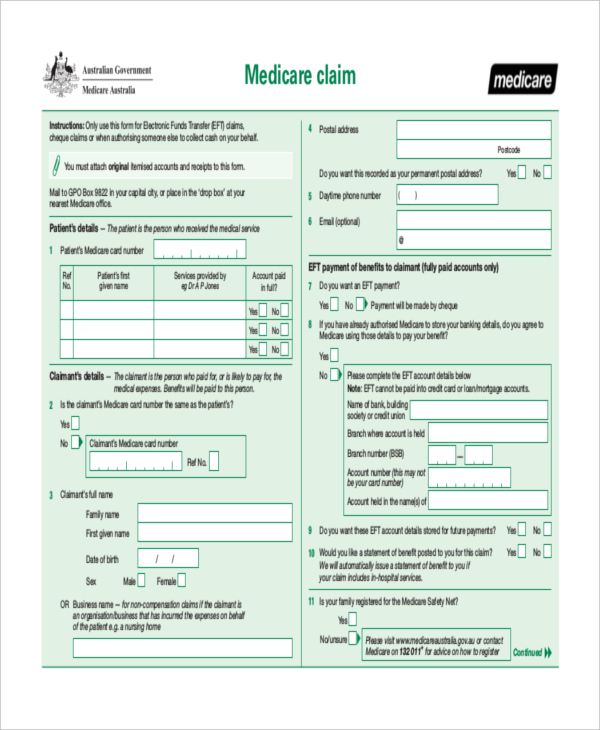

Will I receive a 1095 from Medicare?

Apr 20, 2019 · You shouldn’t have to fill out the 1095-B form. If you receive one, it should come to you pre-filled by Medicare or your Medicare Advantage provider. The 1095-B form is a tax document with proof of your coverage and should be stored with any of your other tax documents for the previous year.

Does Medicare provide a 1095?

Apr 04, 2022 · Form 1095-B. Form 1095-B is sent out by health insurance carriers, government-sponsored plans such as Medicare, Medicaid, and CHIP, and self-insured small employers (large employers, including those that are self-insured, send out Form 1095-C instead). This form is mailed to the IRS and to the insured member.

Do Medicaid recipients get a 1095 a?

How to find your 1095-A online Log in to your HealthCare.gov account. Under "Your Existing Applications," select your 2021 application — not your 2022 application. Select “Tax Forms” from the menu on the left. Download all 1095-As shown on the screen.

Does Everyone receive a 1095 a?

Mar 25, 2021 · Quick tips to 'reconcile' your taxes. Published on March 25, 2021. If anyone in your household had Marketplace health coverage in 2020, you should have already received Form 1095-A, Health Insurance Marketplace® Statement. (If you didn’t get the form online or by mail, contact the Marketplace Call Center.)

How do I get a 1095 medical form?

How to find your 1095-A onlineLog in to your HealthCare.gov account.Under "Your Existing Applications," select your 2021 application — not your 2022 application.Select “Tax Forms” from the menu on the left.Download all 1095-As shown on the screen.

Can I get a copy of my 1095-B online?

IMPORTANT: YOU CAN ACCESS YOUR IRS FORM 1095-B ELECTRONICALLY. Students enrolled in the University of California Student Health Insurance Plan will no longer automatically receive a paper copy of IRS Form 1095-B.

How do I get a copy of my Medicare Form 1095-B?

Call 1-800-MEDICARE (1-800-633-4227) to ask for a copy of your IRS Form 1095-B. TTY users can call 1-877-486-2048.

How do I obtain my 1095-B?

How to find or request your Form 1095-BCall the number on your ID card or other member materials.Complete the 1095B Paper Request Form (pdf) and email it to your health plan at the email address listed on the form.

How to Find Your 1095-A Online

Note: Your 1095-A may be available in your HealthCare.gov account as early as mid-January, or as late as February 1. If you’re already logged in, s...

What’S on Form 1095-A and Why You Need It

1. Your 1095-A contains information about Marketplace plans any member of your household had in 2017, including: 1. Premiums paid 2. Premium tax cr...

How to Check Form 1095-A For Accuracy & What to Do If It's Wrong

1. Carefully read the instructions on the back. 2. Make sure it’s accurate. If anything about your coverage or household is wrong, contact the Mark...

Use The Information from Your 1095-A to “Reconcile”

Once you have an accurate 1095-A and second lowest cost Silver plan premium, you’re ready to fill out Form 8962, Premium Tax Credit.See a step-by-s...

What is a 1095-A?

Form 1095-A is your proof that you had health insurance coverage during the year , and it’s also used to reconcile your premium subsidy on your tax return, using Form 8962 (details below).

When will the IRS issue 1095-B?

The latest extension, detailed in IRS Notice 2020-76, gives insurers and employers until March 2, 2021, to distribute Forms 1095-B and 1095-C to plan members and employees.

Is Form 8962 required for 2020?

The information on Form 1095-A is used to complete Form 8962 (again, Form 8962 is not required for 2020 if you would have had to repay some or all of the premium tax credit; not filing it for 2020 will not affect subsidy eligibility in future years).

What is a 1095-A?

Your 1095-A contains information about Marketplace plans any member of your household had in 2020, including: Premiums paid. Premium tax credits used.

Do I need to file Form 8962?

If you want to see if you qualify for a premium tax credit based on your final income, you can complete Form 8962 to find out. If you don't qualify for a premium tax credit, you don't have to include Form 8962 when you file your income taxes. Learn more about your taxes if you paid full price for a Marketplace plan.