There are no income limits to receive Medicare benefits. You may pay more for your premiums based on your level of income. If you have limited income, you might qualify for assistance in paying Medicare premiums.

Full Answer

How can I get help Paying my Medicare costs?

Dec 01, 2021 · Eligibility for Low-Income Subsidy. This page contains information on eligibility for the Low-Income Subsidy (also called "Extra Help") available under the Medicare Part D prescription drug program. It includes information on how one becomes eligible for the Low-Income Subsidy as well as useful outreach material. See the link under "Related Links Outside …

Do I qualify for assistance in paying Medicare premiums?

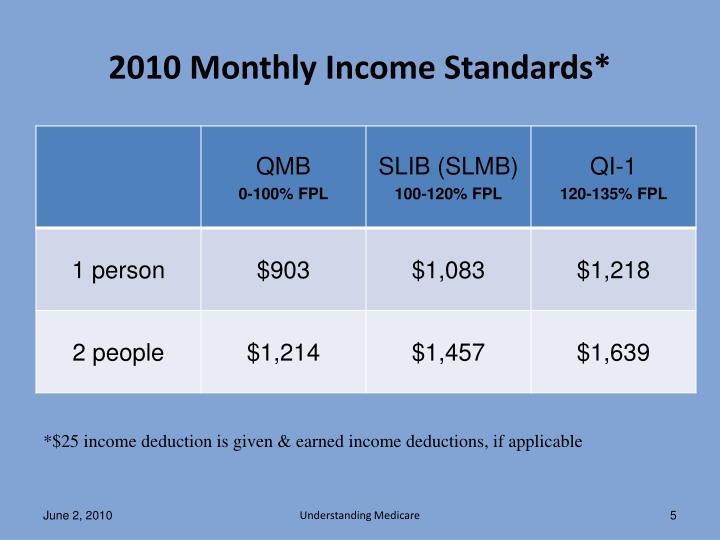

Nov 16, 2021 · Specified Low-Income Medicare Beneficiary (SLMB) program If you make less than $1,308 a month and have less than $7,970 in resources, you can qualify for SLMB. Married couples need to make less...

How can I reduce my Medicare premiums?

Jan 14, 2022 · Part A deductible: $1,556 per benefit period (in 2022) Part A coinsurance for hospital stays past 60 days: Starting at $389 per day and increasing after 91 days. Part B Deductible: $233 per year (in 2022) Part B coinsurance: 20 percent of the Medicare-approved amount for a service.

Are you eligible for the Medicare Part A and B program?

Mar 23, 2015 · By Kevin Prindiville, Executive Director, Justice in Aging. Of the 54 million people with Medicare, a staggering 25% have annual incomes below $14,400. For these people living in retirement, or coping with a disability in poverty, Medicare coverage offers a lifeline, a chance to get needed health care. That precious red white and blue Medicare card means that a doctor …

What is the lowest income to qualify for Medicare?

To qualify, your monthly income cannot be higher than $1,357 for an individual or $1,823 for a married couple. Your resource limits are $7,280 for one person and $10,930 for a married couple. A Specified Low-Income Medicare Beneficiary (SLMB) policy helps pay your Medicare Part B premium.

Is Medicare free if you are poor?

If you have low income and assets, you may qualify for help with some of your Medicare costs from one or more of the programs below. California's Medicaid program, known as Medi-Cal, pays for certain care Medicare doesn't, and helps pay the cost-sharing for the benefits and services Medicare does cover.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

Does Medicare look at your bank account?

Medicare plans and people who represent them can't do any of these things: Ask for your Social Security Number, bank account number, or credit card information unless it's needed to verify membership, determine enrollment eligibility, or process an enrollment request.

Is Medicare based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Can you have Medicare and Humana at the same time?

People eligible for Medicare can get coverage through the federal government or through a private health insurance company like Humana. Like Medicaid, every Medicare plan is required by law to give the same basic benefits.

What is the PACE program?

PACE. PACE (Program of All-inclusive Care for the Elderly) is a Medicare/Medicaid program that helps people meet health care needs in the community.

What is SSI benefits?

A monthly benefit paid by Social Security. SSI is for people with limited income and resources who are disabled, blind, or age 65 or older. SSI benefits aren't the same as Social Security retirement or disability benefits.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How much is Medicare Part B 2021?

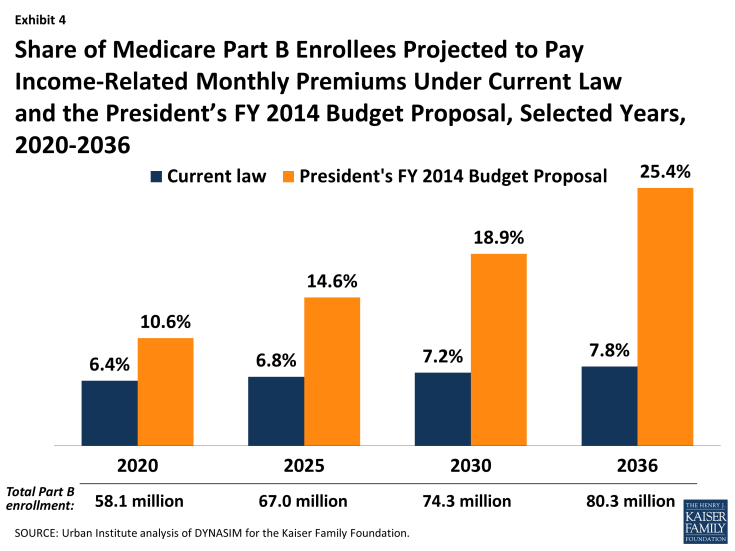

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

Do you pay for Medicare Part A?

Medicare Part A premiums. Most people will pay nothing for Medicare Part A. Your Part A coverage is free as long as you’re eligible for Social Security or Railroad Retirement Board benefits. You can also get premium-free Part A coverage even if you’re not ready to receive Social Security retirement benefits yet.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

What are the costs of Medicare?

Even if a product or service is covered by Medicare, there are some costs you may have to pay out of pocket, including: 1 Part A deductible: $1,484 per benefit period (in 2021) 2 Part A coinsurance for hospital stays past 60 days: Starting at $371 per day and increasing after 91 days 3 Part B Deductible: $203 per year (in 2021) 4 Part B coinsurance: 20 percent of the Medicare-approved amount for a service

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) helps cover some of these out-of-pocket costs, which helps individuals better plan for their insurance costs. Learn more about Medigap below.

Does Medicare Supplement cover out of pocket costs?

Medicare Supplement Insurance. Medicare Supplement Insurance can help cover some of Medicare's out-of-pocket costs. In most states there are 10 standardized Medigap plans to choose from, each providing coverage for a unique mix of basic benefits.

What is the Medicare Part B deductible for 2021?

In 2021, the Medicare Part B deductible is $203. After you reach this deductible, you pay 20% of the Medicare-approved amount for most care.

How much is Medicare Part B deductible?

The most common monthly Part B premium is $148.50. If you have a high income, you'll pay more. In 2021, the Medicare Part B deductible is $203.

Who is Luke Hockaday?

Luke Hockaday is a Customer Success Rep here at Medicare Allies. Luke has been helping Medicare-eligible clients with their insurance and retirement-planning needs since 2011. Luke is passionate about 3 things, and 3 things only: senior insurance, football, and food!

Is Medicare free?

By and large, Medicare is not considered free. Because you have been contributing to your Medicare services through taxes throughout your life, you will have contributed money to Medicare regardless of the current cost of your copayments or premiums. However, it's possible to receive assistance for your Medicare Part A and Part B premiums, copays, ...

Which Medigap Plans Are Most Affordable?

Currently, there are ten different Medigap plan types offered by private insurers. The good news is that these plans are federally regulated, meaning that a Medigap Plan G from Aetna will provide you with the same coverage as Humana’s Plan G.

Why Medigap Plan N Is Ideal for Low-Income Seniors

In 2019, the average yearly income for Americans over 65 was $27,398. Between housing, entertainment, and medical costs, many people are on a budget, meaning you won’t want to add further burden through a Medigap policy. After all, Medigap is designed to help you save. Because of this, I’d recommend people look into Medigap Plan N.

How We Chose the Most Affordable Medigap Plans

No matter which company you choose, your Medigap policy will offer the same coverage. Still, each private insurance provider has its own idiosyncrasies that will ultimately affect your decision. Here’s what I looked for when choosing the most affordable Medigap plans.

How much does Medicare Part B cost?

The standard premium amount for Medicare Part B is $144.60. You may pay a higher premium amount if your income is higher than $85,000 as an individual and $170,000 as a couple.

What is a qualified Medicare beneficiary?

Qualified Medicare Beneficiary. The first program that can help reduce your costs is the Qualified Medicare Beneficiary (QMB). There are two requirements to be eligible for this program, which include the income limit and asset limit. If you meet both of these requirements and are eligible for the program, your state should pay your premiums, ...

Do you have to pay a premium for Medicare Part B?

Although most people have to pay a premium to be eligible to receive Medicare Part B benefits, there are programs that can help reduce or cover the cost depending on your circumstances. Enter your zip code above to receive private Medicare quotes for your state!

What is the asset limit for QMB?

In addition to the income limit, there is an asset limit you must meet in order to be eligible for the QMB program. The asset limit is approximately $7000 for an individual and $11,000 for a couple that is married.

Is Medicare Part B free?

Medicare Part B is very rarely “free”, there are monthly premiums most people have to pay for their Medicare Part B coverage. There are several programs that can help to reduce the cost of your Medicare Part B premium and even cover the cost entirely.