You can change from Medicare Advantage to Medigap

Medigap

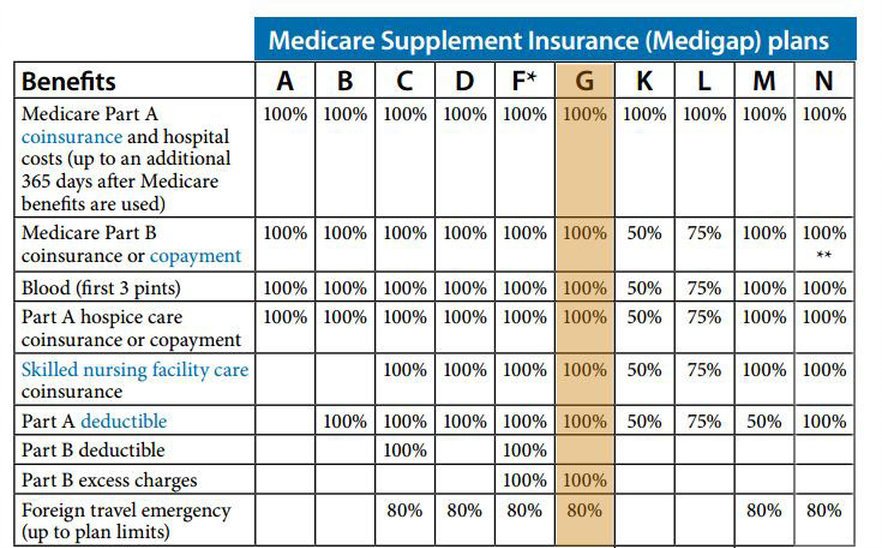

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

How do I switch from Original Medicare to Medigap?

If you want to switch to Original Medicare and buy a Medigap policy, contact your Medicare Advantage Plan to see if you're able to disenroll. If you join a Medicare Advantage Plan for the first time, and you aren’t happy with the plan, you’ll have special rights under federal law to buy a Medigap policy.

Can I buy Medigap If I have Medicare Advantage?

If you have a Medicare Advantage Plan, it's illegal for anyone to sell you a Medigap policy unless you're switching back to Original Medicare. Contact your State Insurance Department if this happens to you. If you want to switch to Original Medicare and buy a Medigap policy, contact your Medicare Advantage Plan to see if you're able to disenroll.

Can I switch from Medicare Advantage to Medigap without underwriting?

For example, when you get a Medicare Advantage plan as soon as you're eligible for Medicare, and you're still within the first 12 months of having it, you can switch to Medigap without underwriting. The opportunity to change is the "trial right." Further, if you move out of your service area, you can switch to a Medigap plan.

Can I get my Medigap policy back?

If you had a Medigap policy before you joined, you may be able to get the same policy back if the company still sells it. If it isn’t available, you can buy another Medigap policy. These plans are offered by insurance companies and other private companies approved by Medicare.

How do I switch back from Medicare Advantage plan?

If you're already in a Medicare Advantage plan and you want to switch to traditional Medicare, you should contact your current plan to cancel your enrollment and call 1-800-MEDICARE (1-800-633-4227). Note there are specific enrollment periods each year to do this.

Can you switch from an Advantage plan to a supplemental plan?

A person can take the following steps to switch from Medicare Advantage to original Medicare plus Medigap during an enrollment period: It is possible to disenroll from a Medicare Advantage plan by contacting the insurance company directly and requesting a disenrollment form.

Can you switch from Medicare Advantage to Original Medicare at any time?

At any point during your first year in a Medicare Advantage plan, you can switch back to Original Medicare without penalty.

Is Medicare with Medigap better than Medicare Advantage?

If you are in good health with few medical expenses, Medicare Advantage can be a suitable and money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

Can I switch from a Medicare Advantage plan to a Medigap plan?

Most Medicare Advantage Plans offer prescription drug coverage. , you may want to drop your Medigap policy. Your Medigap policy can't be used to pay your Medicare Advantage Plan copayments, deductibles, and premiums.

When can I disenroll from a Medicare Advantage plan?

The Medicare Advantage Disenrollment Period (MADP) is when you can disenroll from a Medicare Advantage plan and return to Original Medicare. This period occurs every year from January 1 to February 14.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Can I change Medicare Supplement plans anytime?

As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period. An application may be “medically underwritten”.

What is the difference between Medigap and Medicare Advantage plans Part C?

Medigap supplemental insurance plans are designed to fill Medicare Part A and Part B coverage gaps. Medicare Advantage, also referred to as Medicare Part C plans, often include benefits beyond Medicare Parts A and B. Private, Medicare-approved health insurance companies offer these plans.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

How Much Is Medigap per month?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

Who pays for Medigap?

You pay the private insurance company a monthly premium for your Medigap plan in addition to the monthly Part B premium you pay to Medicare. A Medigap plan only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

How long do you have to keep Medicare Advantage Plan?

If you don’t drop your Medicare Advantage Plan and return to Original Medicare within 12 months of joining, generally, you must keep your Medicare Advantage Plan for the rest of the year. You can disenroll or change plans during the Open Enrollment Period or if you qualify for a Special Enrollment Period.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). .

Does Medigap have prescription drug coverage?

The Medigap policy can no longer have prescription drug coverage even if you had it before, but you may be able to join a. Medicare Drug Plan (Part D) Part D adds prescription drug coverage to: Original Medicare. Some Medicare Cost Plans. Some Medicare Private-Fee-for-Service Plans.

Can you get a Medigap policy back if you leave Medicare?

If you leave the Medicare Advantage Plan, you might not be able to get the same, or in some cases, any Medigap policy back unless you have a " trial right. ". If you have a Medicare Advantage Plan, it's illegal for anyone to sell you a Medigap policy unless you're switching back to. Original Medicare.

Why is it important to review your insurance?

Because of the variety of options and potential costs you might incur, it is a good idea to regularly review your coverage. This is especially true if you have had your plan for several years.

Is Medigap part A or B?

Medigap is a great way to fill in many of the gaps in Medicare parts A and B, but it’s not all encompassing. If you are looking to get Medigap, it’s good to know where you will not be covered so you will be able to make an informed decision.

If you change from Medicare Advantage to Original Medicare plus a Medigap plan when you have guaranteed issue rights, your application won't go through medical underwriting (that's a good thing)

If you’re enrolled in a Medicare Advantage (MA) plan but changed your mind and would rather have a Medicare Supplement (Medigap) insurance plan with Original Medicare, that’s ok. You’re able to switch from Medicare Advantage to Medigap during certain times of the year or with specific qualifying circumstances.

Changing from Medicare Advantage to Medigap

You cannot enroll in both Medicare Advantage and Medigap. If you’d like to switch from an MA plan to a Medigap plan alongside Original Medicare, you must meet certain requirements or do so during a specific time of the year.

When Can I Switch from Medicare Advantage to Medigap?

There are a few times per year when you can leave a Medicare Advantage plan:

How to Switch from Medicare Advantage to Medigap

Here are the steps you’d take to switch from an MA plan to Original Medicare with a Medigap policy during a qualifying circumstance or enrollment period:

What Are Guaranteed-Issue Rights?

In most cases, if you switch to Original Medicare from an MA plan, you lose your guaranteed-issue rights for Medigap. These rights ensure you can purchase any plan sold in your state/area, and you can’t be charged higher premiums based on your health status.

What Is Medicare Advantage?

Medicare Advantage plans (Part C) are offered by private insurance companies contracted through Medicare. They offer the same hospital and medical coverage that Original Medicare does (through Part A and Part B), but they also offer additional coverage such as vision, dental, hearing aids, travel, wellness/gym memberships, and more.

What Is Medigap?

Medicare Supplement, or Medigap, is a supplemental insurance that helps fill “gaps” in Original Medicare coverage. While Medicare pays for much of the hospital and medical costs you may need, it doesn’t cover everything, which is why some people choose to purchase a Medigap policy.

How many options are there for Medicare Advantage?

Usually there are 4 options for seniors currently on a Medicare Advantage (MA) plan who would like to change to a Medicare Supplement (Medigap) plan. Under the first two options, switchers are guaranteed to be approved. Options 3 and 4 require completing certain medical questions before approval.

What is the phone number for Medicare?

If you have an urgent matter or need enrollment assistance, call us at 800-930-7956. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans.

Does Medigap cover out of pocket expenses?

Certain Medigap plans cover all deductibles and most cover all out of pocket costs. You want protect your wealth. Owning a Medigap plan is considered by many the best way to protect yourself from the high cost of medical bills .

Does Medigap have the same network as Medicare?

You are looking to access a bigger network of doctors. Medigap accesses the same network of doctors as Original Medicare, the largest network of doctors in America. You want increased benefits.

How long does it take to switch from Medicare Advantage to Original Medicare?

If you’re covered by both Medicare and Medicaid and then you lose eligibility for Medicaid, you can switch from Medicare Advantage to Original Medicare up to three months from the date you lose Medicaid eligibility, or the date you’re notified, whichever is later.

How long can you switch to Medicare Advantage?

If you wait to tell your Medicare Advantage plan about your move, then you can switch to Original Medicare for up to two full months after the month that you inform your plan.

How to disenroll from Medicare Advantage?

Visit your local Social Security Office and ask to be disenrolled from Medicare Advantage ; Call 1-800-MEDICARE (1-800-633-4227) and process your disenrollment over the phone; or. Contact your Medicare Advantage insurer directly and request a disenrollment form.

What is Medicare Supplement Plan?

This kind of plan, also known as a Medigap policy, pays for gaps in Medicare’s coverage. For instance, Medicare Part B pays 80% of covered costs after you pay your annual deductible. A Medigap policy would pay the remaining 20% ...

When does Medicare open enrollment end?

Medicare Advantage Open Enrollment Period. This special opportunity to leave Medicare Advantage lasts from January 1 through March 31 each year. If you disenroll during January, your changes will be effective on February 1. If you disenroll during February, your changes will be effective on March 1. If you disenroll during March, your changes will ...

Can you switch to Original Medicare if you are eligible for medicaid?

If You Become Eligible for Medicaid. Once you become eligible for Medicaid benefits, then you can drop your Medicare Advantage plan and switch to Original Medicare. While you’re covered under Medicare and Medicaid, you can change that coverage once a quarter during the first three quarters of the year ...

Does Medicare Part B pay 80% of the cost?

For instance, Medicare Part B pays 80% of covered costs after you pay your annual deductible. A Medigap policy would pay the remaining 20% due. But if you’ve missed your Medigap Open Enrollment Period, an insurer could deny you coverage due to your health history.

What happens if you lose Medigap?

An insurance policy that can't be terminated by the insurance company unless you make untrue statements to the insurance company, commit fraud, or don't pay your premiums. All Medigap policies issued since 1992 are guaranteed renewable. . This means your insurance company can't drop you unless one of these happens:

Can insurance drop you?

This means your insurance company can't drop you unless one of these happens: You stop paying your premiums. You weren't truthful on the Medigap policy application. The insurance company becomes bankrupt or insolvent. If you bought your Medigap policy before 1992, it might not be guaranteed renewable.

How to switch Medigap insurance?

How to switch Medigap policies. Call the new insurance company and arrange to apply for your new Medigap policy. If your application is accepted, call your current insurance company, and ask for your coverage to end. The insurance company can tell you how to submit a request to end your coverage.

What happens if you buy a Medigap policy before 2010?

If you bought your policy before 2010, it may offer coverage that isn't available in a newer policy. If you bought your policy before 1992, your policy: Might not be a Guaranteed renewable policy. May have a bigger Premium increase than newer, standardized Medigap policies currently being sold. expand.

How long do you have to have a Medigap policy?

If you've had your Medicare SELECT policy for more than 6 months, you won't have to answer any medical questions.

How long is the free look period for Medigap?

Medigap free-look period. You have 30 days to decide if you want to keep the new Medigap policy. This is called your "free look period.". The 30- day free look period starts when you get your new Medigap policy. You'll need to pay both premiums for one month.

Can you exclude pre-existing conditions from a new insurance policy?

The new insurance company can't exclude your Pre-existing condition. If you've had your Medigap policy less than 6 months: The number of months you've had your current Medigap policy must be subtracted from the time you must wait before your new Medigap policy covers your pre-existing condition.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

Can I keep my Medigap policy if I move out of state?

I'm moving out of state. You can keep your current Medigap policy no matter where you live as long as you still have Original Medicare. If you want to switch to a different Medigap policy, you'll have to check with your current or new insurance company to see if they'll offer you a different policy. If you decide to switch, you may have ...