- Check your Medicare enrollment online. You can quickly find out what Medicare coverage you have (Part A hospital insurance and/or Part B medical insurance) by checking your enrollment status online.

- Review your Medicare plan coverage options. It’s a good idea to review your Medicare coverage every year to make sure the benefits of your Medicare plan remain aligned with your ...

- Make changes to your Medicare plan coverage during the right time of year. ...

- Find out what Medicare plan may fit your needs. Did you know that you could potentially find a Medicare Advantage plan with $0 premiums, $0 deductibles and an annual out-of-pocket ...

What is Medicare best coverage?

Medicare coverage under Part B helps pay for medical and outpatient services. Common health care services that Medicare covers may include: Medically necessary services you receive from a doctor or other licensed health professional. This includes some preventive care services, such as annual wellness exams, flu shots, and screens to help ...

What is Medicare, and what does it cover?

The different parts of Medicare help cover specific services: Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Medicare Part D (prescription drug coverage)

What to know about Medicare health insurance coverage?

- Seniors eligible for Medicare can choose between Original Medicare or Medicare Advantage.

- People with Original Medicare can also add Part D prescription drug benefits. ...

- Medicare Advantage is offered by private health insurance companies and often includes supplemental benefits not found in Original Medicare.

How easy is it to understand Medicare?

- Do give yourself time to bone up about Medicare. ...

- Don’t expect to be notified when it’s time to sign up. ...

- Do enroll when you’re supposed to. ...

- Don’t despair if you haven’t “worked long enough” to qualify. ...

- Do remember that Medicare isn’t free. ...

- Don’t assume that Medicare covers everything. ...

- Don’t expect Medicare to cover your dependents. ...

How do you know what Medicare coverage you have?

For general information on what Medicare covers, visit Medicare.gov, or call 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048.

What are the four types of coverage in Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Do I have Medicare Part A or B?

How do I know if I have Part A or Part B? If you're not sure if you have Part A or Part B, look on your red, white, and blue Medicare card. If you have Part A, “Hospital (Part A)” is printed on the lower left corner of your card. If you have Part B, “Medical (Part B)” is printed on the lower left corner of your card.

Does Medicare Part B cover 100 percent?

Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What is covered by Medicare Part C?

Medicare Part C outpatient coveragedoctor's appointments, including specialists.emergency ambulance transportation.durable medical equipment like wheelchairs and home oxygen equipment.emergency room care.laboratory testing, such as blood tests and urinalysis.occupational, physical, and speech therapy.More items...

What is Medicare Part C called?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

Do you have to enroll in Medicare Part B every year?

Do You Need to Renew Medicare Part B every year? As long as you pay the Medicare Part B medical insurance premiums, you'll continue to have the coverage. The premium is subtracted monthly from most people's Social Security payments. If you don't get Social Security, you'll get a bill.

What is the 3 day rule for Medicare?

The 3-day rule requires the patient have a medically necessary 3-consecutive-day inpatient hospital stay. The 3-consecutive-day count doesn't include the discharge day or pre-admission time spent in the Emergency Room (ER) or outpatient observation.

Which service is not covered by Part B Medicare?

But there are still some services that Part B does not pay for. If you're enrolled in the original Medicare program, these gaps in coverage include: Routine services for vision, hearing and dental care — for example, checkups, eyeglasses, hearing aids, dental extractions and dentures.

Is it necessary to have supplemental insurance with Medicare?

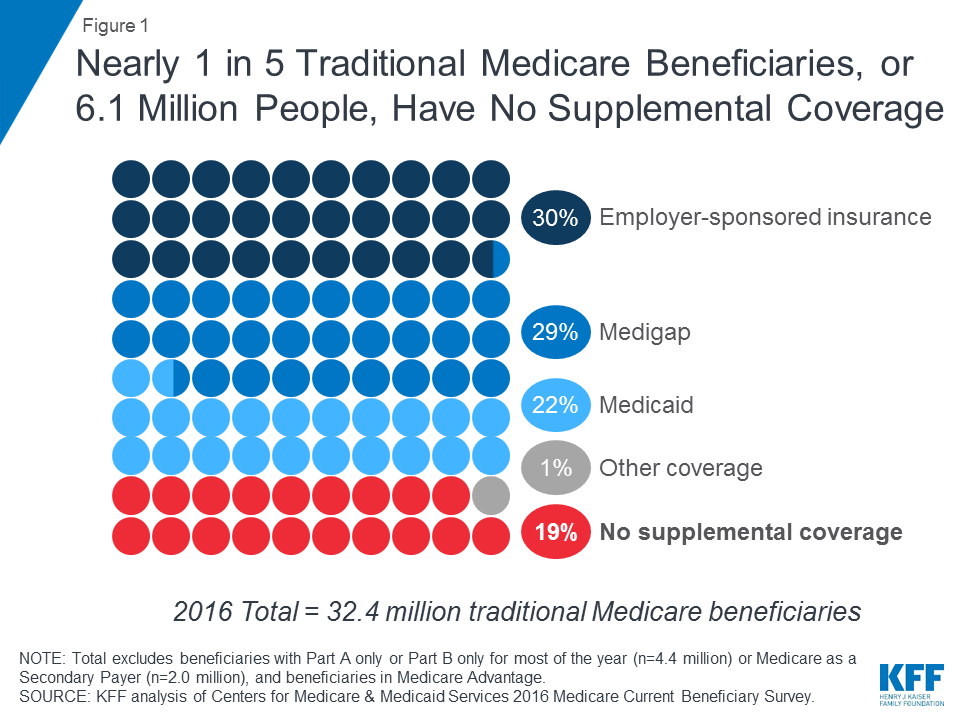

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What is Medicare ID?

The Medicare ID card indicates whether one has Medicare Advantage or Original Medicare. Medicare tracks every participant by the name of the plan used, enrollment status, type of coverage, and the coverage start date. The date of birth and start date of coverage are key facts in identification in the Medicare system.

What is original Medicare?

Original Medicare is government-run medical care and insurance coverage. It uses a fixed price for services a type of managed care. Members have freedom to choose any doctor or hospital in the network. They do not need referrals or special permissions for the majority of available services.

What is FFFS in Medicare?

FFFS is the fixed-fee-for-services type of Medicare Advantage plan. This type of managed care offers a wide network and freedom of choice for the consumer.

What is dual eligibility for medicaid?

Dual Eligibility opens a path for Medicare savings programs such as the QMB for the benefit of low-income Medicare members. Medicaid pays expenses, premiums, and costs consistent with their budgets. The goal is to get the most favorable situation for a low-income person getting health benefits through Medicare.

What is the difference between Medicare Advantage and Original Medicare?

Original Medicare is an open arrangement.Users can go to any doctor or medical care provider that accepts Medicare. Medicare Advantage plans also provide comprehensive coverage but achieves it in different ways. They have management styles that can help patients, for example, some provide a primary care doctor.

How much is Medicare deductible for 2020?

Original Medicare has an annual deductible that in the calendar year 2020 was set at $1,408 for Part A and $198 for Part B. Each Medicare Advantage plan has its list of consumer paid expenses. They include deductibles, copays, coinsurance, and cost-sharing.

Can Medicare Advantage be used for all in one?

Advantage plans can cost less than Medicare Part B and add prescription drug benefits for an all-in-one combination. Users can go to any doctor or medical care provider that accepts Medicare. Medicare Advantage plans also provide comprehensive coverage but achieves it in different ways.

What is a coverage determination?

A coverage determination is the decision process used to receive access to medications or medical procedures that may not usually covered by Medicare.

What is the process of filing for a medical coverage determination?

The process of filing for a coverage determination usually involves filling out some forms and allowing your physician or specialist to review them.

Why is Medicare denial of coverage?

One of the most common reasons for denial of a coverage determination is if alternative treatment options exist. If they do, especially if they are covered by Medicare, you will almost always have to try these methods before your coverage determination request will be considered.

What happens if you get denied coverage?

If a request is denied in part, you may only receive coverage for some of the items in your request. If your request is denied and you are also denied on appeal, you will be left with few options to have your case heard again.

Is cosmetic surgery covered by Medicare?

For example, while things like cosmetic surgery are not covered by original Medicare, a surgical procedure that is usually considered cosmetic may be eligible for coverage after a coverage determination finds that the procedure is required for sustained health.

Does Medicare cover prescription drugs?

Medicare recipients often wonder if a specific prescription drug is covered or if a particular medical procedure will be paid for by their Medicare plans. In order to get these answers, you can simply review your plan’s formulary for prescription medications or review the coverage options under Medicare Part A and Part B.

What happens if you don't sign up for Medicare?

If you don’t sign up within seven months of turning 65 (three months before your 65 th birthday, your birthday month, and three months after), you will pay a 10% penalty for every year you delay. Enroll in a Medicare Advantage plan, which is a privately-run health plan approved by the government to provide Medicare benefits.

Does Part D cover prescriptions?

It will help cover the cost of your prescription medications. Similar to Part B, there is a financial penalty if you do not sign up for a Part D plan when you are first eligible, unless you have other prescription drug coverage.

How much will Medicare premiums be in 2021?

There are six income tiers for Medicare premiums in 2021. As stated earlier, the standard Part B premium amount that most people are expected to pay is $148.50 month. But, if your MAGI exceeds an income bracket — even by just $1 — you are moved to the next tier and will have to pay the higher premium.

What is Medicare Advantage?

Essentially: Medicare Advantage – Private plans that replace your Parts A, B, and in most cases, D. Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A.

Why did Medicare Part B premiums increase in 2021?

That’s because 2021 Medicare Part B premiums increased across the board due to rising healthcare costs. Exactly how much your premiums increased though, isn’t based on your current health or Medicare plan or your income. Rather, it’s the soaring prices of overall healthcare.

How much of Medicare Part B is paid?

But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income. If your income level exceeds a certain threshold, you will have to pay more.

Why are Social Security beneficiaries paying less than the full amount?

In 2016, 2017, and 2018, the Social Security COLA amount for most beneficiaries wasn’t enough to cover the full cost of the Part B premium increases, so most enrollees were paying less than the full amount, because they were protected by the hold harmless rule.

Is Medicare Part D tax deductible?

Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A. However, you are charged monthly premiums for Part B and Part D, and can also be charged for Part C, depending on the plan you select. These premiums are tax-deductible but very few ...

Does Medicare Part B get deducted from Social Security?

Medicare Part B premiums are deducted from Social Security checks, and Social Security benefit amounts are adjusted annually by the cost-of-living adjustment (COLA).

What is an annual review of Medicare?

An annual review of your Medicare coverage can help you determine if your plan combination is right for your needs. For example, if you’re spending a considerable amount of money on prescription drugs, a Medicare Part D plan or a Medicare Advantage plan with prescription drug coverage may be something to consider.

What are the benefits of Medicare Advantage?

Most Medicare Advantage plans offer additional benefits not covered by Original Medicare, such as dental, vision and prescription drug coverage. Medicare Part D provides coverage for prescription medications, which is something not typically covered by Original Medicare.

How long does Medicare AEP last?

The Medicare AEP lasts from October 15 to December 7 every year. During this time, Medicare beneficiaries may do any of the following: Change from Original Medicare to a Medicare Advantage plan. Change from Medicare Advantage back to Original Medicare. Switch from one Medicare Advantage plan to another.

What is Medicare Part B?

Medicare Part B is medical insurance and provides coverage for outpatient appointments and durable medical equipment. Part B is optional, but is required for anyone wanting to enroll in Medicare Part C, Part D or Medicare Supplement Insurance. Part A and Part B are known together as “Original ...

Is Medicare Part A and Part B the same?

Part A and Part B are known together as “Original Medicare.”. Medicare Part C, also known as Medicare Advantage, provides all the same benefits as Medicare Part A and Part B combined into a single plan sold by a private insurance company.

What is Medicare.gov?

Medicare is the agency that runs Medicare. It has many regional contractors that support the systems for payments, processing claims, and durable medical equipment. It oversees the performance of private insurance providers that sell Medicare Advantage, Medigap, and Prescription Drug plans. Medicare.gov is the ideal place to find ...

What is Medicare and Social Security?

Medicare and Social Security provide tools for determining eligibility and benefits. Medicare is the national health care program for older Americans. The start date for Medicare coverage is important; many other features depend on the date of enrollment. Medicare has four parts that cover hospital insurance, medical insurance, ...

What is comparison shopping in Medicare?

Comparison shopping is the ideal tool for making selections of private health, prescription drug, and gap insurance plans.

How long does it take to get Medicare referrals?

Recipients under age 65 get an automatic referral for Medicare after 24 months of payments. Persons with end-stage renal disease or ALS get automatic eligibility when diagnosed.

How old do you have to be to get Medicare?

Medicare has four parts that cover hospital insurance, medical insurance, private all-in-one plans, and prescription drug benefits. Everyone age 65 or older can get Medicare. Disabled persons can get it while under age 65. Those who paid FICA taxes for ten years can get premium-free Medicare.

What is the Social Security Administration?

These dates determine rights later in the process. The Social Security Administration is a partner agency with the Centers for Medicare and Medicaid. It promotes Medicare and has an important portal for providing information on eligibility. You can find out if you’re eligible in a matter of minutes.

How long is the initial enrollment period for Medicare?

The Initial Enrollment Period is the seven-month period that includes the month of the 65th birthday. The period runs from three months before the birthday month, and for three months afterward . This is the ideal time to review options and make choices for Medicare coverage.

What percentage of Medicare beneficiaries are excluded from coverage?

For purpose of this exclusion, "the term 'usually' means more than 50 percent of the time for all Medicare beneficiaries who use the drug. Therefore, if a drug is self-administered by more than 50 percent of Medicare beneficiaries, the drug is excluded from coverage" and the MAC will make no payment for the drug.

What are some examples of Medicare coverage documents?

Examples include guidance documents, compendia, and solicitations of public comments. Close.

What is MEDCAC in medical?

The MEDCAC reviews and evaluates medical literature, reviews technology assessments, public testimony and examines data and information on the benefits, harms, and appropriateness of medical items and services that are covered under Medicare or that may be eligible for coverage under Medicare.

What is a local coverage determination?

A Local Coverage Determination (LCD) is a decision made by a Medicare Administrative Contractor (MAC) on whether a particular service or item is reasonable and necessary, and therefore covered by Medicare within the specific jurisdiction that the MAC oversees. MACs are Medicare contractors that develop LCDs and process Medicare claims.

What is local coverage article?

Local coverage Articles are a type of educational document published by the Medicare Administrative Contractors (MACs). Articles often contain coding or other guidelines that complement a Local Coverage Determination (LCD). MACs are Medicare contractors that develop LCDs and Articles along with processing of Medicare claims.

Why are CPT codes not included in CPT codes?

They are used to identify various items and services that are not included in the CPT code set because they are medical items or services that are regularly billed by suppliers other than physicians. For example, ambulance services, hearing and vision services, drugs, and durable medical equipment.

What is a LCD in Medicare?

LCDs are specific to an item or service (procedure) and they define the specific diagnosis (illness or injury) for which the item or service is covered. LCDs outline how the contractor will review claims to ensure that the services provided meet Medicare coverage requirements.