Information Needed to Verify Medicare Eligibility One must provide identification, and this includes a full name, address, date of birth, and Social Security number. Some questions may involve the work history of the spouse or partner to see if one or both may be eligible for Social Security benefits and Medicare.

- You are a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years and.

- You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them.

How can providers verify Medicare eligibility?

- Medicare ID number (known as the Medicare Beneficiary Identifier (MBI))

- Last Name

- First Name

- Gender (M/F)

- Date of Birth (MMDDCCYY format)

- Eligibility From date / date of service (MMDDCCYY format)

- Eligibility Thru date / date of service or current date (MMDDCCYY format)

What are the criteria to meet eligibility for Medicare?

- You have been receiving Social Security disability benefits for at least 24 months in a row

- You have Lou Gehrig’s disease (amyotrophic lateral sclerosis)

- You have permanent kidney failure requiring regular dialysis or a kidney transplant. This condition is called end-stage renal disease (ESRD).

What are the elegibility criteria of Medicare?

The updated Medicare recommendation is also an important step forward in addressing racial disparities associated with lung cancer, as the expanded criteria includes more individuals from Brown and Black communities.

How do I find out if I qualify for Medicare?

- The Social Security Administration is a partner agency with the Centers for Medicare and Medicaid. ...

- Medicare is the agency that runs Medicare. ...

- The Centers for Medicare and Medicaid or CMS is the federal agency that has responsibility for the entire public healthcare system for Americans of all ages. ...

What are the 3 qualifying factors for Medicare?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant).

What are the income levels that determine Medicare premiums?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How is Medicare amount determined?

Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

At what age can you draw full Medicare?

age 65If you aren't eligible for full Social Security retirement benefits at age 65, and you aren't getting Social Security benefits, you can still get your full Medicare benefits (including premium-free Part A) at age 65, but you must contact Social Security to sign up.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

What are the income limits for Medicare 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

How much Social Security will I get if I make $75000 a year?

about $28,300 annuallyIf you earn $75,000 per year, you can expect to receive $2,358 per month -- or about $28,300 annually -- from Social Security.

Do 401k withdrawals count as income for Medicare?

The distributions taken from a retirement account such as a traditional IRA, 401(k), 403(b) or 457 Plan are treated as taxable income if the contribution was made with pre-tax dollars, Mott said.

How much Social Security will I get if I make $120000 a year?

If you make $120,000, here's your calculated monthly benefit According to the Social Security benefit formula in the previous section, this would produce an initial monthly benefit of $2,920 at full retirement age.

How do I find out my full retirement age?

If your birth year is 1960 or after, your normal retirement age is 67. Anyone born between 1955 and 1959 has a normal retirement age between 66 and 67 – that is, 66 plus a certain number of months. For instance, if you were born in 1958, your FRA is 66 and eight months.

Will the Medicare age be raised to 67?

3 The retirement age will remain 66 until 2017, when it will increase in 2-month increments to 67 in 2022. Several proposals have suggested raising both the normal retirement age and the Medicare eligibility age.

Can I work full time at 66 and collect Social Security?

When you reach your full retirement age, you can work and earn as much as you want and still get your full Social Security benefit payment. If you're younger than full retirement age and if your earnings exceed certain dollar amounts, some of your benefit payments during the year will be withheld.

How to Enroll in Medicare and When You Should Start Your Research Process

Getting older means making more decisions, from planning for your kids’ futures to mapping out your retirement years. One of the most important dec...

Who Is Eligible to Receive Medicare Benefits?

Two groups of people are eligible for Medicare benefits: adults aged 65 and older, and people under age 65 with certain disabilities. The program w...

When Should You Enroll For Medicare?

Just because you qualify for something doesn’t mean you need to sign up, right? Not always. In the case of Medicare, it’s actually better to sign u...

Can You Delay Medicare Enrollment Even If You Are Eligible?

The short answer here is yes, you can choose when to sign up for Medicare. Even if you get automatically enrolled, you can opt out of Part B since...

What About Medigap Plans?

Original Medicare covers a good portion of your care, but it’s not exhaustive. There’s a wide range of services that Parts A and B don’t cover, inc...

How long do you have to be a US citizen to qualify for Medicare?

To receive Medicare benefits, you must first: Be a U.S. citizen or legal resident of at least five (5) continuous years, and. Be entitled to receive Social Security benefits.

How long does it take to enroll in Medicare?

If you don’t get automatic enrollment (discussed below), then you must sign up for Medicare yourself, and you have seven full months to enroll.

How old do you have to be to get a Medigap policy?

In other words, you must be 65 and enrolled in Medicare to sign up for a Medigap policy. Once you’re 65 and enrolled in Part B, you have six months to enroll in Medigap without being subject to medical underwriting. During this initial eligibility window, you can: Buy any Medigap policy regardless of health history.

How long do you have to sign up for Medicare before you turn 65?

And coverage will start…. Don’t have a disability and won’t be receiving Social Security or Railroad Retirement Board benefits for at least four months before you turn 65. Must sign up for Medicare benefits during your 7-month IEP.

When do you sign up for Medicare if you turn 65?

You turn 65 in June, but you choose not to sign up for Medicare during your IEP (which would run from March to September). In October, you decide that you would like Medicare coverage after all. Unfortunately, the next general enrollment period doesn’t start until January. You sign up for Parts A and B in January.

What is the penalty for not signing up for Part D?

The penalty for not signing up on time for Part D is 1 percent x the number of full months you didn’t have coverage, multiplied by the “national base premium,” which changes each year. In 2019, the national base premium for Part D is $33.19.

When does Medicare open enrollment start?

You can also switch to Medicare Advantage (from original) or join a Part D drug plan during the Medicare annual open enrollment period, which runs from October 15 through December 7 each year. Eligibility for Medicare Advantage depends on enrollment in original Medicare.

How to check Medicare eligibility?

The best way to check eligibility and enroll in Medicare online is to use the Social Security or Medicare websites. They are government portals for signing up for Medicare, and they offer free information about eligibility. Medicare is not part of Social Security, but they are connected: getting Social Security benefits is one way ...

What information is needed to check Medicare eligibility?

Information Needed to Check Medicare Eligibility. One must provide identification, and this includes a full name, address, date of birth, and Social Security number. Some questions may involve the work history of the spouse or partner to see if one or both may be eligible for Social Security benefits and Medicare.

What is the difference between Medicare Part A and Part C?

Medicare Part A has the Minimum Essential Coverage required by the Affordable Care Act. Medicare Part C Medicare Advantage plans meet the requirements of the individual mandate for qualified health insurance. These plans provide coverage equal to or better than Original Medicare.

What is the purpose of Social Security?

Social Security helps people enroll in Medicare when they are ready to retire or whether they choose to continue working. The SSA uses its website and offices to assist persons seeking information eligibility and in applying for benefits.

How many quarters of coverage are earned in a year?

Quarters of Coverage each represent a three-month period of work while paying the FICA tax; about 4 Quarters of Coverage are earned in a single year. The Quarters of Coverage are units of measuring eligibility for Medicare coverage and Social Security benefits.

What is the Medicare premium for 2021?

In 2021, the Medicare Part B premium for most people is $148.50. The number of fully-taxed covered quarters of work will also affect the monthly amount received for Social Security or Railroad Retirement Board pension benefits. The number of quarters needed varies on the bases of age, disability, or kidney disease.

What is Medicare Part A?

Medicare Part A: Hospital Insurance covers for inpatient services when admitted to the hospital, as well as home health care, skilled nursing care and Hospice. Part A may require a premium depending on work history while paying taxes, but typically beneficiaries are entitled to it at no cost.

How long do you have to live to qualify for Medicare?

You qualify for full Medicare benefits if: You are a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years and. You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them.

How old do you have to be to get Medicare?

citizen or have been a legal resident for at least five years, you can get full Medicare benefits at age 65 or older. You just have to buy into them by: Paying premiums for Part A, the hospital insurance.

How much will Medicare premiums be in 2021?

If you have 30 to 39 credits, you pay less — $259 a month in 2021. If you continue working until you gain 40 credits, you will no longer pay these premiums. Paying the same monthly premiums for Part B, which covers doctor visits and other outpatient services, as other enrollees pay.

How long do you have to be on disability to receive Social Security?

You have been entitled to Social Security disability benefits for at least 24 months (that need not be consecutive); or. You receive a disability pension from the Railroad Retirement Board and meet certain conditions; or.

How many credits do you get in 2021?

Work credits are earned based on your income; the amount of income it takes to earn a credit changes each year. In 2021 you earn one work credit for every $1,470 in earnings, up to a maximum of four credits per year. If you have accrued fewer than 30 work credits, you pay the maximum premium — $471 in 2021.

What are the requirements to be eligible for Medicare Supplement?

To be eligible for a Medicare Supplement plan, you'll need to meet the following requirements: You must have both Part A and B (original Medicare). You must live where plans are available. You must pay Part A, Part B, and Medicare Supplement premiums, if applicable.

When do you start enrolling in Medicare?

If you qualify for Medicare this way, your Initial Enrollment Period will begin three months before the month you turn 65.

How long do you have to wait to receive Medicare if you have Lou Gehrig's disease?

If none of these situations apply to you, you'll have to wait until age 65 to begin receiving your Medicare benefits.

What is Medicare Supplement Plan?

Medicare Supplement eligibility. Also known as Medigap, Medicare Supplement plans are designed to accompany Original Medicare. They help cover additional Part A and Part B costs, such as deductibles and copayments. To be eligible for a Medicare Supplement plan, you'll need to meet the following requirements:

What is Medicare Advantage?

Medicare Advantage (Part C) eligibility. Medicare Advantage is an alternative to Original Medicare. Private companies provide Medicare-approved plans that cover everything Original Medicare covers, as well as additional benefits that may include vision, dental, hearing, and prescription drug coverage.

When do you get Medicare if you are 65?

Most Medicare recipients under the age of 65 reach eligibility during their 25th month receiving Social Security disability benefits. If you qualify for Medicare because of a disability, your Initial Enrollment Period will begin during the 22nd month you receive these benefits—three months before you’re eligible for coverage.

Can you have a Medicare Advantage plan with Part D?

Like Medicare Advantage and Medicare Supplement, Part D prescription drug coverage is provided by Medicare-approved private insurance companies. These plans accompany Original Medicare. Generally, you can’t have a standalone Part D plan if you have a Medicare Advantage plan.

Key Takeaways

The standard age for Medicare eligibility has been 65 for the entirety of the health insurance program, which debuted in 1965.

Medicare Eligibility Age Chart

Most older adults are familiar with Medicare and its eligibility age of 65. Medicare Part A and Medicare Part B are available based on age or, in some cases, health conditions, including:

Do I Automatically Get Medicare When I Turn 65?

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Is Medicare Free at Age 65?

While Medicare Part B has a standard monthly premium, 99 out of 100 people don’t have to pay a premium for Medicare Part A. Still, no part of Medicare can genuinely be called “free” because of associated costs you have to pay, like deductibles, coinsurance and copays.

Can You Get on Medicare at Age 62?

No, but while the standard age of eligibility remains 65, some call for lowering it. In a recent GoHealth survey, among respondents age 55 and older who weren’t on Medicare and had heard about proposals to lower the age of eligibility, 64% favored lowering the age.

Full Retirement Age by Year - What to Know

Full retirement age is the age you begin to receive full Social Security benefits. If you start to draw your Social Security benefits before reaching your full retirement age, the payment you receive will be less.

What is dual eligible for Medicare?

Eligibility for the Medicare Savings Programs, through which Medicaid pays Medicare premiums, deductibles, and/or coinsurance costs for beneficiaries eligible for both programs (often referred to as dual eligibles) is determined using SSI methodologies..

How long does medicaid last?

Benefits also may be covered retroactively for up to three months prior to the month of application, if the individual would have been eligible during that period had he or she applied. Coverage generally stops at the end of the month in which a person no longer meets the requirements for eligibility.

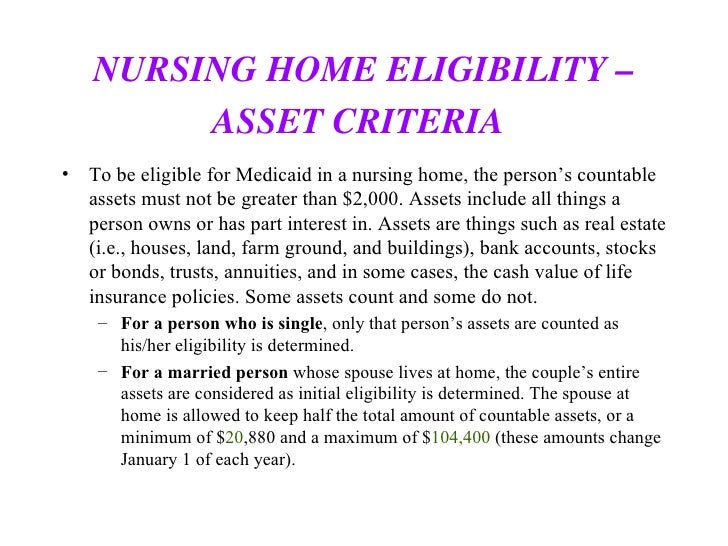

What is Medicaid Spousal Impoverishment?

Spousal Impoverishment : Protects the spouse of a Medicaid applicant or beneficiary who needs coverage for long-term services and supports (LTSS), in either an institution or a home or other community-based setting, from becoming impoverished in order for the spouse in need of LTSS to attain Medicaid coverage for such services.

What is MAGI for Medicaid?

MAGI is the basis for determining Medicaid income eligibility for most children, pregnant women, parents, and adults. The MAGI-based methodology considers taxable income and tax filing relationships to determine financial eligibility for Medicaid. MAGI replaced the former process for calculating Medicaid eligibility, ...

What is Medicaid coverage?

Medicaid is the single largest source of health coverage in the United States. To participate in Medicaid, federal law requires states to cover certain groups of individuals. Low-income families, qualified pregnant women and children, and individuals receiving Supplemental Security Income (SSI) are examples of mandatory eligibility groups (PDF, ...

How many people are covered by medicaid?

Medicaid is a joint federal and state program that, together with the Children’s Health Insurance Program (CHIP), provides health coverage to over 72.5 million Americans, including children, pregnant women, parents, seniors, and individuals with disabilities. Medicaid is the single largest source of health coverage in the United States.

Does Medicaid require income?

Certain Medicaid eligibility groups do not require a determination of income by the Medicaid agency. This coverage may be based on enrollment in another program, such as SSI or the breast and cervical cancer treatment and prevention program.