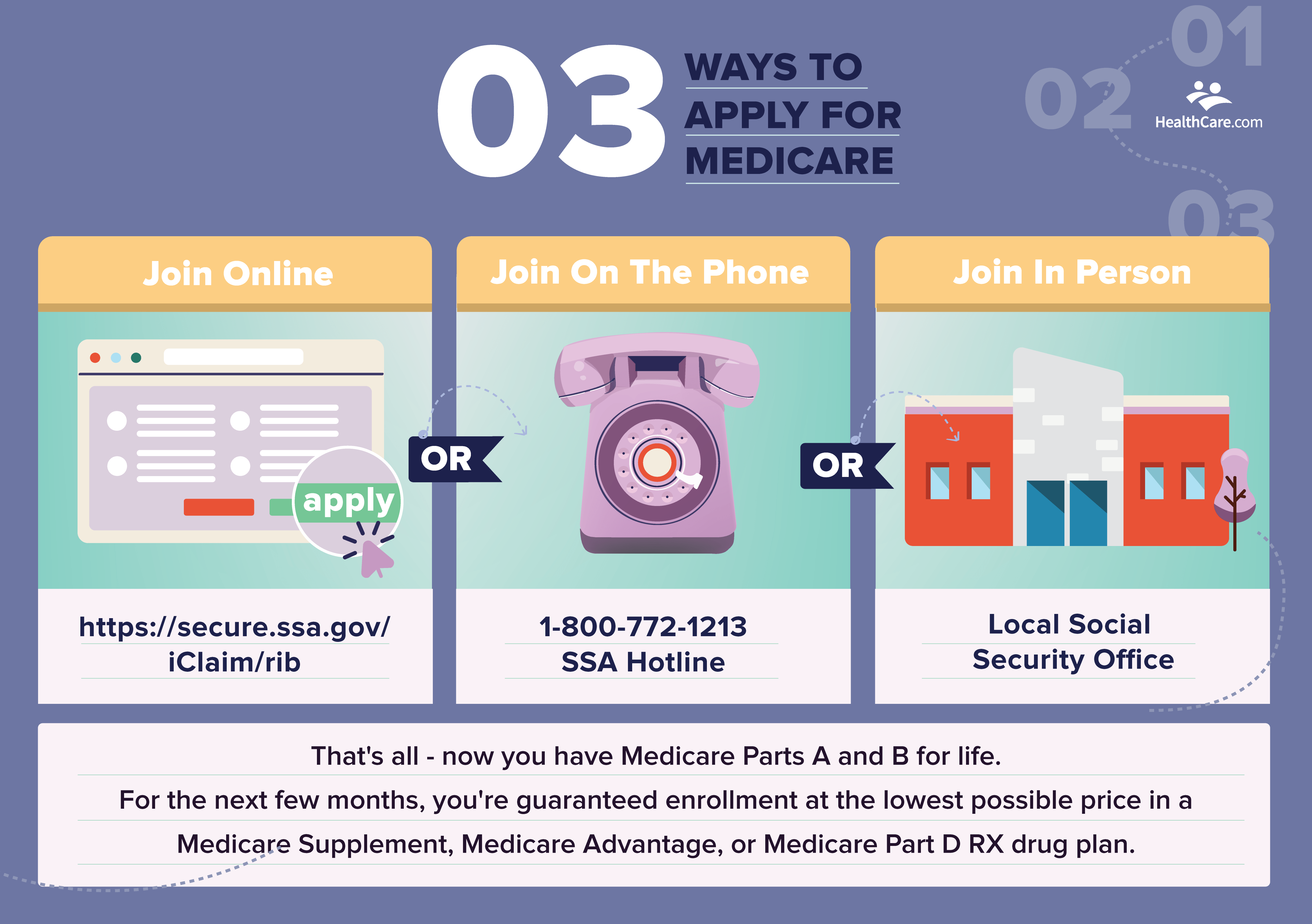

How to enroll in a Medicare Advantage plan. Apply online on the Social Security website. Visit your local Social Security office. Call Social Security at 1-800-772-1213 (TTY: 1-800-325-0778) If you worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772. Complete an Application ...

- Use Medicare's Plan Finder.

- Visit the plan's website to see if you can join online.

- Fill out a paper enrollment form. Contact the plan to get an enrollment form, fill it out, and return it to the plan. ...

- Call the plan you want to join. ...

- Call us at 1-800-MEDICARE (1-800-633-4227).

Who qualifies for a Medicare Advantage plan?

- All-Dual

- Full-Benefit

- Medicare Zero Cost Sharing

- Dual Eligible Subset

- Dual Eligible Subset Medicare Zero Cost Sharing Who is eligible for a DSNP? ...

- You must be a United States citizen or have been a legal resident for at least five years.

- You must be 65 years old or have a qualifying disability if younger than 65.

How do I choose the best Medicare Advantage plan?

- Do your important physicians participate in any Medicare Advantage plans or do they only accept Original Medicare?

- What insurance is accepted by your preferred hospitals?

- Do you travel out of the area frequently? ...

- What is your risk tolerance? ...

- How about peace of mind? ...

Can anyone join a Medicare Advantage plan?

Usually, anyone who has Medicare Part A and Medicare Part B coverage can join a Medicare Advantage plan ( MA or MAPD) if the person lives within the plan's service area (Zip Code area).

How to sign up for a Medicare Advantage plan?

- Your job-based insurance pays first, and Medicare pays second.

- If you don’t have to pay a premium for Part A, you can choose to sign up when you turn 65 (or anytime later).

- You can wait until you stop working (or lose your health insurance, if that happens first) to sign up for Part B, and you won’t pay a late enrollment penalty.

Can you have both original Medicare and a Medicare Advantage plan?

If you're in a Medicare Advantage Plan (with or without drug coverage), you can switch to another Medicare Advantage Plan (with or without drug coverage). You can drop your Medicare Advantage Plan and return to Original Medicare. You'll also be able to join a Medicare drug plan.

Can you switch from original Medicare to Medicare Advantage?

You can switch from original Medicare to Medicare Advantage during one of the Medicare open enrollment periods. Medicare Advantage plans offer a popular substitute for Original Medicare (Parts A and B).

When can I add an advantage plan to my Medicare?

Sign up for a Medicare Advantage Plan (with or without drug coverage) or a Medicare drug plan. During the 7‑month period that starts 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65.

Are you automatically enrolled in Medicare Advantage?

En español | When you first sign up for Medicare, the Social Security Administration (which handles Medicare enrollment) automatically enrolls you in the original Medicare program.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

Do Medicare Advantage plans cover pre existing conditions?

Medicare defines a pre-existing condition as any health problem that you had prior to the coverage start date for a new insurance plan. If you have Original Medicare or a Medicare Advantage plan, you are generally covered for all Medicare benefits even if you have a pre-existing condition.

Do you need Medicare Part B if you have a Medicare Advantage plan?

Many Medicare Advantage plans offer extra benefits not available from Original Medicare. Therefore, to enroll in a Medicare Advantage plan, you must be enrolled in both Medicare Part A and Part B.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...

What are 4 types of Medicare Advantage plans?

Below are the most common types of Medicare Advantage Plans.Health Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

How do I sign up for Medicare Part A?

If you need to sign up for Medicare Part A and Part B, you can do so in one of four ways: Apply online on the Social Security website. Visit your local Social Security office. Call Social Security at 1-800-772-1213 (TTY: 1-800-325-0778) If you worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

When does Medicare open enrollment end?

- Sign up for a Medicare Advantage plan. Fall Medicare Open Enrollment Period for Medicare Advantage plans (aka Annual Enrollment Period, or AEP) Starts October 15. Ends December 7. - Sign up for a Medicare Advantage plan.

How long do you have to be on Medicare before you can get a disability?

If you become eligible for Medicare before 65 due to a qualifying disability, you may be able to enroll in a Medicare Advantage plan after you have been getting Social Security or Railroad Retirement Board benefits for 21 full months. After that point, you have 7 full months to enroll in a Medicare Advantage Plan.

How long do you have to be on Medicare Advantage?

After that point, you have 7 full months to enroll in a Medicare Advantage Plan. Your coverage will begin on your 25th month of receiving disability benefits. If you have Amyotrophic Lateral Sclerosis (ALS), you are eligible for Medicare the first month you receive your disability benefits.

How many types of Medicare Advantage Plans are there?

The availability of Medicare Advantage plans in your area will vary and is subject to how many insurance companies offer plans where you live. There are five primary types of Medicare Advantage plans that are the most prevalent, and the availability of each type of plan will also vary based on your location.

What are the factors that affect Medicare Advantage?

Several factors can affect your Medicare Advantage plan costs, such as: Whether your plan offers $0 monthly premiums. The drug deductible included in your plan, if your plan offers prescription drug coverage. Any network restrictions your plan may include regarding approved providers who are in your plan network.

What are the benefits of Medicare Advantage?

Some of the potential benefits offered by a Medicare Advantage plan can include coverage for: Dental care. Vision care.

How long does it take to get Medicare Advantage?

This is the period that begins three months before your birth month and ends three months after it. While there is no cost penalty for signing up at any time during this period, it is highly desirable to sign up as early in the period as possible. This is because any plan with a Part D component takes approximately three months to kick in, which means you could see a temporary gap in your drug coverage if you sign up any time after your birthday. This gap could last as long as three months after the time you lose the coverage you had before switching to Medicare, so it’s helpful to start your research before the ICEP and get the forms submitted prior to the first day of the month you turn 65.

What is Medicare Part A?

Medicare Part A is the basic coverage Medicare provides for its beneficiaries. This is a no-cost plan that covers the cost of inpatient hospitalization for eligible seniors. All U.S. citizens are automatically enrolled in Part A when they become eligible, since there is no out-of-pocket cost or monthly premium for this coverage. Services covered under Part A generally revolve around admissions to the hospital and treatments provided as part of regular inpatient care. Providers bill the Original Medicare program directly, which then pays for services according to a fixed or negotiated schedule. All Medicare-qualified providers are part of the Part A network, and they are required to bill only Medicare for covered services, unless the patient has a Medicare Advantage plan that provides the same coverage.

Is Medicare Supplement Part C?

Medicare supplements are not strictly part of the Medicare system, but they are a consequence of it. Whether you have Original Medicare or Medicare Advantage, there could easily be some gaps in coverage that leave certain services out. Many seniors also face high copayments and extra out-of-pocket expenses for services not covered by their Part C plan. Medicare supplement plans plug these gaps with various coverage options. These are highly variable, and each plan has to be discussed with an insurance agent to make sure the coverage is adequate for your situation.

Can you enroll in Medicare Advantage outside of the normal enrollment period?

Sometimes circumstances force beneficiaries to enroll in Medicare Advantage outside of the normal enrollment periods. This can be tricky to do without incurring a penalty rate, but there are special circumstances you can invoke to justify an out-of-period enrollment. Examples of special circumstances include:

What is Medicare Advantage?

Medicare Advantage is an alternative to Original Medicare. Medicare Advantage plans are offered by private insurance companies that contract with Medicare to provide your Part A and Part B benefits. Medicare Advantage plans can include: Health Maintenance Organization (HMO)

How long does Medicare enrollment last?

Initial Enrollment Period When you are enrolling in Medicare for the first time, you will have a seven-month Initial Enrollment Period. The Initial Enrollment Period starts three months before your 65 th birthday, includes the month you turn 65, and ends three months after you turn 65.

How much does Medicare pay for a service?

Medicare pays a share of the Medicare-approved amount of a service or supply, and you pay your share (generally 20%) in deductibles or coinsurance. While Original Medicare does help cover many costs, many Medicare beneficiaries find the out-of-pocket expenses overwhelming.

How much is Medicare out of pocket?

If you have Original Medicare, you will likely be responsible for 20% of Medicare approved services and supplies. There is no limit to your out-of-pocket expenses. Medicare Advantage plans, on the other hand, will have an annual maximum out-of-pocket limit.

When does the annual election period end for Medicare?

The Annual Election Period (AEP) starts October 15 and ends December 7.

When was Medicare Part C introduced?

Many things have changed since Medicare Part C was formally introduced by legislation in 1997. Medicare Advantage plans have evolved and with one third of all Medicare recipients enrolled in Part C, it is important for individuals approaching Medicare eligibility, or those who are reconsidering their coverage during the Annual Election Period ...

Is Medicare Advantage all in one?

All-in-One. Many Medicare Advantage enrollees appreciate the all-in-one package of healthcare coverage, instead of managing separate plans, identification cards, and carriers. Medicare Advantage plans may also be more cost-effective than a combination of Original Medicare, Medigap, PDP, and other ancillary insurance.

Determine Eligibility

Generally speaking, you are eligible for Medicare if you're age 65 or older. People under age 65 who have certain disabilities, as well as those who have End Stage Renal Disease, are also eligible. You can use The Offical U.S. Government Site for Medicare online in order to determine your eligibility.

Enroll During Open Enrollment

You must enroll in Medicare Advantage during open enrollment, which is October 15 through December 7. During this period, you can choose your first Medicare or Medicare Advantage program, or switch from original Medicare to Medicare Advantage. You can also switch from Medicare Advantage back to original Medicare.

Find the Right Plan

While about a third of people eligible for Medicare choose a Medicare Advantage plan, Medicare Advantage is not right for everyone. It's important to carefully review plan documents. Make sure that you understand each of the different types of Medicare Advantage plans, which are:

What is a Medigap plan?

These plans, also known as “ Medigap ,” provide coverage for some of Medicare’s out-of-pocket costs, such as deductibles, coinsurance and copayments. Some Medigap plans even include annual out-of-pocket spending limits. Sign up for a Medicare Advantage plan.

How much can you save if you don't accept Medicare?

If you are enrolled in Original Medicare, avoiding health care providers who do not accept Medicare assignment can help you save up to 15 percent on excess charges. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

How much coinsurance is required for hospice?

A 5 percent coinsurance payment is also required for inpatient respite care. For durable medical equipment used for home health care, a 20 percent coinsurance payment is required.

How much is Medicare Part B?

Part B. The standard Medicare Part B premium is $148.50 per month. However, the Part B premium is based on your reported taxable income from two years prior. The table below shows what Part B beneficiaries will pay for their premiums in 2021, based off their 2019 reported income. Medicare Part B IRMAA.

What is Medicare Part D based on?

Part D premiums also come with an income-based tier system that uses your reported income from two years prior, similar to how Medicare Part B premiums are calculated. Part D premiums for 2021 will be based on reported taxable income from 2019, and the breakdown is as follows: Medicare Part D IRMAA. 2019 Individual tax return.

Do you have to pay coinsurance on Medicare?

Medicare coinsurance and copayments. Once you meet your deductible, you may have to pay coinsurance or copayments when you receive care. A coinsurance is a percentage of the total bill, while a copayment is a flat fee.

Does Medicare Advantage have a deductible?

Plans that offer prescription drug coverage may have a separate deductible for drug coverage and another deductible for the plan’s other benefits. Not all Medicare Advantage plans include a deductible.