Enroll in a Medicare plan online, by phone, by mail or in person at a Blue Cross center. See and compare Medicare plans available in your area using our shopping tool. Find a Plan Consult an agent A licensed, authorized, independent Blue Cross agent can help you enroll. Be sure to ask if he or she is certified to sell Medicare products.

Full Answer

How do I enroll in Medicare?

You enroll through the Social Security office. Medicare Advantage plans are the all-in-one option. Private companies like the Blue Cross contract with the federal government to provide all the Original Medicare benefits and sometimes more health coverage on top of that.

Does Blue Cross and blue shield offer Medicare coverage?

As you explore Medicare coverage from Blue Cross and Blue Shield companies, it’s important to first understand all your Medicare plan options.

What are my options if I'm Already a blue cross member?

If you're already a Blue Cross member, you're familiar with our company. We have several options, including Medicare Advantage plans that offer the same benefits as your previous Blue Cross plan.

When should you enroll in Medicare?

You should enroll in Original Medicare when you first become eligible. You're first eligible in the seven-month window that includes the three months before you turn 65, the month of your birthday and the three months after you turn 65. You can apply for a Medicare Advantage plan after you enroll in Original Medicare. Pick an insurance company.

How do I subscribe to Medicare?

Online (at Social Security) – It's the easiest and fastest way to sign up and get any financial help you may need. (You'll need to create your secure my Social Security account to sign up for Medicare or apply for benefits.) Call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778.

Can you combine Medicare with private insurance?

It is possible to have both private insurance and Medicare at the same time. When you have both, a process called “coordination of benefits” determines which insurance provider pays first. This provider is called the primary payer.

Is BCBS the same as Medicare?

BCBS companies have been part of the Medicare program since it began in 1966 and now offers multiple Medicare insurance options. Though quality and costs vary by company and by specific plan within those companies, most BCBS plans offer decent value and benefits across a range of health plan options.

How do you pay for Medicare Part B if you are not collecting Social Security?

If you have Medicare Part B but you are not receiving Social Security or Railroad Retirement Board benefits yet, you will get a bill called a “Notice of Medicare Premium Payment Due” (CMS-500). You will need to make arrangements to pay this bill every month.

Is it better to have Medicare as primary or secondary?

Medicare is always primary if it's your only form of coverage. When you introduce another form of coverage into the picture, there's predetermined coordination of benefits. The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary.

Can you have Medicare and employer insurance at the same time?

Can I have Medicare and employer coverage at the same time? Yes, you can have both Medicare and employer-provided health insurance. In most cases, you will become eligible for Medicare coverage when you turn 65, even if you are still working and enrolled in your employer's health plan.

Is Blue Anthem Medicare?

Anthem Blue Cross is an HMO plan with a Medicare contract. Enrollment in Anthem Blue Cross depends on contract renewal.

How do I know if my insurance is Medicare?

You will know if you have Original Medicare or a Medicare Advantage plan by checking your enrollment status. Your enrollment status shows the name of your plan, what type of coverage you have, and how long you've had it. You can check your status online at www.mymedicare.gov or call Medicare at 1-800-633-4227.

Does Medicare have a yearly deductible?

Yes, you have to pay a deductible if you have Medicare. You will have separate deductibles to meet for Part A, which covers hospital stays, and Part B, which covers outpatient care and treatments. What is the Medicare deductible for 2022? The Part A deductible for 2022 is $1,556 for each benefit period.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Are you automatically enrolled in Medicare Part B?

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you're not getting disability benefits and Medicare when you turn 65, you'll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

Does Medicare automatically start at 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Can I be on two health insurance plans?

Yes, you can have two health insurance plans. Having two health insurance plans is perfectly legal, and many people have multiple health insurance policies under certain circumstances.

Will Medicare pay my primary insurance deductible?

“Medicare pays secondary to other insurance (including paying in the deductible) in situations where the other insurance is primary to Medicare.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Is Medicare primary or secondary to employer coverage?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

How long does it take to get Medicare?

If you’re within the three months before or after the month in which you turn 65, you qualify for the typical seven-month Initial Enrollment Period. To begin the Medicare application process, contact your local Social Security office to find out which forms and documents you need.

How long does it take to get medicare after unemployment?

Your timeline for applying for Medicare coverage depends on your age: If you’re already over age 65 and three months, you qualify for a Special Enrollment Period, which lasts until eight months after you lost your health coverage due to unemployment.

What is the phone number for Medicare?

If you have any questions or need more information, call one of our Medicare experts at 1-800-678-2265 (TTY: 711) from 8:00 a.m. to 8:00 p.m. ET, Monday through Friday, April 1 through September 30, or seven days a week, October 1 through March 31.

When do you sign up for Part A and Part B?

To get Part A and/or Part B the month you turn 65, you must sign up during the first three months before the month you turn 65. You can apply during any of the seven months that make up what's called the Initial Enrollment Period.

What are the penalties for late enrollment in Medicare?

While you are not required to enroll in Medicare, there are late enrollment penalties-Part B can have a 10% penalty and Part D can have a 1% of the national base premium penalty. These penalties may apply if you choose not to enroll when initially eligible and may also apply if you choose to enroll at a later date.

What happens if you don't sign up for Medicare Part B?

If you don’t sign up for Medicare Part B when you’re first eligible, Medicare will require you to pay a late enrollment penalty. Your Initial Enrollment Period is: Three months before the month of your eligibility. In the month of your eligibility .

How to change Medicare Advantage plan?

What you can do: 1 Change Medicare Advantage plans 2 Drop your Medicare Advantage Plan and return to Original Medicare/Medicare Supplement 3 If returning to Original Medicare, you also have the option at this time to purchase a standalone Medicare Prescription Drug Plan (PDP).

Consult an agent

A licensed, authorized, independent Blue Cross agent can help you enroll. Be sure to ask if he or she is certified to sell Medicare products.

Visit a Blue Cross center

We have enrollment experts available to help you at a Blue Cross center in Duluth, Edina or Roseville.

More about Medicare Plans

Blue Cross offers Cost, PPO and PDP plans with Medicare contracts. Enrollment in these Blue Cross plans depends on contract renewal.

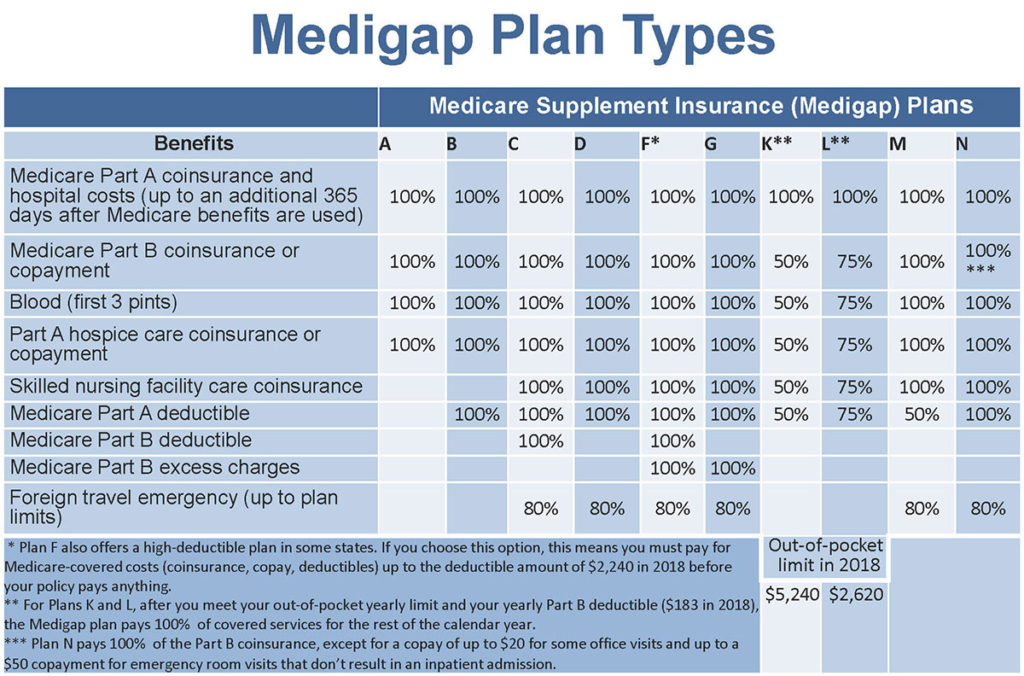

What is a Medigap plan?

Medigap (Medicare Supplement) is an option for those with Original Medicare. It covers the out-of-pocket costs for the health expenses not typically covered by Medicare Parts A and B (Original Medicare). Individuals enrolled in Medicare Advantage do not need to purchase a Medigap plan.

Does Medicare Advantage cover emergency services?

On the other hand, Medicare Advantage plans typically have a network but will cover urgent and emergency services anywhere in the country. FAQ Item Question. Limited Coverage. FAQ Item Answer.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What happens when there is more than one payer?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) to pay. In some rare cases, there may also be a third payer.

How much does Medicare reimburse for a B plan?

Each member of a Basic Option plan who has Medicare Part A and Part B can get reimbursed up to $800 per year for paying their Medicare Part B premiums.

How does Medicare work with service benefit plan?

Combine your coverage to get more. Together, the Service Benefit Plan and Medicare can protect you from the high cost of medical care . Medicare works best with our coverage when Medicare Part A and Part B are your primary coverage. That means Medicare pays for your service first, and then we pay our portion.

What is Medicare for seniors?

What's Medicare? Medicare is a federal health insurance program for people age 65 or older, people under 65 who have certain disabilities and people of any age who have End-Stage Renal Disease. It has four parts that cover different healthcare services.

Shop for Medicare Supplement plans

Get your Medicare supplement coverage from a company most North Dakotans trust: Blue Cross Blue Shield of North Dakota.

Shop for Medicare Part D – Prescription Drug Coverage

A Prescription Drug Plan (PDP) from BCBSND will help you cover the cost of your medications.

Shop for Medicare Advantage

Learn about our affiliate, NextBlue of North Dakota, the only locally administered Medicare Advantage plan in the state.

Get your Free Medicare Information Guide

I understand there is no obligation to purchase any products from BCBSND.