Should you enroll in Medicare if you are still working?

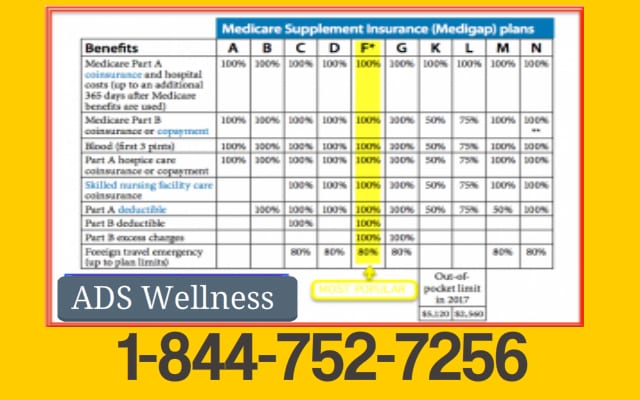

First, you have to be enrolled in Medicare Part A and Part B (Original Medicare). Then, you may want to compare Medicare Supplement plans sold in your state. You can do that anytime – just enter your zip code in the box on this page to get started. They’re sold by private companies, and premiums can vary.

How to enroll in Medicare if you are turning 65?

Dec 12, 2019 · How to apply for a Medicare Supplement plan: The basics Step 1: Research your plan options There are currently 10 plans to choose from, so you have some decisions to make (for... Step 2: See pricing and availability for your area Using this handy tool on Medicare.gov, enter your ZIP code (you can... ...

When can you sign up for Medicare supplement insurance?

Oct 01, 2021 · How To Enroll In A Medicare Supplement Plan. You must reside in Massachusetts, which means your permanent home address is within the state of Massachusetts. You may also be eligible if you are under age 65 and have a disability other than End Stage Renal Disease (ESRD). You must be entitled to ...

Is supplemental insurance mandatory if I qualify for Medicare?

Jan 01, 2022 · Ways to sign up: Online (at Social Security) – It’s the easiest and fastest way to sign up and get any financial help you may need. (You’ll need to create your secure my Social Security account to sign up for Medicare or apply for benefits.) Call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778.

Can you add a Medicare Supplement at any time?

One interesting feature of Medicare Supplement insurance plans is that you can apply for a plan anytime – you only need to be enrolled in Medicare Part A and Part B. However, a plan doesn't have to accept your application, unless you have guaranteed-issue rights.

What is the open enrollment period for Medicare Supplements?

Under federal law, you have a six-month open enrollment period that begins the month you are 65 or older and enrolled in Medicare Part B. During your open enrollment period, Medigap companies must sell you a policy at the best available rate regardless of your health status, and they cannot deny you coverage.

Can you be denied a Medicare Supplement plan?

Within that time, companies must sell you a Medigap policy at the best available rate, no matter what health issues you have. You cannot be denied coverage.

Can Medicare Supplements be purchased at any time of the year?

If you're in good health and comfortable answering medical questions, you can apply to change Medigap plans at any time of the year. Medicare Advantage plans and Medicare Part D prescription drug plans can only be changed during certain times of year, but Medicare supplements are different.Jan 26, 2021

What are the four prescription drug coverage stages?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.Oct 1, 2021

What is the maximum out-of-pocket for Medicare Advantage?

The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit. However, you should note that some insurance companies use lower MOOP limits, while some plans may have higher limits.Oct 1, 2021

What pre-existing conditions are not covered?

Health insurers can no longer charge more or deny coverage to you or your child because of a pre-existing health condition like asthma, diabetes, or cancer, as well as pregnancy. They cannot limit benefits for that condition either.

Do Medicare supplement plans increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

What states allow you to change Medicare supplement plans without underwriting?

In some states, there are rules that allow you to change Medicare supplement plans without underwriting. This includes California, Washington, Oregon, Missouri and a couple others. Call us for details on when you can change your plan in that state to take advantage of the “no underwriting” rules.

What counts toward the out-of-pocket maximum?

The out-of-pocket maximum is the most you could pay for covered medical services and/or prescriptions each year. The out-of-pocket maximum does not include your monthly premiums. It typically includes your deductible, coinsurance and copays, but this can vary by plan.

Is Medigap and supplemental insurance the same thing?

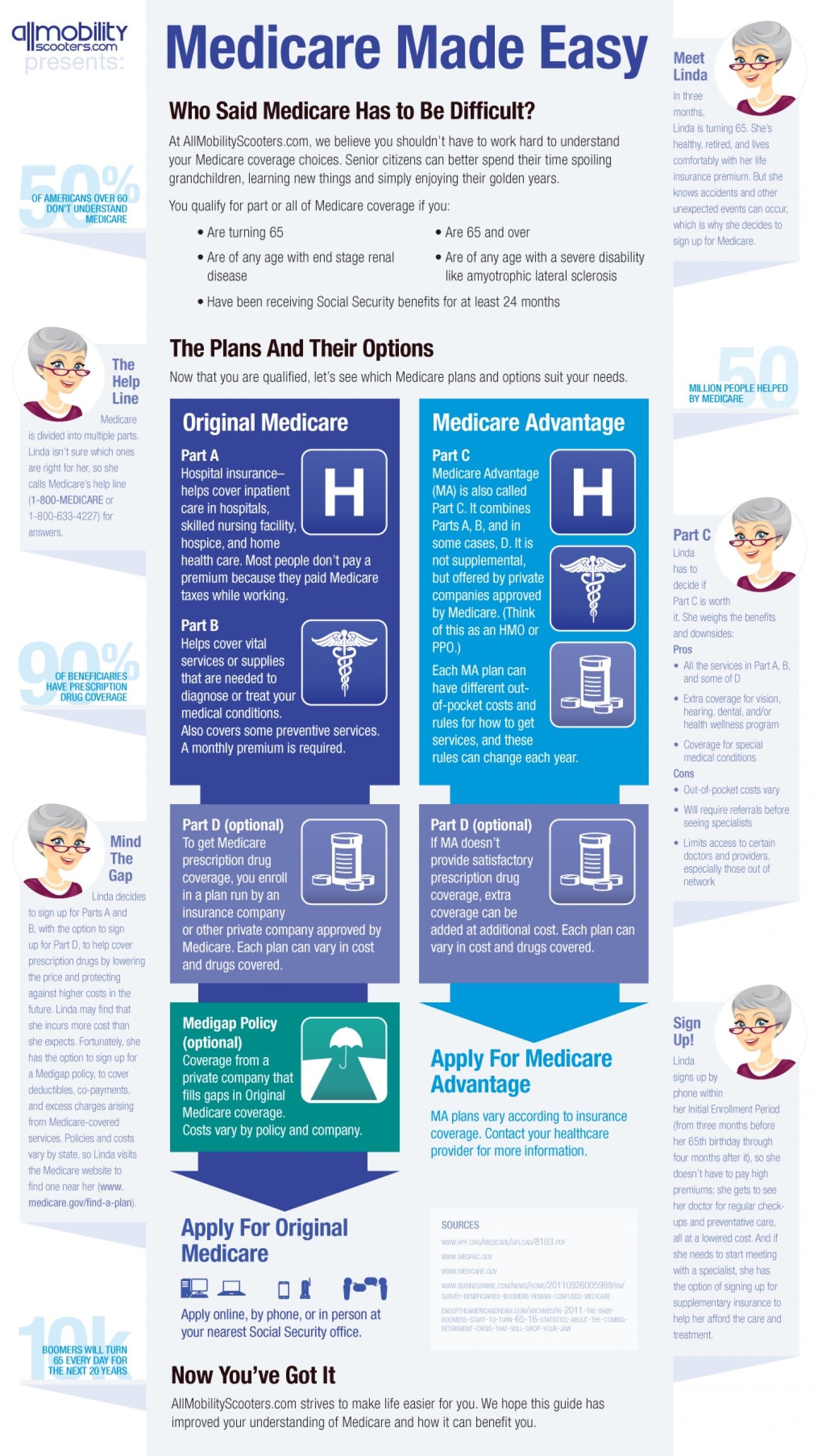

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

Can I change Medicare supplement plans without underwriting?

During your Medigap Open Enrollment Period, you can sign up for or change Medigap plans without going through medical underwriting. This means that insurance companies cannot deny you coverage or charge you more for a policy based on your health or pre-existing conditions.Nov 22, 2021

Medicare Supplement plans: how do I buy one?

If you want to buy a Medicare Supplement plan, you probably already know that these plans may help cover some of your out-of-pocket costs. Medicare Part A and Part B coinsurance, copayments and deductibles are common examples of these costs.

Medicare Supplement plans: when can you get one?

It’s easier to buy a Medicare Supplement plan during certain time periods. Usually, your best bet is to buy a plan during your Medicare Supplement (Medigap) Open Enrollment Period (OEP). This is the six-month period that starts the month you’re both at least 65 years old and enrolled in Medicare Part B.

How long does it take to apply for Medicare Supplement?

When to apply for a Medicare Supplement plan. Here's the quick answer: Most people should apply for a Medigap plan within six months of signing up for Part B. Medigap open enrollment begins when you sign up for Medicare Part B (at age 65) and lasts for six months. If you defer Part B coverage past age 65 because of health coverage ...

Is eligibility.com a Medicare provider?

Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.

Does Medicare cover medical expenses?

December 12, 2019. Medicare can cover a wide range of medical costs, but like anything else, it’s not perfect. We would all like a bit more coverage than Original Medicare can offer, especially when we know we'll be in more need of the benefits later in life. Luckily, Medicare Supplement (also called Medigap) plans provide a solution, ...

How To Enroll In A Medicare Supplement Plan

Thank you for your interest in our Medicare Supplement plans. To be eligible to enroll in one of for our Medicare Supplement plans, you must meet the following requirements:

Choose one of the following options to get your enrollment started

1. Online - 2021 Enrollment is now available! 2. By Mail – Please read the instructions carefully and answer all the questions. We cannot process incomplete enrollment forms.

How to enroll in Medicare online?

Enroll in Original Medicare online at the Social Security website or by calling or visiting your local Social Security office. Enroll directly in the plan; e.g., on the plan’s website or Medicare.gov . Enroll directly in the plan; e.g., on the plan’s website or Medicare.gov .

When is Medicare open enrollment?

The Medicare Annual Enrollment Period (AEP), October 15 – December 7. The Medicare Advantage Open Enrollment Period, January 1 – March 31.

Is UnitedHealthcare a Medicare Advantage?

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract and a Medicare-approved Part D sponsor. Enrollment in these plans depends on the plan's contract renewal with Medicare.

Who offers Medigap insurance?

Medigap plans are offered by private insurance companies, and you’ll have to enroll directly with the insurance plan provider. Below are some helpful steps for enrolling in a Medigap plan.

Is it easy to enroll in Medicare?

Enrolling in Medicare is easy once you understand how to do so. It's important to know that how you enroll in Medicare Part A and Part B is different from how you enroll in Medicare Advantage (Part C), Part D or Medicare supplement insurance.

Check when to sign up

Answer a few questions to find out when you can sign up for Part A and Part B based on your situation.

Check how to sign up

Answer a few questions to find out if you need to sign up or if you’ll automatically get Part A and Part B.

When coverage starts

The date your Part A and Part B coverage will start depends on when you sign up.

What is Medicare Supplement Plan?

A Medicare Supplement plan (also known as Medigap) is used for exactly what the name suggests — it supplements the gaps in your original Medicare coverage. This means you must have Medicare Parts A and B in order to get a Medigap plan.

How long is the Medigap enrollment period?

Medicare Supplements are no different. There is a 6-month Medigap enrollment period, during which you can enroll at any time.