The three most significant considerations for finding the best Medicare supplement insurance are: price transparency, customer service and pricing methods. Price transparency is when the consumer can determine premium costs with no hassles. You should quickly obtain quotes over the phone, online or in person.

Full Answer

How do I compare the benefits of the different Medicare supplement plans?

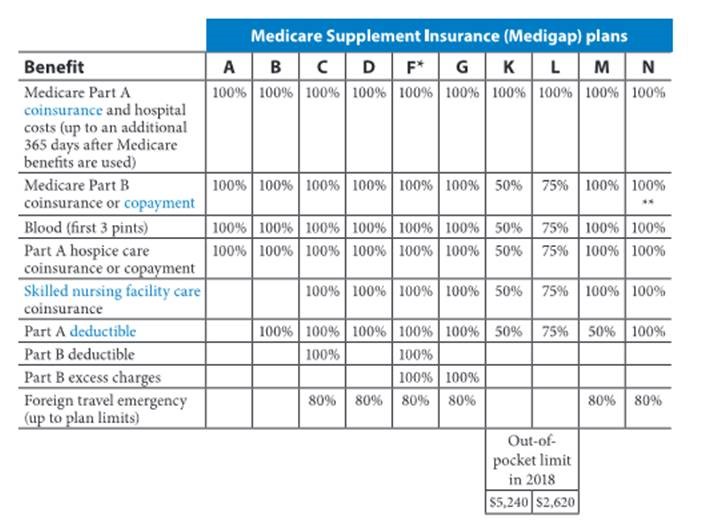

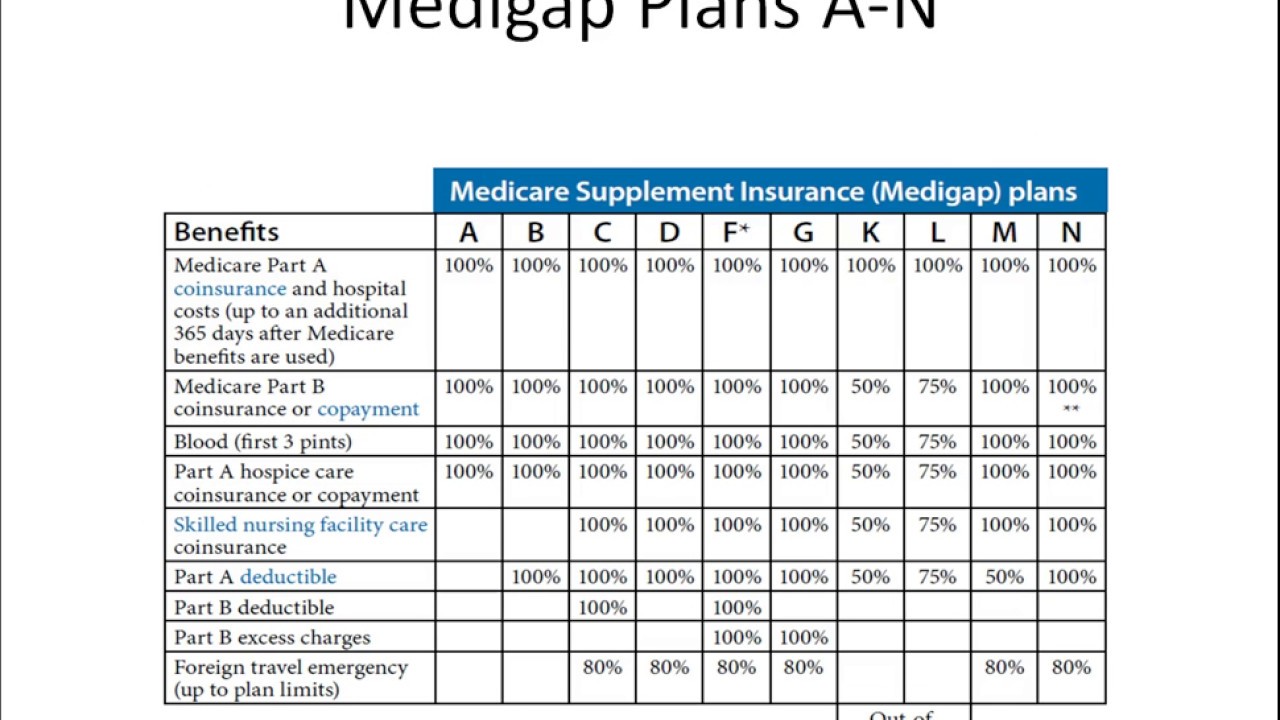

One way to compare the benefits offered by the 10 standardized Medicare Supplement plans is to take a look at this chart. Think about which services you use the most and where your highest Medicare out-of-pocket costs have been.

What are Medicare supplement plans and how do they work?

Medicare supplement plans are partially standardized plans offered by private companies under Medicare rules that pay for some of the costs Medicare normally doesn’t cover – things like copays, coinsurance, and deductibles. These plans work with Medicare Part A and Part B and are not stand-alone plans.

How do I buy a Medicare supplement plan?

When buying a Medicare Supplement Plan, you have two basic routes: buy directly from an insurance company or go through a broker. Going to an insurance company you already trust can be an appealing option.

How do I verify my ZIP code for Medicare supplement plans?

As with most sites offering Medicare Supplement Plans, GoHealth asks you to first verify your zip code to make sure there are plans in your area. From there, you'll enter your name, email address (optional), and phone number.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

Do Medicare supplements have star ratings?

Medicare uses information from member satisfaction surveys, plans, and health care providers to give overall performance star ratings to plans. A plan can get a rating between 1 and 5 stars. A 5-star rating is considered excellent.

Which Medicare Supplement plan has the highest level of coverage?

Plan FPlan F premiums are usually the highest of all Medicare Supplement plans. This makes sense because it offers the highest level of coverage. Medicare Supplement costs vary based on a number of factors, including your age, sex, smoking status, and even your ZIP code.

What are the criterias of a Medicare Supplement plan?

You must be enrolled in BOTH Parts A and B at the time of application. You must be age 65 or older (in several states, some Plans are offered to those under 65 who are on disability). You must reside in the state in which the Supplement Plan is offered at the time of application.

What is the best way to compare Medicare Advantage plans?

The Medicare Plan Finder on Medicare.gov is currently the most comprehensive tool for comparing Medicare Advantage plan benefits, prescription drug coverage and costs.

What does a CMS 5 Star rating mean?

Nursing homes with 5 stars are considered to have much above average quality and nursing homes with 1 star are considered to have quality much below average.

Is there a Medicare Supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

What is the deductible for plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies.

Do Medigap premiums increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

Who is the largest Medicare Supplement provider?

UnitedHealthCareAARP/United Health Group has the largest number of Medicare Supplement customers in the country, covering 43 million people in all 50 states and most U.S. territories. AARP licenses its name to insurer UnitedHealthCare, which helps make these policies so popular.

How are Medicare Supplement plans regulated?

The California Department of Insurance (CDI) regulates Medicare Supplement policies underwritten by licensed insurance companies. The CDI assists consumers in resolving complaints and disputes concerning premium rates, claims handling, and many other problems with agents or companies.

Who has the cheapest Medicare supplement insurance?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022.

What Is A Medicare Supplement Plan?

Let’s start with a bit of background about Medicare Supplement (also called Medigap) plans.Private insurance companies offer Medicare Supplement pl...

Is A Medicare Supplement Plan Right For You?

Ultimately you are the best judge of the type of insurance that meets your personal needs and lifestyle. However, if one or more of the following c...

How Do I Shop For The Best Medicare Supplement Plan?

Each standardized Medicare Supplement plan helps cover a different range of certain Medicare costs. For example, some plans may cover 100% of the M...

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What states have Medigap policies?

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

Where do you live in Medigap?

You live in Massachusetts, Minnesota, or Wisconsin. If you live in one of these 3 states, Medigap policies are standardized in a different way. You live in Massachusetts. You live in Minnesota. You live in Wisconsin.

Do insurance companies have to offer every Medigap plan?

Insurance companies that sell Medigap policies: Don't have to offer every Medigap plan. Must offer Medigap Plan A if they offer any Medigap policy. Must also offer Plan C or Plan F if they offer any plan.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

Know this: All Medicare supplement plans have the same coverage

Many consumers don’t realize that every Medicare supplement plan type offers the same basic benefits, regardless of the provider. In other words, no matter which insurance company you get your particular Medicare supplement insurance plan from, the coverage is the same.

What does your current plan offer beyond the basic coverage?

Medicare supplement insurance providers distinguish themselves from one another in two general areas: 1) customer service and 2) the extra features and benefits they offer. So if you’ve found it difficult to get answers or satisfactory customer service from your Medicare supplement insurance provider, it might be time to switch.

Does your current plan meet your needs?

If your coverage offers what you need at a price that fits your budget, you may not need to make a change. But if your research reveals that your current plan will have changes in the coming year that could be out of sync with your needs, including coverage or cost, it may be time to consider shopping.

Can you afford the premium, deductible, copay and other costs?

When you’re looking for a Medicare supplement insurance plan that fits your budget, look beyond the monthly premium. You might prefer a high-deductible plan because it has a lower monthly premium.

How to choose a Medicare Supplement Plan?

Is a Medicare Supplement plan right for you? 1 You are enrolled in Medicare Part A and Part B and have many doctor visits or frequent hospitalizations. 2 You want the security of knowing you’ll have help with many of the medical expenses that Medicare Part A and Part B don’t completely cover. 3 You like the flexibility of being able to choose any doctor or hospital that accepts Medicare, possibly even when traveling throughout the United States 4 You divide your time between two homes in different regions of the United States and you want to be able to receive treatment from any doctor or health facility that accepts Medicare.

How does Medicare Supplement work?

When you buy a Medicare Supplement plan, you generally pay a premium to the insurance company for your coverage. Typically, as long as you continue to pay your premium and have Medicare Part A and Part B, your Medicare Supplement plan will be automatically renewed each year, although the premium amount may change.

Which states have different Medicare Supplement plans?

Massachusetts, Minnesota, and Wisconsin have different standardized Medicare Supplement plans than the 10 types offered elsewhere in the United States. Please note that all insurance companies won’t necessarily offer all the types of Medicare Supplement plans. When you buy a Medicare Supplement plan, you generally pay a premium to ...

Do you pay monthly premiums for Medicare Supplement?

Keep in mind that you do pay a monthly premium with a Medicare Supplement policy (and you still continue paying your Medicare Part B premium as well). Medicare Supplement plan premiums may vary by insurance company and among different plans. Generally speaking, the more coverage provided by the Medicare Supplement plan, the higher the premium.

Does Medicare Supplement cover deductible?

Each standardized Medicare Supplement plan helps cover a different range of certain Medicare costs. For example, some plans may cover 100% of the Medicare Part A deductible, some cover a portion of that deductible, and some plans don’t cover the deductible at all. Some plans may cover emergency medical care when you’re traveling ...

Is Medicare Supplement a good plan?

However, if one or more of the following circumstances is true for you, a Medicare Supplement plan may be a good choice. You are enrolled in Medicare Part A and Part B and have many doctor visits or frequent hospitalizations. You want the security of knowing you’ll have help with many of the medical expenses that Medicare Part A ...

Does Medicare Supplement Plan A include the same benefits?

For example, Medicare Supplement Plan A (not to be confused with Medicare Part A) includes the same benefits no matter where you buy this plan (however, some insurance companies might offer additional benefits). Massachusetts, Minnesota, and Wisconsin have different standardized Medicare Supplement plans than the 10 types offered elsewhere in ...

What Is a Medigap Plan?

No matter what plan (s) you select to provide your Medicare benefits, you can count on having out-of-pocket expenses such as copays, deductibles or coinsurance. Generally speaking, Medicare Part A provides hospital insurance benefits that cover four specific services: inpatient hospital care, skilled nursing/rehab, hospice and home care.

What Do Medigap Plans Cover?

Since 2010, all Medigap plans were standardized which allowed the offering companies to provide the same coverage for all plans (A-N). Those basic benefits include:

How to Evaluate Medicare Supplement Plan Options

Medicare Supplement plans that are currently available include Plans A, B, D, G, K, L, M, and N, which we’ll explore later. Note that as of January 1, 2020, Medicare beneficiaries can no longer purchase Medigap Plans C and F as they provided coverage for Part B deductible costs, which is no longer allowed for new Medicare enrollees.

What Will the Cost of My Medigap Plan Be?

The cost of your plan depends on your Medigap plan, Medigap insurance provider and their premium-pricing methods, which can increase over time due to inflation. The premium-pricing methods are: attained-age rated, community-rated and issue-age rated. For example, your plan may be priced via the issue-age rated method.

What are Medicare Supplement Plans?

Medicare Supplement Plans, or Medigap plans, were designed to cover many costs not covered by your Medicare plan. In order to enroll in a Medigap plan, you must first be enrolled in Original Medicare. There are 10 options, plans A-N each offering different levels of coverage. Please see this chart for more in-depth information about each plan.

Which plan offers the most coverage?

Each Medigap plan can be useful depending on the person, but the two most popular are Plans F and G. Plan F is by far the most heavily enrolled because it covers 100% of your expenses after Medicare qualified expenses.

Is there a big difference between Supplement and Advantage Plans?

Medicare Supplement plans are an excellent resource for many retirees. But going this route, you will need to make sure you enroll in your care separately:

Can you switch to a Supplement plan from an Advantage Plan?

If you are unhappy with your Advantage plan and want to switch to a Supplement plan, you do have that option.

What are the three methods of Medicare supplementation?

These are community-rated (no age-rated), issue-age-rated (initial age-rated), and attained-age-rated. Even when companies use the same rating method, the actual premiums will likely vary widely between the companies.

What factors influence Medicare Supplement Plan premiums?

Some of these are discounts, medical underwriting, high deductible plan options, what state you live in, and extra coverages offered by the company .

How much does Medicare require for a plan modifier?

Plan Modifiers: Companies are allowed to offer Medicare Select policies that require you use a specific network of doctors and high deductible options (Plan F only) that require you pay $2,240 (amount set by CMS) in deductibles before the plan makes any payments.

Why do insurance premiums not rise?

Under this type of calculation, premiums will not rise due to increases in age as long as the policy is renewed without a gap in coverage. However, premiums might rise due to other factors such as increased healthcare costs overall and inflation.

When will Medicare be available in 2021?

July 9, 2021. Medicare plans themselves, specifically Medicare Part A and Medicare Part B, have premiums set by the government. However, Medigap, or Medicare Supplement plans, have rates that are different as they are offered by authorized private insurance companies and have different coverages available. Source: Getty.

Which states have the most changes to Medicare Supplement?

Three states with the most changes are Massachusetts, Minnesota, and Wisconsin.

What is included in the price calculation?

The price calculation often includes things like total benefits paid in previous years, expected increases in health care costs, and inflation but does not include factors related to an individual policyholder.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

What is SelectQuote Senior?

SelectQuote Senior is one of several brokers that refers prospective clients to various insurance companies for Medicare Supplement Plans. You'll get quotes for 20+ different providers through this service, depending on which companies are issuing policies where you live. Those companies may include Aetna, Cigna, Anthem and Humana; all insurers with whom they partner are at least A- rated. The business itself has an "A+" rating and accreditation from the BBB, which means that in the company's 36 years in operation, they've done a good job of treating their clients fairly and honestly.

What is the name of the insurance company that offers Medicare Supplement Plans?

Blue Cross Blue Shield. BlueCross Blue Shield (known as Anthem in some states, as well as BCBS) is one of the biggest names in insurance. They have a website specifically dedicated to Medicare Supplement Plans, so you don't have to worry about sorting through health insurance information that doesn't apply to you.

How to find Medicare premiums with United Medicare Advisors?

When it comes to finding plans and premiums with United Medicare Advisors, they provide a simple online form where you enter contact information such as your name, phone number, and email address. This same information is required by almost all Medicare Supplement Plan sites.

How much is the BCBS discount?

There is also a household discount of 5% if more than one household member is enrolled in a BCBS Medicare Supplement Plan. That discount is lower than many other insurers, who typically offer anywhere from 7% to 15% off, and sometimes that applies even if no one else is currently enrolled with you.

What is the Learn About Medicare tab?

Under the Learn About Medicare tab, you can find information on Medicare Supplement, Medicare Advantage, Prescription Drug Plans, and Medicare Parts A and B. They provide access to blogs covering health care news, retirement, and health wellness.