How do I compare the benefits of the different Medicare supplement plans?

Mar 02, 2022 · Carefully choosing a supplemental insurance plan is key if you're enrolled in traditional Medicare. Mark Miller Mar 2, 2022 When you sign up …

How do Medicare supplement plans work?

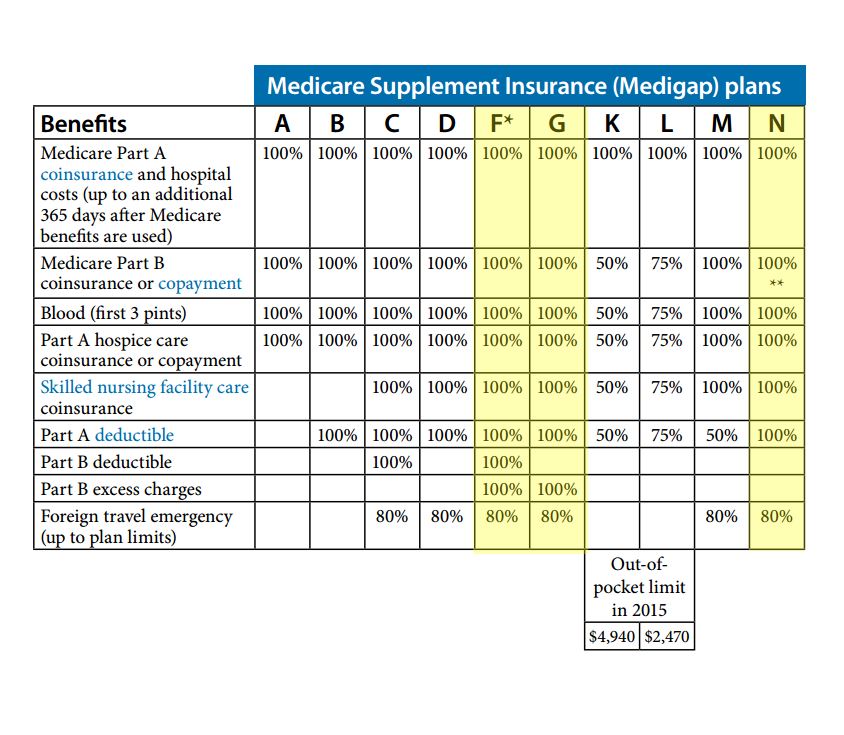

Sep 16, 2018 · One way to compare the benefits offered by the 10 standardized Medicare Supplement plans is to take a look at this chart. Think about which services you use the most and where your highest Medicare out-of-pocket costs have been. For example, is there a good chance you’ll spend some time in a skilled nursing facility?

What are Medicare supplement (Medigap) plans?

Step 1 Decide which plan you want Medigap policies are standardized, and in most states are named by letters, Plans A-N. Compare the benefits each plan helps pay for and choose a plan that covers what you need. See benefits of each plan Step 2 Pick your policy Find policies in your area.

Do I have to pay a monthly premium for Medicare supplement insurance?

What are Medicare Supplement Plans? Medicare Supplement Plans, or Medigap plans, were designed to cover many costs not covered by your Medicare plan. In order to enroll in a Medigap plan, you must first be enrolled in Original Medicare. There are 10 options, plans A-N each offering different levels of coverage. Please see this chart for more in ...

What are the 3 ways Medicare Supplement plans are rated?

Medigap Plan Costs Policy prices for Medigap are set by the individual insurance companies selling them. Companies set their premium pricing in one of three ways: Community-rated: Premiums are the same regardless of age. Issue or entry age-rated: Premiums are cheaper if the policy is purchased at a younger age.Feb 9, 2022

How do I know which Medicare plan is best for me?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

What are the pros and cons of Medicare Supplement plans?

Medigap Pros and ConsMedigap ProsMedigap ConsPlans are easy to compareDifficult to switch once enrolledGuaranteed 6 month enrollment period when 1st eligibleMay not be able to enroll after initial enrollment periodAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductible3 more rows•Sep 26, 2021

What is the difference between a Plan F and Plan G for Medigap policies?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.Feb 18, 2021

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What are the 4 phases of Medicare Part D coverage?

The Four Coverage Stages of Medicare's Part D ProgramStage 1. Annual Deductible.Stage 2. Initial Coverage.Stage 3. Coverage Gap.Stage 4. Catastrophic Coverage.Oct 1, 2021

What is the difference between an Advantage plan and a supplemental plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

What is better a Medigap plan or an Advantage plan?

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

What Is A Medicare Supplement Plan?

Let’s start with a bit of background about Medicare Supplement (also called Medigap) plans.Private insurance companies offer Medicare Supplement pl...

Is A Medicare Supplement Plan Right For You?

Ultimately you are the best judge of the type of insurance that meets your personal needs and lifestyle. However, if one or more of the following c...

How Do I Shop For The Best Medicare Supplement Plan?

Each standardized Medicare Supplement plan helps cover a different range of certain Medicare costs. For example, some plans may cover 100% of the M...

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What states have Medigap policies?

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

Do insurance companies have to offer every Medigap plan?

Insurance companies that sell Medigap policies: Don't have to offer every Medigap plan. Must offer Medigap Plan A if they offer any Medigap policy. Must also offer Plan C or Plan F if they offer any plan.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

Is Medigap standardized?

Medigap policies are standardized. Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as "Medicare Supplement Insurance.". Insurance companies can sell you only a "standardized" policy identified in most states by letters. All policies offer the same basic.

How to choose a Medicare Supplement Plan?

Is a Medicare Supplement plan right for you? 1 You are enrolled in Medicare Part A and Part B and have many doctor visits or frequent hospitalizations. 2 You want the security of knowing you’ll have help with many of the medical expenses that Medicare Part A and Part B don’t completely cover. 3 You like the flexibility of being able to choose any doctor or hospital that accepts Medicare, possibly even when traveling throughout the United States 4 You divide your time between two homes in different regions of the United States and you want to be able to receive treatment from any doctor or health facility that accepts Medicare.

How does Medicare Supplement work?

When you buy a Medicare Supplement plan, you generally pay a premium to the insurance company for your coverage. Typically, as long as you continue to pay your premium and have Medicare Part A and Part B, your Medicare Supplement plan will be automatically renewed each year, although the premium amount may change.

Which states have different Medicare Supplement plans?

Massachusetts, Minnesota, and Wisconsin have different standardized Medicare Supplement plans than the 10 types offered elsewhere in the United States. Please note that all insurance companies won’t necessarily offer all the types of Medicare Supplement plans. When you buy a Medicare Supplement plan, you generally pay a premium to ...

Do you pay monthly premiums for Medicare Supplement?

Keep in mind that you do pay a monthly premium with a Medicare Supplement policy (and you still continue paying your Medicare Part B premium as well). Medicare Supplement plan premiums may vary by insurance company and among different plans. Generally speaking, the more coverage provided by the Medicare Supplement plan, the higher the premium.

Does Medicare Supplement cover deductible?

Each standardized Medicare Supplement plan helps cover a different range of certain Medicare costs. For example, some plans may cover 100% of the Medicare Part A deductible, some cover a portion of that deductible, and some plans don’t cover the deductible at all. Some plans may cover emergency medical care when you’re traveling ...

Is Medicare Supplement a good plan?

However, if one or more of the following circumstances is true for you, a Medicare Supplement plan may be a good choice. You are enrolled in Medicare Part A and Part B and have many doctor visits or frequent hospitalizations. You want the security of knowing you’ll have help with many of the medical expenses that Medicare Part A ...

Does Medicare Supplement Plan A include the same benefits?

For example, Medicare Supplement Plan A (not to be confused with Medicare Part A) includes the same benefits no matter where you buy this plan (however, some insurance companies might offer additional benefits). Massachusetts, Minnesota, and Wisconsin have different standardized Medicare Supplement plans than the 10 types offered elsewhere in ...

How to choose a Medigap plan?

Medigap policies are standardized, and in most states are named by letters, Plans A-N. Compare the benefits each plan helps pay for and choose a plan that covers what you need. See benefits of each plan. Step 2.

What is Medigap insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs.

What are Medicare Supplement Plans?

Medicare Supplement Plans, or Medigap plans, were designed to cover many costs not covered by your Medicare plan. In order to enroll in a Medigap plan, you must first be enrolled in Original Medicare. There are 10 options, plans A-N each offering different levels of coverage. Please see this chart for more in-depth information about each plan.

Which plan offers the most coverage?

Each Medigap plan can be useful depending on the person, but the two most popular are Plans F and G. Plan F is by far the most heavily enrolled because it covers 100% of your expenses after Medicare qualified expenses.

Is there a big difference between Supplement and Advantage Plans?

Medicare Supplement plans are an excellent resource for many retirees. But going this route, you will need to make sure you enroll in your care separately:

Can you switch to a Supplement plan from an Advantage Plan?

If you are unhappy with your Advantage plan and want to switch to a Supplement plan, you do have that option.

What does Medicare cost sharing include?

What you pay depends on what Medicare coverage you have (the kind of Medicare plan or plans) and how you use it. Let’s quickly look at the potential costs you may pay. Your cost sharing may include some or all of the following: Premium: A fixed fee that you pay—usually monthly—to your plan, to Medicare or to both.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Do deductibles go up or down?

The reverse is also true. As premiums go up, deductibles may go down. Also, plans usually charge a copayment or coinsurance for any given service—not both. Copayments may be less than coinsurance amounts for the same service.

Medicare 101

Before we dive into the many intricacies of Advantage plans, let’s go back to square one and take a look at what Original Medicare is and what it entails.

What is a Medicare Advantage Plan?

A Medicare Advantage plan, also known as Medicare Part C, is a Medicare enrollment election through a private insurance company. How it works is that a private insurance provider is contracted with Medicare, with all of the benefits being managed through the insurance company, not Medicare.

What is the difference between HMO and PPO plans?

A Health Maintenance Organization, or HMO, Medicare Advantage Plan can offer great benefits such as a low or even non-existent monthly premiums. But it is important to know that whenever you need to see a doctor or specialist, your insurance provider will need to review and approve the referral before you can make an appointment.

The Costs of Advantage Plans

On the surface, Medicare advantage plans seem to be an ideal situation. They offer more benefits in an all-inclusive setting streamlining the process for many customers. But there are some important caveats to keep in mind before enrolling in an Advantage Plan.

What Is a Medigap Plan?

No matter what plan (s) you select to provide your Medicare benefits, you can count on having out-of-pocket expenses such as copays, deductibles or coinsurance. Generally speaking, Medicare Part A provides hospital insurance benefits that cover four specific services: inpatient hospital care, skilled nursing/rehab, hospice and home care.

What Do Medigap Plans Cover?

Since 2010, all Medigap plans were standardized which allowed the offering companies to provide the same coverage for all plans (A-N). Those basic benefits include:

How to Evaluate Medicare Supplement Plan Options

Medicare Supplement plans that are currently available include Plans A, B, D, G, K, L, M, and N, which we’ll explore later. Note that as of January 1, 2020, Medicare beneficiaries can no longer purchase Medigap Plans C and F as they provided coverage for Part B deductible costs, which is no longer allowed for new Medicare enrollees.

What Will the Cost of My Medigap Plan Be?

The cost of your plan depends on your Medigap plan, Medigap insurance provider and their premium-pricing methods, which can increase over time due to inflation. The premium-pricing methods are: attained-age rated, community-rated and issue-age rated. For example, your plan may be priced via the issue-age rated method.

How much money will Medicare spend in 2036?

Congress will need to reduce Medicare spending or increase revenues by at least $700 billion to extend the solvency of the Medicare Trust Fund to 2036. A new comprehensive tool for evaluating Medicare savings options assesses the impacts of proposed changes not only on budgetary concerns but also on beneficiaries and providers.

How much will Medicare save in 2027?

Beneficiary: Total OOP cost burden for Medicare beneficiaries without supplemental coverage would be reduced by $39 on average in 2027; savings would range from $28 for beneficiaries with low incomes to $112 for beneficiaries with high OOP costs and an inpatient stay. 3.

How much would Medicare reduce over 10 years?

Budgetary: Would reduce Medicare spending by $127 billion over 10 years and reduce average annual spending per beneficiary by about 1 percent. However, it would have no impact on the projected Part A Trust Fund insolvency date; it only affects Part B spending.

How do savings measures affect health care providers?

Savings measures also can affect health care providers, for instance, by changing payment rates for various services or introducing new program requirements. Rural hospitals and safety-net providers generally serve a higher proportion of Medicare patients and can be especially vulnerable to payment reductions.

What will the hospital margin be in 2027?

Health system: In 2027, the average hospital margin would decline by a projected –0.9 percent. This change would range from –1.2 percent to –0.3 percent depending on hospital characteristics.

Is Medicare in its worst shape?

Although the COVID-19 pandemic is currently the focus in Congress, other health care priorities will soon come to the forefront. Most notably, Medicare will demand attention, as its financial condition is currently in its worst shape since 1997, when Congress enacted the Balanced Budget Act. The Congressional Budget Office (CBO) ...