Full Answer

What income is used to determine Medicare premiums?

Estimate my Medicare eligibility & premium Get an estimate of when you're eligible for Medicare and your premium amount. If you don't see your situation, contact Social Security (or the Railroad Retirement Board if you get railroad benefits) to learn more about your …

How should I Pay my Medicare premiums?

Oct 11, 2021 · For 2021, the monthly premium for Part B can range from $148.50 to a maximum amount of $504.90. You can view the income thresholds and premium amounts on Medicare's website. An important point to note is that these tiers are cliff-like, meaning that even one dollar over the top end of any tier will bump your premium surcharge up to the next level.

How do you calculate Medicare premium?

Jan 22, 2020 · $252 per month for those who paid Medicare taxes for 30-39 quarters. Medicare Part B premium While zero-premium liability is typical for Part A, the standard for Medicare Part B is a premium that changes annually, determined by modified adjusted gross income and tax filing status. For 2020, the standard monthly rate is $144.60.

How to pay your Medicare premiums?

Oct 16, 2020 · Medicare Part B premiums are calculated as a share of Part B program costs. For higher income enrollees in 2020, Part B premiums ranged from $202.40/month for enrollees with income of $109,000/single and $218,000/married to $491.60 for enrollees with income of $500,000/single and $750,000/married

How is my Medicare premium calculated?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is the Medicare premium for 2021?

$148.50The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What income is used to determine Medicare premiums 2020?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

At what income level does Medicare premium increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.Nov 16, 2021

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What month is Medicare deducted from Social Security?

Hi RCK. The Medicare premium that will be withheld from your Social Security check that's paid in August (for July) covers your Part B premium for August. So, if you already have Part B coverage you'll need to pay your Medicare premiums out of pocket through July.Mar 5, 2021

Is Social Security counted as income for Medicare?

For purposes of the Medicare Prescription Drug Discount Card, we have defined “income” as money received through retirement benefits from Social Security, Railroad, the Federal or State Government, or other sources, and benefits received for a disability or as a veteran, plus any other sources of income that would be ...

Is Social Security included in modified adjusted gross income?

MAGI is adjusted gross income (AGI) plus these, if any: untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest. For many people, MAGI is identical or very close to adjusted gross income. MAGI doesn't include Supplemental Security Income (SSI).

Are Medicare premiums calculated every year?

The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare.

Is Social Security income included in Magi?

Social Security income includes Social Security Disability Insurance (SSDI), retirement income, and survivor's benefits. These forms of income are counted in MAGI, even when not taxable.

Does income affect Medicare premiums?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, you'll pay higher premiums.

Why is my Medicare premium so high?

CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system. Some of the higher health care spending is being attributed to COVID-19 care.Nov 15, 2021

How Are Medicare Premiums calculated?

Many individuals are wondering how medicare premiums are calculated. Medicare Part A is free to most beneficiaries and covers hospital stays, care...

How Is A Beneficiary’S Premium determined?

The Social Security Administration reviews a beneficiary’s most recent federal tax information in order to determine what their premium will be. Ba...

Beneficiary Premium Rates

Beneficiaries filing an individual tax return must pay a monthly premium of: 1. $146.90 with an income of $85,001-$107,000, 2. $209.80 with an inco...

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant). Medicare coverage is broken down into different parts.

How much is Medicare Part B 2020?

Most beneficiaries enrolled in Part B in 2020 will have a premium of $144.60/month. Medicare Part B premiums are calculated as a share of Part B program costs.

Does Medicare cover hospice?

Medicare Part A is free to most beneficiaries and covers hospital stays, care in a skilled nursing facility, hospice care, and some health care. However, premiums for Part B and Part D depend on a beneficiary’s income. In other words, beneficiaries with higher incomes pay higher premiums.

How is Medicare Part B calculated?

Medicare Part B premiums are calculated based on your income. More specifically, they’re based on the modified adjusted gross income (MAGI) reported on your taxes from two years prior. This means your 2021 Medicare Part B premium may be calculated using the income you reported on your 2019 taxes. If your reported income was higher ...

How much will Medicare pay in 2021?

If you paid Medicare taxes for fewer than 30 quarters, you will pay $471 per month for Part A in 2021.

What is the late enrollment penalty for Medicare?

The Part A late enrollment penalty is 10 percent of the Part A premium, which you must pay for twice the number of years for which you were eligible for Part A but didn’t sign up. Medicare Part B. Medicare Part B is optional coverage, but if you don’t sign up when you’re first eligible, your late enrollment penalty will be calculated based on how ...

Does Medicare Advantage have a monthly premium?

Some Medicare Advantage plans offer $0 monthly premiums and $0 deductibles, and all Medicare Advantage plans must include an annual out-of-pocket cost limit. $0 premium plans may not be available in all locations.

How does Medicare Advantage work?

A Medicare Advantage plan could potentially help you save money on costs such as dental care, prescription drugs and other costs. A licensed insurance agent can help you compare the Medicare Advantage plans that are available where you live. You can compare benefits, coverage and the costs of each plan and then choose the right fit for your needs.

What happens if you don't enroll in Part A?

If you aren’t eligible for premium-free Part A don’t enroll in Part A when you’re first eligible but decide to enroll later, your Part A late enrollment penalty will be calculated based on how long you went without Part A coverage.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Calculate Original Medicare Costs

At the beginning of the worksheet, you’ll enter your Original Medicare costs, including costs for Part A, your hospital insurance, and Part B, your medical insurance.

Compare Medigap Plans

When making a Medicare plan, it’s crucial to consider Medigap, or Medicare Supplement, plans. They fill in the coverage gaps left by Medicare, including deductibles and coinsurance.

Add Extra Cancer Coverage

The lifetime risk of developing cancer is 1 in 2 for men and 1 in 3 for women. While Medicare covers medically necessary cancer costs, it doesn’t help with non-medical expenses.

Medicare Advantage Costs

We didn’t add a Medicare Advantage section to the Medicare Cost Worksheet for a few reasons:

Compare Part D Costs

Part D, or your prescription drug plan, is an essential part of your overall Medicare plan. Our worksheet allows you to compare three plan options side-by-side.

Add Final Expense Insurance

According to the National Funeral Directors Association, the national median cost for a funeral with burial is $7,181. A final expense insurance plan can pay for that.

Your Total Estimated Medicare Costs

Once you’ve filled out the whole worksheet, it’ll automatically populate your total estimated monthly costs.

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

What happens if you don't get Social Security?

If the amount is greater than your monthly payment from Social Security, or you don’t get monthly payments, you’ll get a separate bill from another federal agency , such as the Centers for Medicare & Medicaid Services or the Railroad Retirement Board.

What is MAGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

Do you pay monthly premiums for Medicare?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much is Part B insurance in 2021?

The IRMAA is based on your reported adjusted gross income from two years ago. For 2021, your Part B premium may be as low as $148.50 or as high as $504.90.

What is Medicare Part B?

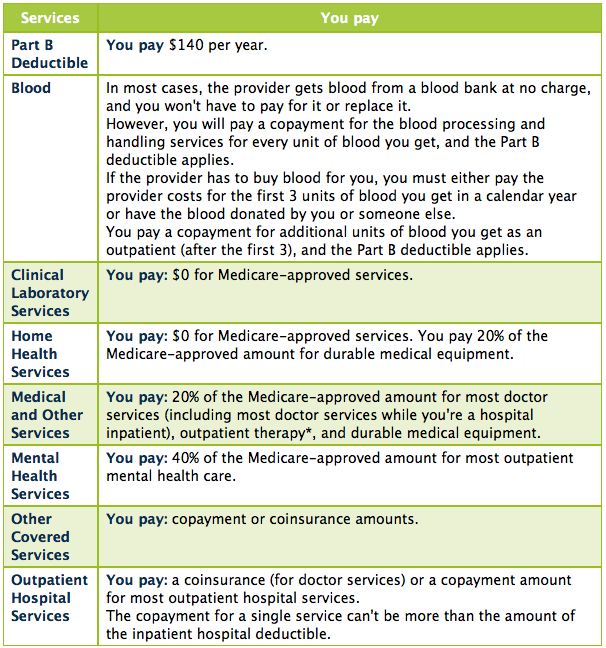

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.