Full Answer

How does Medicare determine your income?

How Does Medicare Determine Your Income? Original Medicare is two-fold, comprised of Part A (hospital insurance) and Part B (medical insurance). They differ not only in the Medicare benefits covered but also in how the premiums are determined.

How is the cost of Medicare premium calculated?

The premium is based on credits earned by working and paying taxes. When you work in the U.S., a portion of the taxes automatically deducted are earmarked for the Medicare program. Workers are able to earn up to four credits per year.

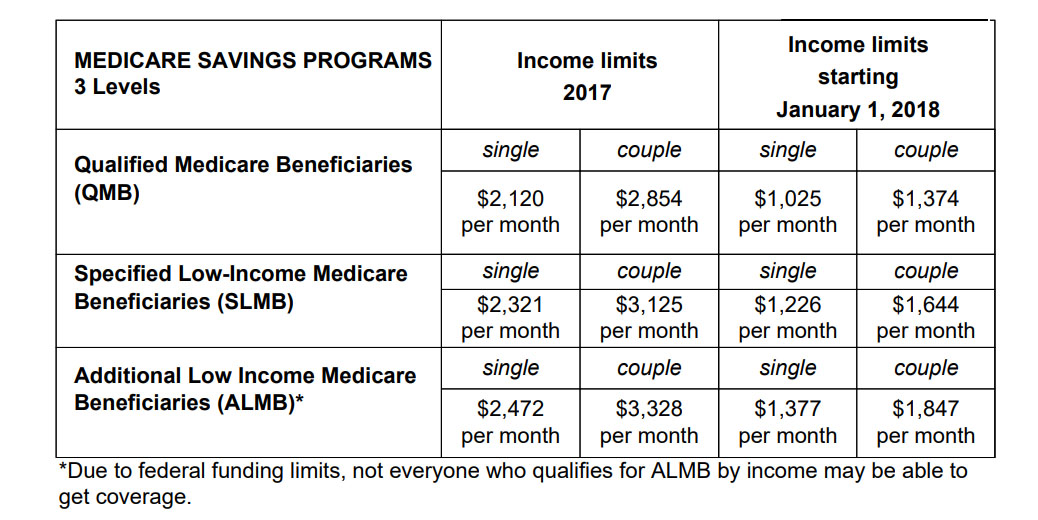

What are the monthly income limits for Medicare savings programs?

2021 Monthly Income Limits for Medicare Savings Programs Medicare Savings Program Monthly Income Limits for Individual Monthly Income Limits for Married Couple QMB $1,084 $1,457 SLMB $1,296 $1,744 QI $1,456 $1,960 3 more rows ...

How do Medicare savings programs pay for care?

In some cases, Medicare Savings Programs may also pay Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. deductibles, coinsurance, and copayments if you meet certain conditions.

What is Medicare Savings Program?

A Medicare Savings Program (MSP) can help pay deductibles, coinsurance, and other expenses that aren’t ordinarily covered by Medicare. We’re here to help you understand the different types of MSPs. Below, we explain who is eligible for these programs and how to get the assistance you need to pay for your Medicare.

What is QI in Medicare?

Qualifying Individual (QI) Programs are also known as additional Low-Income Medicare Beneficiary (ALMB) programs. They offer the same benefit of paying the Part B premium, as does the SLMB program, but you can qualify with a higher income. Those who qualify are also automatically eligible for Extra Help.

What is balance billing?

Balance billing refers to the cost for a service that remains after Medicare pays. If you’re a QMB, your providers should not be billing you directly for the balance after Medicare pays them for your service. Yet, if you’re an SLMB or a QI, there is no rule against your doctor’s office sending you a bill for the balance of your service.

Does Medicare savers have a penalty?

Also, those that qualify for a Medicare Savings Program may not be subject to a Part D or Part B penalty. Although, this depends on your level of extra help and the state you reside in. Call the number above today to get rate quotes for your area.

Qualified Medicare Beneficiary (QMB) Program

One type of Medicare Savings Program is the Qualified Medicare Beneficiary Program, or QMB. The Medicare QMB helps pay for Medicare Part A and Part B premiums, deductibles and coinsurance copayments.

Specified Low-Income Medicare Beneficiary (SLMB) Program

The Specified Low-Income Medicare Beneficiary (SLMB) Program helps pay for Medicare Part B premiums only. The 2020 SLMB income limits are:

Qualifying Individual (QI) Program

The Qualifying Individual (QI) Program helps a qualifying individual pay Medicare Part B premiums, and it comes with the following income and resource limits in 2020:

Qualified Disabled and Working Individuals (QDWI) Program

The Qualified Disabled and Working Individuals (QDWI) Program helps beneficiaries pay for their Medicare Part A premium. The 2020 QDWI income and resource limits are:

What Counts As a Financial Resource?

The resources used to determine eligibility for a Medicare Savings Program include money in a checking or savings account, stocks and bonds.

How many credits can you earn on Medicare?

Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

What is Medicare's look back period?

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

How does Medicare affect late enrollment?

If you do owe a premium for Part A but delay purchasing the insurance beyond your eligibility date, Medicare can charge up to 10% more for every 12-month cycle you could have been enrolled in Part A had you signed up. This higher premium is imposed for twice the number of years that you failed to register. Part B late enrollment has an even greater impact. The 10% increase for every 12-month period is the same, but the duration in most cases is for as long as you are enrolled in Part B.

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.

What is extra help for Medicare?

Extra Help is the federal program that helps with Part D prescription drug costs if you meet the income and asset requirements. This change helps more people become eligible for MSPs and was a result of the Medicare Improvements for Patients and Providers Act (MIPPA). In 2021, the asset limits for full Extra Help are $9,470 for individuals ...

Why is the MSP limit lower than the extra help limit?

MSP limits appear lower than Extra Help limits because they do not automatically include burial funds. This means that the $1,500 disregard for MSP eligibility typically will not apply unless you prove that you have set aside these funds in a designated account or in a pre-paid burial fund.

Does MAGI include SSI?

Tax-exempt interest. MAGI does not include Supplemental Security Income (SSI) See how to make an estimate of your MAGI based on your Adjusted Gross Income. The chart below shows common types of income and whether they count as part of MAGI.

Do you have to report health insurance changes to the marketplace?

Report income changes to the Marketplace. Once you have Marketplace health insurance, it’s very important to report any income changes as soon as possible. If you don’t report these changes, you could miss out on savings or wind up having to pay money back when you file your federal tax return for the year.

Is Marketplace Savings based on income?

Marketplace savings are based on total household income, not the income of only household members who need insurance. If anyone in your household has coverage through a job-based plan, a plan they bought themselves, a public program like Medicaid, CHIP, or Medicare, or another source, include them and their income on your application.

Qualified Medicare Beneficiary (QMB) Program

- One type of Medicare Savings Program is the Qualified Medicare Beneficiary Program, or QMB. The Medicare QMB helps pay for Medicare Part A and Part Bpremiums, deductibles and coinsurance copayments. The income limit for QMB in 2020 is: 1. Individuals Monthly income or no more than $1,084 and financial resources valued at no more than $7,860 2. Marr...

Specified Low-Income Medicare Beneficiary (SLMB) Program

- The Specified Low-Income Medicare Beneficiary (SLMB) Program helps pay for Medicare Part B premiums only. The 2020 SLMB income limits are: 1. Individuals Monthly income of no more than $1,296 and resources valued at no more than $7,860 2. Married couples Income of no more than $1,744 and resources valued at no more than $11,800

Qualifying Individual (Qi) Program

- The Qualifying Individual (QI) Program helps a qualifying individual pay Medicare Part B premiums, and it comes with the following income and resource limits in 2020: 1. Individuals Monthly income of no more than $1,456 and resources valued at no more than $7,860 2. Married couples Income of no more than $1,960 and resources valued at no more than $11,800

Qualified Disabled and Working Individuals (QDWI) Program

- The Qualified Disabled and Working Individuals (QDWI) Program helps beneficiaries pay for their Medicare Part A premium. The 2020 QDWI income and resource limits are: 1. Individuals Monthly income of no more than $4,339 and resources valued at no more than $4,000 2. Married couples Income of no more than $5,833 and resources valued at no more than $6,000

What Counts as A Financial Resource?

- The resources used to determine eligibility for a Medicare Savings Program include money in a checking or savings account, stocks and bonds. The following assets are not included: 1. Your home 2. One car 3. A burial plot 4. Up to $1,500 for burial expenses 5. Furniture 6. Other household and personal items You must also meet the following criteria in order to be eligible fo…