What is Medicare subrogation?

Dec 01, 2021 · Please note that CMS’ Medicare Secondary Payer (MSP) recovery claim (under its direct right of recovery as well as its subrogation right) has sometimes been referred to as a Medicare “lien”, but the proper term is Medicare or MSP “recovery claim.” Pursuant to 42 U.S.C. 1395y(b)(2(B)(ii)/Section 1862(b)(2)(B)(ii) of the Act) and 42 C.F ...

Is a Medicaid subrogation claim based on 50% of recovery?

Medicare subrogation claims. However, a close reading of the applicable regulations reveals that CMS may opt to recover its conditional payment not from the beneficiary or his attorney at all." 42 C.F.R. § 411.24(i) provides in part as follows: (i) Special rules. (1) In the case of liability insurance settlements and disputed claims ...

Can my health insurance claim subrogation from my own insurance?

Nov 15, 2016 · In a case involving Medicare, the subrogation payout is set by a formula. The amount paid is reduced in proportion to the plaintiff’s attorney fees and expenses. This is an attempt to account for the fact that the plaintiff incurs costs and attorney fees from pursuing a settlement or judgment. Recent changes in Ohio Medicaid subrogation law

Is there Medicare subrogation of third party liability claims?

Feb 26, 2018 · You or your attorney will ask the health insurance company for a detail account of all the medical bills they are claiming as part of subrogation. This should eliminate any medical bills that were not related to your accident. Secondly, request any attorney’s fees be subtracted from the subrogation claim.

Does Medicare have a subrogation clause?

"Subrogation" literally means the substitution of one person or entity for another. Under the Medicare subrogation provision, the program is a claimant against the responsible party and the liability insurer to the extent that Medicare has made payments to or on behalf of the beneficiary.

Do I have to pay back Medicare?

The Nature of the Medicare Medical Lien This means that if you get a settlement, you will have to pay back Medicare before anything else gets taken out. While you can get the lien reduced, paying back Medicare after a settlement is not optional. The only path around a Medicare lien is to negotiate the lien to zero.Dec 9, 2021

Why would I receive a letter from CMS?

When the most recent search is completed and related claims are identified, the recovery contractor will issue a demand letter advising the debtor of the amount of money owed to the Medicare program and how to resolve the debt by repayment. The demand letter also includes information on administrative appeal rights.Dec 1, 2021

What is Medicare conditional payment letter?

conditional payment is made so that the Medicare beneficiary won't have to use their own money to pay the bill. The payment is “conditional” because it must be repaid to Medicare when a settlement, judgment, award or other payment is secured.

How do you qualify to get 144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

How far back can Medicare recoup payments?

3 calendar yearsFor Medicare overpayments, the federal government and its carriers and intermediaries have 3 calendar years from the date of issuance of payment to recoup overpayment. This statute of limitations begins to run from the date the reimbursement payment was made, not the date the service was actually performed.Jan 4, 2017

How does Medicare reimbursement work?

Medicare pays for 80 percent of your covered expenses. If you have original Medicare you are responsible for the remaining 20 percent by paying deductibles, copayments, and coinsurance. Some people buy supplementary insurance or Medigap through private insurance to help pay for some of the 20 percent.

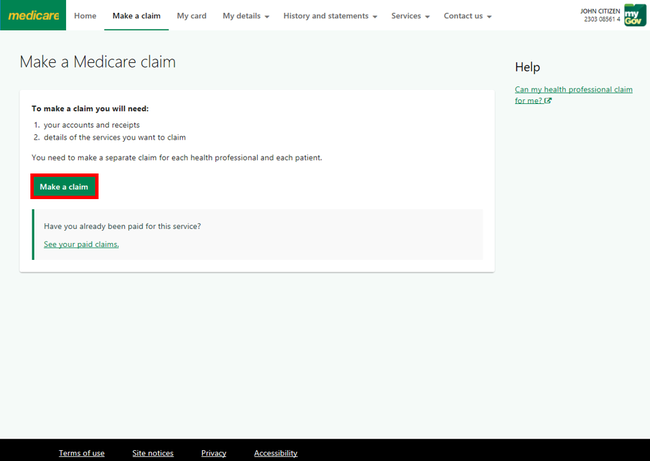

How do I get reimbursed from Medicare?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

How do I find out how much I owe Medicare?

Visiting MyMedicare.gov. Calling 1-800-MEDICARE (1-800-633-4227) and using the automated phone system. TTY users can call 1-877-486-2048 and ask a customer service representative for this information. If your health care provider files the claim electronically, it takes about 3 days to show up in Medicare's system.

When would Medicare make a conditional payment to a beneficiary?

MSP provisions allow conditional payments in certain situations when the primary payer has not paid or is not expected to pay within 120 days after receipt of the claim for specific items and/or services. Medicare makes these payments “on condition” that it will be reimbursed if it is shown another payer is primary.

What is a conditional claim?

Conditional (or “contingent”) claim limitations recite a step or function that is only performed upon the satisfaction of some condition. In a method claim, a conditional limitation might follow the structure, “if A, then B,” reciting that the step B is performed if the condition A occurs.Oct 25, 2018

What letter sent to the beneficiary provides an interim estimate of conditional payments to date?

The CPL explains how to dispute any unrelated claims and includes the BCRC's best estimate, as of the date the letter is issued, of the amount Medicare should be reimbursed (i.e., the interim total conditional payment amount).Dec 1, 2021

What is Medicare beneficiary?

The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals (ORM). For ORM, there may be multiple recoveries ...

How long does it take to appeal a debt?

The appeal must be filed no later than 120 days from the date the demand letter is received. To file an appeal, send a letter explaining why the amount or existence of the debt is incorrect with applicable supporting documentation.

How does subrogation work?

How subrogation works with taxpayer-funded insurance. Medicare and Medicaid are government run programs, funded by taxpayer dollars. The intent of subrogation in these programs is to offset taxpayer responsibility for the related healthcare costs. Subrogation rules are written into the statutes that govern Medicare and Medicaid.

Is Medicaid run by individual states?

The rules for Medicaid can vary from state to state because unlike Medica re, which is a federal program, Medicaid is run by individual states. Some recent federal rulings have led to changes in Ohio law about Medicaid subrogation.

What would happen if I didn't have an attorney?

After all, if you had not engaged an attorney, you likely would not have received any settlement. Therefore, the amount of the attorney’s fees should be taken out of the subrogation claim as well. Finally, negotiate the remainder of the claim. After all, the insurance company wishes to close the matter quickly as well.

Can a personal injury attorney negotiate with insurance?

You or your personal injury attorney may be able to negotiate with your health insurance provider to reduce the amount being claimed by subrogation. Because attorneys are more experienced in dealing with these situations, they often get better results than attempting to negotiate the subrogation claim yourself.

Does California law allow subrogation?

California state law limits subrogation to no more than one-third of your total settlement if you engaged an attorney, or one-half of your settlement without an attorney. This is meant to protect you from situations where you might receive nothing after subrogation and ensures that you will receive at least one-third of your settlement.

Is there a subrogation clause in health insurance?

In every health insurance policy there is a subrogation clause. This is true whether you have a private insurance carrier, Medicare, or Medi-Cal. While few people take the time to read every detail in their insurance policy, the subrogation clause is a part of your health insurance. Subrogation comes into play when a third party pays ...

What happens if Medicare is not paid off?

If a Medicare lien is not properly handled and paid off, Medicare is permitted to file against the defendant, the plaintiff, or the plaintiff’s counsel. If Medicare is forced to bring suit against a party to collect its lien, in some situations it is entitled to a civil penalty of two times the amount owed. Additionally, Medicare can fine the “Responsible Reporting Entity,” usually the insurer, up to $1,000 for each day that they are out of compliance with Medicare’s reporting requirements. That is some harsh medicine. It leaves insurance companies stone terrified.

What is Medicare lien?

To enforce this right to reimbursement, a “Medicare lien” will attach to judgment or settlement proceeds that are awarded as compensation for the accident. This means that if you get a settlement, you will have to pay back Medicare before anything else gets taken out.

What is the purpose of the MSP?

The purpose of this law was to make sure that sure Medicare was not paying for medical bills that should be paid by someone else. The MSP gives Medicare the right to claim (i.e., a lien) reimbursement from any judgment or settlement proceeds that include compensation for medical bills paid by Medicare.

Is Medicare a secondary payer?

Under the Medicare Secondary Payer (“MSP”) statute, when another payer (the “primary plan”) is available, Medicare, as the “secondary plan,” is not responsible for paying for the medical services. 42 U.S.C. § 1395y (b) (2) (A).

What happened to Maryland malpractice law firm?

A Maryland malpractice law firm recently had to pay $250k for failing to pay off a Medicare lien. The firm had obtained a $1.15 million dollar settlement for one of its clients in a medical malpractice case. This client happened to be a Medicare beneficiary for whom Medicare had made conditional payments. Medicare had been notified of the settlement and demanded repayment of its debts incurred. But the law firm apparently refused or failed to pay the lien off in full, even after an administrative finding had made the debt final.

Does Medicare have a super lien?

The law gives Medicare “ super lien ” for reimbursement. This means that Medicare, Medicaid, and Medicare Part C plans now all have super lien rights.

How to check Medicare Part A?

To check the status of#N#Medicare Part A (Hospital Insurance)#N#Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.#N#or#N#Medicare Part B (Medical Insurance)#N#Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.#N#claims: 1 Log into (or create) your secure Medicare account. You’ll usually be able to see a claim within 24 hours after Medicare processes it. 2 Check your#N#Medicare Summary Notice (Msn)#N#A notice you get after the doctor, other health care provider, or supplier files a claim for Part A or Part B services in Original Medicare. It explains what the doctor, other health care provider, or supplier billed for, the Medicare-approved amount, how much Medicare paid, and what you must pay.#N#. The MSN is a notice that people with Original Medicare get in the mail every 3 months. It shows:#N#All your Part A and Part B-covered services or supplies billed to Medicare during a 3-month period#N#What Medicare paid#N#The maximum amount you may owe the provider

What is a Medicare summary notice?

Medicare Summary Notice (Msn) A notice you get after the doctor, other health care provider, or supplier files a claim for Part A or Part B services in Original Medicare. It explains what the doctor, other health care provider, or supplier billed for, the Medicare-approved amount, how much Medicare paid, and what you must pay. .

What is MSN in Medicare?

The MSN is a notice that people with Original Medicare get in the mail every 3 months. It shows: All your Part A and Part B-covered services or supplies billed to Medicare during a 3-month period. What Medicare paid. The maximum amount you may owe the provider. Learn more about the MSN, and view a sample.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is a PACE plan?

PACE plans can be offered by public or private companies and provide Part D and other benefits in addition to Part A and Part B benefits. claims: Contact your plan.

Does Medicare Advantage offer prescription drug coverage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. Check your Explanation of Benefits (EOB). Your Medicare drug plan will mail you an EOB each month you fill a prescription. This notice gives you a summary of your prescription drug claims and costs.

What is the difference between subrogation and reimbursement?

Despite this conflation, the two are different legal concepts and hold different perils for the injury victim attempting to obtain compensation for their injuries. Subrogation means to substitute one person for another. Often subrogation is analogized to “standing in someone else’s shoes.” Within our context it means that the health insurance carrier can “stand in the shoes” of the injury victim–essentially becoming the injury victim for the limited purpose of asserting a claim against the at-fault party for the amount of medical benefits they have provided. The insurance carrier asserts a claim independent of the claim being asserted by the actual injury victim. Reimbursement, on the other hand, is when the insurance carrier claims that their insured recovered money from the at-fault party for expenses which the insurance carrier, and not the injury victim, paid. The concept of reimbursement guards against an individual receiving a “windfall” by recovering money for an expense that was paid by another.

Who funds medicaid?

The Medicaid program is funded by the federal government but administered by each state. Part of the requirement for the states to receive Medicaid funds is to assert repayment demands in cases where another party has become responsible for items or services that Medicaid has already provided.

What is secondary payer act?

Medicare and Medicare Advantage beneficiaries will face the Medicare Secondary Payer Act when they are attempting to resolve a repayment demand being asserted against any settlement or award they obtain. Under this Act, Medicare is identified as a “payor of last resort” and creates what is often referred to as a “super lien.” The amount due back is calculated per federal regulation and is dependent on the size of the settlement relative to the amount of benefits provided as follows: 1 C.F.R. 411.37 (c)#N#Medicare payments are less than the judgment or settlement.#N#Add (Attorney’s Fees) and (Costs) = Procurement Costs#N#(Procurement Costs) / (Gross Settlement Amount) = Ratio#N#Multiply (Lien Amount) by (Ratio) = Reduction Amount#N#(Lien Amount) – (Reduction Amount) = Medicare Demand 2 C.F.R. 411.37 (d)#N#Medicare payments are equal to or exceed the judgment or settlement.#N#Add (Attorney’s Fees) and (Costs) = Procurement Costs 3 (Settlement Amount) – (Procurement Costs) = Medicare Demand

What is reimbursement insurance?

Reimbursement, on the other hand, is when the insurance carrier claims that their insured recovered money from the at-fault party for expenses which the insurance carrier, and not the injury victim, paid. The concept of reimbursement guards against an individual receiving a “windfall” by recovering money for an expense that was paid by another.

Can a hospital assert a repayment demand?

Often these repayment demands from providers is due to a lack of insurance, or a choice on the part of the provider not to bill insurance. Addressing these types of repayment demands may involve not only state statutes, but perhaps even county ordinances.

What is FEHBA health insurance?

Federal employees, both civilian and military, also face a daunting challenge when attempting to resolve their personal injury actions. Many civilian federal employees received their health insurance via the Federal Employee Health Benefits Act (FEHBA). These plans are quasi-government plans that are administered by private insurance carriers but overseen by the Office of Personnel Management. (OPM). Recently FEHBA plans achieved a significant victory before the United States Supreme Court in case called Nevils. In this case, the FEHBA plans were able to obtain a ruling which allows them to circumvent state law and enforce the terms of their plan as written. Since this is as relatively new change in interpretation there have been no cases yet limiting the rights of these plans. Fortunately, these plans are all available for review online at the Office of Personal Management website

What is an ERISA plan?

An ERISA plan’s rights to repayment from an injury victim’s settlement or award is greatly dependent on how the ERISA plan is funded. Large employers with substantial assets often have a “self-funded” ERISA plan.

Medicare’s Demand Letter

- In general, CMS issues the demand letter directly to: 1. The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. 2. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals ...

Assessment of Interest and Failure to Respond

- Interest accrues from the date of the demand letter, but is only assessed if the debt is not repaid or otherwise resolved within the time period specified in the recovery demand letter. Interest is due and payable for each full 30-day period the debt remains unresolved; payments are applied to interest first and then to the principal. Interest is assessed on unpaid debts even if a debtor is pu…

Right to Appeal

- It is important to note that the individual or entity that receives the demand letter seeking repayment directly from that individual or entity is able to request an appeal. This means that if the demand letter is directed to the beneficiary, the beneficiary has the right to appeal. If the demand letter is directed to the liability insurer, no-fault insurer or WC entity, that entity has the ri…

Waiver of Recovery

- The beneficiary has the right to request that the Medicare program waive recovery of the demand amount owed in full or in part. The right to request a waiver of recovery is separate from the right to appeal the demand letter, and both a waiver of recovery and an appeal may be requested at the same time. The Medicare program may waive recovery of the amount owed if the following con…