How do I know if I have a PPO or HMO?

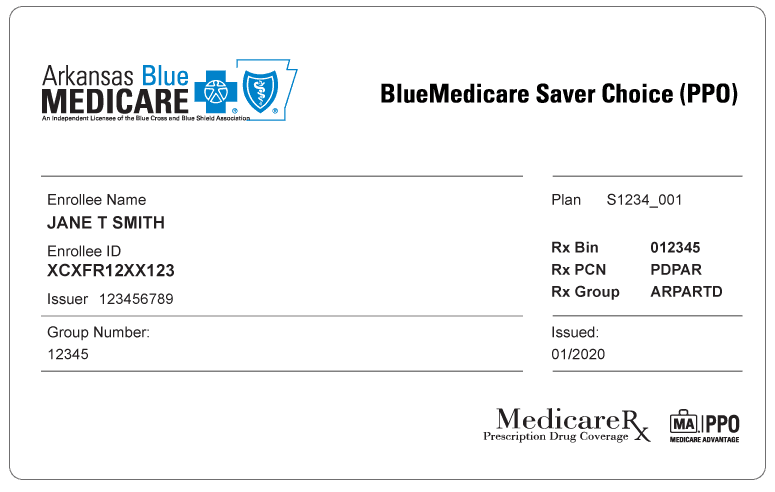

Step 1…. Look at the front of your insurance card. Read it word for word (there won’t be many) and see if anywhere on it it says PPo or. HMO or POs… if it doesn’t, and this is very important.. flip the card over to the back. Read the back word for word (there are a few more) and look for a series of 10 numbers with a few hyphens in between.

Should I Choose an HMO or a PPO Medicare Advantage plan?

Each type of Medicare Advantage plan has its own benefits, and choosing between an HMO and a PPO is entirely up to your health care needs and budget. Some people might enjoy having a primary care physician. This doctor will get to know you and your health, and you can establish a trusting and long-lasting relationship.

How much does a Medicare HMO cost?

While Medicare HMO plans may charge a monthly premium and a deductible, these costs may be quite low – even $0 in some cases. Members usually pay a copayment for covered health care services, after meeting any deductible.

What is a Medicare PPO plan?

With a Medicare PPO, you are free to visit the health care provider of your choice. The PPO plan will have a network of providers (similar to as with an HMO plan), and you will typically have lower out-of-pocket costs if you stay within that network.

How do I know what type of Medicare I have?

You will know if you have Original Medicare or a Medicare Advantage plan by checking your enrollment status. Your enrollment status shows the name of your plan, what type of coverage you have, and how long you've had it. You can check your status online at www.mymedicare.gov or call Medicare at 1-800-633-4227.

Is Original Medicare an HMO or PPO?

There are several differences in costs and coverage among Original Medicare, Preferred Provider Organizations (PPOs), and Health Maintenance Organizations (HMOs). The table below compares these three types of Medicare plans.

What part of Medicare is HMO?

A Medicare Advantage HMO plan delivers all your Medicare Part A and Part B benefits, except hospice care – but that's still covered for you directly under Part A, instead of through the plan. Medicare Advantage plans are offered by private, Medicare-approved insurance companies.

What is the difference between an HMO and a PPO Medicare plan?

There are differences between Medicare Advantage plans. The specific structure of the plan you choose dictates how much you pay for care and where you can seek treatment. HMO plans limit you to a specific network of providers, while PPO plans offer lower rates to beneficiaries who seek care from a preferred provider.

Is Medicare considered PPO?

Medicare HMO (Health Maintenance Organization) plans and Medicare PPO (Preferred Provider Organization) plans are two types of Medicare Advantage plans. There are few differences between the two.

Is Medicare Advantage the same as Medicare HMO?

A Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan's network (except emergency care, out-of-area urgent care, or out-of-area dialysis).

Is Medicare Part B an HMO?

Eligibility and costs basics You must have both Parts A and B to join a Medicare HMO. Generally you will continue paying your Medicare Part B premium, though some HMOs will pay part of this premium. Some HMOs may charge an additional premium, on top of your Part B premium.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is a PPO plan?

A type of health plan that contracts with medical providers, such as hospitals and doctors, to create a network of participating providers. You pay less if you use providers that belong to the plan's network.

Why would a person choose a PPO over an HMO?

Advantages of PPO plans A PPO plan can be a better choice compared with an HMO if you need flexibility in which health care providers you see. More flexibility to use providers both in-network and out-of-network. You can usually visit specialists without a referral, including out-of-network specialists.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is Medicare Part C called?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

What is the difference between a PPO and an HMO?

The key difference between HMOs and PPOs is that a PPO plan is more flexible and allows you to see healthcare providers both inside and outside your plan’s network, while an HMO plan only covers in-network treatment (with exceptions detailed below).

What is the disadvantage of an HMO plan?

The disadvantage of an HMO plan is that it limits choice to only healthcare providers that have elected to participate in the network.

What is an EPO plan?

An Exclusive Provider Organization (EPO) is a relatively new type of plan that sounds similar in name to a PPO but, in fact, removes out-of-network benefits. This often causes confusion. In 2017, Anthem offered EPOs to Californian customers, even converting existing PPO policies to EPOs without advertising that the coverage had substantially changed. Subsequent legal action claimed that the notices sent to existing Anthem customers informing them of the change were unclear, and many members were not made aware that their new EPO plans did not include out-of-network benefits.

What is the first step in choosing a healthcare plan?

When you choose your healthcare plan, either through an employer or privately, the first step for most Americans is a choice between the two most common organization types: Health Maintenance Organization (HMO)

Do PPO plans have deductibles?

PPO plans do have provider networks, just as HMOs do, but also allow patients the flexibility to receive treatment outside their network. In such cases, they will often pay you back for a portion of your out-of-network costs. It is useful to bear in mind that they will only reimburse once you’ve met your deductible. These can range from $0-$20,000 but the average for PPO deductibles is $1,415 for an individual.

Does HMO cover medical emergency care?

If you choose to be treated by a provider who is not participating in that network, your HMO will not reimburse you for the care you receive, except in certain extenuating circumstances, such as a medical emergency. (The Affordable Care Act mandates insurance companies to cover emergency care even if treatment is out-of-network).

Does PPO cover out of network care?

PPO policies do not reimburse you for 100% of the cost of out-of-network care in most cases. Insurers use a complicated formula to calculate the dollar amount you get back on each claim. We’ll talk more about this in a later blog!

Which has higher premiums, PPO or HMO?

HMO plans often have a lower premium, and tend to have lower or no deductibles. Conversely, PPO plans have higher premiums and higher deductibles.

What happens if you choose a PPO plan?

However if the provider you choose is outside of your network , it’s likely that your coinsurance, which is the portion that is covered by the carrier, will be greatly reduced, there could also be additional deductibles that you would pay as well. It’s also likely that you would lose some or all of your network discounts. These are discounts that your network uses with physicians and hospitals to reduce the initial cost of your bill before your insurance benefit kicks in. In some cases this could be in excess of 50%.

How to read insurance card?

Step 1…. Look at the front of your insurance card. Read it word for word (there won’t be many) and see if anywhere on it it says PPo or. HMO or POs… if it doesn’t, and this is very important.. flip the card over to the back. Read the back word for word (there are a few more) and look for a series of 10 numbers with a few hyphens in between. This will say something like “for customer service call”

Why are PPOs more favorable?

Overall PPOs are much more favorable because you don’t have to worry about traveling. They tend to be more expensive but not so much that it should deter you from the alternative.

How to contact a group plan provider?

Call the customer service number listed on your membership card or the agent that sold it to you. If it is a group plan through your employer ask your HR Department person who handles the insurance. If it’s an HMO you had to select a primary care physician, if it’s not you didn’t and you can use any physician in the network. HMO plans do not have an out of network benefit and require a referral before seeing any physician other than your Primary Care doc.

How to find out what your health insurance is?

The simplest answer is to review your health insurance contract, look on your benefits card , or most insurance agents can tell you if you give them the Carrier, state, and plan name . You can also Google the carrier, plan name and number and it will tell you.

Can you visit a specialist on a PPO plan?

Those on a PPO plan can directly visit a specialist of choosing. Coverage. In a HMO plan, you are restricted to doctors and specialists within the network, visiting any outside the network is not covered and you would have to pay for all medical costs.

What is an HMO and PPO?

What are HMO and PPO Plans and How Do They Work? A Health Maintenance Organization (HMO) is a type of health insurance plan that, in most cases, restricts policyholders from seeking care outside of its provider network. A Preferred Provider Organization (PPO) is a type of managed care organization that provides access to a network of doctors, ...

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (also called Medigap) works alongside your Original Medicare (Medicare Part A and Part B) benefits by helping pay for out-of-pocket medical costs such as deductibles, coinsurance and copays without limit ing your choice of health care providers.

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

When will Medicare plan F and C be available?

* Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare.

Does Medicare accept Medigap?

If your provider accepts Medicare, they'll also accept your Medigap plan. This is true anywhere in the U.S. and U.S. territories where Medicare is accepted.

Do HMOs require you to work in their network?

In most cases, HMOs don’t offer health care services from providers who aren’t within their networks, with the exception of emergency medical care. HMOs also sometimes require that you live or work in their service area. With most HMOs, you select a primary care physician (PCP).

Do you need a referral for a primary care doctor?

If you need other medical services, your primary care doctor will make a referral — except in emergencies, in which case a referral is not required.

What Is Medicare PPO (Preferred Provider Organization)?

When you choose a Medicare PPO plan, you may pay less if you use the doctors and hospitals in the plan’s network. PPOs have large networks, but you can also see doctors that aren’t in the network. Plus, you don’t need a referral to see a specialist. Anthem MediBlue PPO is a Part C plan that gives you the flexibility to work with any doctor or specialist, in or out of network, no referrals needed.

What Is Medicare HMO (Health Maintenance Organization)?

When you choose a Medicare HMO plan, you get most of your care from a network of doctors and hospitals unless it is an emergency. You may also need a referral from a primary doctor to see a specialist. Anthem MediBlue HMO has all the benefits of a Medicare Advantage plan with access to our leading network of quality doctors.

Is Medicare PPO Or HMO Better?

Both types of plans offer different types of coverage based on cost and networks, so the best plan for you depends on your budget and your doctor preferences.

Are PPO And HMO Offered Under Original Medicare?

PPO and HMO plans are only available through private insurers like Anthem as Medicare Advantage plans. If you are enrolling in Medicare for the first time, you’ll have to sign up for Original Medicare first. You can then choose a Medicare Advantage HMO or PPO plan that works for you.

What is the difference between a PPO and a HMO?

The Main Difference: Using the Plan’s Provider Network. Medicare HMO and PPO plans differ mainly in the rules each has about using the plan’s provider network . In general, Medicare PPOs give plan members more leeway to see providers outside the network than Medicare HMOs do.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is a PCP in Medicare?

Medicare HMO plans and provider network rules. Medicare HMO plan members usually have to choose a primary care provider (PCP) from the plan network. The PCP provides general medical care, helps plan members get the services they need and provides referrals to specialists like cardiologists or dermatologists. While Medicare HMO plans may charge ...

What is a provider network?

A provider network is a list of doctors, hospitals and other health care providers under contract with a health plan. Providers in a network agree to accept the plan’s payment terms for covered services, which helps plans manage costs. As a result, plans are able to share the savings with plan members through low out-of-pocket costs.

Does Medicare PPO have out of network care?

Every Medicare PPO plan has a provider network. However, these plans also offer coverage for out-of-network care. In addition, PPO plan members may see specialists without a referral.

Does Medicare HMO have a deductible?

While Medicare HMO plans may charge a monthly premium and a deductible, these costs may be quite low – even $0 in some cases. Members usually pay a copayment for covered health care services, after meeting any deductible.

Does Medicare HMO cover outside providers?

Importantly, a Medicare HMO plan may not cover care received from providers outside the network at all. The plan member could be responsible for the entire cost.

What is a PPO?

The PPO (Preferred Provider Network) is broader with more PCP’s and Specialists and you choose a specialist from the network when your PCP diagnos is indicates you might or should see a specialist. Again the PPO uses the approved amount fo

Why are HMO premiums lower?

In a word - Cost. Premiums for HMO’s are lower due to size of provider base (you choose a Primary Care Provider - PCP) and that person controls your healthcare - such as, when you need to see a specialist, he/she will send you to one of the participating specialialists in the network. Their charges are based on the HMO’s approved amount for a specific service.

How to read insurance card?

Step 1…. Look at the front of your insurance card. Read it word for word (there won’t be many) and see if anywhere on it it says PPo or. HMO or POs… if it doesn’t, and this is very important.. flip the card over to the back. Read the back word for word (there are a few more) and look for a series of 10 numbers with a few hyphens in between. This will say something like “for customer service call”

What is a PPO network?

A PPO is a preferred provider network, meaning there's a network of doctors that are considered preferred providers, and choosing one of those doctors for treatment is covered by the insurance company much more than doctors outside of the network because they have negotiated reimbursement with the insurance company in advance.

Do you know if a PPO is covered?

With any PPO these days, you don't know on the front End if a service is covered fully or somewhat or not at all. You don't know if you will have to fight some frivolous billing codes on your statement of benefits. And it's like butting heads with 3 different people - doctors office, their billing service provider and the insurance company or their TPA.

Is it better to have an HMO or PPO?

A Dental HMO is going to most likely cost less and limit your options on who you can see. If your assigned dentist is who you want to go to then maybe this is a good option for you. However, if you want control of who you see, and the option to see a specialist or another dentist then you should go with a PPO. Most PPO’ s give you the option of seeing whoever you want but will pay the best when you see someone that is contracted with their fee list.

Is Kaiser KMNO4 an HMO?

Kaiser KMnO4 is its own beast. It functions like an HMO, but has its own facilities, and less often contracts with independent offices and hospital s. It's like a super-HMO. I generally like Kaiser, because they try to be evidence-based, but when I get a patient's notes transferred from them, it's a CD that contains hundreds of pdf pages of EMR-generated verbiage to wade through. The information overload is off-putting, and makes me wonder whether or not anybody ever organized and pared down the core issues affecting the individual patient.