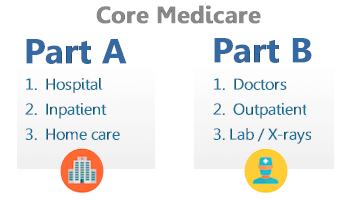

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

How much will you pay for Medicare Part B?

The standard Part B premium in 2021 is $148.50 per month, though you could potentially pay more, depending on your income. Your Medicare Part B premium largely depends on the income reported on your tax return from two years prior.

Do I really need Medicare Part B?

You don't have to take Part B coverage if you don't want it, and your FEHB plan can't require you to take it. There are some advantages to enrolling in Part B: You must be enrolled in Parts A and B to join a Medicare Advantage plan. You have the advantage of coordination of benefits (described later) between Medicare and your FEHB plan, reducing your out-of-pocket costs.

How do you enroll in Medicare Part B?

You can also fax or mail your completed CMS-40B, Application for Enrollment in Medicare – Part B (Medical Insurance) and the CMS-L564, Request for Employment Information enrollment forms and evidence of employment to your local Social Security office. If you have questions, please contact Social Security at 1-800-772-1213 (TTY 1-800-325-0778).

How do I add Part B to my Medicare?

When you have an Advantage plan, Medicare Parts A and Part B do not act as secondary coverage for your Advantage plan. You don’t get healthcare services from both, because when you choose a Medicare Advantage plan you are deselecting CMS as the ...

Can Medicare Part B be free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

How do I get Medicare Part B reduced?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

What income is used for Medicare Part B premiums?

The adjustment is calculated using your modified adjusted gross income (MAGI) from two years ago. In 2022, that means the income tax return that you filed in 2021 for tax year 2020.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

Why is my Medicare Part B premium so high?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, you'll pay higher premiums.

Does everyone pay the same for Medicare Part B?

Medicare premiums are calculated based on your modified adjusted gross income from two years prior. Thus, your premium can change if you receive a change in income. Does everyone pay the same for Medicare Part B? No, each beneficiary will pay a Medicare Part B premium that is based on their income.

What is the standard Medicare Part B premium for 2021?

$148.50Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the cost of Medicare Part B for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

What happens if you don't enroll in Part A?

If an individual did not enroll in premium Part A when first eligible, they may have to pay a higher monthly premium if they decide to enroll later. The monthly premium for Part A may increase up to 10%. The individual will have to pay the higher premium for twice the number of years the individual could have had Part A, but did not sign up.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

What is MEC in Medicare?

Medicare and Minimum Essential Coverage (MEC) Medicare Part A counts as minimum essential coverage and satisfies the law that requires people to have health coverage. For additional information about minimum essential coverage (MEC) for people with Medicare, go to our Medicare & Marketplace page.

How much is Part B insurance in 2021?

The standard monthly premium for Part B is $148.50 in 2021 – but that assumes you are not earning a higher income. Your yearly income from 2019 will be what will determine the premiums you pay for 2021. If you filed an individual tax return and made $88,000 or less, you will pay the standard premium. If you filed a joint tax return and made $176,000 or less, you will also pay the standard premium. However, anything above these figures will result in a higher premium payment.

What is Medicare Savings Program?

Medicare Savings Programs can help with Medicare Part B out-of-pocket costs and premiums for Medicare beneficiaries with limited income and assets. There are four different types of Medicare Savings Program, and they offer varying benefits. The four types of MSPs each have different requirements in terms of a financial situation that will make you eligible, including income and asset limits.

How much is Medicare Part B deductible?

The most common monthly Part B premium is $148.50. If you have a high income, you'll pay more. In 2021, the Medicare Part B deductible is $203.

What is the Medicare Part B deductible for 2021?

In 2021, the Medicare Part B deductible is $203. After you reach this deductible, you pay 20% of the Medicare-approved amount for most care.

Is Medicare free?

By and large, Medicare is not considered free. Because you have been contributing to your Medicare services through taxes throughout your life, you will have contributed money to Medicare regardless of the current cost of your copayments or premiums. However, it's possible to receive assistance for your Medicare Part A and Part B premiums, copays, ...

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much does Medicare Plan B cost?

In the case that this cost is not incorporated into your plan already, you will have to pay your premium yourself. The cost varies from plan to plan but usually it starts around $135.50.

What is Medicare Advantage?

A Medicare Advantage Plan is not the same as Original Medicare. Medicare Advantage (MA or Part C) Plans are an all-inclusive alternative to Original Medicare. Private Medicare-approved companies offer these bundled policies. They include Medicare Part A, Part B, and Part D benefits. MA Plans cover all Medicare services and many offer extra coverage. Medicare pays a fixed amount each month to the MA Plan companies, as long as they follow a set of rules placed by Medicare.

What is a Medicare MSA?

A Medicare Medical Savings Account (MSA) Plan works with private insurance companies to focus on offering a consumer-directed plan. This means the consumer is more in control of the plan and what they get, like choosing health care services and providers.

What is deductible in MA?

A deductible is another out-of-pocket expense that may come with an MA Plan. This is a predetermined amount that you have to pay prior to your plan paying for your medical bills. So this means there is a certain threshold that you have to account for before your insurance kicks in. Usually plans have a deductible for medical bills and then a separate one for prescription drugs.

Does Medicare Advantage have a low cost?

Some Medicare Advantage plans will have $0 or low-cost premiums – but will require extremely high out-of-pocket costs. Be wary of high coinsurance, copayments, and deductibles hidden in some Medicare Advantage policies.