How to Enroll in Medicare Plan G The easiest way to get started and enroll in Plan G is to just call us today at 1-888-891-0229, or click below to set an appointment to speak with one of us. You can choose which time and day work best for you, and we’ll call you then to get you started.

Should You Choose Medicare supplement plan F or Plan G?

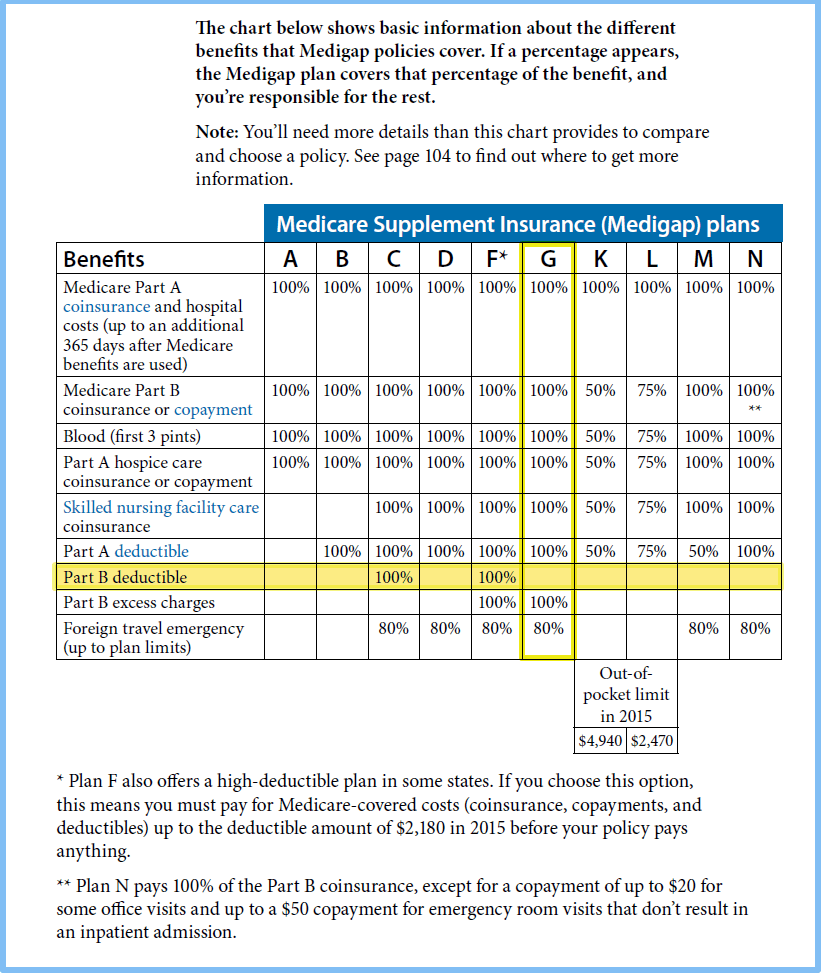

The reason is simple: Plan G is less expensive than F and there is speculation that because of the Changes in Medicare Supplement plans in 2020, the prices of Plan F will increase significantly. While nothing is yet certain, switching to Plan G is worth considering. What is the difference between Medigap Plan G and Plan F?

Is Medigap Plan G better than Plan F?

Medigap Plans F, G, and N are three of the most popular plans ... underwriting or a premium penalty – but only for plans with the same or lower benefits than your existing plan. In other words, you can’t trade up. Bottom line When evaluating a Medigap ...

What is plan F and G in Medicare?

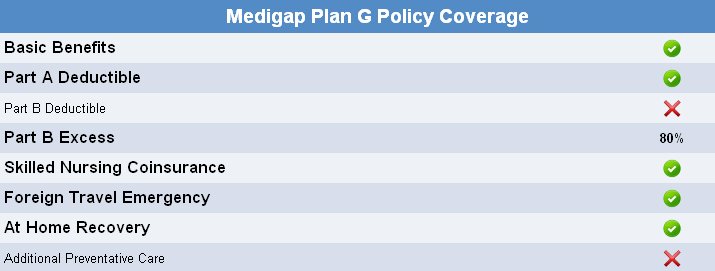

Plan G offers excellent value for Medicare beneficiaries who are willing to get a small annual deductible. After that, Plan G will provide complete coverage for all the gaps in Medicare. It will be covering 20 percent of what Medicare Part B fails to cover. It will take care of the Medicare Part A hospital deductible, coinsurance, and copays.

What is Medigap Plan G?

Thus, Medigap Plan G is at present the most popular among the Medigap plans since it offers almost the same coverage as Plan F, except for the Part B deductible, which costs $233 in 2022. Meanwhile, Plan N offers a good balance between protection against catastrophic out of pocket expenses and affordable premiums.

Can you still get Medicare Plan G?

You can buy MedSup Plan G — and every other MedSup plan — from any insurance company that's licensed in your state to sell Medicare Supplement coverage.

Who qualifies for Medicare G?

Everyone is eligible for Medicare Plan G, also known as Medigap Plan G, during the Medigap Open Enrollment Period. After the open enrollment period, a plan may cost more, or an insurer may deny it, depending on a person's health. People who are 65 years of age or older are eligible for Medicare coverage.

How much is the G plan for Medicare?

Medicare Plan G is the most comprehensive coverage you can buy if you became eligible for Medicare after December 31, 2019. Plan G has essentially the same benefits as Plan F, except for the Part B deductible. Annual premiums for Medicare Plan G typically cost between $1,500 and $2,000.

What is Medicare supplemental G?

Medigap Plan G is one of 10 Medicare Supplement Insurance plans. Medigap plans cover certain expenses such as coinsurance, copayments and deductibles that aren't covered under Medicare Part A and Part B, also known as Original Medicare.

What is the monthly premium for plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

Does AARP Offer plan G?

AARP also offers a high-deductible version of Plan G. This option will require you to pay a deductible of $2,340 before the plan begins to assist with costs. Once you've met your deductible, the plan will pay 100% of covered costs for the remainder of the year. This plan does not cover your Part B deductible.

How much does AARP Medicare Supplement plan G cost?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan G (1)$173Plan K$70Plan L$136Plan N$1676 more rows•Jan 24, 2022

What is the deductible for Medicare Plan G in 2022?

$2,490* Plans F and G also offer a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of$2,490 in 2022 before your policy pays anything.

Does plan G have a deductible?

However, Plan G does not have its own deductible separate from the Part B deductible. There is also a High Deductible Plan G which has a deductible of $2,490 in 2022.

Can I switch from plan N to plan G?

You can switch from Plan N to Plan G any time during the year, but if you are outside your 6-month Open Enrollment window, then you may have to answer health questions to switch. Your approval is not guaranteed.

What plan G does not cover?

Medigap Plan G does not cover dental care, or other services excluded from Original Medicare coverage like cosmetic procedures or acupuncture. Some Medicare Advantage policies may cover these services. Like Medigap, Medicare Advantage is private insurance.

Is plan F better than plan G?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.

What is the average cost of Plan G?

There is no set premium for Plan G as plans can range from $100 to $200. Your monthly premium will depend on your location and zip code, your gende...

What is the Plan G deductible in 2022?

$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separ...

What is the difference between Plan N and Plan G?

The biggest difference between these two is your out-of-pocket costs. With Plan N you will be responsible for the Part B deductible, $20 copay for...

What Does Medicare Plan G pay for?

Plan G pays for your hospital deductible and all copayments and coinsurance under Medicare. For example, this would include the hospice care coinsu...

Does Medicare Plan G cover dental?

No, since Medicare does not cover routine dental care, a Medigap policy will not either. However, medically necessary dental services can be covere...

Does Plan G cover prescriptions?

Plan G will cover the coinsurance on any Part B medications. These are typically drugs that are administered in a clinical setting, such as chemoth...

Which is better, Medicare Plan F vs G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more th...

How to apply for Medicare Supplement?

This is an ideal time to apply for a Medicare supplement plan because during that Open Enrollment period, an insurance company is not allowed to use medical underwriting to decide whether to accept your application. This means that the insurance company can’t take certain actions based on any of your existing health conditions, including: 1 Not sell you a policy 2 Upcharge you for a Medigap policy as compared to someone else without your health conditions 3 Make you wait for coverage, aside from a few exceptions

What is Plan G?

Plan G is available to individuals who want comprehensive coverage and became newly eligible to Medicare after January 1, 2020. Ron Elledge. Medicare Consultant and Author. Ron Elledge. Medicare Consultant and Author.

Do you have to pay a monthly premium for Medicare?

All Medica re supplement plans require you to pay a monthly premium. Premiums are set by each state and each insurance provider. Because Medicare supplement plans are offered through private insurance companies, the companies will set their own premiums, so they will vary.

Why is Medicare Plan G so popular?

It is because Medigap Plan G is also a long-term rate saver. Medicare Supplemental Plan G has a lower rate increase trend from year to year than Plan F.

Why is Medicare Supplement G more expensive than Plan N?

Medicare Supplement G usually costs more than Plan N, because it covers more. People seem to like the security and peace of mind that a comprehensive policy like Plan G seems to offer. Want to know which companies offer the best Medicare Plan G policies. Read our Plan G Reviews here or attend one of our free New to Medicare webinars ...

What is the difference between Medigap Plan G and Plan N?

With Plan N you will be responsible for the Part B deductible as well as excess charges. With Medigap Plan G, you will be responsible for the Part B deductible but you will have no excess charges.

What is a small deductible for Medicare?

Medigap Plan G: A Small Deductible = Big Savings. Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $203 in 2021. In fact, if you have a Plan F that has been in place for years, ...

How long does a hospital stay last after Medicare runs out?

It also covers the expensive daily copays that you might encounter for a hospital stay that runs longer than 60 days. It provides an additional 365 days in the hospital after Medicare runs out, and it covers your skilled nursing facility co-insurance, too.

What is Plan G?

After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your hospital deductible, copays and coinsurance. It also covers the 20% that Part B doesn’t cover.

Does Medicare pay for inpatient hospital?

So, it helps to pay for inpatient hospital costs, such as blood transfusions, skilled nursing, and hospice care. It also covers outpatient medical services such as doctor visits, lab work, diabetes supplies, durable medical equipment, x-rays, ambulance, surgeries and much more. Medicare pays first, then Plan G pays all the rest after you pay ...

What is the Medicare Supplement Plan G?

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203. In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible.

What is a G plan?

This means that Plan G will be the plan with the most comprehensive coverage available to you. Additionally, you will have the option to sign up for a High Deductible Plan G. If you currently have a Plan F and are considering switching, we can help you evaluate your options.

Does Medicare pay your portion?

It is easy for you to use the coverage, and most people never see any paperwork. Once Medicare approves your claim, they will pay their portion and notify your provider of what they owe. The company must then pay the amount due per Medicare’s instructions.

Is Plan G more cost effective than Plan F?

Because of this, many people find that even after they pay their deductible, Plan G is still the more cost-effective option. Keep in mind: if you become eligible for Medicare in 2020 or later, you will not be able to get Plan F.

Does Medicare Supplement have a doctor network?

The benefits of a Plan G will be the same regardless of the company you select. Doctor’s Network – Medicare Supplement insurance companies don’t have their own doctor’s networks. Their plans are only supplements to your primary Medicare Parts A & B coverage.

What is Medicare Plan G?

Plan G offers full coverage of the Part A deductible and the Part A coinsurance charges. Under Original Medicare, inpatient hospital stays are only covered for the first 90 days, with 60 lifetime reserve days available if recipients exceed ...

How long does Medigap Plan G last?

Medigap Plan G extends that coverage for up to 365 additional days once Original Medicare benefits are exhausted. For surgeries that require blood transfusion, Plan G pays for the first three pints.

Does Medigap have an out-of-pocket limit?

Some Medigap plans impose an out-of-pocket limit, which works much the same as an Original Medicare deductible — Plan G, however, does not require enrollees to meet an out-of-pocket limit before coverage begins. It also offers the maximum amount of coverage for treatment during foreign travel, which is 80% of the cost of care.

Does Plan G cover Part B coinsurance?

Although it does not cover the Part B deductible, Plan G does cover costs related to Part B coinsurance or copayment charges. It also covers any excess charges that Medicare allows health care professionals to bill to the recipient for the services they receive.

Does Medigap cover Part B?

Although it does not cover the Part B deductible, Plan G does cover costs related to Part B coinsurance or copayment charges.

Can Medicare expand?

Medicare recipients have several options when it comes to expanding or enhancing their Original Medicare benefits. These options vary widely, so understanding their differences can help recipients make the best choice for their care.

Does Medicare Advantage cover prescription drugs?

Medicare Advantage plans can offer similar coverage options combined with prescription drug coverage, but recipients cannot enroll in both a Medicare Supplement ...

What is Medicare Supplement Plan G?

Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries. Medicare Supplement Plan G, like other Medigap plans (A through N), is standardized by the federal government.

What states have high deductible plan G?

High-Deductible Plan G is available in 13 states, including Alabama, Arizona, Delaware, Georgia, Illinois, Iowa, Kansas, Louisiana, Maryland, North Carolina, Ohio, Pennsylvania, and South Carolina. Aetna’s Medicare Supplement Plan G has a premium discount of 7% if someone in your home is also on one of its plans.

How much did Medicare spend in 2016?

In 2016, the average Medicare beneficiary spent more than $5,400 out of pocket for health care and more than $7,400 when they did not have supplemental insurance. Thankfully, Medicare Supplement Plans, also known as Medigap, help fill in the gaps. Medicare Supplement Plan G, in particular, offers the broadest coverage for new Medicare beneficiaries.

When did Medicare stop allowing Part B deductible?

When Congress passed the Medicare Access and CHIP Reauthorization Act (MACRA) of 2015, it changed which Medicare Supplement Plans could be made available to new Medicare beneficiaries. The law required discontinued plans that paid the Part B deductible. This is why, starting on January 1, 2020, Medicare Plans C and F were no longer available to people who were newly eligible for Medicare. There are no current plans to discontinue Plan G, and high-deductible plans were made available for the first time in 2020. 5

Does BCBS offer a discount on Medicare?

Although AARP by UnitedHealthcare offers a higher New to Medicare discount in its first year, BCBS offers the most discount savings over time. Check with your state’s plan for details about BCBS discount programs. BCBS prices Medicare Supplement Plan G according to attained-age in most states.

Is Humana a high deductible plan?

It offers Medicare Supplement Plan G in all 47 states where traditional Medicare Supplement Plans are available. High-Deductible Plan G is available in all of those states except Missouri.

Does Mutual of Omaha offer Medicare Supplement Plan G?

Mutual of Omaha offers Medicare Supplement Plan G in all 47 states where traditional Medicare Supplement Plans are available, and High-Deductible Plan G in all of those states except New York.

What is Medicare Supplement Plan G?

Medigap is supplemental insurance plan sold by private companies to help cover original Medicare costs, such as deductibles, copayments, and coinsurance . Medigap Plan G is a Medicare supplement plan that offers eight of the nine benefits available. This makes it one the most comprehensive Medigap plan offered.

What factors go into what an insurance company charges for Plan G?

There are lots of factors that go into what an insurance company charges for Plan G. These include: your age. your overall health.

What is the most comprehensive Medicare supplement plan?

Formerly, Medigap Plan F was the most comprehensive and popular Medicare supplement plan. Now, Plan G is the most comprehensive plan insurance companies offer.

What are the letters in a Medigap plan?

Exceptions exist for Massachusetts, Minnesota, and Wisconsin, who standardize their plans differently. Most companies name the plans by uppercase letters A, B, C, D, F, G, K, L, M, and N.

Why is it so hard to change Medigap plan?

However, some people find it hard to change their coverage because they get older (and premiums are more likely to be higher) and they may find switching plans costs them more. Because Medigap Plan G is one of the most comprehensive plans, it’s likely that health insurance companies may increase the costs over time.

How long does Medicare coinsurance last?

Medicare Part A coinsurance and hospital costs up to 365 days after your Medicare benefits are used up. Medicare Part B coinsurance or copayments. first 3 pints of blood for transfusions. Medicare Part A hospice care coinsurance or copayments. skilled nursing care facility coinsurance.

Does Medicare supplement plan increase deductible?

Once you choose a Medicare supplement plan, the deductibles can increase on a yearly basis.

What is Medicare Supplement Plan G?

(Massachusetts, Minnesota, and Wisconsin have different options). Medicare Supplement Plan G is the fastest growing Medigap plan. 1 Learn more about what Plan G covers, ...

When will Medicare plan G be available?

Starting in 2020, the highly-popular Plan F and Plan C will no longer be made available to new Medicare beneficiaries who become eligible for Medicare on or after January 1, 2020. If you are eligible for Medicare before January 1, 2020, you may be able to enroll in Medigap Plan C ...

How much is Medicare Part A deductible?

Medicare Part A comes with a deductible, which is $1,408 per benefit period in 2020. Medigap Plan G will cover your deductible in full for each benefit period you require.

How much is a high deductible plan G?

If you choose the high-deductible Plan G, you must meet a yearly deductible of $2,340 (in 2020) before the plan covers anything. The high-deductible version of Plan G may have lower premiums than the regular Plan G, but it also comes with much higher out-of-pocket costs. Learn more about how high-deductible Medigap Plan G works.

What is Medicare Part A?

Medicare Part A Coinsurance. Medicare Part A is known as hospital insurance, and it includes cost-sharing measures like coinsurance. Inpatient hospital stays covered by Medicare Part A require coinsurance fees if they exceed 60 days.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

What is the fastest growing Medicare Supplement Plan?

Medicare Supplement Plan G is the fastest growing Medigap plan. 1 Learn more about what Plan G covers, its cost and why it might be the right Medigap plan for you.

How to choose a Medigap plan?

Medigap policies are standardized, and in most states are named by letters, Plans A-N. Compare the benefits each plan helps pay for and choose a plan that covers what you need. See benefits of each plan. Step 2.

What is Medigap insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs.

What Does Medigap Plan G Offer?

Original Medicare, which covers hospital care, doctor’s visits, and related services, does not cover all care, according to the Centers for Medicare and Medicaid Services. You’ll still have a deductible, and may have copays or coinsurance fees.

Get Started Now

Interested in learning more about Medicare, Medigap, and Medicare Advantage plans? WebMD Connect to Care Advisors may be able to help.