Ways to sign up: Online (at Social Security) – It’s the easiest and fastest way to sign up and get any financial help you may need. (You’ll need to create your secure my Social Security account to sign up for Medicare or apply for benefits.) Call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778.

Full Answer

When does open enrollment start for Medicare?

Jan 01, 2022 · About 2 weeks after you sign up, we’ll mail you a welcome package with your Medicare card. Know when to sign up for Part B. You can only sign up for Part B at certain times. If you don’t sign up for Part B when you turn 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

What do you need to know about Medicare open enrollment?

Apr 08, 2022 · You can enroll in Medicare during your Initial Enrollment Period (IEP). This is a 7-month window that spans the three months before the month of your 65th birthday and extends to the three months after the month you turn 65. During the Initial Enrollment Period, you can enroll in: A Medicare Supplement Insurance Plan

Does open enrollment only apply to Medicare?

Apr 01, 2022 · During the Medicare open enrollment period, you can: Switch from Original Medicare to Medicare Advantage (as long as you’re enrolled in both Medicare Part A and Part B, and you live in the Medicare Advantage plan’s service area). Switch from Medicare Advantage to Original Medicare (plus a Medicare Part D plan, and possibly a Medigap plan ).

How we can help with Medicare open enrollment?

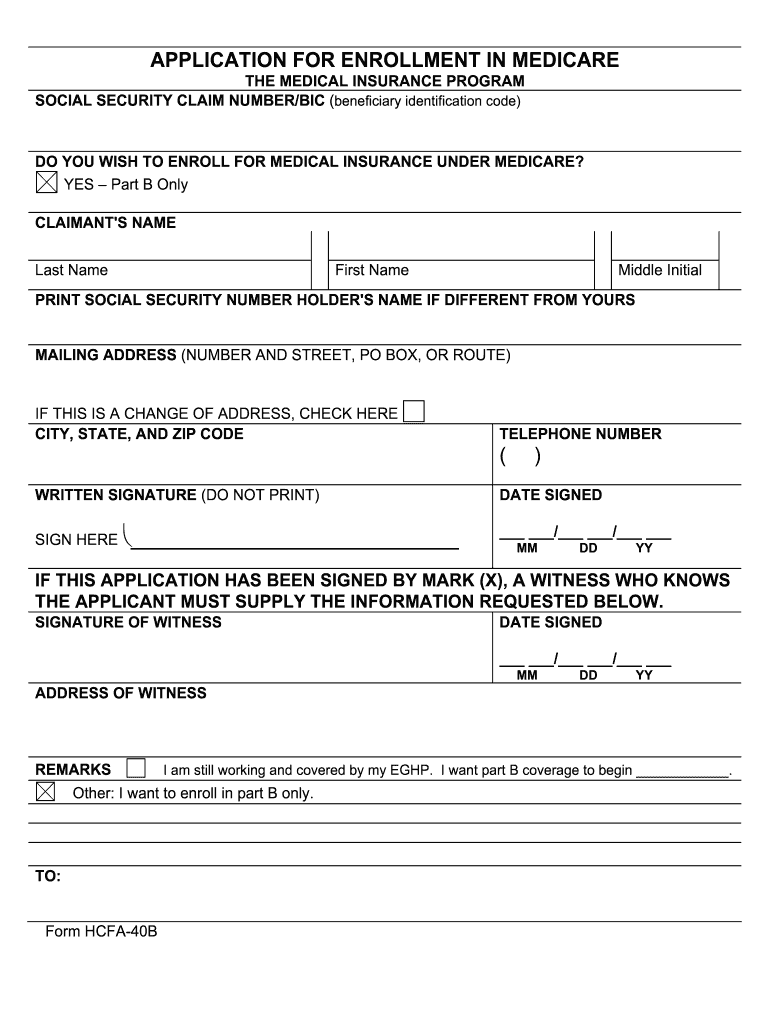

How do I enroll in Medicare? Administration at 1-800-772-1213 to enroll in Medicare or to ask questions about whether you are eligible. You can also visit their web site at www.socialsecurity.gov. The Medicare.gov Web site also has a tool to help you determine if you are eligibile for Medicare and when you can enroll.

What is Medicare open enrollment?

When you first become eligible for Medicare, you can join a plan. Open Enrollment Period. From October 15 – December 7 each year, you can join, switch, or drop a plan. Your coverage will begin on January 1 (as long as the plan gets your request by December 7).

What is the difference between OEP and AEP?

AEP stands for Medicare Annual Enrollment Period and OEP stands for Medicare Open Enrollment Period. Depending on the context, OEP can refer to many other Medicare enrollment windows.Oct 5, 2021

Is Medicare open enrollment only once a year?

The Medicare Open Enrollment Period is also known as the Annual Election Period (AEP) for Medicare health and prescription drug plans. It's also called the Fall Open Enrollment Period. This time period happens only once a year.Jul 6, 2021

Can you switch to Medicare at any time?

Can I make that change during the Medicare Open Enrollment period? Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year.

What does Sep stand for in Medicare?

Special Enrollment PeriodsYou can make changes to your Medicare Advantage and Medicare prescription drug coverage when certain events happen in your life, like if you move or you lose other insurance coverage. These chances to make changes are called Special Enrollment Periods (SEPs).

How many times can you change plans during AEP?

You may only make one change during this enrollment period. Your changes will go into effect beginning the first month after your change request is received by the provider.

What happens if I miss Medicare open enrollment?

If you missed your Initial Enrollment Period (IEP) and need to enroll in Medicare, you likely will have to enroll during either a Special Enrollment Period (SEP) or the General Enrollment Period (GEP).

How long before you turn 65 do you apply for Medicare?

3 monthsGenerally, you're first eligible starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you don't sign up for Part B when you're first eligible, you might have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Can you drop Medicare Part B anytime?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.Nov 24, 2021

Which company has the best Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

When is Medicare open enrollment?

Medicare open enrollment – also known as Medicare’s annual election period – runs from October 15 through December 7 each year. (Although Medicare’...

What plan changes can I make during the Medicare open enrollment period?

During the Medicare open enrollment period, you can: Switch from Original Medicare to Medicare Advantage (as long as you’re enrolled in both Medica...

How do I enroll in Medicare Advantage?

To join a Medicare Advantage Plan, you will need to have Original Medicare (Part A and Part B) coverage and live in an area where an Advantage plan...

When can I enroll in Medicare Part D?

The first opportunity for Medicare Part D sign up is when you’re initially eligible for Medicare – during the seven-month period beginning three mo...

How do I enroll in a Medicare Supplement (Medigap) plan?

During your initial Medigap enrollment period (the six months starting with the month you’re at least 65 years old and enrolled in Medicare A and B...

When will Medicare open enrollment start in 2022?

Medicare open enrollment for 2022 coverage starts on October 15, 2021, and continues through December 7. Learn how you can change your Medicare coverage outside of the fall open enrollment period.

What is Medicare's general enrollment period?

Medicare’s general enrollment period is for people who didn’t sign up for Medicare Part B when they were first eligible, and who don’t have access to a Medicare Part B special enrollment period. It’s also for people who have to pay a premium for Medicare Part A and didn’t enroll in Part A when they were first eligible.

How much is coinsurance for skilled nursing in 2021?

After the first 20 days, your skilled nursing facility coinsurance in 2021 is $185.50 per day for days 21-100 (after that, Medicare no longer covers skilled nursing facility charges, so you’ll pay the full cost). Supplemental coverage, including Medigap plans, is designed to pay the Part A coinsurance on your behalf.

What is the Medicare Advantage Plan 2021?

$7,550 is the upper limit; the average Medicare Advantage plan tends to have an out-of-pocket cap below the maximum that the government allows.

How much is Medicare Part D in 2021?

The average premium for Medicare Part D coverage is about $38/month in 2021. There continue to be a wide range of Part D plan options available. Premiums for Part D plans start as low as about $7/month in 2021, down from a low of about $13/month in 2020.

When does Medicare coverage take effect?

If you enroll during the general enrollment period, your coverage will take effect July 1. Learn more about Medicare’s general enrollment period. Back to top.

Do you have to pay for Medicare if you turn 65?

Most Medicare beneficiaries receive Medicare Part A without a monthly premium, but some have to pay for it. And some beneficiaries have to pay more than the standard amount for their Medicare Part B and Part D coverage.

If you already receive benefits from Social Security

If you already get benefits from Social Security or the Railroad Retirement Board, you are automatically entitled to Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) starting the first day of the month you turn age 65. You will not need to do anything to enroll.

If you are not getting Social Security benefits

If you are not getting Social Security benefits, you can apply for retirement benefits online. If you would like to file for Medicare only, you can apply by calling 1-800-772-1213.

If you are under age 65 and disabled

If you are under age 65 and disabled, and have been entitled to disability benefits under Social Security or the Railroad Retirement Board for 24 months, you will be automatically entitled to Medicare Part A and Part B beginning the 25th month of disability benefit entitlement. You will not need to do anything to enroll in Medicare.

What is Medicare open enrollment?

Open enrollment is the health care user’s chance to evaluate the plan they have, take a look at what’s on the market and update their coverage for the coming year. Open enrollment is for consumers who already have Original Medicare or Medicare Advantage.

What you can do to change it

During open enrollment, you have the ability to change many things. These are the things you can do between Oct. 15 and Dec. 7.

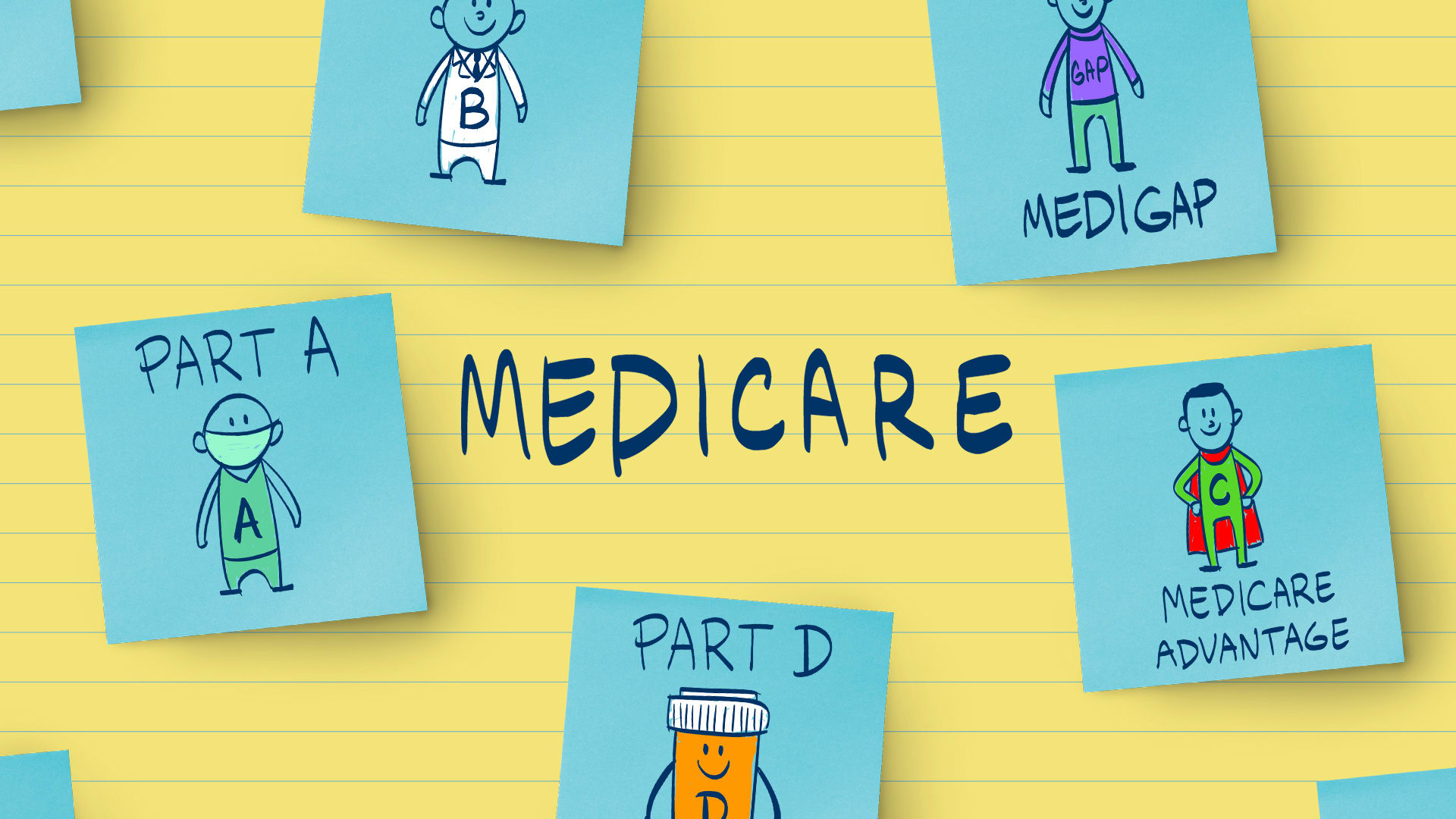

Comparison of Original Medicare and Medicare Advantage

Open enrollment is a time to switch to a Medicare Advantage plan if you are enrolled in Original Medicare Part A or Part B. Some people find purchasing a Medicare Advantage plan easier than others.

How to Compare Medicare Advantage Plans

Because there are so many options, choosing a Medicare Advantage plan can seem daunting. Gordon states that the average Medicare beneficiary has about two dozen options. Although it sounds great, Gordon says, “It can be overwhelming for consumers to have that many choices.”

How to change Medicare Advantage Plans

You can switch to another Medicare Advantage plan if you are already enrolled in one of the open enrollment periods: Oct. 15-Dec. 7, Jan. 1-March 31. Once you sign up for a new plan you will be automatically removed from your existing plan.

What is Medicare open enrollment?

What is Open Enrollment? The Medicare open enrollment period, also known as the annual election period, refers to a period each year during which people enrolled in Medicare plans re-evaluate and change their health insurance coverage plans. Whether you are in enrollment in the original Medicare supplement plans, or the Medicare Advantage plan, ...

How to change Medicare Advantage plan?

When the Open Enrollment period is ongoing, you as a beneficiary can perform the following things: 1 Make a change in the Medicare Advantage plans or switch from the Medicare Advantage plans to the original Medicare plan and vice versa. 2 Sign up for the Medicare Part D prescription drug plan. Private insurance companies provide the Medicare Part D prescription drug plan (MAPD) because Medicare A and B do not cover outpatient prescriptions. 3 Make a switch from one Part D plan to another. There are two general options for the Medicare Part D plan. You can choose either the Medicare part D prescription drug program (PDP) through a private carrier, thereby supplementing the original Medicare. Alternatively, you can enroll in the prescription drug coverage as part of a Medicare advantage plan. 4 Drop the Medicare Part D coverage in its entirety and return to the original Medicare plan.

What is a Medigap plan?

Medigap plans is Medicare supplement insurance purchased by Medicare beneficiaries to cover expenses such as co-payments, co-insurances and deductibles. Medigap is enrolled for when beneficiaries learn that the original Medicare plan may not cover all of their expenses.

Does Medicare Part D cover outpatient prescriptions?

Private insurance companies provide the Medicare Part D prescription drug plan (MAPD) because Medicare A and B do not cover outpatient prescriptions. Make a switch from one Part D plan to another. There are two general options for the Medicare Part D plan.

How does connecting to the best plan providers in your ZIP work?

By connecting you to the best plan providers in your ZIP, you will get access to every information available about the plans you intend to switch. It allows you to make the best decision about your healthcare.

Can you change your Medicare plan during open enrollment?

Whether you are in enrollment in the original Medicare supplement plans, or the Medicare Advantage plan, you are allowed to make changes during the healthcare open registration.

What is open enrollment in Medicare?

What is Medicare open enrollment? Open enrollment is the health care user’s chance to evaluate the plan they have, take a look at what’s on the market and update their coverage for the coming year. Open enrollment is for consumers who already have Original Medicare or Medicare Advantage.

What is Medicare Advantage?

Medicare Advantage Plans usually offer coverage for things that aren’t included under Original Medicare, such as dental, vision, hearing and wellness programs. With a Medicare Advantage Plan, you must use health care providers that are in the plan’s network, and you may need a referral to see a specialist.

What are the different types of Medicare Advantage plans?

There are five different types of Medicare Advantage Plans: 1 Health Maintenance Organization, or HMO, plans: This kind of plan requires you to see an in-network provider unless it’s an emergency situation. Most require you to get a referral to see a specialist. 2 Preferred Provider Organization, or PPO, plans: This kind of plan allows you to see both in-network and out-of-network health care providers, although it typically is more expensive to go out of network. 3 Private Fee-for-Service, or PFFS, plans: This kind of plan allows you to see any Medicare-approved health care provider as long as they accept the plan’s payment terms and agree to see you, and you may also have access to a network of providers. You can see doctors that don’t accept the plan’s payment terms, but you might pay more. 4 Special Needs Plans, or SNPs: This kind of plan provides benefits to people with certain diseases, such as cancer, or health care needs, such as living in a nursing home. It also provides benefits to people with a limited income. 5 Medical Savings Account, or MSA, plans: These combine a high-deductible insurance plan with a medical savings account that can be used for health care costs.

Does Medicare have a limit on out of pocket expenses?

Under Original Medicare, there is no limit on your out-of-pocket costs each year. With a Medicare Advantage Plan, once you spend a certain amount, the plan will cover 100% of the costs for the rest of the year.

What is MSA insurance?

Medical Savings Account, or MSA, plans: These combine a high-deductible insurance plan with a medical savings account that can be used for health care costs. Choosing between Medicare Advantage Plans will require you to understand your health care needs and think about what each type of plan offers.

What is a special needs plan?

Special Needs Plans, or SNPs: This kind of plan provides benefits to people with certain diseases, such as cancer, or health care needs, such as living in a nursing home. It also provides benefits to people with a limited income.

Is Medicare Part A or B?

Comparing Original Medicare and Medicare Advantage. If you have an Original Medicare plan — you’re enrolled in Medicare Part A and Medicare Part B — open enrollment is the time when you might consider switching to a Medicare Advantage Plan. For some people, purchasing a Medicare Advantage Plan feels simpler.