To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

How to choose the perfect Medicare plan?

Your Ultimate Guide to Choosing the Perfect Medicare Plan

- Importance of Medicare Advantage Plans. ...

- Enrol early. ...

- You can evaluate your coverage each year. ...

- Select a plan with an extensive network. ...

- Check out what’s NOT covered. ...

- Don’t miss the deadline for enrolment. ...

- Choose the Right Medicare Plan. ...

How do you find top rated Medicare Advantage plans?

Listed in order of importance, they are:

- Coverage and benefits

- Provider choice

- Cost

- Customer service

- Information and communication

- Billing and payment

Which Medicare plan is best for You?

Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Plans may have lower out-of-pocket costs than Original Medicare. In many cases, you’ll need to use doctors and other providers who are in the plan’s network and service area for the lowest costs.

How to choose the best Medicare drug plan?

How to Choose With 5 Tips

- Consider the Timing. Timing plays a key role in signing up for a Medicare plan. ...

- Do Your Research. There are two main types of Medicare plans: Original Medicare and Medicare Advantage. ...

- Review Drug Coverage. Many Medicare eligibles overpay for their Medicare plan by hundreds of dollars. ...

- Choose the Right Plan. ...

- Enroll. ...

What are the different types of insurance plans?

Is monthly premiums important?

About this website

Who has the best Medicare coverage plan?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCoverage areaBlue Cross Blue Shield5.0Offers plans in 48 statesCigna4.5Offers plans in 26 states and Washington, D.C.United Healthcare4.0Offers plans in all 50 statesAetna3.5Offers plans in 44 states1 more row•Jun 8, 2022

What are the top 3 most popular Medicare supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

How do you shop for Medicare plans?

You can find and compare Medicare Advantage and Medicare Prescription Drug Plans available in your area by inputting your zip code on the Plan Finder tool at Medicare.gov. Counselors are also available, free of charge, to provide you with personalized assistance through State Health Insurance Assistance Programs.

Who sells the most Medicare Advantage plans?

UnitedHealthcareStandout feature: UnitedHealthcare offers the largest Medicare Advantage network of all companies, with more than 1 million network care providers. UnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

What is the deductible for Plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies.

Who has the cheapest Medicare supplement insurance?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022.

Is there a website to compare Medicare plans?

Compare plans online with Medicare.gov One way to compare plans online is using the Medicare.gov “Medicare Plan Finder” tool. Medicare.gov is the official U.S. Government site for the Medicare program. The site offers two search options: a general search and a personalized search.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

What percent of seniors choose Medicare Advantage?

[+] More than 28.5 million patients are now enrolled in Medicare Advantage plans, according to new federal data. That's up nearly 9% compared with the same time last year. More than 40% of the more than 63 million people enrolled in Medicare are now in an MA plan.

What are 4 types of Medicare Advantage plans?

Below are the most common types of Medicare Advantage Plans.Health Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

How to Choose Health Insurance: A Guide for Beginners

1 Minute Review. Blue Cross Blue Shield consists of 35 separate companies that provide health insurance for roughly one-third of Americans. The company serves all 50 states, Washington D.C ...

Things to know before picking a health insurance plan

Choosing a health insurance plan can be complicated. Knowing just a few things before you compare plans can make it simpler.. The 4 “metal” categories: There are 4 categories of health insurance plans: Bronze, Silver, Gold, and Platinum.These categories show how you and your plan share costs.

Health insurance plans & prices | HealthCare.gov

Get health plans and price quotes for your area. See Obamacare health insurance coverage options to save on premiums.

What Is Medicare Advantage?

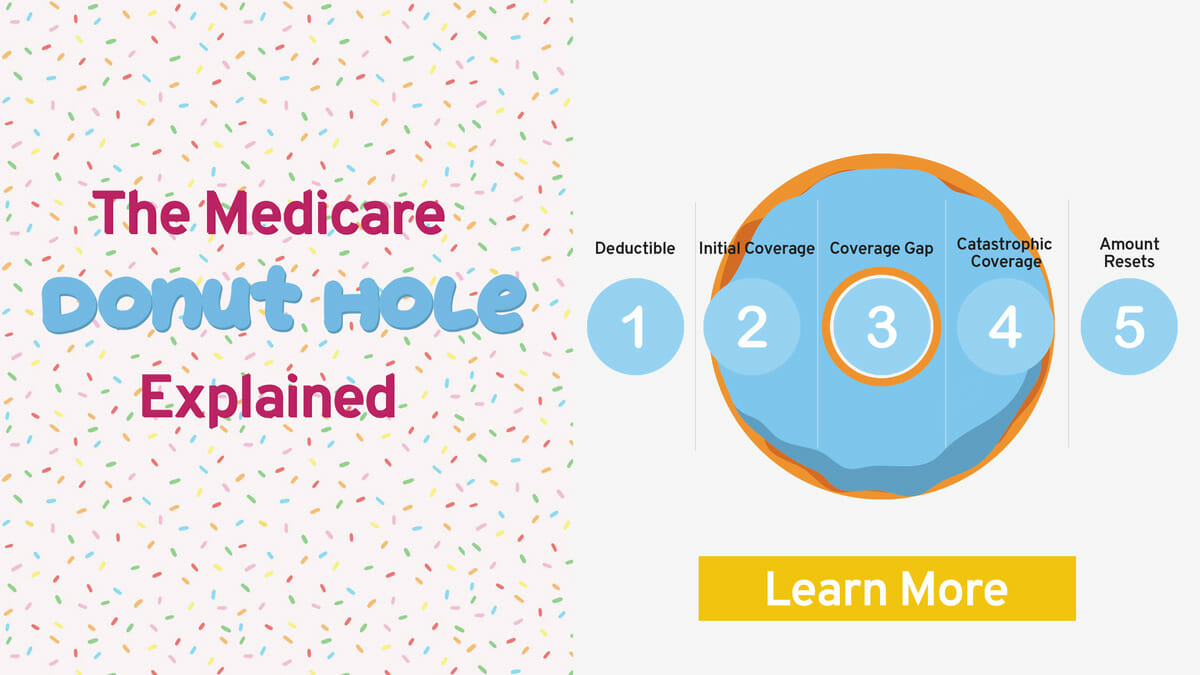

Medicare Advantage is an all-in-one plan choice alternative for receiving Medicare benefits. You may also hear it referred to as Medicare Part C. This plan is bundled with Medicare Part A and Part B and usually includes Part D, which provides prescription drug coverage.

The Average Cost of a Medicare Advantage Plan

Some Medicare Advantage plans may have lower out-of-pocket costs than Original Medicare, and some have a $0 monthly premium. Here are a few questions to consider before purchasing a plan.

Types of Medicare Advantage Plans

There are four common types of Medicare Advantage plans to compare when making your selection.

Medicare Advantage vs. Original Medicare

Consider the following details when deciding whether a Medicare Advantage plan or Original Medicare is best for you.

Methodology

To determine the best Medicare Advantage providers of 2021, the Forbes Health editorial team evaluated all insurance companies that offer plans nationwide in terms of:

Add your favorite providers

Keep a list of all your favorite providers – Select the button above to find and compare providers. Then, select the heart icon next to any of the providers to add them to your list of favorites.

Not sure what type of provider you need?

Use our provider search tool to find quality data, services offered, and other information for these type of providers:

What if I Still Have Private Health Insurance?

If you're turning 65 but will still have private insurance through your or your spouse's job, you might be thinking about waiving Medicare Part A hospital coverage and Part B medical coverage for now. In this case, you've still got some research to do.

Important Facts About Medicare

Medicare can be a big help for people, so learn more about this program, including when you can sign up, what’s included, and what you can add.

Tips for Plan-Shopping

These tactics may help you once you plunge into the sea of Medicare plans:

Should You Get Help?

Many people decide they can handle Medicare decisions on their own. But you may feel more comfortable with one-on-one expert help. You might start by calling 800-MEDICARE (800-633-4227) or with a live help chat on the Medicare.gov site.

What are the different types of insurance plans?

Here are some important things to consider when choosing a plan: Plan category: There are 5 categories of Marketplace insurance plans: Bronze, Silver, Gold, Platinum, and Catastrophic. The health plan category you choose determines how you and your plan share the costs of care. Monthly premiums: This is the amount you pay your insurance company ...

Is monthly premiums important?

Monthly premiums are important, but they’re not all you need to think about. Out-of-pocket costs: It’s important to know how much you have to pay out of your pocket for services when you get care. You pay these out-of-pocket costs in addition to your monthly premiums. Type of insurance plan and provider network: Different plan types provide ...

Key Points in Making Your Decision

There are many choices for health coverage in the Medicare system. You are eligible for Medicare Part A (hospital care) and Part B (doctor visits) when you turn 65. If you are already receiving Social Security benefits, you will automatically be enrolled in Medicare.

Medicare Information to Consider

Enroll in the Original Medicare plan. If you don’t sign up within seven months of turning 65 (three months before your 65 th birthday, your birthday month, and three months after), you will pay a 10% penalty for every year you delay.

Best Health Insurance Companies of 2021

Our star ratings are based on a range of criteria and are determined solely by our editorial team. See our methodology for more information.

What Is Health Insurance?

Health insurance is a contract that requires an insurer to pay some or all of a person’s medical expenses in exchange for a monthly premium. “It’s to prevent you from hitting financial ruin should you run into an emergency,” says Molly Moore, co-founder and chief health plan officer at health insurance start-up Decent.

How Much Does Health Insurance Cost?

The cost of health insurance varies dramatically, but certain factors might increase or lower your costs. According to HealthCare.gov, the five things that can increase your monthly premium are:

How to Choose the Best Health Insurance for You

There are some questions to ask yourself to ensure you’re choosing the best health insurance plan for you, including:

Methodology

To determine the best health insurance companies of 2021, the Forbes Health editorial team evaluated insurance companies that offer plans nationwide in terms of:

What are the different types of insurance plans?

Here are some important things to consider when choosing a plan: Plan category: There are 5 categories of Marketplace insurance plans: Bronze, Silver, Gold, Platinum, and Catastrophic. The health plan category you choose determines how you and your plan share the costs of care. Monthly premiums: This is the amount you pay your insurance company ...

Is monthly premiums important?

Monthly premiums are important, but they’re not all you need to think about. Out-of-pocket costs: It’s important to know how much you have to pay out of your pocket for services when you get care. You pay these out-of-pocket costs in addition to your monthly premiums. Type of insurance plan and provider network: Different plan types provide ...