantage Be Right For You

A Medicare Advantage plan might be ideal for beneficiaries who want dental, vision or hearing coverage but do not have it through other means.

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility.

Medicare Advantage Also Known As Medicare Part C

Medicare Advantage , also called Medicare Part C, is a type of private Medicare health plan sold by insurance companies. These plans replace your Medicare Part A and Part B coverage and offer all of the same benefits you would otherwise receive from Medicare Part A and Part B.

What is the best Medicare Advantage plan?

Which Is Better: Medigap or Medicare Advantage? 1 One of the advantages of Medigap is that a plan can potentially help you greatly reduce or even eliminate many of your out-of-pocket Medicare costs. Surprise medical bills can be stressful and damaging to your household budget, and a Medigap plan can provide you with more predictable Medicare spending.#N#Medigap plans also have the luxury of being accepted all over the U.S. If you’re a frequent traveler, you can use your Medigap plan anywhere in America where Original Medicare is accepted. 2 On the other hand, Medicare Advantage plans include out-of-pocket spending limits and generally have lower monthly premiums than Medigap plans. (Many Medicare Advantage plans actually have $0 premiums).#N#Medicare Advantage plans may also cover things you don’t otherwise get through Original Medicare, which can allow you to bundle a variety of benefits under one plan without having to juggle multiple insurance policies for everything you need.#N#One type of Medicare Advantage plan called a Special Needs Plan (SNP) can even be customized to fit the needs of someone with a specific health condition or circumstance

What is a Medigap plan?

Medigap plans are also referred to as Medicare Supplement Insurance, and there are 10 different types of standardized Medigap plans that are available from private insurance companies in most states. Medigap plans pay for some of the out-of-pocket costs that are required by Original Medicare. The costs that Medigap plans can cover include things like Medicare deductibles, copayments, coinsurance and more.

Does Medigap accept Medicare?

Medigap plans are accepted by any health care provider who accepts Original Medicare. There are no network restrictions or participating providers to worry about. If a doctor accepts your Medicare insurance, they will accept your Medigap coverage as well.

Does Medicare Supplement pay out of pocket?

When you use a Medigap plan, it works alongside your Original Medicare coverage so that when you receive care that’s covered by Medicare, your Medicare Supplement plan will pay certain out-of-pocket costs that might be due when you receive that care.

Is Medigap Plan A standardized?

Medigap plans are standardized in terms of their benefits (except for Medigap plans in Massachusetts, Minnesota and Wisconsin, where plans are standardized differently). For example, Medigap Plan A purchased in California will include the same benefits as Medigap Plan A purchased in New York.

Does Medigap cover prescriptions?

Medigap plans do not cover prescription drug costs. Beneficiaries who have a Medigap plan must enroll in a Medicare Part D plan or other type of prescription drug insurance plan (such as an employer-provided drug plan) if they want drug coverage.

Your Options

There are a number of Medicare insurance plans available in the marketplace. You can supplement your insurance plan either with Medigap, Medicare Advantage, or Part D coverage.

Ten Options for Making a Decision

There is no right or wrong answer—both Medicare Advantage plan and Original Medicare plus supplemental coverage are effective. However, there are several factors to consider when making your decision: