Medicare Supplement Insurance plan; How to Enroll: Enroll in Original Medicare online at the Social Security website or by calling or visiting your local Social Security office. Enroll directly in the plan; e.g., on the plan’s website or Medicare.gov . Enroll directly in the plan; e.g., on the plan’s website or Medicare.gov .

Full Answer

How do you sign up for a Medicare supplement plan?

Dec 12, 2019 · How to apply for a Medicare Supplement plan: The basics Step 1: Research your plan options There are currently 10 plans to choose from, so you have some decisions to make (for... Step 2: See pricing and availability for your area Using this handy tool on Medicare.gov, enter your ZIP code (you can... ...

How do I pick a Medicare supplement plan?

Oct 01, 2021 · 1. Online - 2022 Enrollment is now available! 2. By Mail – Please read the instructions carefully and answer all the questions. We cannot process incomplete enrollment forms. Get 2021 Form >. Get 2022 Form >. 3. By Phone – Enrolling by phone is easy.

How do you enroll in a Medicare Advantage plan?

Jan 01, 2022 · Ways to sign up: Online (at Social Security) – It’s the easiest and fastest way to sign up and get any financial help you may need. (You’ll need to create your secure my Social Security account to sign up for Medicare or apply for benefits.) Call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778.

How to enroll in Medicare if you have ALS?

There are two main ways to enroll in Medigap: (1) you can join on your own. Most private insurance companies have access on their websites or by phone; (2) a licensed insurance agent can help you find the right plan and enroll. It does not cost you anything to speak with a GoHealth licensed insurance agent.

Can you change Medicare supplement plans without underwriting?

Which is true about Medicare supplement open enrollment?

Can you be denied a Medicare supplement plan?

Can you add a supplement to Medicare at any time?

Do you have to renew Medicare supplement every year?

Why do doctors not like Medicare Advantage plans?

What pre-existing conditions are not covered?

Can you be turned down for Medicare Part D?

What states are guaranteed issue for Medicare supplement?

Can I change Medicare supplement plans anytime?

What is the average cost of supplemental insurance for Medicare?

What counts toward out-of-pocket maximum?

What happens after you enroll in Medicare Supplement?

After you enroll in Medicare Supplement, you will receive new ID cards for medical and prescription drug coverage. You should destroy your old cards and carry the new ones — in addition to your Medicare card — for emergency and routine use.

How old do you have to be to be eligible for Medicare Supplement?

To meet the Rule of 70: You must be age 55 or older when you terminate eligible active service. You must have at least five years of Medical Plan participation.

What happens when you retire from Medicare?

When you retire, your medical coverage through the Board of Pensions ends. If you are eligible for Medicare and about to retire, contact the Board of Pensions to discuss your eligibility for Medicare Supplement coverage. When you retire, you may enroll in Medicare Supplement if you.

Who is eligible for Medicare Part A and Part B?

your spouse or eligible child (ren) who has maintained continuous coverage and is enrolled in Medicare Part A and Part B . your surviving or former spouse who has maintained continuous coverage and is enrolled in Medicare Part A and Part B.

Do you have to have continuous coverage to get Medicare?

You must meet a continuous coverage requirement in order to enroll for Medicare Supplement coverage . The medical coverage you had through the Board while actively working typically will meet this requirement if you retire at age 65 (or later) and enroll in Medicare Supplement coverage right away.

How long before retirement do you have to file a retirement packet?

This form is included in the personalized retirement packet you receive after you notify the Board of Pensions of your retirement date. Three to six months before your retirement date, call the Board at 800-773-7752 (800-PRESPLAN) to request a packet. Submit the completed, signed form at least 45 days before your retirement date, ...

How long do you have to file a medical claim before retirement?

Submit the completed, signed form at least 45 days before your retirement date, but no later than 30 days after your last day of medical coverage through the Board as an active employee.

What is Medicare Supplement Insurance?

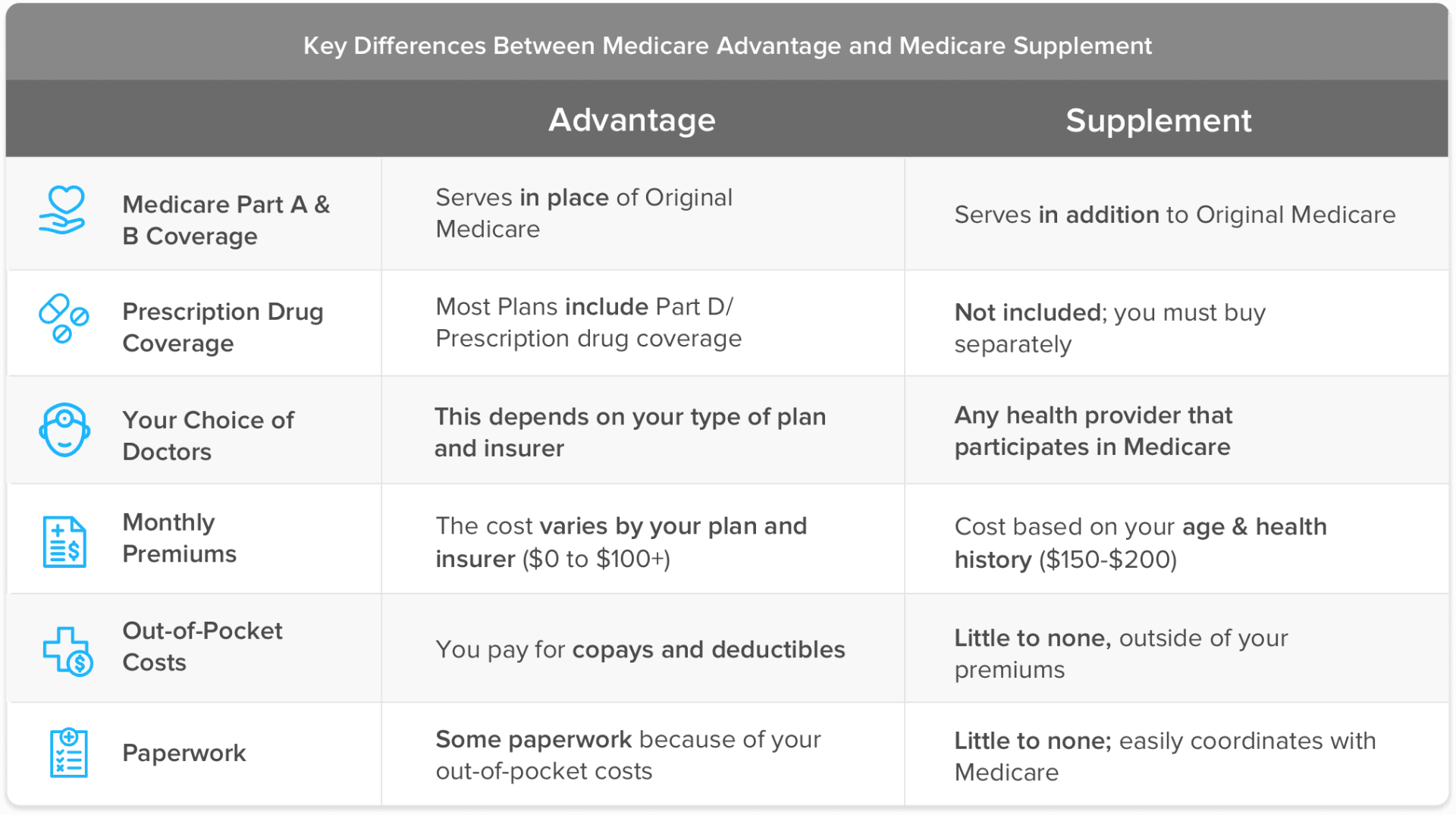

Medicare Supplement Insurance (Medigap) is extra coverage for costs like co-insurance, copayments, and deductibles. It’s a popular option, too; nearly a quarter of Original Medicare beneficiaries also purchase a Medigap policy.

How to enroll in Medigap?

There are two main ways to enroll in Medigap: (1) you can join on your own. Most private insurance companies have access on their websites or by phone; (2) a licensed insurance agent can help you find the right plan and enroll. It does not cost you anything to speak with a GoHealth licensed insurance agent.

Is Medigap a fee for service?

Medigap policies are purchased in addition to Original Medicare and have their own monthly premiums you'll need to pay. Original Medicare is a fee-for-service health insurance program available to Americans aged 65 and older and some individuals with disabilities.

How long is the open enrollment period for Medigap?

Medigap’s six month Open Enrollment Period starts the month you turn 65 and are enrolled in Medicare Part B. Medicare Part B is the portion of Medicare that covers your medical expenses. Sometimes called "medical insurance," Part B helps pay for the Medicare-approved services you receive. .

What is Medicare Part A?

Most individuals are automatically enrolled in Medicare Part A. Medicare Part A, also called "hospital insurance," covers the care you receive while admitted to the hospital, skilled nursing facility, or other inpatient services. Medicare Part A is part of Original Medicare.

When is Medicare open enrollment?

Medicare Advantage Open Enrollment is from January 1 - March 31.

When is the open enrollment period for Medicare Part B?

The Open Enrollment Period for under 65 runs from November 1 to December 15. If you don’t enroll by Dec. 15, you won’t be eligible for coverage unless you qualify for a Special Enrollment Period. period lasts for six months. This window begins the month you turn 65 and enroll in Medicare Part B.

How to enroll in Medicare online?

Enroll in Original Medicare online at the Social Security website or by calling or visiting your local Social Security office. Enroll directly in the plan; e.g., on the plan’s website or Medicare.gov . Enroll directly in the plan; e.g., on the plan’s website or Medicare.gov .

Is it easy to enroll in Medicare?

Enrolling in Medicare is easy once you understand how to do so. It's important to know that how you enroll in Medicare Part A and Part B is different from how you enroll in Medicare Advantage (Part C), Part D or Medicare supplement insurance.

When is Medicare open enrollment?

The Medicare Annual Enrollment Period (AEP), October 15 – December 7. The Medicare Advantage Open Enrollment Period, January 1 – March 31.

Is UnitedHealthcare a Medicare Advantage?

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract and a Medicare-approved Part D sponsor. Enrollment in these plans depends on the plan's contract renewal with Medicare.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap or MedSup), sold by private companies, helps pay some health care costs that Original Medicare (Part A and Part B) doesn’t cover. Policies can include coverage for deductibles, coinsurance, hospital costs, skilled nursing facility costs, and sometimes health care costs when traveling outside the U.S.

How long is the free look period for Medigap?

If you’re within your six-month Medigap Open Enrollment Period and considering a different Medigap plan, you may try a new Medigap policy during a 30-day “free look period.”. During this period, you will have two Medigap plans, and pay the premium for both.

What is Medicare Supplement Plan?

A Medicare Supplement plan (also known as Medigap) is used for exactly what the name suggests — it supplements the gaps in your original Medicare coverage. This means you must have Medicare Parts A and B in order to get a Medigap plan.

How long is the Medigap enrollment period?

Medicare Supplements are no different. There is a 6-month Medigap enrollment period, during which you can enroll at any time.

How to get Medicare Supplement insurance?

There are three common methods: Call Social Security at 1-800-772-1213 ( Monday through Friday, 7 am to 7 pm) Visit your closest Social Security office in person. Once you are enrolled in Original Medicare, then you are eligible to enroll in a Medigap plan, which is also commonly known as Medicare Supplement insurance.

How long do you have to sign up for Medicare Supplement?

To receive a Medicare Supplement plan, you must apply with one of these insurers. You’ll have a six-month period around your 65th birthday when you can sign up, and your Medigap insurance company will not be able to use medical underwriting to turn you down because of health conditions.

Is Medicare Supplement a federally sponsored plan?

While Original Medicare is federally-sponsored, Medigap plans are offered by independent insurance providers that are recognized by Medicare. To receive a Medicare Supplement plan, you must apply with one of these insurers.

How long does it take to enroll in Medicare Part B?

The day after you turn age 65 and are enrolled in Medicare Part B, your six-month Open Enrollment Period will begin. During this period, federal law states that insurance companies cannot reject your application for any Medigap plan due to pre-existing conditions or disability; this is known as having guaranteed issue rights.

Does Medicare Part D include prescriptions?

Medicare Part D Prescription drug coverage will not be included in your Medigap plan. You will need to sign up for a separate Part D prescription drug plan. If you choose a Medicare Advantage plan, on the other hand, prescription drug coverage might be included. If so, it will be required to be creditable coverage.

How to contact Medicare for Part B?

Call the plan. Call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. When you join a Medicare drug plan, you'll give your Medicare Number and the date your Part A and/or Part B coverage started. This information is on your Medicare card.

Do you have to have Part A and Part B to get Medicare?

You get all of your Part A, Part B, and drug coverage, through these plans. Remember, you must have Part A and Part B to join a Medicare Advantage Plan , and not all of these plans offer drug coverage. Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans you’re interested in ...

What are the different types of Medicare plans?

You can only join a separate Medicare drug plan without losing your current health coverage when you’re in a: 1 Private Fee-for-Service Plan 2 Medical Savings Account Plan 3 Cost Plan 4 Certain employer-sponsored Medicare health plans

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or other. Medicare Health Plan. Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan.

Does Medicare change drug coverage?

The drug coverage you already have may change because of Medicare drug coverage, so consider all your coverage options. If you have (or are eligible for) other types of drug coverage, read all the materials you get from your insurer or plan provider.

What happens if you don't get prescription drug coverage?

If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later.