Part 2 of 2: Paying Your Taxes

- Work with an accountant or tax professional. Tax laws are subject to change, and can be complex. ...

- Fill out the required IRS forms. Actually paying your Social Security and Medicare taxes involves completing a couple of forms along with your IRS Form 1040 (your income tax ...

- Take the allowable tax deductions. While you must pay the full amount of Social Security and Medicare taxes if you are self-employed, you can also claim a few tax ...

- Pay any tax remaining. The amount you owe in Social Security and Medicare taxes equals the standard tax percentages of your income minus any deductions you are eligible for.

Full Answer

What is the Medicare tax?

Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. Employers calculate Social Security and Medicare taxes of most wage earners. However, you figure self-employment tax (SE tax) yourself using …

How do I calculate my social security and Medicare taxes?

Jun 17, 2020 · The form provides information on the amount of Social Security income you received, which you’ll report to the IRS when you file your tax return. How it relates to Medicare. This form has little ...

Do you have to withhold Medicare tax?

Nov 02, 2021 · Medicare taxes, along with other types of Federal income taxes, as well as Social Security, should be deposited through the Electronic Federal Tax Payment System. Late deposits may incur financial penalties. Every quarter you’ll need to file IRS Form 941. This is the Employer’s Quarterly Federal Tax Return.

Do I have to pay Social Security and Medicare taxes?

If you are self-employed, you must file a Schedule C each year along with your Form 1040. The Schedule C is where you report your business earnings and expenses and calculate your net profit or loss. You’ll also include your estimated tax payments on the Form 1040, deducting them from your total tax obligation to calculate any remaining tax due.

How do I file Medicare on my taxes?

Do you have to file Medicare on taxes?

Do I need my 1095-B to file taxes?

Where is Medicare tax on return?

Do I get a 1095-A for Medicare?

How do I get a 1099 from Medicare?

What happens if I don't file my 1095-B?

What is the difference between IRS Form 1095-A and 1095-B?

Where do I report 1095-B on my tax return?

- Check the “Full-year coverage” box on your federal income tax form. You can find it on Form 1040 (PDF, 147 KB).

- If you got Form 1095-B or 1095-C, don't include it with your tax return. Save it with your other tax documents.

Are Medicare withholdings tax deductible?

Does Medicare tax count as federal withholding?

Why do I pay for Medicare tax?

Does Medicare send a 1099?

Does Medicare send a tax statement?

Are Medicare premiums deducted from Social Security tax-deductible?

Does Medicare have deductible?

How to pay Social Security and Medicare taxes?

Fill out the required IRS forms. Actually paying your Social Security and Medicare taxes involves completing a couple of forms along with your IRS Form 1040 (your income tax form). File Schedule C (Profit or Loss from a Business) as well as Schedule SE (Self-Employment Tax). All of these forms are available from the IRS's website, and include instructions for filling them out. [7]

How much is Medicare tax?

Taxes for Medicare are currently set at 2.9 percent of your income . If you receive wages from an employer, this is split 50/50, and each of you pays 1.45 percent of the total tax. If you are self-employed, you must pay the full amount yourself. [3]

What is the FICA rate?

The FICA rate is 6.2% of wages paid up to $128,400. This may change for 2019.

How to apply for religious exemption for Social Security?

Certain recognized religious groups opposed to Social Security and Medicare can apply for the exemption by filling out IRS Form 4029.

How much is SS taxed?

All of your wages and income will be subject to SS taxes because they total less than $127,200. If you have $100,000 from wages and $50,000 from self-employment income, your employer will take out Social Security taxes on your wages.

How is Social Security calculated?

These amounts are based on an employee's wages. Social Security is calculated by multiplying the wage amount by 6.2% and Medicare is calculated by multiplying the wage amount by 1.45%.

How much is Social Security tax?

Currently, Social Security taxes amount to 12.4 percent of your income. If you work with an employer, this amount is split 50/50 (you pay 6.2 percent, and your employer pays the other 6.2 percent). If you are self-employed, you need to calculate 12.4 percent of your income and pay this amount yourself. [2]

How much is Medicare tax for 2021?

The amount increased to $142,800 for 2021. (For SE tax rates for a prior year, refer to the Schedule SE for that year). All your combined wages, tips, and net earnings in the current year are subject to any combination of the 2.9% Medicare part of Self-Employment tax, Social Security tax, or railroad retirement (tier 1) tax.

What is self employment tax?

Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. You figure self-employment tax (SE tax) yourself using Schedule SE (Form 1040 or 1040-SR).

What is the tax rate for self employment?

The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance). For 2020, the first $137,700 of your combined wages, tips, and net earnings is subject to any combination of the Social Security part of self-employment tax, ...

What is Schedule C for self employed?

If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-emplo yment. If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total ...

Does the 1040 affect self employment?

This deduction only affects your income tax. It does not affect either your net earnings from self-employment or your self-employment tax. If you file a Form 1040 or 1040-SR Schedule C, you may be eligible to claim the Earned Income Tax Credit (EITC).

Is self employment tax included in Medicare?

Self-Employment Tax (Social Security and Medicare Taxes) It should be noted that anytime self-employment tax is mentioned, it only refers to Social Security and Medicare taxes and does not include any other taxes that self-employed individuals may be required to file. The list of items below should not be construed as all-inclusive.

Do you pay Medicare on your wages?

However, you must pay the 2.9% Medicare part of the SE tax on all your net earnings.

What happens if you don't have Medicare?

If you had Medicare Part A or Medicare Part C, you met the individual mandate. If you didn’t have health insurance coverage, though, you were subject to a penalty fee, which was calculated as a percentage of your income. In 2019, the U.S. Department of Justice and federal appeals courts ruled that the individual mandate was unconstitutional.

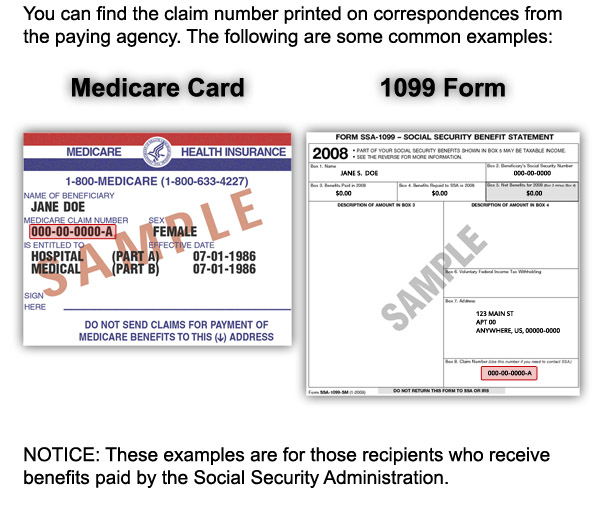

When is the SSA 1099 mailed?

The annual benefit statement from the Social Security Administration is form SSA-1099/1042S. It is mailed to beneficiaries every January.

What is a 1095-B?

The 1095-B Qualifying Health Coverage Notice is a tax form that was developed in response to a provision of the 2010 Affordable Care Act (ACA). The ACA was phased in over several years, and in 2014, everyone was required to have health insurance through the individual mandate provision. If you had Medicare Part A or Medicare Part C, ...

Is Healthline Media a licensed insurance company?

Healthline Media does not transact the business of insurance in any manner and is not licensed as an insurance company or producer in any U.S. jurisdiction. Healthline Media does not recommend or endorse any third parties that may transact the business of insurance. Last medically reviewed on June 17, 2020.

When is the 1095-B mailed?

The 1095-B is mailed between Dec. and March 2.

Do you get a 1095B form if you have Medicare?

Here’s what you need to know about the 1095-B form.

Is the 1095-B a reference?

Others, like the 1095-B Qualifying Health Coverage Notice, are now for reference purposes only.

What is Medicare tax?

The Medicare tax is what’s known as a type of payroll tax. It’s paid by both employers and employees, so it’s your responsibility to withhold the correct amount from the salaries of your employees. You also need to make a matching contribution. The Federal Insurance Contributions Act ( FICA) is made up of a combination of Social Security ...

What is the additional Medicare tax?

The Additional Medicare Tax is aimed at high-income taxpayers in the US. This tax is worth approximately 0.9% of everything above a certain limit.

How much is FICA tax?

FICA differs from income taxes because it’s a flat tax of 15.3% per year. The chances are your employees are thinking about whether they must pay this tax on all types of income. The truth is that practically every type of compensation is eligible for Medicare. Certain types of compensation are ignored for Medicare taxation purposes, though.

What happens if you cross the threshold for Medicare?

If you cross this threshold, you’ll be asked to withhold the Additional Medicare Tax.

How much does an employee have to pay for Medicare?

An employee will have to pay 1.45% of their wages every year to cover Medicare taxes. The employer is responsible for calculating the right amount and contributing 1.45% to the program. You can use the free withholding calculator to figure this amount. Medicare itself only makes up 2.9% of FICA.

How often do you deposit Medicare taxes?

Paying and Reporting Medicare Taxes. There’s a depositing schedule you need to follow in order to deposit Medicare taxes. This can be either semi-weekly or monthly. Your tax liability over the last four financial quarters will determine this.

What is Medicare insurance?

Medicare is the health insurance program offered by the Federal government. Millions of people take advantage of it every year and can access world-class medical treatment because of it.

How to determine self employment tax?

Rather, it’s based on your net profit (or net loss). To determine this, you must subtract your business expenses from your business income. If your expenses do not exceed your income, you have a net profit. You can then calculate the precise amount of tax due using Form 1040.

How much do you have to pay for Social Security?

Currently, that means you have to pay 12.4 percent for Social Security and 2.9 percent for Medicaid. If you earn more than $200,000, for taxpayers filing as single, or $250,000, for married taxpayers filing jointly, you’ll have to pay an extra 0.9 percent for Medicare. In general, none of these taxes are considered deductible from your overall ...

What is estimated tax?

Estimated taxes are filed using Form 1040ES—Estimated Tax for Individuals. This form includes vouchers that you can print off and use to mail in your estimated tax payments throughout the year. You can also pay your taxes online with the Electronic Federal Tax Payment System, provided by the IRS.

What is Schedule C on a 1040?

The Schedule C is where you report your business earnings and expenses and calculate your net profit or loss. You’ll also include your estimated tax payments on the Form 1040, deducting them from your total tax obligation to calculate any remaining tax due.

Is self employment tax deductible?

In general, none of these taxes are considered deductible from your overall business overhead. This is the self-employment tax, and it does not take into account federal or state income taxes.

Do you have to pay Medicare and Social Security separately?

If you’re employed by someone else, the employer takes your Social Security and Medicare taxes out of your paycheck for you so that you don’t have to pay them separately. If you’re self-employed—whether you’re working as an independent contractor, a member of a partnership, or as a business owner, even part time—the IRS collects Social Security ...

Can you deduct expenses on your self employment tax return?

If your expenses exceed your profit, however, you have a net loss. Generally, those losses can be deducted from gross income, and the self-employment tax is calculated on the same form. But the government limits the deductibility of losses in some situations. To see if you qualify to deduct a net loss, you must complete Schedule C, following the instructions in IRS Publication 334.

Does Medicare cover travel?

If you have Original Medicare and have a Medigap policy, it may provide coverage for foreign travel emergency health care. Learn more about Original Medicare outside the United States.

Can you voluntarily terminate Medicare Part B?

Voluntary Termination of Medicare Part B. You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 ( PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA ( 1-800-772-1213) to get this form.

How much Medicare tax is due in 2013?

Starting with the 2013 tax year, you may be subject to an additional 0.9 percent Medicare tax on wages that exceed a certain threshold. The Additional Medicare Tax is charged separately from, and in addition to, the Medicare taxes you likely pay on most of your earnings.

When do you file Form 8959?

If you have self-employment income , you file form 8959 if the sum of your self-employment earnings and wages or the RRTA compensation you receive is more than the threshold amount for your filing status.

How to fill out 8959?

Working through Form 8959 1 Fill out Part I if you received W-2 income. 2 Fill out Part II if you received self-employment income. 3 Fill out Part III if you received RRTA

How many parts are on Form 8959?

Form 8959 consists of three parts. Each part includes a short calculation to figure out how much Additional Medicare Tax you owe, if any. You complete only the part of the form that applies to the type of income you received. Fill out Part I if you received W-2 income. Fill out Part II if you received self-employment income.

What is the threshold for married filing jointly for 2020?

On the other hand, if you were married filing separately, you could end up owing more tax, because the threshold is only $125,000.

Do you have to complete Form 8959?

If you had more than one type of income, such as W-2 income and self-employment income, you will have to complete all sections that apply. Once you complete Form 8959 and figure out the total Additional Medicare Tax you're responsible for, the final section of the form subtracts the tax you paid through withholding and estimated tax payments to determine if there is any Additional Medicare Tax due— which ultimately gets reported on your 1040 form.

Is TurboTax free?

Just answer simple questions about your life, and TurboTax Free Edition will take care of the rest.

Phone

For specific billing questions and questions about your claims, medical records, or expenses, log into your secure Medicare account, or call us at 1-800-MEDICARE.

1-800-MEDICARE (1-800-633-4227)

For specific billing questions and questions about your claims, medical records, or expenses, log into your secure Medicare account, or call us at 1-800-MEDICARE.