Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

Full Answer

How to choose the best Medicare supplement plans?

How to choose the best Medicare supplement plans. The best Medicare supplement plan for you will depend on which Original Medicare parts you need filled and the cost of the plan.You should choose the supplement policy that provides the best benefits for you and fills in the coverage gaps where you expect to spend the most on health care.

What is the best and cheapest Medicare supplement insurance?

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

Which Medicare supplement plan should I buy?

One of the most common types of supplemental insurance is Medigap, which is sold by private insurance companies to people enrolled in Original Medicare. (Medigap plans cannot be paired with Medicare Advantage plans).

Are Medicare supplement insurance plans worth it?

To help answer it for yourself, it would be wise to compare Medicare Supplement plans to the other two options available to you: Doing nothing, and sticking with Original Medicare, and; Medicare Advantage plans; If you can afford the monthly premiums, Medicare Supplement plans may very well be worth the price. This is because it can limit, or eliminate, your out-of-pocket medical costs.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

What is a zero dollar premium?

A zero-premium plan is a Medicare Advantage plan that has no monthly premium. In other words, you don't pay anything to the insurance company each month for your coverage. That's in comparison with the average Medicare Advantage premium of $23/month in 2020.

Which plan is free in Medicare?

Medicare Advantage plans cover your Medicare Part A and Part B. Most include drug coverage. Medicare Part A (hospital insurance) is free if you or your spouse paid Medicare taxes for a certain amount of time while working. Medicare Advantage plans aren't totally free.

Are Medicare Supplement plans based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is the cheapest Medicare plan?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022.

What is the least expensive Medicare Advantage plan?

Aetna Medicare Advantage plans have the cheapest overall prices, costing an average of $7 per month for 2022. Aetna's Medicare Advantage plans stand out for those who are looking for affordable coverage.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How much is the monthly premium for Medicare supplement?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization. Several factors impact Medigap costs, including your age and where you live.

What income is used to determine Medicare premiums?

modified adjusted gross incomeMedicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

What is the monthly premium for Plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

Is traditional Medicare free?

Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.

Is Medicare truly free?

Medicare is a federal insurance program for people aged 65 years and over and those with certain health conditions. The program aims to help older adults fund healthcare costs, but it is not completely free. Each part of Medicare has different costs, which can include coinsurances, deductibles, and monthly premiums.

Why is my Medicare free?

Medicare Part A is free if you: Have at least 40 calendar quarters of work in any job where you paid Social Security taxes in the U.S. Are eligible for Railroad Retirement benefits. Or, have a spouse that qualifies for premium-free Part A.

What is Medicare Part A and B?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers. Outpatient care.

How much is Medicare Part B deductible?

The most common monthly Part B premium is $148.50. If you have a high income, you'll pay more. In 2021, the Medicare Part B deductible is $203.

What is the Medicare Part B deductible for 2021?

In 2021, the Medicare Part B deductible is $203. After you reach this deductible, you pay 20% of the Medicare-approved amount for most care.

Is Medicare free?

By and large, Medicare is not considered free. Because you have been contributing to your Medicare services through taxes throughout your life, you will have contributed money to Medicare regardless of the current cost of your copayments or premiums. However, it's possible to receive assistance for your Medicare Part A and Part B premiums, copays, ...

Why are Medicare Advantage plans free?

Certain Advantage plans are called free because they offer a $0 monthly premium to be enrolled in the plan. This makes zero premium Medicare Advantage plans an attractive offer for those looking to save money on monthly Medicare costs.

What is free Medicare Advantage?

Free Medicare Advantage plans are private Medicare insurance plans that offer a $0 monthly premium. While these plans are advertised as free, you’ll still have to pay the standard out-of-pocket costs for other premiums, deductibles, and copayments. If you qualify for Medicare and are enrolled in parts A and B, you can use ...

What is a yearly deductible for Medicare?

There are two types of yearly deductibles associated with most Medicare Advantage plans: The plan itself may have a yearly deductible, which is the out-of-pocket amount you pay before your insurance pays out. The plan may also charge you a drug deductible as well.

How much is Medicare Part B?

Medicare Part B. Medicare Part B charges a standard monthly premium of $135.50 or more , depending on your gross yearly income. You’ll owe this Part B premium as part of your free Medicare Advantage plan unless it’s covered by the plan.

Does Medicare Advantage charge yearly?

Compared to other Medicare plans, these zero premium Medicare Advantage plans don’t charge a yearly amount to be enrolled in the plan. There’s generally no difference in coverage between a free plan and a paid plan.

Does Medicare Advantage have different copayments?

Type of plan. Medicare Advantage plans can also differ in costs based on their structures. For example, PPO plans charge different copayment amounts based on whether your provider is in-network or out-of-network. These costs may even vary from year to year.

Is Medicare free?

Medicare isn’t free health insurance. There are many different costs that are associated with Medicare coverage. Before you can enroll in a Medicare Advantage plan, you must have Medicare parts and B coverage. Below you’ll find the costs associated with those plans.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

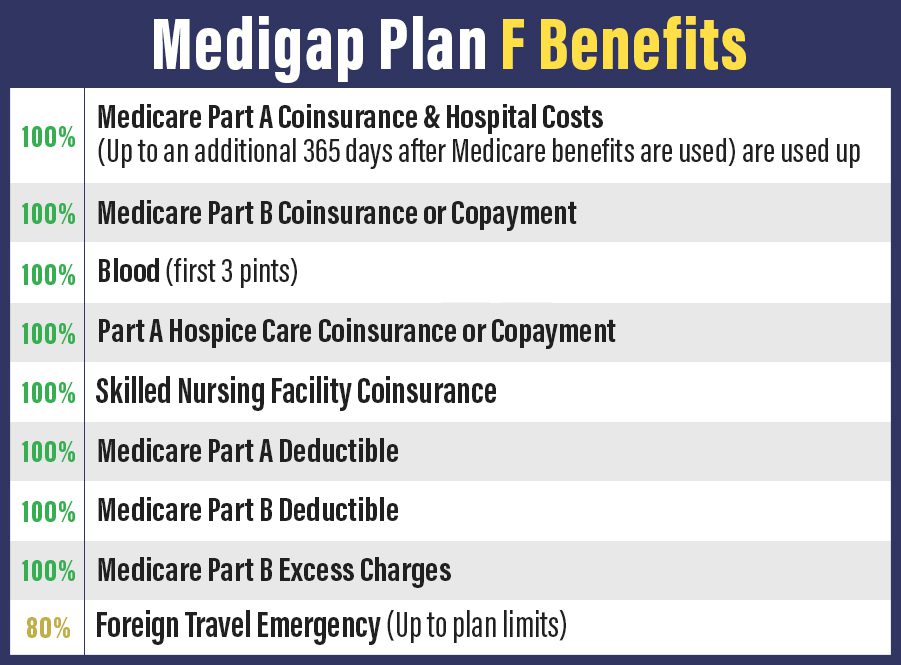

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

What are the three cost reduction programs for Medicare Part B?

The three cost reduction programs are the Qualified Medicare Beneficiary (QMB), the Specified Low-Income Medicare Beneficiary (SLMB), and Qualifying Individual (QI)

How much does Medicare Part B cost?

The standard premium amount for Medicare Part B is $144.60. You may pay a higher premium amount if your income is higher than $85,000 as an individual and $170,000 as a couple.

What is a qualified Medicare beneficiary?

Qualified Medicare Beneficiary. The first program that can help reduce your costs is the Qualified Medicare Beneficiary (QMB). There are two requirements to be eligible for this program, which include the income limit and asset limit. If you meet both of these requirements and are eligible for the program, your state should pay your premiums, ...

How much was Medicare Part B premium in 2015?

The standard Part B premium for 2015 was $121.80, although it can be higher based on your income or other factors. Although most people have to pay a premium to be eligible to receive Medicare Part B benefits, there are programs that can help reduce or cover the cost depending on your circumstances. Enter your zip code above to receive private ...