To qualify, you must be enrolled in Part A and Part B Medicare. You also need to pay your own Part B premiums. If you receive financial assistance through Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

What are the requirements for Medicare Advantage?

You can do it in one of four ways:

- Apply on the Social Security website

- Visit your local Social Security office

- Call Social Security at 1-800-772-1213 (TTY: 1-800-325-0778)

- If you worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772

- Complete an Application l Enrollment in Part B (CMS-40B)

How much can you make to qualify for Medicare?

What Are the Medicare Income Limits in 2021?

- There are no income limits to receive Medicare benefits.

- You may pay more for your premiums based on your level of income.

- If you have limited income, you might qualify for assistance in paying Medicare premiums.

How to enroll in Medicare Advantage?

- If you move back to the U.S. ...

- If you live in, or recently moved out of an institution (such as a nursing home or rehabilitation hospital), you can join a MAP as long as you live in ...

- If you are released from jail, you can join a MAP for up to two full months after the month you are released.

Who qualifies for a Medicare Advantage plan?

- All-Dual

- Full-Benefit

- Medicare Zero Cost Sharing

- Dual Eligible Subset

- Dual Eligible Subset Medicare Zero Cost Sharing Who is eligible for a DSNP? ...

- You must be a United States citizen or have been a legal resident for at least five years.

- You must be 65 years old or have a qualifying disability if younger than 65.

Is Medicare Advantage based on your income?

Unlike Original Medicare Plan B, Medicare Advantage premiums are not based on income but rather the options offered within a particular plan. Plans that limit coverage to standard Plan A and Plan B offerings may have little to no additional premium.

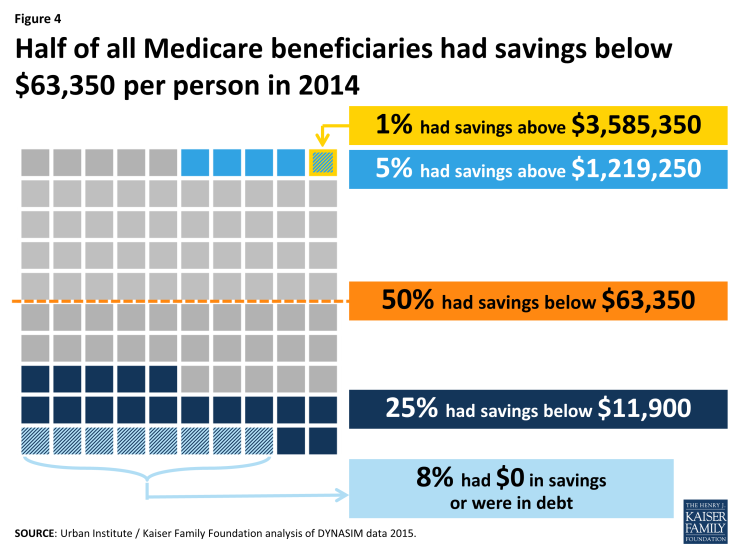

How much money can you have in the bank if your on Medicare?

You may have up to $2,000 in assets as an individual or $3,000 in assets as a couple. As of July 1, 2022 the asset limit for some Medi-Cal programs will go up to $130,000 for an individual and $195,000 for a couple. These programs include all the ones listed below except Supplemental Security Income (SSI).

Can I be turned down for a Medicare Advantage plan?

Generally, if you're eligible for Original Medicare (Part A and Part B), you can't be denied enrollment into a Medicare Advantage plan. If a Medicare Advantage plan gave you prior approval for a medical service, it can't deny you coverage later due to lack of medical necessity.

What are the criteria for Medicare Advantage?

Generally, you can get Medicare if one of these conditions applies: You are at least 65 years old. You are disabled and receive Social Security Disability Insurance (SSDI) or Railroad Retirement disability payments. You have End-Stage Renal Disease (ESRD) and require dialysis or a kidney transplant.

Does Medicare look into your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

What assets are exempt from Medicare?

Other exempt assets include pre-paid burial and funeral expenses, an automobile, term life insurance, life insurance policies with a combined cash value limited to $1,500, household furnishings / appliances, and personal items, such as clothing and engagement / wedding rings.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Can you switch back to traditional Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Why can you be denied Medicare?

Medicare's reasons for denial can include: Medicare does not deem the service medically necessary. A person has a Medicare Advantage plan, and they used a healthcare provider outside of the plan network. The Medicare Part D prescription drug plan's formulary does not include the medication.

Which of the following consumers are eligible for Medicare if other eligibility requirements are met?

Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance).

Do Medicare Advantage plans require underwriting?

Because Advantage plans have no medical underwriting, the insurer must accept you. Many of these plans have extra perks, such as dental, vision or hearing coverage, that original Medicare doesn't provide.

Does Medicare Advantage plans have to follow Medicare guidelines?

Medicare Advantage Plans Must Follow CMS Guidelines In the United States, according to federal law, Part C providers must provide their beneficiaries with all services and supplies that Original Medicare Parts A and B cover. They must also provide any additional benefits proclaimed in their Part C policy.

Is eligibility for all Medicare Advantage plans the same?

No, not all Medicare Advantage plan eligibility is the same. Some plans, called Special Needs Plans (SNPs) have very specific eligibility standards...

What if I can’t afford the plan I want?

If you’ve found a Medicare Advantage plan that seems to suit you but you are worried that you cannot afford its premiums or other costs, you may be...

Do all Medicare Advantage plans include prescription drug coverage?

Many Medicare Advantage plans include coverage for Medicare Part D (Prescription Drug Coverage). However, this coverage is not mandatory, so some p...

How should I decide which Medicare Advantage plan is right for me?

Deciding which MA plan is right for you can require quite a bit of time and thought. All MA plans must offer coverage that’s roughly equal to or be...

Can all seniors use a Medicare Advantage plan?

Eligibility for Medicare Advantage is the same as eligibility for Original Medicare . The one exception to this is with certain Special Needs Plan...

What does Medicare Advantage cover?

Medicare Advantage provides, at minimum, approximately the same amount of coverage as Original Medicare . This means that at a minimum it covers a...

How do I know if Medicare Advantage is right for me?

Exactly who Medicare Advantage benefits the most is a matter of debate; there’s not just one clear-cut answer. However, it can be a good option for...

When can my Medicare Advantage premiums change?

Medicare Advantage plans can change their coverage and premium costs once each year. They are required to send an Annual Notice of Change (ANOC) ea...

Why do I have to keep paying for Parts A and B if I have Medicare Advantage?

Those who have Medicare Advantage need to keep paying their Part A (if applicable) and Part B premiums because they still have a form of Medicare....

What is Medicare Advantage?

Medicare Advantage plans provide a way to get Medicare coverage from a quality private insurance company rather than directly from the government.

How many Medicare Advantage plans are there in New York City?

As of March 2020, in New York City there are 50 Medicare Advantage plan choices. Options in less populous areas are likely to be far more limited, with moderately populated locations offering perhaps 20 to 25 options. Some extremely rural areas may have only one or two plan options.

What is a dual eligible SNP?

Dual Eligible SNP (D-SNP): Many low-income and/or disabled seniors are simultaneously eligible for both Medicare and Medicaid. These individuals are referred to as “dual eligible.”. They can sign up for a Dual Eligible SNP (D-SNP) that is uniquely designed to help them understand their coverage under both programs.

How long is open enrollment for Medicare?

When added together, open enrollment periods account for roughly 4.25 months of each year. The two different open enrollment periods have slightly different rules. During the first one seniors can join a Medicare Advantage plan for the first time, switch from one plan to another, or switch back to Original Medicare.

How much has Medicare increased in 2019?

According to a recent study by J.D. Powers, enrollment in Medicare Advantage plans increased by almost 10% between 2018 and 2019.

When can seniors switch to 5 star Medicare?

Medicare also allows plan changes due to the “5-star special enrollment period.”. Every year between December 8th and November 30th seniors can move from a Medicare Advantage plan they already have to a 5-star Medicare Advantage plan if one is offered in their area.

Can I use Medicare Advantage if I have ESRD?

However, those with the preexisting condition ESRD may not be eligible for any Medicare Advantage plan except for a C-SNP. Those who don’t have access to a C-SNP that accepts ESRD patients will most likely need to use Original Medicare instead of Medicare Advantage.

How old do you have to be to qualify for Medicare?

In general, to be eligible for Medicare or Medicare Advantage, you must be 65 or older or else have certain disabilities and/or End-Stage Renal Disease (ESRD). Some people are automatically enrolled in Medicare if they are already receiving Social Security benefits, but many people need to apply.

Why is there such a wide range of Medicare Advantage premiums?

Ultimately there is such a wide range of Medicare Advantage premiums because companies have financial support from Original Medicare, options for limiting their administrative costs, and the ability to choose the kinds of extras, if any, that they offer.

How much does Medicare cost for seniors?

The range of available Medicare Advantage plan premiums that seniors can choose from is usually between $0-$500, though this can vary by location and year. Companies that offer $0 or otherwise very low premiums are able to do so for multiple legitimate reasons, which we explore in detail below.

How much is Medicare premium 2020?

The standard amount is what most seniors owe, and in 2020 this amount is $144.60. However, the amount charged can be as high as $491.60 per month.

What is Medicare Advantage Health Network?

Health Networks: Medicare Advantage insurance companies may place limits on the way they provide coverage , though the coverage must be roughly equivalent to or better than that provided by Original Medicare. Health networks are the primary way that insurance companies place cost-savings limits on coverage.

What is Medicare Part A?

Medicare Part A Premiums. Medicare Part A is considered “hospital insurance,” and it provides coverage for stays in hospitals and skilled nursing facilities. It also covers hospice and some forms of home health care. Part A costs, as in all Medicare costs, are “shared” with the patient rather than being 100% covered.

What is covered under Part B?

The range of supplies, tests, doctor visits, emergency medical transportation, and services that are covered under Part B is extensive. As with Part A, Medicare gives some funding to the insurance company in recognition of the company taking on the responsibility of providing Part B coverage.

What is Medicare income?

To learn more about the costs of Medicare, read the most frequently misunderstood Medicare terms. Income is the amount of money you earn during the year. Assets are any money you have in the bank, and the value of any investments (i.e., stocks, bonds and real estate).

What is the asset limit for Medicare Part D 2021?

Asset limits in 2021 are up to $14,790 for an individual or $29,520 for a couple. Depending on which Medicare Part D plan you choose, the program can reduce or eliminate your plan’s premium and deductible, and also lower the cost you pay for the prescription drugs covered under your plan.

What is QMB in Medicare?

Qualified Medicare Beneficiary (QMB) Program. This program helps to pay Part B premiums and copayments. It also helps to pay deductibles and coinsurance for both Part A and Part B. A single person can qualify for the program in 2021 with an income up to $1,094 per month. A couple can qualify with a combined income of $1,472 per month.

What are the benefits of dual eligibility?

If you are a full benefit dual eligible, you can receive benefits included in both Medicaid and Medicare coverage. Here are some examples of what’s covered under Medicaid: 1 Some types of care you get at your home, like nursing that focuses on helping a person get in and out of bed or get dressed 2 Care delivered in a nursing home 3 Some prescription drugs not covered by Medicare Part D plans

How much income can a couple make in 2021?

Specified Low-Income Medicare Beneficiary (SLMB) Program. This program helps to pay premiums for Part B. A single person can qualify in 2021 with an income up to $1,308 per month.

How much is a burial fund?

Burial funds up to $1,500 per person. There are three types of Medicare Savings Programs designed to help with paying costs for Original Medicare or Medicare Part B. They are distinguished by their income limits and what costs they help pay for. The programs include: Qualified Medicare Beneficiary (QMB) Program.

Is Medicare Part D covered by nursing home?

Care delivered in a nursing home. Some prescription drugs not covered by Medicare Part D plans. If you only meet the income and asset requirements of the Medicare Savings Program, you are a partial dual eligible and will receive assistance with Medicare costs, but will not receive additional Medicaid benefits.

What is Medicare Advantage?

Medicare Advantage is private insurance's counterpart to Original Medicare. It's a great alternative for receiving your Medicare coverage. Rather than purchasing individual components through Original Medicare, Medicare Advantage bundles benefits from Part A and Part B and can even include drug coverage, vision, dental, hearing, ...

How long does Medicare Advantage last?

If you’re new to Medicare, you’ll want to enroll in an MA Plan during your Initial Enrollment Period (IEP). This period lasts for seven months— three months before the month when you turn 65, and three months after.

What is the lock in requirement for a health insurance plan?

Charges you’re responsible for. Lock-in requirement, which means you’re required to keep the plan for the rest of the year, unless you meet special circumstances or qualify for an enrollment period.

How to find a special needs plan?

If you're looking for a Special Needs Plan (SNP), use the drop down menu to answer questions about your needs. If you receive a lot of results, use the drop down menu to sort by lowest deductible or lowest premium. Select up to three plans you like best.

When is the open enrollment period for Medicare?

There’s also a Fall Open Enrollment Period (October 15 through December 7) during which you may sign up. Learn about enrollment periods and when they apply to you.

Is there more to Medicare Advantage than drug coverage?

But as you’ll soon see, there is much more to a Medicare Advantage plan than drug coverage. Don’t worry, though—we'll walk you through each step. By the time we’re through, you'll find the best Medicare Advantage plan for your needs.

How to save money on Medicare?

There are even more ways to save money on your Medicare costs, including joining a Medicare Advantage plan that may offer the benefits you need at a price you can afford .

What if you don't qualify for QMB?

Those who do not qualify for either the QMB or SLMB programs may still be eligible for the Qualifying Individual Program, which pays for Medicare Part B premiums and qualifies you for Medicare Extra Help.

Medicaid

Medicaid is a joint federal/state program that helps with medical costs for some people with limited income and resources.

Medicare Savings Programs

State Medicare Savings Programs (MSP) programs help pay premiums, deductibles, coinsurance, copayments, prescription drug coverage costs.

PACE

PACE (Program of All-inclusive Care for the Elderly) is a Medicare/Medicaid program that helps people meet health care needs in the community.

Lower prescription costs

Qualify for extra help from Medicare to pay the costs of Medicare prescription drug coverage (Part D). You'll need to meet certain income and resource limits.

Programs for people in U.S. territories

Programs in Puerto Rico, U.S. Virgin Islands, Guam, Northern Mariana Islands, American Samoa, for people with limited income and resources.

Find your level of Extra Help (Part D)

Information for how to find your level of Extra Help for Medicare prescription drug coverage (Part D).

Insure Kids Now

The Children's Health Insurance Program (CHIP) provides free or low-cost health coverage for more than 7 million children up to age 19. CHIP covers U.S. citizens and eligible immigrants.