How to complete the AARP medicare supplement application form online: To get started on the document, utilize the Fill camp; Sign Online button or tick the preview image of the form. The advanced tools of the editor will direct you through the editable PDF template. Enter your official identification and contact details.

Full Answer

How to fill out the AARP Medicare supplement application form?

Use this step-by-step guide to fill out the Aarp medicare supplement application form quickly and with perfect accuracy. To get started on the document, utilize the Fill & Sign Online button or tick the preview image of the form. The advanced tools of the editor will direct you through the editable PDF template.

How do I sign the Medicare supplement application form?

Make use of the Sign Tool to create and add your electronic signature to signNow the Aarp medicare supplement application form. Press Done after you finish the form. Now you'll be able to print, save, or share the document. Follow the Support section or contact our Support staff in the event that you have got any questions.

What are AARP application printableblets?

aarp application printableblets are in fact a ready business alternative to desktop and laptop computers. You can take them everywhere and even use them while on the go as long as you have a stable connection to the internet. Therefore, the signNow web application is a must-have for completing and signing aarp application on the go.

Why start eSigning AARP application form with US?

Start eSigning aarp application form with our tool and become one of the numerous satisfied customers who’ve already experienced the key benefits of in-mail signing. aarp application printableblets are in fact a ready business alternative to desktop and laptop computers.

Can you add a supplement to Medicare at any time?

One interesting feature of Medicare Supplement insurance plans is that you can apply for a plan anytime – you only need to be enrolled in Medicare Part A and Part B. However, a plan doesn't have to accept your application, unless you have guaranteed-issue rights.

What is the monthly premium for AARP Medicare Supplement?

2. AARP Medigap costs in states where age affects pricing. In states with this pricing structure, the average monthly cost for the AARP Medigap Plan G is $124 per month for someone who is 65 years old. At age 75, the average monthly premium is $199, and it's $209 for those aged 85.

What is the AARP 24 month rule?

You qualify for full Medicare benefits under age 65 if: You have been entitled to Social Security disability benefits for at least 24 months (that need not be consecutive); or. You receive a disability pension from the Railroad Retirement Board and meet certain conditions; or.

What is the average cost of AARP Medicare supplement insurance?

Luckily, that's simple and inexpensive to do — a membership costs about $16 per year. Next, pay careful attention to your enrollment period. The best time to join a Medicare Supplement plan — AARP or otherwise — is during your Initial Enrollment Period (IEP).

Who is the best Medicare supplement provider?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

Does AARP plan G have a deductible?

Plans F and G also offer a high deductible plan which has an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

How long do I have to enroll in a Medicare Supplement?

six monthsThe best time to enroll in a Medicare Supplement plan may be your Medicare Supplement Open Enrollment Period. This period lasts six months and begins the first day of the month in which you are both 65 or older and enrolled in Medicare Part B. For example, your birthday is August 31, 1953, so you turn 65 in 2018.

Is AARP UnitedHealthcare good?

Yes, AARP/UnitedHealthcare Medicare Advantage plans provide good coverage and have an average overall rating of 4.2 stars. The company stands out for cheap PPO plans that cost $15 per month on average. The downside is overall customer satisfaction trails behind other companies such as Humana and Anthem.

Can you be dropped from a Medicare Supplement plan?

All Medigap policies issued since 1992 are guaranteed renewable. . This means your insurance company can't drop you unless one of these happens: You stop paying your premiums.

Does AARP own UnitedHealthcare?

UnitedHealth Group not only owns UnitedHealthcare, it also owns one of the country's largest PBMs, OptumRx, with whom AARP also has a revenue-generating, branded prescription drug plan.

Does AARP supplemental cover Part B deductible?

In addition to the standard benefits offered under Plan A, AARP's Medicare Supplement Plan F covers: Medicare Part B excess charges. Your Medicare Part A deductible ($1,408 in 2020)

Does AARP Medicare Supplement cover deductible?

It covers the Medicare Part B deductible, skilled nursing facility care, and foreign travel. This plan is available only to people who were eligible for Medicare before January 1, 2020. Medicare Supplement Plan F.

To Fill In Aarp Medicare Supplement Application Form , Follow the Steps Below

Draw Up your Aarp Medicare Supplement Application Form online is easy and straightforward by using CocoSign . You can simply get the form here and then put down the details in the fillable fields. Follow the guides given below to complete the document.

How to employ The Aarp Medicare Supplement Application Form ?

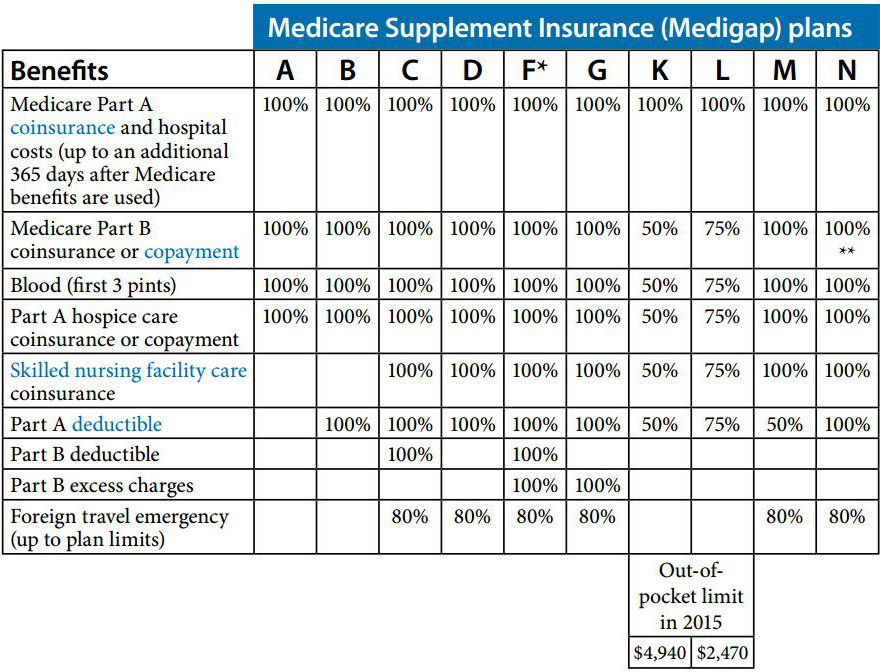

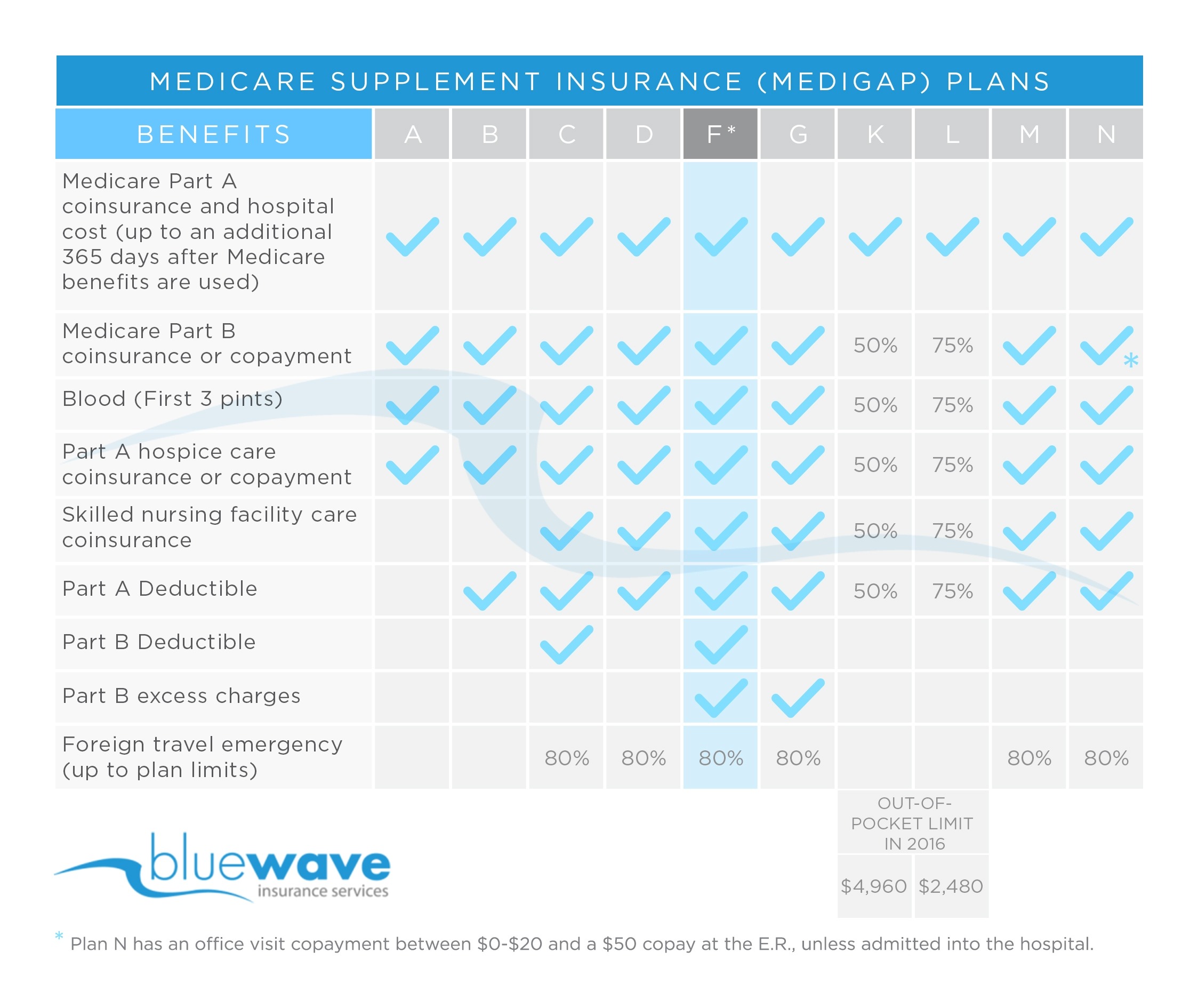

hi folks Christian brindle here and.today I wanted to do a quick Medicare.supplement review our third of this.series of the AARP Medicare supplement.plans provided from United Healthcare.now a lot of people that see these.actually think that their coverage is.being provided by AARP it's a common.misconception AARP is simply a sponsor.they had they have a agreement to where.they will exclusively represent and.sponsor UnitedHealthcare Medicare.supplement plans so they're the only.company that has this agreement with the.AARP brand but AARP actually does not.provide any insurance of any kind with.any 12 any to anyone they actually just.sponsor different insurance companies.they do they have a company that they.sponsor for life insurance they have a.company that they sponsor for car.insurance and so on and so forth United.Healthcare is their company of choice.for Medicare supplement plans so without.further ado let's jump right into this.so what's the first thing we know about.UnitedHealthcare well United Healthcare.is a gigantic insurance company in fact.they're number six on the fortune 500.list they are the largest insurance.company that offers Medicare supplement.and Medicare Advantage plans and they.actually have the largest market share.of any company they have a 31% market.share as of 2018 I'm sure it's much.larger now as we are in 2020 as I record.this as I mentioned they're the only.company with the AARP affiliation and.like we mentioned they're number six in.the fortune 500 list right behind Amazon.which is at number five.Medicare supplement plans as many of you.may already know are standardized.meaning that the plans are themselves.are designed by the government and then.given to private insurance companies to.market which means the plans you see in.front of you are the different plans.that are going to be available in 2020.and going forward not just for United.Healthcare but for every single Medicare.supplement insurance company every.single company takes these plans as is.as they're designed by Medicare and then.they determine what price they're going.to charge as far as a premium is.concerned monthly not only that they.also determine how much they're going to.raise their rates every single year as.the person gets older United Healthcare.has a very unique way of going about.this which we will touch on later on in.this presentation now Medicare.supplements Plan F and G and C excuse me.F isn't Frank and C as in Charlie as you.can see over here on this right-hand.side of the screen will not be eligible.to people that become eligible for.Medicare starting January 1st and going.forward this is due to the Macra bill.that passed in 2015 and just started.taking effect in 2020 so but what this.means is people that have a plan F or a.plan C will still be able to keep their.plans that just grandfathered in and.people that were eligible for Medicare.before January 1st for 2020 will still.have the option of purchasing an F or C.if they so choose to the way that the.Medicare supplement chart works here is.this shows the different plans and what.percentages if a hundred percent or if.at all they'll cover of the gaps that.Medicare leaves behind as many people.know Medicare Parts A and Medicare Part.B however 80 percent in most cases of a.person's medical bills Medicare Parts A.and Part B both work like two pieces of.a puzzle that fit together to cover a.person's Medicare out-of-pocket but they.typically only like image pay eighty.percent of the bill.after certain deductibles are met and so.on and so forth so on the side here.under where it says benefits you have.every single thing that Medicare pays.for in these different categories here.like the Medicare Part A coinsurance and.deductibles you can see you have.Medicare supplement plan a B D G K L M.and n and then C and F for people that.were eligible for Medicare before.January 1st of 2020 like I mentioned.earlier medicare plan a and B supplement.plan a and B are not to be confused with.Medicare Parts A and B these are just.Medicare supplement plans the most.popular Medicare supplement plans going.forward have will be plan G and plan n.plan G is the closest thing to plan F.which Plan F was 100% medical coverage.as long as Medicare paid something plan.F would pay for it also plan G is very.similar to that which it covers.everything that Medicare does not cover.with the exception of one thing as you.can see which is the Medicare Part B.deductible which this year in 2020 was.one hundred and ninety eight dollars one.time of year after that deductible is.met the plan G pays a hundred percent of.what Medicare does not pay for the.remainder of the year so in layman's.terms if someone has a Medicare.supplement plan G to partner with their.Medicare Parts A and B they have a.hundred percent full medical coverage as.long as it's covered by Medicare first.the plan n has the same deductible but.it does not cover what's known as.Medicare Part B excess charges which you.don't see typically charged depending on.the area but it still does not cover it.if it were to be charged it also comes.with some co-pays and up to $20.00.doctor cope it could be less depending.on the type of doctor and a $50.emergency room copay so those are the.two most popular plans moving forward.with plan F out of the picture for new.enrollees.so here are some extra perks that in.some areas United Healthcare AARP.Medicare supplement provide it's not in.every area so depending on where you're.watching this from it may be available.it may not but in a lot of areas these.are some things that set AARP plans.apart usually Medicare supplement plans.do not come with anything other than the.traditional Medicare supplement benefits.to where their pain what Medicare.doesn't pay if Medicare pays first the.supplement will pay afterward if.Medicare does not cover something.neither will the supplement but in a lot.of areas the AARP UnitedHealthcare.Medicare supplement plans come with.something called renew active which is.basically like their version of.SilverSneakers which is a benefit to.where they will cover a gym membership.for you for certain locations which is.very cool as well as some exercise.classes in some areas they offer.IMed vision discounts and hearing care.hearing discounts also they in some.areas they provide a nurse line service.which is basically a phone line you can.call and get medical advice 24 hours a.day seven days a week from from from a.registered nurse they also have wellness.coaching benefits in some areas which.basically is coaching to kind of help.you with dietary wellness and health and.things along that nature so this is very.unique because very few Medicare.supplement companies offer these.programs a lot of these programs are.usually only provided to Medicare.Advantage enrollees but with some but in.some states in some markets.UnitedHealthcare Medicare supplement.plans offer these benefits which is huge.so what are some of the perks of going.with an AARP Medicare supplement plan.instead of maybe one of their.competitors well in a lot of markets.their rates are fairly competitive.because they're so large they're able to.remain competitive large market share.allows the ability to spread risk what.this means is because they have more.policyholders on Medicare supplement.plans in the United States as of 2018.they had 4.1 million Medicare supplement.policyholders nationwide as of 2019 they.had four point five million so the.reason for they mention this is because.the lot more customers they have the.harder it is for them to take hardship.financially by paying out certain claims.this matters because when Medicare.supplement companies raise your price.they do so for one of three reasons.number one is age they raise it a.predetermined amount as you get older.number two is inflation the dollar going.down in value makes the cost of medical.care go up number three is if the.company needs to pay out more claims.than they were anticipating and they.make up the difference on the back end.by raising their customers premiums.United Healthcare typically historically.has very very low rate increases in most.places because they're able to spread.risk around probably as much if not more.than any other insurance company in the.industry also they have some of the most.liberal underwriting and I don't mean.political when I say that they have some.of the easiest health questions to pass.in order to qualify if you're not in.you're new to Medicare open enrollment.period typically unless you have some.kind of chronic health problem they will.usually accept you they have to rate.levels they have a prefer they have a.preferred rate which they have a second.list of health questions that they ask.you and they have a non preferred rate.to where as long as you don't have.something.credibly chronic or just got out of the.hospital they'll take you but they might.charge you a little bit more this this.allows them to be able to get customers.that might not be able to get coverage.with further Medicare supplement plans.with any other company but United.Healthcare will take them because.they're underwriting and their health.questions might be a little bit more.liberal to some of their competitors.these are our states that we're able to.offer AARP Medicare supplement plans to.our clients and customers right now we.are located in Utah just outside of Salt.Lake City.we also are licensed in the state of.Colorado South Carolina Idaho Oregon.Texas Florida Virginia California and.it's not on this list yet but we also.are licensed in Washington we'll have an.updated list soon on our future videos.so to refresh Colorado South Carolina.Idaho Oregon Texas Florida Utah Virginia.California and Washington if you'd like.an AARP Medicare supplement plan and you.live in one of those tents all today my.name is Christian brindle I'm a licensed.Medicare expert I've been doing this.since I was 20 years old I've written.three books on the topic of insurance.two about Medicare and I host the.ever-popular.everything Medicare podcast which is the.number one Medicare centric podcast on.the internet today we'll take good care.of you we offer year-round customer.service to all of our clients and.customers if you'd like to see if you.qualify for one of these programs today.don't hesitate to pick up the phone and.call we'd love the opportunity to talk.with you..

How to generate an electronic signature for the Aarp Medicare Supplement Application Form online

CocoSign is a browser based program and can be used on any device with an internet connection. CocoSign has provided its customers with the easiest method to e-sign their Aarp Medicare Supplement Application Form .

How to create an electronic signature for the Aarp Medicare Supplement Application Form in Chrome

Google Chrome is one of the most favored browsers around the world, due to the accessibility of many tools and extensions. Understanding the dire need of users, CocoSign is available as an extension to its users. It can be downloaded through the Google Chrome Web Store.

How to create an electronic signature for the Aarp Medicare Supplement Application Form in Gmail?

These days, businesses have revamped their method and evolved to being paperless. This involves the forming an agreement through emails. You can easily e-sign the Aarp Medicare Supplement Application Form without logging out of your Gmail account.

How to create an e-signature for the Aarp Medicare Supplement Application Form straight from your smartphone?

Smartphones have substantially replaced the PCs and laptops in the past 10 years. In order to fulfilled your needs, CocoSign allows to work more productively via your personal mobile phone.

How to create an e-signature for the Aarp Medicare Supplement Application Form on iOS?

The iOS users would be happy to know that CocoSign present an iOS app to aid them. If an iOS user needs to e-sign the Aarp Medicare Supplement Application Form , put to use the CocoSign program now.

Medicare Advantage Plan Enrollment

Get important information about Medicare Advantage eligibility—including Medicare Special Needs plans. Then see what you need to do to enroll in a plan.

Medicare Prescription Drug Plan Enrollment

Do you need a Medicare Part D prescription drug plan? Get eligibility and enrollment information here.

Medicare Supplement Insurance Plan Application

Find out when and how to apply for Medicare supplement insurance coverage.

Medicare Eligibility

It's important to know when you're eligible for Medicare and what to do if you are.

How to fill out and sign youll online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

How to enroll in Medicare Advantage?

1. On the phone by calling Medicare at 800-633-4227. If you’re hard of hearing and use TTY, call 877-486-2048 toll free. 2. Online at www.medicare.gov. If you use the plan finder program to compare Part D or Medicare Advantage plans, you can enroll in the one of your choice by clicking on the “Enroll” button shown alongside the plan’s name.

What to do if a sales agent signs you up for Medicare Advantage?

If a sales agent signs you up for a Medicare Advantage plan, the plan should call you to check that you understand its conditions and consequences and offer you the chance of withdrawing from the enrollment if you want to. Don’t be rushed into enrolling. Take a few days to consider.

What is a SEP?

Special Enrollment Period (SEP): You’re entitled to an SEP in certain circumstances — for example, if you lose creditable drug coverage (such as from an employer or union), or you turned 65 before moving abroad or going to prison and now want Part D coverage on your return or release.

How long is the initial enrollment period for Medicare?

Initial Enrollment Period (IEP): If you’re not yet in Medicare and have no other drug coverage that’s “creditable” (considered as good as Medicare’s), you can join a drug plan at any time during your seven-month initial Medicare enrollment period.

How long does it take to sign up for Part D?

Technically, you can sign up with a Part D plan on the very last day of your enrollment period. However, it takes time for a plan to process your enrollment information and upload it into the computer system. To be sure of getting your prescriptions filled at the pharmacy without delay on day one of coverage, it’s best to sign up about two weeks ...

When is the open enrollment period for Part D?

This enrollment period runs from Oct. 15 to Dec. 7 each year, with coverage beginning Jan. 1.

What is an acknowledgment of a completed application?

An acknowledgment of your completed application, a copy of it, and details of the plan’s costs and benefits; or. A request for more information to complete the application; or. A notice saying your application has been denied and the reasons why.

Prescription drug formulary and other plan documents

The Plan Documents search tool can help make it easier to find documents for a specific plan, like a plan's provider directory, drug list (formulary) or Evidence of Coverage.

Authorization forms and information

Authorization to Share Personal Information Form (PDF) (89 KB) - Complete this form to give others access to your account. Choose someone you trust such as a spouse, family member, caregiver or friend to access or help you manage your health plan.

Prescription medication forms

Some medications require additional information from the prescriber (for example, your primary care physician). The forms below cover requests for exceptions, prior authorizations and appeals.

Other resources and plan information

Prescription drug coverage determinations and appeals, drug conditions and limitations and quality assurance policies

Disenrollment information

To learn about what can cause automatic disenrollment from a Medicare Part C or Part D plan or to request disenrollment from your current plan to switch to Original Medicare only, please visit the Disenrollment Information page.

Declaration of Disaster or Emergency

If you're affected by a disaster or emergency declaration by the President or a Governor, or an announcement of a public health emergency by the Secretary of Health and Human Services, there is certain additional support available to you.

How to apply for survivor benefits?

To apply for survivor benefits, make sure you have: 1 The Social Security number and death certificate of the late wage earner on whose record you are applying. 2 Your Social Security number and those of any dependent children. 3 Your birth certificate or an acceptable religious record of your birth (such as a baptismal certificate). 4 Your marriage certificate (and divorce papers if filing as a former spouse ). 5 Tax records documenting your earnings.

How to apply for Social Security benefits in person?

You can do that by phone at 800-772-1213, Monday through Friday, 8 a.m. to 7 p.m. ET. To apply for Social Security of any kind while living abroad, contact the nearest U.S. embassy or consulate.

Can I update my Social Security number online?

Many Social Security services are available online and by phone. If you have a "dire need situation" regarding your benefits or need to update information attached to your Social Security number, such as your name or citizenship status, you may be able to schedule an in-person appointment.