How do I find an agent for Medicare?

Nov 10, 2021 · Field-Based Independent Medicare Insurance Agents. These agents live in your local area and sell Medicare insurance from multiple companies. They sell Medicare insurance policies primarily by individually meeting with their potential and current customers. Often, they will come right to your house and review your options across the kitchen table.

How do I find out if my insurance agent is licensed?

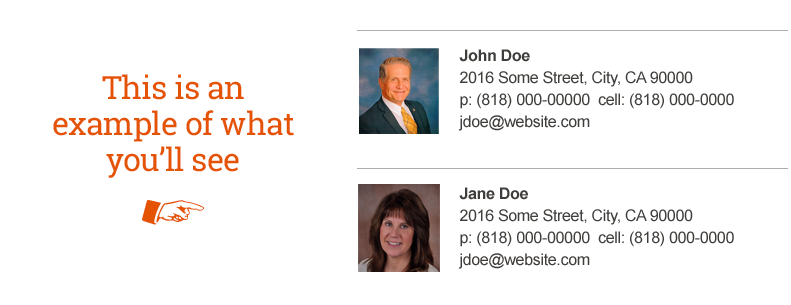

Find A Medicare Supplement Insurance Agent Find the right Medicare Coverage for you. Find local Medicare Supplement insurance agents for all 50 states. Enter Your Zip Code to see agents nearest you. YOU DO NOT ENTER ANY INFORMATION TO ACCESS THE DIRECTORY. You decide who you want to connect with (if anyone). It’s Free. Try it now.

How do I find the best health insurance for Medicare?

Mar 11, 2021 · 3. A Full-Time Specialist in Medicare Coverage and Medicare Plans. Finding an agent that specializes in Medicare is your best option when looking for advice about enrollment choices. Some insurance agents bundle multiple types of …

Where can I find a listing of independent Medicare insurance agents?

Need Help? Call 1-877-704-7864 (TTY: 711) | Hours: 8 a.m. - 8 p.m. Central, daily

Who is the best person to talk to about Medicare?

If you've contacted 1-800-MEDICARE (1-800-633-4227; TTY: 1-877-486-2048) about a Medicare-related inquiry or complaint but still need help, ask the 1-800-MEDICARE representative to send your inquiry or complaint to the Medicare Ombudsman's Office.

What is a Medicare advisor?

What Are Medicare Advisors? Medicare advisors are insurance agents, Medicare brokers and Medicare underwriters. They work for private companies that are under contract with Medicare to sell certain Medicare plans — Medicare Advantage plans and Medicare Part D prescription drug plans.

Is United Medicare Advisors legitimate?

Yes, United Medicare Advisors is a reputable company offering legitimate services and insurance products. Its licensed agents can provide free, reliable advice as you navigate the confusing world of Medicare supplement insurance so that you can choose the best plans for your needs and budget.

What insurance company has the best Medicare plans?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

Does Medicare representatives come to your house?

Hard Facts About Medicare Medicare will never call or come to your home uninvited to sell products or services. SSA representatives may call Medicare beneficiaries if they need more information to process applications for Social Security benefits or enrollment in certain Medicare Plans, but, again, this is rare.May 24, 2021

How much do Medicare insurance agents make?

Average Assurance IQ Medicare Agent yearly pay in the United States is approximately $53,643, which is 17% below the national average.Jan 17, 2022

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

What is the difference between Medicare Plan G and F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.Feb 18, 2021

What is Aetna accendo?

Accendo Insurance, originally a subsidiary company of CVS Caremark, has partnered with the well-known Medicare supplement provider Aetna. Accendo Insurance, based out of Salt Lake City, Utah, provides Medicare Supplement plans with a 14% household premium discount in 15 states.

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Is Medicare G the best plan?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

Find the right Medicare Coverage for you

Find local Medicare Supplement insurance agents for all 50 states. Enter Your Zip Code to see agents nearest you. YOU DO NOT ENTER ANY INFORMATION TO ACCESS THE DIRECTORY. You decide who you want to connect with (if anyone). It’s Free. Try it now.

IMPORTANT MESSAGE TO CONSUMERS

The Medicare Supplement Find An Agent online directory is designed to be a free service for consumers made available by the American Association for Medicare Supplement Insurance (AAMSI). You do not enter any information to access and we do not gather any information on you. It's your choice who you contact (if anyone).

1. Properly Licensed Medicare Agents

Agents who offer Medicare options and advice must complete Medicare training and certification through America’s Health Insurance Plans AHIP. (Sometimes referred to as American Health Insurance Plans AHIP.) When considering an agent or agency, make sure to ask if they have this training.

2. An Independent Agent or Independent Medicare Insurance Agency

Independent Medicare agents and independent Medicare insurance agencies are not employed by insurance companies. This means they are able to offer multiple plan options.

3. A Full-Time Specialist in Medicare Coverage and Medicare Plans

Finding an agent that specializes in Medicare is your best option when looking for advice about enrollment choices.

4. A Local Agent in the 50 States

There are many benefits to working with a local Medicare agent. For instance, they will be up to date on area-specific requirements or recent changes made by the state.

Find An Independent Medicare Insurance Agent – Free Online Directory

The American Association for Medicare Supplement Insurance makes available a directory listing independent Medicare insurance agents. Listed by Zip Code.

How to Interview Medicare Insurance Agents

Whether this is the first time you are eligible for Medicare, or you already have Medicare coverage and wonder if you can do better, we want to help.

Do you sell both Medicare Advantage and Medicare Supplement?

Amazon allows you to exchange or return (most) things you buy. But Medicare insurance doesn’t work like that. And some recent studies report that a significant percentage of people were not happy with the plan they selected. Switching may be possible … but generally not immediately.

How many Medicare insurance plans did you sell last year?

You aren’t trying to find out how much the agent earns. No. You are looking to see if the individual is what we call an ‘incidental’ or occasional Medicare agent or someone who really specializes in the field.

What is Medicare insurance agent?

A Medicare insurance agent is a licensed expert that helps you review and evaluate Medicare plans and their benefits, and guides you in choosing a suitable one. There are two kinds of Medicare insurance agents. The first is the independent Medicare agent. This type of Medicare agent works with many different insurance companies ...

What is Medicare broker?

A Medicare agent or broker can help you streamline your options and eventually settle on one. They'll speak with you and gain a solid understanding of your finances and health needs and then offer you plans that fit within those established parameters. Once you make a decision, the agent will enroll you in the plan.

What is a captive agent?

Unlike independent agents, captive agents partner with only one insurance company and are limited to plans from that particular insurer when assisting Medicare beneficiaries. A Medicare insurance broker is quite similar to an independent Medicare agent. They're not bound to just one insurer. They can educate you about and enroll you in plans ...

How do insurance agents get paid?

In contrast, others have merely have contracts based on enrolments they make. Most agents get paid by commission. When they enroll someone in a plan, they receive a payment for the first year of the policy.

Who is Tolu Ajiboye?

Licensed Experts to Help You Make Choices. Tolu Ajiboye is a health writer who works with medical, wellness, biotech, and other healthcare technology companies. James Lacy, MLS, is a fact checker and researcher. James received a Master of Library Science degree from Dominican University.

Is it expensive to buy health insurance?

Buying health coverage can be expensive. For this reason, you want to make sure that you end up with a plan (or combination of plans) that suits your needs the most. But Medicare plans, their benefits, rules, and exceptions can be quite overwhelming to navigate on one's own.

What does it mean to work with an independent Medicare insurance agent?

Working with an independent Medicare insurance agent means you get to choose policy options from different companies. Independent agents and brokers are more likely to give unbiased plan recommendations and advice. But they may not have in-depth knowledge of these plans.

What is independent insurance?

Independent. An independent agent can partner with and sell policies for different insurance companies. The agent can choose the specific policies they want to sell from a multitude of providers.

What is an ethical broker?

An ethical and knowledgeable agent or broker can help you get the best value for your money. Agents or brokers who sell health insurance products related to Medicare have to pass a test on their knowledge of Medicare every year. 3.

Can captive agents sell Medicare?

Agents who represent a particular health insurer can only sell you plans from that insurer. These captive agents are typically experts on all the options their company offers. But you won’t learn about plans from other Medicare insurance companies.

Who is Tolu Ajiboye?

Tolu Ajiboye is a freelance healthcare writer. She’s worked with Fortune 500 companies and written for publications like The Guardian, NBCNews and Health magazine. We do not sell insurance products, but there may be forms that will connect you with partners of healthcare.com who do sell insurance products.

Is Medicare complicated?

Medicare can be complex. There are numerous plans, plan combinations, benefits, rules, and exceptions — all of which can be confusing. Buying health insurance is a huge investment, so you want to find a plan that meets your needs. An ethical and knowledgeable agent or broker can help you get the best value for your money.

What is the job description of a Medicare agent?

When you become a Medicare insurance agent, there are two main groups you are marketing to. Those are turning 65 and becoming eligible for Medicare health benefits. Those who are disabled, under 65, and are eligible for Medicare. Selling Medicare health insurance can be rewarding in many ways, ...

What is E&O insurance?

E&O insurance is insurance intended to protect you in the event you give a client incorrect or misleading information and they decide to take legal action against you. As well as getting covered through an FMO, these policies can also be purchased through many property and casualty insurance agencies.

What is an FMO?

Choosing an FMO. FMO is an acronym that stands for the field marketing organization. These are companies that distribute health insurance plans to agents and agencies on behalf of various carriers. An FMO can help you quickly get contracted and appointed to sell with multiple insurance companies.