Medicare Wages and Tips may also be calculated by taking the amount in Box 1 and ADDING all of your TIAA-CREF retirement deductions. Retirement contributions are not taxable for federal income tax, however, they are taxable for Medicare (Medic) tax.

How do you calculate Medicare taxable wages?

The Medicare wages and tips section on a W-2 form states the amount of your earnings that are subject to Medicare tax withholding. The number included in this box will usually be identical to the “wages, tips, other compensation” section on the W-2 form. These matching numbers show that the Medicare tax is based on 100% of an employee’s earnings.

What wages are Medicare taxable?

Sep 26, 2017 · Subtract applicable pretax deductions from the employee’s gross pay – earnings before deductions – to arrive at Medicare wages. This process gives the employee a tax break since it reduces the amount of wages subject to Medicare tax. If the employee has no pretax deductions, her entire gross pay is also her Medicare wages.

Why are Medicare wages higher than wages?

Mar 07, 2020 · This is the amount of social security tax withheld from your wages during the calendar year. The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction. Beside above, how are wages calculated on w2? Find …

Are all wages subject to Medicare tax?

Nov 24, 2003 · Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. Employees whose wages exceed $200,000 are also subject to a 0.9% Additional Medicare Tax. 2 Employers also...

How do you calculate Medicare wages and tips?

Medicare Wages and Tips may also be calculated by taking the amount in Box 1 and ADDING all of your TIAA-CREF retirement deductions. Retirement contributions are not taxable for federal income tax, however, they are taxable for Medicare (Medic) tax.

What are Medicare wages and tips on w2?

Box 5 "Medicare wages and tips": This is total wages and tips subject to the Medicare component of social security taxes. Box 6 "Medicare tax withheld": This is Medicare tax withheld from your pay for the Medicare component of social security taxes. The rate is 1.45% of the Medicare wage base.

Are tips included in Medicare wages?

Box 1 (Wages, Tips and Other Compensation) represents the amount of compensation taxable for federal income tax purposes while box 3 (Social Security Wages) represents the portion taxable for social security purposes and box 5 (Medicare Wages) represents the portion taxable for Medicare tax purposes.

What wages are included in Medicare wages?

Key TakeawaysMedicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. ... Employers also pay 1.45%. ... The Medicare tax for self-employed individuals is 2.9% to cover both the employee's and employer's portions.More items...

What are wages and tips?

Definition. Wages, tips and other compensation describes the total federal taxable income reported by your employer. The total dollar mount is a combination of your gross pay, plus any cash you received, plus any noncash benefits.

What is state wages tips etc on W-2?

Box 16: State wages, tips, etc. – This amount represents the total of taxable wages earned in that state. Box 17: State Income tax – This amount represents the total of state income taxes withheld from your paycheck for the wages reported in Box 16.

How do you calculate allocated tips?

The first step is determining how much money tipped employees should earn. To do this, you can multiply your gross receipts for the payroll period by 8%, which is the approved portion of sales that tips need to meet or surpass. Then, you can subtract the total value of tips that indirectly tipped employees report.Jul 8, 2021

How do you prove tips as income?

Attach Form 4137, Social Security and Medicare Tax on Unreported Tip Income, to Form 1040, U.S. Individual Income Tax Return, or Form 1040-SR, U.S. Tax Return for Seniors, to report tips allocated by your employer (in Box 8 of Form W-2). Other tips not reported to the employer must also be reported on Form 4137.

How much of my tips should I claim?

If you receive $20 or more per month in cash tips, report that income to your employer. Your employer will report your tip income on your W-2, Box 7 (Social Security tips). The law assumes an average tip rate of 8%, and it expects employees to report tips at least 8% of the gross food and drink sales.

What is the difference between Medicare wages and gross wages?

It is calculated the same way as Social Security taxable wages, except there is no wage limit. Medicare taxable wage refers to the employee wages on which Medicare tax is paid. It is calculated as the employee's gross earnings less the non-taxable items, without any maximum on gross wages.

How to determine Medicare tax amount?

To determine the amount of Medicare tax an employee should pay, you must first figure the wages. Determine whether the employee has voluntary pretax deductions. These are deductions the employer offers and the employee accepts.

How much Medicare tax is paid if there is no pretax deduction?

If the employee has no pretax deductions, her entire gross pay is also her Medicare wages. Calculate Medicare tax at 1.45 percent of the employee’s Medicare wages to arrive at the amount of tax to withhold. Notably, the employer pays an equal portion of Medicare tax.

What is pretax deduction?

Pretax deductions are those that meet the requirements of IRS Section 125 code, such as a traditional 401k plan, a Section 125 medical or dental plan or a flexible spending account. Subtract applicable pretax deductions from the employee’s gross pay – earnings before deductions – to arrive at Medicare wages.

Is Medicare based on wages?

Unlike federal income tax, which depends on varying factors such as the employee’s filing status and allowances, Medicare tax is based on a flat percentage of wages. Furthermore, unlike Social Security tax, which has an annual wage limit, Medicare has none.

Can an employer withhold Medicare from employee wages?

An employer is legally required to withhold Medicare tax from employee wages. The employee is exempt from withholding only if an exception applies, such as if she works for a university at which she is also a student.

How is Medicare calculated on W2?

How are Medicare wages calculated on w2? It is calculated as the employee's gross earnings less the non-taxable items, without any maximum on gross wages. Employers are required to withhold 1.45% of employee's Medicare wages as Medicare tax and submit a matching amount to cover the costs of the Medicare program. Click to see full answer.

What is Medicare payroll tax?

Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the "Medicare tax.". Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government's Medicare program, which provides subsidized healthcare and hospital insurance benefits to retirees and the.

What is Medicare wages?

What Are Medicare Wages? Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax. Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government's Medicare program, which provides subsidized healthcare and hospital insurance benefits to people ages 65 ...

How much is Medicare taxed?

Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. Employers also pay 1.45%. Employees whose wages exceed $200,000 are also subject to a 0.9% Additional Medicare Tax.

What is the Medicare tax rate for self employed?

The Medicare tax for self-employed individuals is 2.9% to cover both the employee's and employer's portions. 2 . The 2020 CARES Act expanded Medicare's ability to cover the treatment and services of those affected by COVID-19. Employees should also consider having money deducted from their wages to fund their retirement through an ...

Can you deduct retirement from paycheck?

In many cases, you can elect to have a portion deducted from your paycheck for this purpose. Many employers offer certain types of retirement plans, depending on the length of time an employee has been with an organization (known as vesting) and the type of organization (company, nonprofit, or government agency).

Do self employed people pay Medicare?

Self-employed individuals must pay double the Medicare and Social Security taxes that traditional employees pay because employers typically pay half of these taxes. But they are allowed to deduct half of their Medicare and Social Security taxes from their income taxes. 6 .

Is there a limit on Medicare tax?

4 . Unlike the Social Security tax, there is no income limit on the Medicare tax.

What to call if your W-2 does not match Social Security?

If you find that after making these adjustments to your Gross Pay YTD per your final pay stub, the result does not match Box 3 Social Security Wages and Box 5 Medicare Wages on your W-2, call Central Payroll, 617-495-8500, option 4 for assistance.

What to call if your W-2 does not match Box 1?

If you find that after making these adjustments to your Gross Pay YTD per your final pay stub, the result does not match Box 1 Federal Wages and Box 16 State Wages on your W-2, call Central Payroll, 617-495-8500, option 4, for assistance.

What is the Medicare tax rate?

The Medicare tax rate is 1.45% each for the employee and employer, unchanged from 2019. There is no wage base limit for Medicare tax. What is excluded from Medicare wages? The non-taxable wages are deductions appearing on the pay stub under 'Before-Tax Deductions.

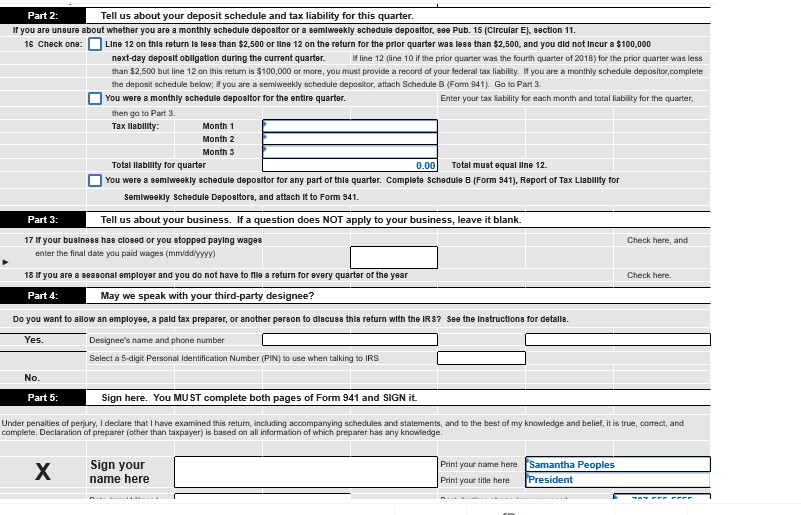

How much is a 941?

Completing Form 941 When you calculate the amount to send to the IRS, in addition to federal income tax, the payment must reflect 6.2 percent of each employee's wages, up to $132,900 in 2019, for Social Security insurance.

What is the starting point for tax liability?

1. Gross wages . Gross wages are the starting point from which the IRS calculates an individual’s tax liability. The total amount of money paid to an employee equals their gross wages , so add up all payments such as a salary and overtime as well as reimbursements for items like tuition and business expenses.

What is considered income tax?

Any income earned by an individual is subject to taxation by the government. This includes earnings in the form of hourly pay, overtime wages, a salary, commissions, bonuses, and even tips and severance pay.

Is pretax income the same as gross wages?

This is not the same as pretax income, which applies to businesses, not individual workers. After all qualified deductions are subtracted from gross wages, the remainder is the taxable wage amount. If an employee has no deductions, then gross wages equate to the taxable wage amount.