Where do I enter the percentage on Form 990?

Although this percentage cannot be entered on Part I, line 7, column (f), it can be entered on Schedule H (Form 990), Part VI, line 1. .

What is Form 990 finder?

990 Finder provides access to the most recent Forms 990 and 990-PF filed by nonprofit organizations with the Internal Revenue Service (IRS). Learn how to install the 990 Finder widget on your own web page or blog!

Where can I find 990s from last 3 years?

GuideStar, 990 Finder or Foundation Directory Online Quick Start are Candid's free online tools, searchable by name, location, EIN, and more. You can find 990s from the last 3 years. Foundation Directory Online subscription plans also link to 990s.

How do I Look Up my Medicare eligibility information?

Each MAC offers its own Medicare online provider portal so that you can access real time information, anytime. You can look up eligibility information by entering the following information: Medicare Beneficiary Identifier (MBI) First and last name

What information is included on Form 990?

In a nutshell, the form gives the IRS an overview of the organization's activities, governance and detailed financial information. Form 990 also includes a section for the organization to outline its accomplishments in the previous year to justify maintaining its tax-exempt status.

Where can I find expenses on 990?

These expenses are recorded on the organizations IRS Form 990, Part IX, Column B, including Lines 4- 24f. These expenses are also reported on Line 7 of the Statement of Operations.

How do you read a Form 990?

The Form 990, entitled “Return of Organization Exempt From Income Tax,” is a report that must be filed each year with the Internal Revenue Service (IRS) by organizations exempt from Federal income taxes under section 501 of the Internal Revenue Code, and whose annual receipts are "normally" more than $25,000 a year.

How do you read a 990 EZ form?

0:012:24Understanding Form 990-EZ Net Assets & Balance Sheet - YouTubeYouTubeStart of suggested clipEnd of suggested clipHere's. What you should remember net assets or fund balances. Equal assets minus liabilities SS areMoreHere's. What you should remember net assets or fund balances. Equal assets minus liabilities SS are what you own such as your bank account your equipment.

What are functional expenses on 990?

The Statement of Functional Expenses (Part IX, page 10) is where you must report the details of your organization's expenses and indicate whether those expenses were used for program services, management and general or fundraising purposes.

What are functional expenses for a nonprofit?

The Statement of Functional Expenses that nonprofits issue is referred to as a matrix, because it requires organizations to report their expenses by both functional and natural classification....FundraisingSalaries.Office rent.Insurance.Utilities.Repairs.Office supplies.Depreciation.

How do I file a 990 for a non profit?

Charities and nonprofits can file the following forms electronically through an IRS Authorized e-File Provider.Form 990, Return of Organization Exempt from Income Tax.Form 990-EZ, Short Return of Organization Exempt from Income Tax.Form 990-PF, Return of Private Foundation.Form 990-N (e-Postcard)More items...•

How many parts are there in a standard 990 form?

It's possible that some donors may base their gifting decisions on what they can discern from Form 990. The IRS requires an extensive amount of information from the organization; the instructions for how to complete the 12-page form are 100 pages in length.

What is net income called for a nonprofit?

The profit of a nonprofit organization is called a net asset. It's computed by deducting expenses and losses from the amount of revenue.

What is group exemption number on Form 990 EZ?

Form 990 Filing Help. Enter the four-digit group exemption number if the organization is included in a group exemption. The group exemption number (GEN) is a number assigned by the IRS to the central/parent organization of a group that has a group ruling.

How do you read a nonprofit balance sheet?

For a nonprofit balance sheet, you will use the equation: assets = liabilities + net assets (instead of owner's equity). Let's break this down into simpler terms. Note that our template shows the Statement of Financial Position with assets on the left, and liabilities and net assets on the right.

How do you analyze financial statements for a non profit?

Seven Key Financial Metrics to Measure Nonprofit Health#1: Liquidity. ... #2 Program expenses as percentage of total expenses. ... #3 Sources of unrestricted recurring dollars. ... #4 Liabilities as percentage of total assets. ... #5 Full-cost coverage. ... #6 Fundraising expenses as percentage of total contributions.More items...•

What is revenue minus expenses?

Gross profit is the total revenue minus the expenses directly related to the production of goods for sale, called the cost of goods sold. Derived from gross profit, operating profit reflects the residual income that remains after accounting for all the costs of doing business.

How do you calculate operating budget?

Creating an operating budget is a fairly simple task for any business owner.Identify expenses for the month. Look at every expenditure for the entire business. ... Identify production for the month. ... Divide expenses by production. ... Determine revenue. ... Subtract the cost per unit from the revenue per unit.

How is operating income calculated?

Formula for Operating incomeOperating income = Total Revenue – Direct Costs – Indirect Costs. OR.Operating income = Gross Profit – Operating Expenses – Depreciation – Amortization. OR.Operating income = Net Earnings + Interest Expense + Taxes.

Which line on 990 form must be attached to Schedule H?

An organization that answered "Yes" on Form 990, Part IV, line 20a, must complete and attach Schedule H to Form 990.

Where to enter bad debt expense on 990?

If applicable, enter the bad debt expense included in Form 990, Part IX, line 25, column (A) (but subtracted for purposes of calculating the percentages in this column).

What is part VI on 990?

Use Part VI to provide the narrative explanations required by the following questions, and to supplement responses to other questions on Schedule H ( Form 990 ). In addition, use Part VI to make disclosures described in section 7 of Rev. Proc. 2015-21. Identify the specific part, section, and line number that the response supports, in the order in which they appear on Schedule H (Form 990). Part VI can be duplicated if more space is needed.

What is Schedule H for 990?

Hospital organizations use Schedule H (Form 990) to provide information on the activities and policies of, and community benefit provided by, its hospital facilities and other non-hospital health care facilities that it operated during the tax year. This includes facilities operated either directly or through disregarded entities or joint ventures.

Can a community benefit report be made public?

Answer "Yes" if the organization made the community benefit report it prepared during the tax year available to the public.

Tired of searching for grants in a 990?

You’ll be able to build more robust prospect lists by easily pinpointing which funders support your mission the most. FDO allows you to:

Learn more

990 Finder provides access to the most recent Forms 990 and 990-PF filed by nonprofit organizations with the Internal Revenue Service (IRS).

What is 990 Finder?

GuideStar, 990 Finder or Foundation Directory Online Quick Start are Candid's free online tools, searchable by name, location, EIN, and more. You can find 990s from the last 3 years.

Who files 990 N?

990-N tax forms are filed by tax-exempt organizations whose gross receipts are normally $50,000 or less. This page provides a link to search for and view 990-N filings, or you can download a complete list of organizations.

What is GuideStar 990?

GuideStar. GuideStar works to improve public access to information about nonprofit organizations by providing Forms 990 and other data through their searchable online database. Users can search organizations by name, keyword, location, or EIN.

Does nonprofit Explorer have 990s?

According to ProPublica, Nonprofit Explorer has summaries and PDFs of full 990s for 3 million tax-exempt organizations. ProPublica says you can "see financial details such as their executive compensation and revenue and expenses. You can browse IRS data released since 2013 and access over 9.6 million tax filing documents going back as far as 2001."

Is Form 990 comprehensive?

Coverage for Forms 990 is not necessarily comprehensive in the resources listed above. If you are unable to find the Form 990 for the public charity you are researching using these resources, you can submit a request directly to the IRS using Form 4506-A: Staff pick.

Do nonprofits have to file 990?

The IRS requires all U.S. tax-exempt nonprofits to make public their three most recent Form 990 or 990-PF annual returns (commonly called "990s") and all related supporting documents. They must also make public their Form 1023, which organizations file when they apply for tax-exempt status.

How long before Medicare card is sent out?

We’ll mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

How to contact railroad retirement board?

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

How long after you sign up for Part A do you have to sign up for Part B?

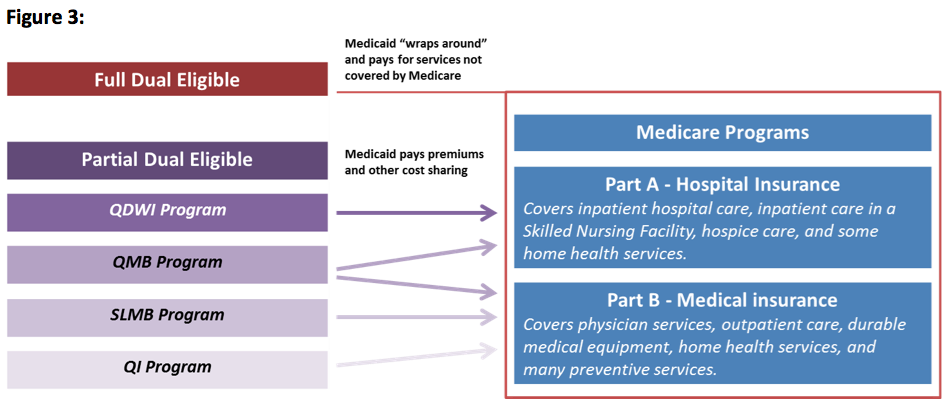

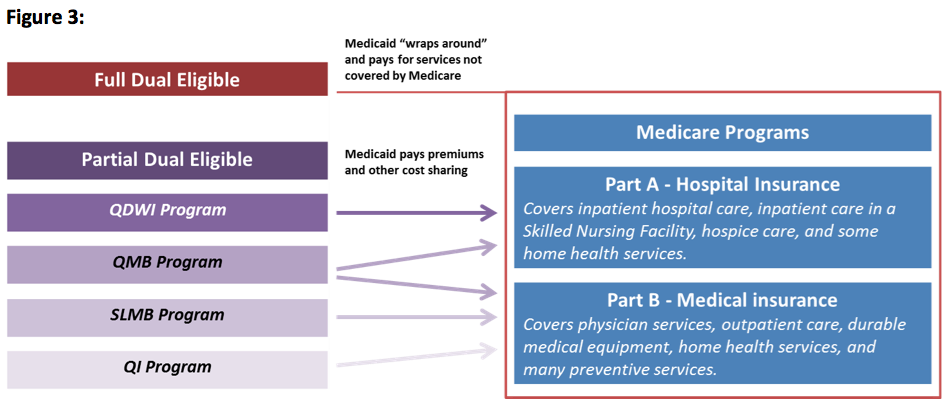

You get Part A automatically. If you want Part B, you need to sign up for it. If you don’t sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

What is 990 form?

Key Takeaways. Form 990 is a form that some tax-exempt organizations are required to submit to the Internal Revenue Service (IRS) as a part of their annual reporting. Organizations that use Form 990 are federal income tax-exempt under the tax categories that are outlined in Section 501 (c), Section 527, and Section 4947 ...

How long is a 990?

The IRS requires an extensive amount of information from the organization; the instructions for how to complete the 12-page form are 100 pages in length. Additionally, the organization can be subject to a large penalty if it does not file on time.

What is 990 exempt from?

Organizations that use Form 990 are exempt under the tax categories that are outlined in Section 501 (c), Section 527, and Section 4947 (a) of the IRC. These organizations are typically classified by the IRS as charitable organizations, political organizations, or nonexempt charitable trusts. 1 Private foundations are not required to file Form 990 because they have their own annual filing requirement: Form 990-PF. 2

What schedules are required to be attached to 990?

In addition to the form, the organization may be required to attach various schedules–A through O and R–to the form in order to provide supplemental information. The organization can determine the schedules they are required to use based on answers to questions throughout the form. One of the most commonly used schedules that organizations use to provide supplemental information to Form 990 is Schedule O .

Why do organizations have to file 990?

Because organizations that are required to file Form 990 are tax-exempt, their year ly activities may be subject to more scrutiny by the IRS . Form 990 allows an organization to completely disclose all of its activities every year.

Is Form 990 open to public inspection?

Unlike federal income tax returns that are private, Form 990 is open to public inspection. Form 990 must be filed by an exempt organization, even if it has not yet filed Form 1023 with the IRS to receive official approval of its tax-exempt status. However, there are certain organizations that are exempt from filing the form.

What is the revenue code for inpatient admissions?

Revenue code – In relation to inpatient admissions. • Revenue Code 760 is not allowed because it fails to specify the nature of the services. • Revenue Code 761 is acceptable when an exam or relatively minor treatment or procedure is performed.

What is the code for imaging services?

0400 – 0409 Other Imaging Services Code for imaging services, such as, mammography, ultrasound, PET, etc.

Why is it important to bill with the correct NPI?

It is important to bill with the correct NPI for the service you provided or this could delay payment or even result in a denial of a claim. Patient Status The appropriate patient status is required on an inpatient claim. An incorrect patient status could result in inaccurate payments or a denial.

Is the Revenue Code compatible with the CPT?

The Revenue Code and CPT/HCPCS codes must be compatible .

Does zero level billing require HCPC codes?

Zero level billing is encouraged for all services which do not require HCPC codes.