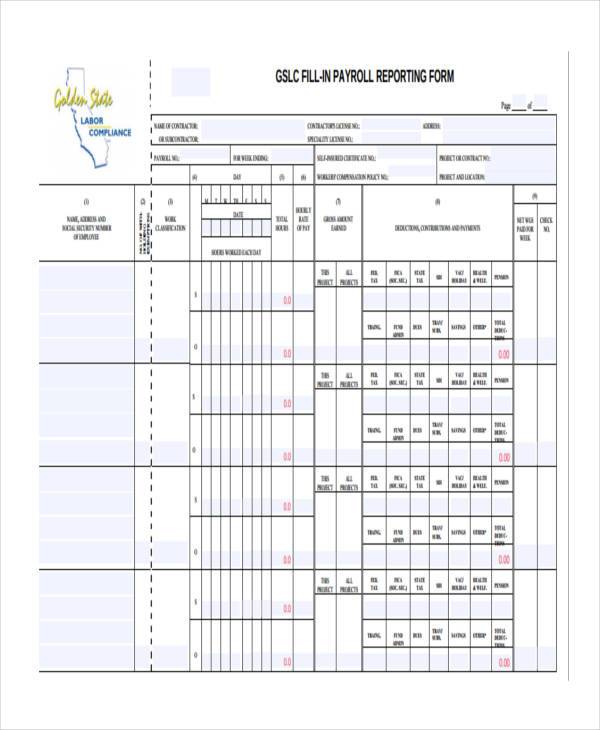

Actually paying your Social Security and Medicare taxes involves completing a couple of forms along with your IRS Form 1040 (your income tax form). File Schedule C (Profit or Loss from a Business) as well as Schedule SE (Self-Employment Tax). All of these forms are available from the IRS's website, and include instructions for filling them out.

How to pay Social Security and Medicare taxes?

How to Pay Social Security and Medicare Taxes. 1. Work with an accountant or tax professional. Tax laws are subject to change, and can be complex. Talk to an accountant or tax professional if you ... 2. Fill out the required IRS forms. Actually paying your Social Security and Medicare taxes involves ...

How are Social Security and Medicare calculated?

These amounts are based on an employee's wages. Social Security is calculated by multiplying the wage amount by 6.2% and Medicare is calculated by multiplying the wage amount by 1.45%.

How do I apply for Medicare?

You can apply online for Medicare or continue an application you already started. If you are almost 65 but you don't want your retirement benefits to start, you can just apply online for Medicare using the "Retirement/Medicare Benefits" application. Information You May Need to Apply:

How do I report my earnings for Social Security?

You report your earnings for Social Security when you file your federal income tax return. If your net earnings are $400 or more in a year, you must report your earnings on Schedule SE, in addition to the other tax forms you must file.

How do I claim Social Security and Medicare taxes?

You must complete and submit IRS Form 843 to claim a refund of Social Security and Medicare taxes. When you apply for a refund from the IRS, include either: A letter from your employer stating how much you were reimbursed. A cover letter attesting that your employer has refused or failed to reimburse you.

How do I submit wages to Social Security?

You may call us at 1-800-772-1213. Or you may call, visit, or write your local Social Security office. Social Security also offers a toll-free automated wage reporting telephone system and a mobile wage reporting application. You may also use my Social Security to report wages online.

Are Medicare wages the same as Social Security wages?

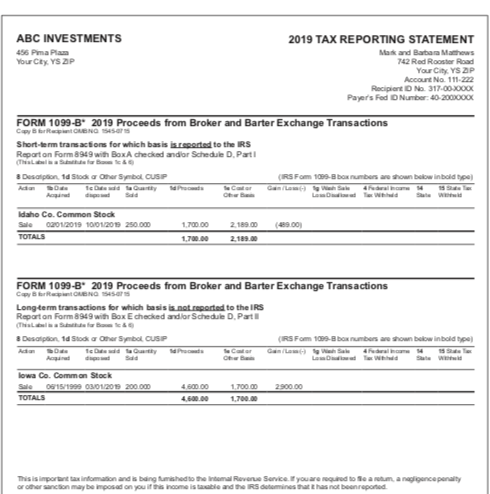

Box 1 (Wages, Tips and Other Compensation) represents the amount of compensation taxable for federal income tax purposes while box 3 (Social Security Wages) represents the portion taxable for social security purposes and box 5 (Medicare Wages) represents the portion taxable for Medicare tax purposes.

How do independent contractors pay Social Security and Medicare?

Independent contractors contribute to Social Security and Medicare through the self-employment tax (SET). Since ICs have no employer, they pay both the employer and the employee shares of the Social Security and Medicare contributions.

How do I send my W-2 to Social Security?

Review your paper Forms W-2, especially Copy A, to ensure that they print accurately prior to mailing them to Social Security's Wilkes-Barre Direct Operations Center. Social Security accepts laser printed Forms W-2/W-3 as well as the standard red drop-out ink forms.

What happens if I don't report wages to SSI?

We may apply a penalty that will reduce your SSI payment by $25 to $100 for each time you fail to report a change to us, or you report the change later than 10 days after the end of the month in which the change occurred.

Why does my W-2 not have Social Security wages?

Social Security wages should be in box 3 and the Social Security Taxes withheld should be in box 4 of the W-2. Contact your employer for either an explanation of why there are no SS wages or taxes withheld or to get a corrected W-2.

Are Box 1/3 and 5 the same on W-2?

Question: Why doesn't Box 1 match Box 3 and Box 5? Answer: Box 3 and Box 5 include your tax-deferred retirement contributions, Box 1 does not.

Do I have to report Box 12 D on my tax return?

The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan on an employee's Form W-2, Wage and Tax Statement, in Box 12, using Code DD.

Do 1099 employees pay Medicare?

In addition to paying federal and state income taxes, independent contractors, the self-employed, freelancers, and anyone who receives a 1099 are also responsible for paying self-employment income taxes, i.e, Social Security and Medicare taxes.

Can you be self-employed and collect Social Security?

Yes, you pay Social Security if you are self-employed. Those new to working for themselves need to know that your employer paid half of your social security contributions and you paid the other half.

Do 1099 employees get Social Security benefits?

Your 1099 income would count as earnings that could be used to calculate your Social Security benefit amount provided that you report the 1099 income as self employment earnings and pay self-employment taxes on your net profit.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

How much is Medicare tax?

Taxes for Medicare are currently set at 2.9 percent of your income . If you receive wages from an employer, this is split 50/50, and each of you pays 1.45 percent of the total tax. If you are self-employed, you must pay the full amount yourself. [3]

How much is SS taxed?

All of your wages and income will be subject to SS taxes because they total less than $127,200. If you have $100,000 from wages and $50,000 from self-employment income, your employer will take out Social Security taxes on your wages.

How much is Social Security tax?

Currently, Social Security taxes amount to 12.4 percent of your income. If you work with an employer, this amount is split 50/50 (you pay 6.2 percent, and your employer pays the other 6.2 percent). If you are self-employed, you need to calculate 12.4 percent of your income and pay this amount yourself. [2]

Do you pay FICA taxes if you are self employed?

If you earn wages from an employer, these are called Federal Insurance Contributions Act (FICA) taxes, and they are split 50/50 between the two of you. If you are self-employed, according to the Self-Employment Contributions Act (SECA), you must pay the full amount of these taxes yourself. When completing your yearly income taxes, you will need ...

Who is Darron Kendrick?

This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984. This article has been viewed 26,463 times.

Is Social Security split 50/50?

It is not split 50/50. Pay both FICA and SECA Social Security taxes, if necessary. If you have both wages from an employer and income from self-employment, Social Security taxes are paid on your wages first, but only if your total income is more than $127,200.

Apply for Retirement Benefits

Starting your Social Security retirement benefits is a major step on your retirement journey. This page will guide you through the process of applying for retirement benefits when you’re ready to take that step. Our online application is a convenient way to apply on your own schedule, without an appointment.

Ready To Retire?

Before you apply, take time to review the basics, understand the process, and gather the documents you’ll need to complete an application.

What is self employment tax?

Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. You figure self-employment tax (SE tax) yourself using Schedule SE (Form 1040 or 1040-SR).

How much is Medicare tax for 2021?

The amount increased to $142,800 for 2021. (For SE tax rates for a prior year, refer to the Schedule SE for that year). All your combined wages, tips, and net earnings in the current year are subject to any combination of the 2.9% Medicare part of Self-Employment tax, Social Security tax, or railroad retirement (tier 1) tax.

What is the tax rate for self employment?

The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance). For 2020, the first $137,700 of your combined wages, tips, and net earnings is subject to any combination of the Social Security part of self-employment tax, ...

What is Schedule C for self employed?

If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-emplo yment. If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total ...

When do you have to use the maximum earnings limit?

If you use a tax year other than the calendar year, you must use the tax rate and maximum earnings limit in effect at the beginning of your tax year. Even if the tax rate or maximum earnings limit changes during your tax year, continue to use the same rate and limit throughout your tax year.

Can you deduct Social Security and Medicare taxes?

Also, you can deduct the employer-equivalent portion of your SE tax in figuring your adjusted gross income. Wage earners cannot deduct Social Security and Medicare taxes.

Does the 1040 affect self employment?

This deduction only affects your income tax. It does not affect either your net earnings from self-employment or your self-employment tax. If you file a Form 1040 or 1040-SR Schedule C, you may be eligible to claim the Earned Income Tax Credit (EITC).

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What makes a worker an "employee"

A business may hire a worker as an independent contractor, but the worker may be classified as a paid employee by the Internal Revenue Service, depending on how their position is structured.

When to use Form 8919

Perform services for a company that aren’t those of an independent contractor as defined by the IRS, and Social Security and Medicare taxes were not withheld from your pay

Don't use Form 4137

Prior to the introduction of Form 8919, workers may have used Form 4137 to report Social Security and Medicare amounts. Since 2008, usually only tipped employees use Form 4137 to report Social Security and Medicare amounts on allocated tips and those not reported by their employers.