What is the best resource to understand Medicare?

Who is the best person to talk to about Medicare?

How can I talk to someone about my Medicare?

For questions about your claims or other personal Medicare information, log into (or create) your secure Medicare account, or call us at 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048.

Do seniors understand Medicare?

What are the 4 types of Medicare?

- Part A provides inpatient/hospital coverage.

- Part B provides outpatient/medical coverage.

- Part C offers an alternate way to receive your Medicare benefits (see below for more information).

- Part D provides prescription drug coverage.

Does Medicare cover dental?

What phone number is 800 633 4227?

For specific billing questions and questions about your claims, medical records, or expenses, log into your secure Medicare account, or call us at 1-800-MEDICARE.

What is the Medicare helpline?

Is Blue Cross Blue Shield Medicare?

Can I get health insurance if I am over 65?

What is the Medicare premium for seniors?

Do people understand Medicare?

What is part A in Medicare?

Part A is your Hospital Coverage. This coverage pays for your room and board in the hospital or in a skilled nursing facility. Part B is your Outpatient Coverage. This includes pretty much everything else: doctor visits, equipment, lab-work, surgeries, durable medical equipment, diagnostic tests, etc.

Is Medicare scary?

Frankly, Medicare can feel a little scary when it’s entirely new to us. Most of us spend our lives working for an employer who selects our insurance for us. We go to an annual benefits meeting and sign up for the plan they’ve chosen for us. We hit 65, and we are clueless about Medicare and its dozens of plan options.

What is the Medicare Part B rate for 2021?

Medicare Part B depends on your income. People new to Medicare 2021 have a base rate of $148.50/month. However, people in higher income brackets will pay an “Income Adjustment.” Really that’s just a nifty term for explaining that people who earn higher incomes pay higher costs for Medicare.

How much is Medicare deductible for 2021?

Your share of that cost is a hospital deductible, which will be $1,484 in 2021. After 60 days consecutive days in the hospital, Medicare pays a diminishing share of your benefits. You begin paying a larger share in the form of a daily hospital copay.

Do you have to keep mailers for Medicare Advantage?

There's no need to keep mailers about Medicare Advantage plans if you determine that Medigap plans are a better fit for you, and vice versa. One of the great things about the Medicare insurance options is that there are plans available for any budget on the spectrum.

What is covered by Part B?

After a small deductible that you pay once per year ($203 in 2021), Part B will cover 80% of all of these services for you.

How much does Part B cover?

After a small deductible that you pay once per year ($203 in 2021), Part B will cover 80% of all of these services for you. Your share is the other 20% of all of these services, with no cap. That can be quite a bit of money for some of the bigger ticket items like surgeries or cancer treatments.

What is the number to call for Medicare?

Medicare – The federal government has a toll-free number, 1-800-MEDICARE, and a website that provides basic information about Medicare coverage and your private health and/or drug plan options.

What is the toll free number for Medicare?

Learn about and contact other agencies for additional assistance. Medicare – The federal government has a toll-free number, 1-800-MEDICARE, and a website that provides basic information about Medicare coverage and your private health and/or drug plan options. Social Security Administration (SSA) – The federal government has a toll-free number, ...

What is Medicare Rights Center?

Medicare Rights Center – The Medicare Rights Center is a national nonprofit consumer service organization that works to ensure access to affordable health care for older adults and people with disabilities through counseling and advocacy, educational programs, and public policy initiatives.

What is Medigap insurance?

A: Medigap is private insurance that covers out-of-pocket expenses in the Original Medicare program. (If you are under age 65 and have Medicare due to disability, see the next Q&A in this section, because the rules are different for your situation.) — Read Full Answer.

Does Medicare cover all medical expenses?

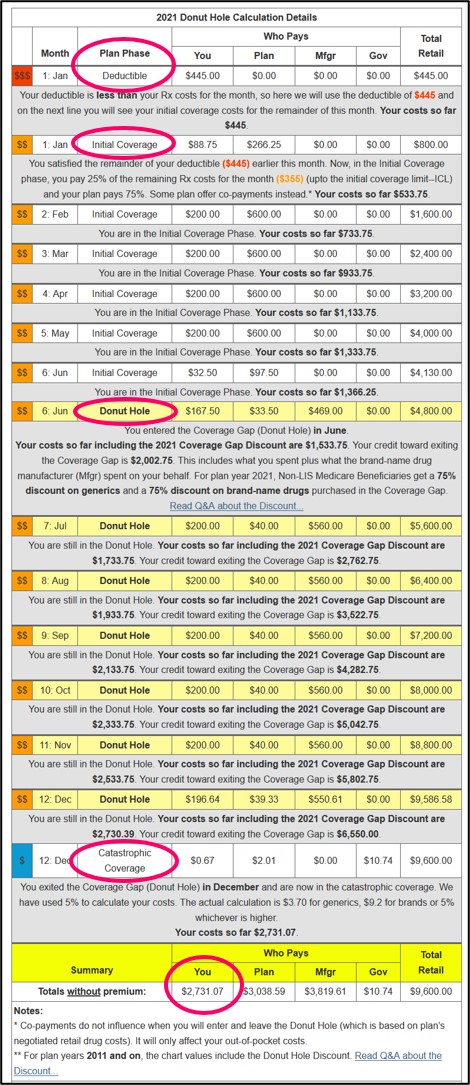

A: Medicare does not cover all your health care costs. It requires you to pay premiums, deductibles and copays, which vary according to the type of Medicare coverage you choose and, in some cases, your income. — Read Full Answer. Q: I want to be sure I understand the Part D “doughnut hole” or coverage gap.

How long does it take for Social Security to review your income?

When determining one’s income adjustment, Social Security will review previous tax returns, up to two years. If you find that your income has decreased from the previous years, you may be able to file a reconsideration request. Social Security will require proof of income and will then reconsider your premium costs.

What is the SEP period for Medicare?

If this criterion is met, you may delay enrollment for Medicare until after turning age 65. GEP – General Enrollment Period: If you fail to apply for Medicare ...

Does Social Security have a deductible?

Social Security will require proof of income and will then reconsider your premium costs. Once the premium costs are determined, they will be deducted from your monthly income. Part B has a deductible. If you’re enrolled in a first-dollar coverage Medigap plan, then your Part B deductible will be covered 100%.

What is supplemental coverage?

Supplemental Coverage. As stated before, supplemental coverages can be a huge lifesaver in the event you find yourself in a flurry of hospital and physician charges. Medigap Plans – These are plans that pay after Medicare pays. This will cover that 20% patient responsibility for your outpatient services.

When do you have to enroll in Part A and B?

Automatic Enrollment: You may be automatically enrolled in Part A and B at 65 years of age if you begin to receive retirement benefits from either the Railroad Retirement Board or from Social Security.

Get started with Medicare

Get basics on how Medicare works, sign up, and review your options for more coverage. Learn about it at your own pace.

Medicare costs

Learn about Medicare costs, how to pay premiums, and cost-saving programs.

Identity theft & fraud: Protect yourself

Find out how to protect your personal information, including your Medicare Number, and how to spot and stop scams and fraud.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

Does Medicare Advantage have out of pocket costs?

Medicare Advantage. Out-of-pocket costs vary—plans may have lower out-of-pocket costs for certain services. You may pay the plan’s premium in addition to the monthly Part B premium. (Most plans include Medicare drug coverage.) Plans may have a $0 premium or may help pay all or part of your Part B premiums.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance).

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What is the number to call for Medicare?

1-800-MEDICARE (800-633-4227): This 24/7 resource has recorded answers to most every Medicare question. Say “agent” at any time to be connected to a live person. Medicare Savings Programs: These help low-income beneficiaries pay for some part A and B costs.

What is the number to call to talk to a live person at Medicare?

It also has a live chat available at any time. 1-800-MEDICARE (800-633-4227): This 24/7 resource has recorded answers to most every Medicare question. Say “agent” at any time to be connected to a live person. Medicare Savings Programs: These help low-income beneficiaries pay for some part A and B costs.

What is Ships for Medicare?

SHIPs are free health-benefits counseling services for Medicare beneficiaries and their families, friends and caregivers. Each state has its own SHIP website; find yours at shiptacenter.org. Services include free counseling at workshops or over the phone.

Is AARP an insurer?

AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers. AARP. The third edition of AARP’s "Medicare for Dummies," by Medicare expert Patricia Barry, is now available.

Who pays royalty fees to AARP?

UnitedHealthcare Insurance Company pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

Take advantage of your state's one-on-one counseling program

If you have a complicated question about Medicare, or just want some help talking through your options, you should take advantage of the free one-on-one counseling available through your state's State Health Insurance Assistance Program (SHIP)

See all our Medicare information

We've collected the information you need to manage your Medicare benefits. How to sign up for the first time. How to decide between Medicare Advantage and Medigap. How to pick the best Advantage or prescription drug plan.