To get the statement you need to fill in a form. You or your tax agent can complete Application for a Medicare Entitlement Statement form. But you must sign it.

How do I access my Medicare Information?

Create an account to access your Medicare information anytime. You can also: Add your prescriptions and pharmacies to help you better compare health and drug plans in your area. Sign up to get your yearly "Medicare & You" handbook and claims statements, called "Medicare Summary Notices," electronically.

Do you still issue tax statements for Medicare benefits?

We no longer issue tax statements for Medicare benefits. Medicare benefit tax statements were available in the past, so you could claim the Net Medical Expenses Tax Offset (NMETO) in your annual tax return. It showed you the Medicare benefits you got for medical services.

What is a Medicare Part a tax statement?

Medicare sends a tax statement to beneficiaries between December and January of each year. The document shows a person had Medicare Part A during the tax year. Medicare Part A and Medicare Advantage are classed as qualifying health coverage, under the Affordable Care Act.

How do I get my Medicare summary notices electronically?

Select "Get your Medicare Summary Notices (MSNs) electronically" under the "My messages" section at the top of your account homepage. You'll come to the "My communication preferences" page where you can select "Yes" under "Change eMSN preference," then "Submit."

Does Medicare provide a tax statement?

Medicare sends a tax statement to beneficiaries between December and January of each year. The document shows a person had Medicare Part A during the tax year. Medicare Part A and Medicare Advantage are classed as qualifying health coverage, under the Affordable Care Act.

Will I receive a 1095 form for Medicare?

Form 1095-B –Individuals who enroll in health insurance through Medi-Cal, Medicare, and other insurance companies or coverage providers will receive this form. Form 1095-C –Individuals who enroll in health insurance through their employers will receive this form.

Does Medicare provide a 1099?

Medicare contractors send the 1099-MISC or 1099-INT (1099 Forms) to providers to report the payments made by the contractor for the calendar year. Providers who receive the 1099 Form are required to use its information as part of their tax reporting.

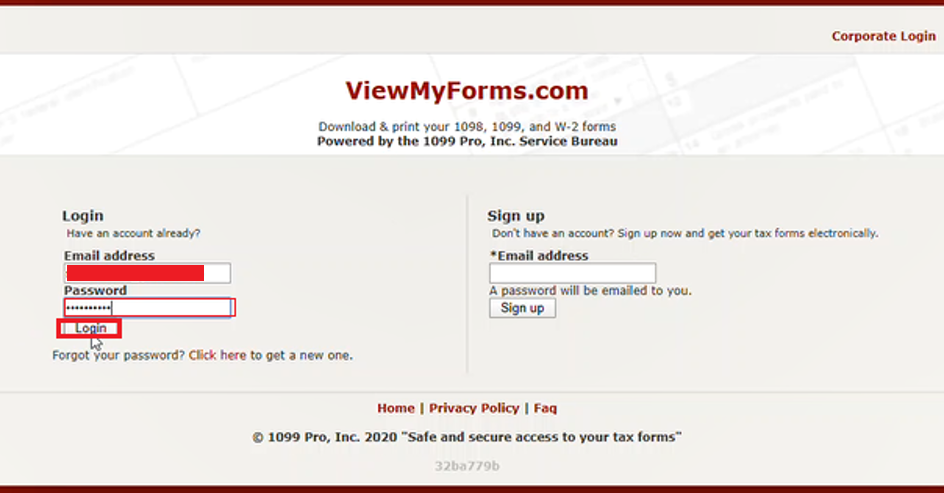

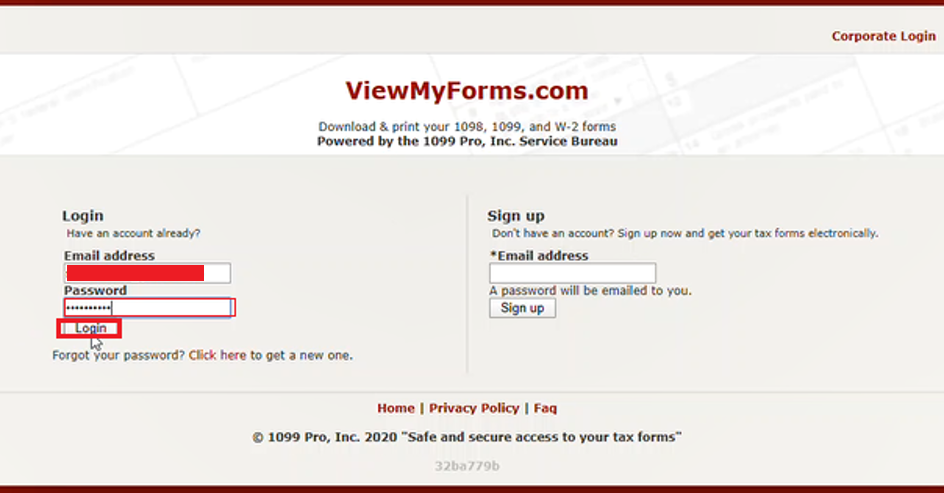

How do I get my 1095-B form online?

How to find your 1095-A onlineLog in to your HealthCare.gov account.Under "Your Existing Applications," select your 2021 application — not your 2022 application.Select “Tax Forms” from the menu on the left.Download all 1095-As shown on the screen.

How do I get my Medicare statement?

If you have lost your MSN or you need a duplicate copy, call 1-800-MEDICARE or go to your account on www.mymedicare.gov.

How do I get proof of Medicare payments?

The easiest receipt for you to use as proof of eligible expenses is the annual statement you receive from Social Security for the upcoming calendar year.

How do I get my 1095-B form from medical?

For questions regarding this notice or for additional information regarding Form 1095-B, contact a live agent at DHCS' Medi-Cal Helpline 1-844-253-0883.

Does Medicare send a statement?

It's a notice that people with Original Medicare get in the mail every 3 months for their Medicare Part A and Part B-covered services. The MSN shows: All your services or supplies that providers and suppliers billed to Medicare during the 3-month period.

Do I need my 1095-B to file taxes?

You do not need 1095-B form to file taxes. It is for your records. IRS 1095-B form is your proof of the month(s) during the prior year that you received qualifying health coverage.

Who provides the 1095-B?

Form 1095-B is sent out by health insurance carriers, government-sponsored plans such as Medicare, Medicaid, and CHIP, and self-insured small employers (large employers, including those that are self-insured, send out Form 1095-C instead). This form is mailed to the IRS and to the insured member.

When should I expect my 1095-B?

When will I receive these health care tax forms? The annual deadline for the Marketplace to provide Form 1095-A is January 31. The deadline for insurers, other coverage providers and certain employers to provide Forms 1095-B and 1095-C to individuals is January 31.

What is the difference between 1095-A and 1095-B?

If you have a 1095-B, a form titled Health Coverage, the IRS does NOT need any details from this form. You can keep any 1095-B forms you get from your health insurance company or the government agency that sponsors your plan for your records. The form 1095-A is for Obamacare.

When does Medicare send out tax statements?

Medicare sends a tax statement to beneficiaries between December and January of each year. The document shows a person had Medicare Part A during the tax year. Medicare Part A and Medicare Advantage are classed as qualifying health coverage, under the Affordable Care Act.

What is the Medicare benefit statement?

The Medicare benefit tax statement is sent to individuals to confirm that their health plan with Medicare is qualifying, should the Internal Revenue Service (IRS) ask for evidence of coverage. ...

What is the number to call to replace a 1095-B?

If a person’s Medicare 1095-B statement is lost or damaged, a free replacement is available by calling Medicare at 800-633-4227.

What is a 1095B statement?

At the end of each year, Medicare sends a 1095-B statement. This statement shows the IRS a person had ...

What are some examples of medical expenses?

Examples may include services like dental, hearing, and eye care . These are types of services that, although not generally covered by Medicare, can be deducted as medical expenses. Some qualified medical expenses can also count toward a Medicare Medical Savings Account (MSA), which is a type of Medicare Advantage plan.

What are not qualifying health plans?

There are plans that are not qualifying health coverage. These can include: Medicare Part B when a person has this plan alone. plans that cover only eye or dental care. workers’ compensation. plans that cover only specific diseases or health conditions. plans that give only discounts on health services.

How often is the Social Security tax statement sent?

A person may also receive a Medicare Summary Notice (MSN). The MSN is sent every 3 months to people enrolled in Medicare.

What is the simplest way to file a tax return?

Filing a tax return electronically is the simplest way to file a complete and accurate tax return as it guides you through the process and does all the math for you. Electronic Filing options include free Volunteer Assistance, IRS Free File, commercial software and professional assistance.

Who will send 1095-C?

Certain employers will send Form 1095-C to certain employees, with information about what coverage the employer offered. The IRS has posted questions and answers about the Forms 1095-B and 1095-C.

What is a 1095-A?

Form 1095-A, Health Insurance Marketplace Statement. If you or your family had coverage through a Marketplace, the Marketplace will send you information about the coverage on Form 1095-A. The form will show coverage details such as the effective date, amount of the premium, and the advance payments of the premium tax credit or subsidy.

What to do if you haven't filed your 2020 taxes?

If you have not filed your 2020 tax return, here's what to do: If you have excess APTC for 2020, you are not required to report it on your 2020 tax return or file Form 8962, Premium Tax Credit. If you're claiming a net Premium Tax Credit for 2020, you must file Form 8962, Premium Tax Credit. For details see: Tax Year 2020 Premium Tax Credit ...

What is self insured coverage?

Employers that offer health coverage referred to as “self-insured coverage” send this form to individuals they cover, with information about who was covered and when. You can use Form 1095-C to help determine your eligibility for the premium tax credit.

When will the 1040-SR be reduced to zero?

Under the Tax Cuts and Jobs Act, passed December 22, 2017, the amount of the individual shared responsibility payment is reduced to zero for months beginning after December 31, 2018. Beginning in tax year 2019, Forms 1040 and 1040-SR will not have the “full-year health care coverage or exempt” box ...

How long does it take to create a Social Security document?

If you don’t have a my Social Security account, creating one is very easy to do and usually takes less than 10 minutes.

When was the last update for Social Security?

Last Updated: February 22, 2019. Tax season is approaching, and Social Security has made replacing your annual Benefit Statement even easier. The Benefit Statement is also known as the SSA-1099 or the SSA-1042S.

Can I get a copy of my SSA 1099?

The forms SSA-1099 and SSA-1042S are not available for people who receive Supplemental Security Income (SSI). With a personal my Social Security account, you can do much of your business with us online, on your time, like get a copy of your SSA-1099 form. Visit our website to find out more. See Comments.

Form 8962, Premium Tax Credit

If you had Marketplace insurance and used premium tax credits to lower your monthly payment, you must file this health insurance tax form with your federal income tax return. You’ll use this form to “reconcile” — to find out if you used more or less premium tax credit than you qualify for.

Health coverage tax tool

You’ll need to use this tool when filing your 2020 taxes only if the information on your health care tax Form 1095-A about your “second lowest cost Silver plan” (SLCSP) is missing or incorrect. See how to find out if this applies to you.